February 2026

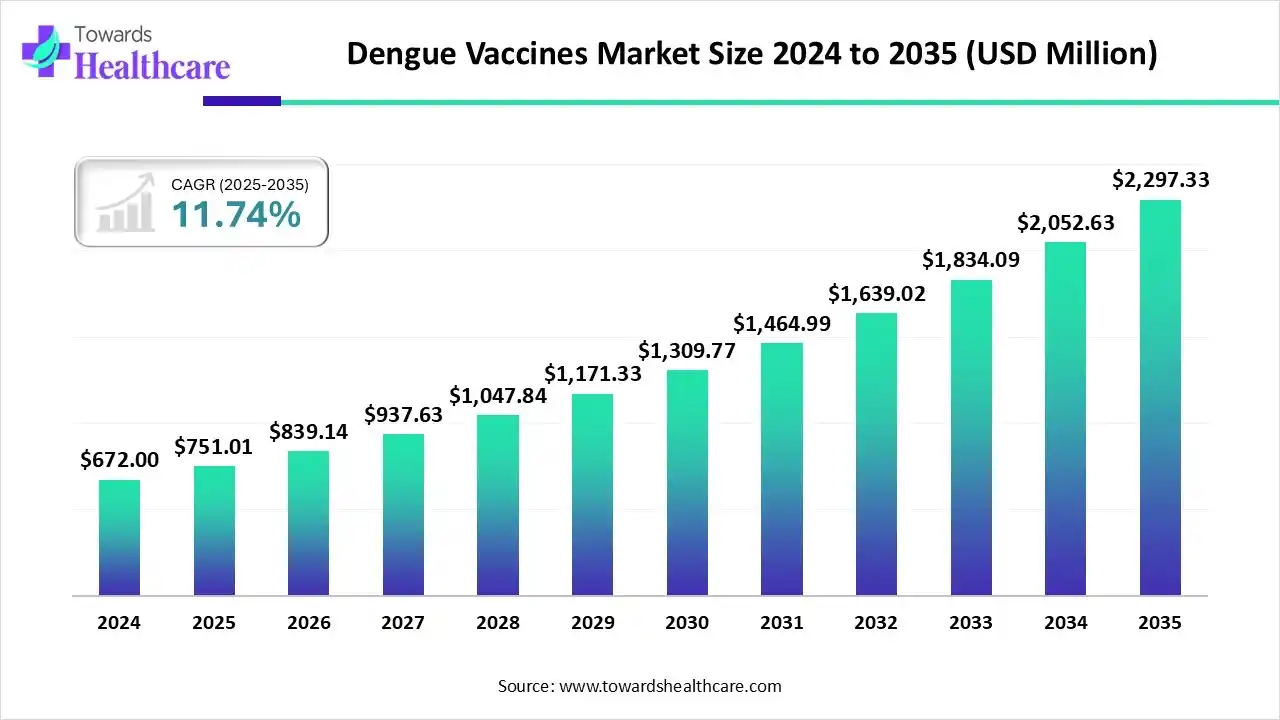

The global dengue vaccine market size is calculated at US$ 751.01 million in 2025, grew to US$ 839.14 million in 2026, and is projected to reach around US$ 2297.33 million by 2035. The market is expanding at a CAGR of 11.74% between 2026 and 2035.

The government's efforts to encourage vaccination programs, growing awareness of the severity of dengue and the shortcomings of current treatment options, and continuous research and development that is enhancing vaccine efficacy and safety profiles are all contributing factors to the dengue vaccine market's expansion. At the forefront are major firms such as Sanofi and Takeda, which leverage strategic alliances and comprehensive clinical studies to drive innovation and market penetration.

| Table | Scope |

| Market Size in 2025 | USD 751.01 Million |

| Projected Market Size in 2035 | USD 2297.33 Million |

| CAGR (2026 - 2035) | 11.74% |

| Leading Region | North America |

| Market Segmentation | By Type, By Route of Administration, By End-Users, By Distribution Channel, By Region |

| Top Key Players | Teva Pharmaceutical Industries Ltd. (Israel), Sanofi (France), Novartis AG (Switzerland), GSK plc (U.K.), F. Hoffmann-La Roche Ltd. (Switzerland), Takeda Pharmaceutical Company Limited (Japan), BIO-MED (India), Intercept Pharmaceuticals, Inc. (U.K.), Emcure Pharmaceuticals Ltd (India), Changchun BCHT Biotechnology Co. (China), Novo Medi Sciences Pvt. Ltd. (India), Biological E. Limited (India), Panacea Biotec Ltd. (India), Merck & Co., Inc., Johnson & Johnson, GeneOne Life Science, Medigen Vaccine Biologics, Sun Pharmaceutical Industries Ltd., Serum Institute of India Pvt. Ltd., Biological E, and VabioTech |

The sector devoted to the creation, manufacturing, and marketing of vaccinations intended to prevent dengue disease is known as the dengue vaccine market. Another significant driver of market expansion is the growing funding and assistance provided by governmental and non-governmental organizations for the development and dissemination of dengue vaccines. Increased healthcare resources and public-private partnerships are being used to hasten the release of vaccines in dengue-endemic regions.

In the WHO Region of Europe (EURO), the Regions of the Americas (PAHO), South-East Asia and West Pacific Regions (SEA RO and WPRO, respectively), the Eastern Mediterranean WHO Region (EMRO), and Africa, 101 countries and territories have reported more than 4 million dengue cases and more than 2500 dengue-related deaths since the start of 2025.

AI plays a crucial role in market growth, as it has become a significant part of vaccine development. From initial research to formulation to clinical trials, and other aspects of vaccine development. AI's incorporation into vaccine development is a revolutionary step that will speed up the process, improve accuracy, and increase our knowledge of infectious diseases.

Which Vaccine Type Dominated the Dengue Vaccine Market in 2024?

The live attenuated vaccine segment dominated the market in 2024 because one of the most effective and economical medical interventions in history has been the use of live attenuated vaccines to prevent human viral diseases. Live attenuated vaccines can be produced at a relatively low cost, can be given orally, stimulate a variety of immune responses, produce quick, lasting immunity, frequently eliminate the need for booster shots, and don't require adjuvants.

Nucleic Acid-Based Vaccine

The nucleic acid-based vaccine segment is expected to grow at the fastest CAGR in the dengue vaccine market during the forecast period because platforms based on nucleic acids, such as DNA and mRNA vaccines, have become viable substitutes because of their capacity to stimulate robust immune responses, speed up development, and enable scalable production.

Chimeric Live Attenuated Vaccine

The chimeric live attenuated vaccine segment is expected to grow significantly in the market during the forecast period. Researchers have created affordable chimeric vaccines that can quickly reach a large population in response to outbreaks of terrible diseases. In a single formulation, these vaccines can offer complete protection against a variety of pathogens. The design of chimeric vaccines can benefit greatly from omics-based research. Researchers are now able to create stable and highly immunogenic chimeric antigens thanks to recent developments in bioinformatics tools.

How Parenteral Segment Dominated the Dengue Vaccine Market in 2024?

The parenteral segment dominated the market in 2024 because vaccines administered parenterally have proven to be a very successful method of preventing and managing infectious diseases. These pathways have a number of benefits, such as improved vaccine stability, strong immune response induction, and quick and effective antigen delivery to the immune system.

Oral

The oral segment is expected to grow at the fastest CAGR during the forecast period because they are less invasive, easier to administer, safer overall, and less expensive than injectable vaccines. Oral vaccines are becoming more and more popular. Furthermore, because oral vaccinations avoid the blood vessels and circulatory system, they are a preferable option for people with compromised immune systems.

Why did Hospitals Dominate the Dengue Vaccine Market in 2024?

The hospitals segment dominated the market in 2024. During mass vaccination campaigns, hospitals are essential for delivering vaccines to the general public. They possess the facilities, medical staff, and knowledge required to effectively and efficiently reach a sizable population. Because of their accessibility and capacity to offer a wide range of medical services, hospitals are frequently chosen as vaccination locations.

Specialty Clinics

The specialty clinics segment is expected to grow at the fastest CAGR in the dengue vaccine market during the forecast period. Vaccination services are provided by specialty clinics, and people frequently choose them for a variety of reasons, such as convenience, individualized treatment, access to specialized knowledge, and a greater selection of vaccines, including premium and optional ones.

Homecare

The homecare segment is growing significantly in the market during the forecast period because not only is at-home vaccination convenient, but it's also a wise, secure, and humane decision for a modern society that demands the best without sacrificing comfort or security. The advantages of home vaccination are genuinely revolutionary, ranging from lowering the risk of infection to facilitating prompt immunization and providing individualized care.

Why Hospital Pharmacy Dominated the Dengue Vaccine Market in 2024?

The hospital pharmacy segment dominated the market in 2024. Pharmacists can assist with vaccination in a number of ways in a range of healthcare settings, according to their expertise and experience in providing vaccines. Hospital pharmacists will play a bigger part in vaccinations as hospitals grow, transform into health systems, and take on more responsibility for patient care.

Online Pharmacy

The online pharmacy segment is expected to grow at the fastest CAGR in the dengue vaccine market during the forecast period. The option to purchase vaccines directly from an internet pharmacy is probably going to grow in the future, but it will still be a highly regulated procedure that needs a legitimate prescription and expert administration. Instead of just sending the vaccine product to the customer's home, the main model will change to include integrated at-home vaccination services provided by authorized e-pharmacies.

Retail Pharmacy

The retail pharmacy segment is growing significantly in the market during the forecast period because, over the past ten years, retail pharmacies have become increasingly important in supplying the public with vaccines. Retail pharmacies are in a good position to provide a variety of preventive care services that can enable people to take control of their health because of their accessibility and the knowledge of pharmacists.

North America dominated the dengue vaccine market in 2024. The need for preventative vaccines is being driven by public health campaigns and growing dengue awareness in North America. Rapid vaccine uptake is made possible by the region's strong healthcare system and increased R&D funding. Additionally, the risks associated with international travel are increasing demand for travel safety measures, which is propelling the market's expansion.

Over the past five years, dengue cases have significantly increased worldwide, with the Americas seeing the most notable increases. In 2023, there were 4.6 million cases and 2,400 deaths in the Americas; in 2024, there were 13 million cases and 8,200 deaths. More than 760,000 dengue cases have been reported in 2025 as of March 6, a 15% increase over the previous 5-year average.

The CDC released a Health Update in March 2025 with the title "Ongoing Risk of Dengue Virus Infections and Updated Testing Recommendations in the United States." "Increased Risk of Dengue Virus Infections in the United States" was the title of a Health Advisory published by the CDC through the Health Alert Network in June 2024.

Asia Pacific is estimated to host the fastest-growing dengue vaccine market during the forecast period because of their tropical wet and dry climates and increased susceptibility to dengue outbreaks. Nations like Thailand, Indonesia, India, and the Philippines are the only ones in Asia-Pacific where both demand and supply for dengue vaccines are increasing. Since this area accounts for nearly half of all dengue cases globally, vaccination is a crucial component of overall management.

To ensure successful sanitation and vector control campaigns, the Union Health Minister emphasized the significance of strengthening inter-sectoral coordination among state health departments, public health engineering, irrigation departments, NGOs, municipal bodies, railroads, local government institutions, and disaster management authorities.

In 2024, the nation reported 2,33,519 cases of dengue and 297 fatalities. 42 fatalities and 49,573 cases have been reported as of August 31, 2025. Up until August 31st of this year, 964 cases were reported in Delhi, compared to 1,215 during the same period last year. There have been 1,646 cases reported from Uttar Pradesh, 298 from Haryana, and 1,181 from Rajasthan in the nearby NCR states.

In August 2024, the first-ever Phase 3 clinical trial for a dengue vaccine in India began, according to a statement from Panacea Biotec and the Indian Council of Medical Research (ICMR). The effectiveness of DengiAll, an indigenous tetravalent dengue vaccine created by Panacea Biotec in India, will be assessed in this historic trial.

Europe is expected to grow at a significant CAGR in the dengue vaccine market during the forecast period because vaccination against dengue has been incorporated into public health plans in countries such as France and Spain, particularly for vulnerable groups. The significance of immunizations prior to travel has been highlighted by traveler awareness campaigns. The region's proactive approach is highlighted by the European Union's pledge to support studies on dengue prevention and mosquito control. These programs seek to safeguard public health and stop the spread.

In France, the number of "indigenous" dengue fever cases is rapidly increasing. It is crucial to evaluate preventative measures for both tourists and the local French population, as dengue has the potential to become endemic in France. Over 4,000 imported cases of dengue, 18 chikungunya, and 5 Zika virus cases were reported as of October 30, 2024.

South America is expected to grow significantly in the dengue vaccine market during the forecast period. The Pan American Health Organization reported 6,253,754 dengue cases in the Americas through week 36, 2024, with 6,650 deaths. This surge has spurred major governments to purchase the QDENGA vaccine (two-dose tetravalent), increasing uptake and driving the market. The sheer volume of cases means healthcare systems demand preventive solutions, prompting broader access to vaccination beyond treatment alone.

In Argentina, cases exceeded 576,000 by Oct 2024 and had risen by over 2,153% year-on-year earlier in the season. This health crisis triggered a strategic plan for dengue control (2024-2025), including targeted vaccine programs in 48 identified zones. With such urgency, demand for vaccines has accelerated, pushing procurement and deployment growth ahead of traditional vectors.

The Middle East and Africa are expected to grow at a lucrative CAGR in the dengue vaccine market during the forecast period. Rising temperatures and 32,925 dengue cases across 13 nations in 2024 spurred collaborations among health ministries, vaccine trial authorizations, and donor-backed immunization funding, accelerating the emergence of the dengue vaccine market regionwide.

Following 306 dengue cases in 2024, the UAE intensified vector-control efforts, eliminated 409 breeding sites, and launched vaccine-readiness programs aligned with national health sustainability goals and climate resilience strategies.

To establish basic safety and immunogenicity, preclinical studies in animal models and basic research on the dengue virus are the first steps in research and development (R&D). Finding viable vaccine candidates and selecting the most promising ones for additional testing are the tasks of this stage.

Top Companies Include: Sanofi, Teva, Takeda, GSK, Merck & Co., Johnson & Johnson, Roche, Novartis, Pfizer, AstraZeneca, and Eli Lilly. Merck & Co, etc.

Phase 1 of clinical trials evaluates safety in small groups; Phase 2 studies immune response and dosage in larger groups; and Phase 3 assesses safety and efficacy in endemic areas in thousands of people. After that, data is sent to national organizations or regulatory agencies like the FDA in the form of a Biological License Application (BLA) for approval.

Top Companies Include: Sanofi, Teva, Takeda, GSK, Merck & Co., Johnson & Johnson, Roche, Novartis, Pfizer, AstraZeneca, and Eli Lilly. Merck & Co, etc.

A carefully thought-out vaccine rollout and long-term surveillance (Phase 4 trials) to track safety and effectiveness in the general population are part of patient support after approval. To guarantee proper administration, it consists of community education, precise dosage schedules (such as a three-dose series), and integration with current healthcare systems.

Top Companies Include: Merck & Co., Johnson & Johnson, Roche, Novartis, Pfizer, AstraZeneca, and Eli Lilly. Merck & Co, etc.

Company Overview

Corporate Information

History and Background

Key Milestones/Timeline

Business Overview

A global healthcare company focused on human health through the discovery, development, manufacture, and marketing of pharmaceutical products and vaccines.

Business Segments/Divisions

Pharmaceuticals, Vaccines (Sanofi Pasteur), Consumer Healthcare.

Geographic Presence

Operates in over 70 countries worldwide, with a significant footprint in Europe, North America, and emerging markets.

Key Offerings

End-Use Industries Served

Hospitals and Specialty Clinics, Government and Public Health Agencies, Pharmacies, Retail Consumers.

Key Developments and Strategic Initiatives

Focus on strategic acquisitions to strengthen its pipeline in areas like rare diseases, immunology, and digital health.

Partnerships with academic institutions and biotechnology firms to accelerate R&D, including significant investments in mRNA technology collaborations.

Capacity Expansions/Investments

Committed to substantial annual R&D vaccine investment, approximately €1 billion.

Regulatory Approvals

Dengvaxia is approved in several endemic countries, but its use is generally restricted by the WHO to individuals with confirmed prior dengue infection due to safety concerns in seronegative individuals.

Distribution channel strategy

Utilizes a global distribution network, targeting government-led immunization programs and private healthcare channels.

Technological Capabilities/R&D Focus

Focus on next-generation vaccines, including mRNA technology platforms, to address RSV, influenza, and other infectious diseases.

Core Technologies/Patents

Holdings related to its tetravalent live attenuated dengue vaccine platform (Dengvaxia)

Research & Development Infrastructure

Global R&D centers, with a focus on advanced R&D in areas like immunology, including a commitment to make Montpellier the global hub for translational research on autoimmune diseases (October 2025).

Innovation Focus Areas

Immunology and inflammation, rare diseases, oncology, and next-generation vaccines.

Competitive Positioning

Long-standing global leader in vaccines (Sanofi Pasteur), first-to-market advantage with Dengvaxia, and broad vaccine portfolio.

Strong presence in key global vaccine markets, a critical supplier to global public health organizations.

SWOT Analysis

Recent News and Updates

Press Releases

Industry Recognitions/Awards

Continually recognized for its contributions to global health and vaccine innovation.

Company Overview

Corporate Information

History and Background

Key Milestones/Timeline

Business Overview

A patient-focused, values-based, R&D-driven global biopharmaceutical company focusing on five key business areas.

Business Segments/Divisions

Geographic Presence

Operates in over 80 countries and regions, with significant operations in Japan, the U.S., and Europe.

Key Offerings

End-Use Industries Served

Hospitals and Specialty Clinics, Government and Public Health Agencies (via immunization programs), Pharmacies.

Key Developments and Strategic Initiatives

Major acquisition of Shire plc in 2019 for approximately $62 billion, which diversified its product portfolio and global footprint.

Product Launches/Innovations

Launched Qdenga (TAK-003) as a second-generation dengue vaccine.

Capacity Expansions/Investments

Focusing on scaling up global manufacturing capacity for Qdenga, with the German facility as a primary hub and Biological E. as a key partner for future volumes and public health formats.

Regulatory Approvals

Distribution channel strategy

Strategic focus on public health programs, leveraging the WHO Prequalification for procurement by organizations like UNICEF and PAHO, alongside private market distribution.

Technological Capabilities/R&D Focus

Core technology based on a live-attenuated tetravalent vaccine, utilizing a serotype two backbone to induce robust immunity against all four serotypes (DENV-1 to DENV-4).

Core Technologies/Patents

Proprietary technology related to the DENV-2 backbone vaccine approach, Takeda's tetravalent dengue vaccine platform.

Research & Development Infrastructure

Global R&D network, including the pivotal TIDES study involving 20,000 participants across dengue-endemic countries.

Innovation Focus Areas

Complex infectious diseases, rare diseases, and advanced cell and gene therapies.

Competitive Positioning

Strengths & Differentiators

Qdenga's favorable profile for both seropositive and seronegative individuals (approved for use regardless of prior dengue exposure), strong efficacy against hospitalization, and WHO Prequalification (May 2024).

Market presence & ecosystem role

Rapidly growing presence in dengue-endemic countries, emerging as the preferred option for public health programs due to its broader label.

SWOT Analysis

Recent News and Updates

Press Releases,

Industry Recognitions/Awards

Qdenga's WHO Prequalification in May 2024 is a significant endorsement and key driver of global adoption.

| Company | Vaccine / Candidate | Key Activity in the Dengue Vaccine Market | Contribution to Market Growth |

| GlaxoSmithKline plc (GSK) | TDENV PIV (tetravalent dengue virus purified inactivated vaccine) | In phase I trials via collaboration with the Walter Reed Army Institute of Research for a dengue vaccine candidate. | Adds developmental pipeline and future supply potential through large-scale R&D. |

| Merck & Co., Inc. | V181 (quadrivalent dengue vaccine candidate) | Has initiated a Phase 3 trial (MOBILIZE-1) for V181 targeting all four serotypes, irrespective of prior exposure. | Strengthens global vaccine options and supports broader uptake beyond endemic populations. |

| Panacea Biotec Ltd. (India) | DengiAll® (tetravalent dengue vaccine) | Undertaking Phase III clinical trial across India (~10,335 participants) in collaboration with the Indian Council of Medical Research (ICMR) for an indigenous vaccine. | Enhances regional access in India/Asia, supports localization, and cost-effective production. |

| Biological E. Limited (India) | Manufacturing partner (for another company’s vaccine) | Partnering with another major vaccine firm to ramp up large-scale production capacity (50 million doses/year) for dengue vaccine multi-dose vials. | Improves supply chain, enables national immunization programs in endemic regions. |

| Teva Pharmaceutical Industries Ltd. (Israel) | Generic/Research role (less specific) | Mentioned among key players in market reports as part of the dengue vaccine market ecosystem. | Although less advanced, its inclusion supports market scale via manufacturing/distribution capacity. |

By Type

By Route of Administration

By End-Users

By Distribution Channel

By Region

February 2026

February 2026

February 2026

February 2026