Gestational Diabetes Giants of the Global Market:

- F. Hoffmann-La Roche Ltd.

- Biocon Limited

- Johnson & Johnson

- Merck & Co., Inc.

- AstraZeneca plc

- Boehringer Ingelheim GmbH

- Becton, Dickinson and Company (BD)

- Ascensia Diabetes Care

- Insulet Corporation

- Tandem Diabetes Care, Inc.

- Ypsomed Holding AG

- Thermo Fisher Scientific

- Sun Pharmaceutical Industries Ltd.

- Nipro Diagnostics

Introduction

The Gestational Diabetes Market is witnessing steady growth driven by rising maternal health awareness, increasing obesity rates, and the global emphasis on early diagnosis and management of diabetes during pregnancy. Gestational diabetes mellitus (GDM) affects about 14% of pregnancies worldwide, translating to nearly 18 million cases annually. The prevalence is increasing due to lifestyle changes, advanced maternal age, and the growing burden of type 2 diabetes risk factors among women of childbearing age.

According to the International Diabetes Federation (IDF), over 21 million live births were affected by some form of hyperglycemia in pregnancy in 2024, of which 84% were due to gestational diabetes. The economic burden of untreated or poorly managed GDM can lead to higher maternal and neonatal complications, including preeclampsia, macrosomia, and long-term metabolic disorders in both mother and child.

Market Growth

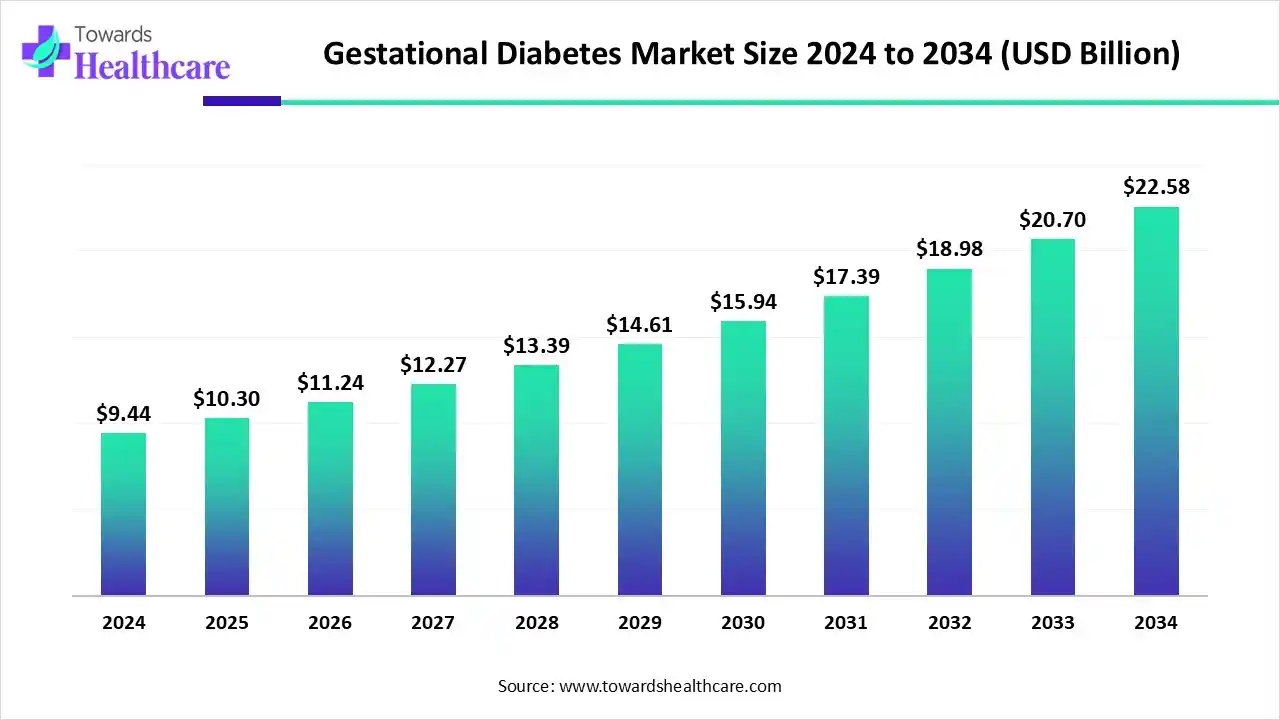

The global gestational diabetes market size is calculated at USD 10.3 billion in 2025, grew to USD 11.24 billion in 2026, and is projected to reach around USD 24.62 billion by 2035. The market is expanding at a CAGR of 9.15% between 2026 and 2035.

What is Gestational Diabetes?

Gestational diabetes mellitus (GDM) is a type of diabetes that develops during pregnancy when the body cannot produce enough insulin to regulate blood sugar levels effectively. Unlike Type 1 or Type 2 diabetes, GDM typically appears in the second or third trimester and often resolves after childbirth. However, it poses serious risks to both the mother and the baby if left unmanaged.

Key facts about gestational diabetes:

- It affects about 14% of pregnancies worldwide, translating to nearly 18 million women each year.

- Women with GDM are at a sevenfold higher risk of developing Type 2 diabetes later in life.

- Babies born to mothers with GDM have an increased risk of macrosomia (large birth weight), premature birth, and metabolic disorders in childhood.

Exploring the Global Demand for Maternal Health Solutions and Its Importance

Maternal health solutions are becoming central to healthcare strategies worldwide due to their direct impact on reducing maternal and infant morbidity. Gestational diabetes represents a key intersection of maternal and metabolic health. The World Health Organization (WHO) emphasizes that screening and managing gestational diabetes can reduce complications by up to 40% in both mother and newborn.

Developed countries like the U.S., Germany, and Japan are integrating gestational diabetes screening as part of standard prenatal care. Meanwhile, emerging economies such as India and Brazil are expanding awareness and implementing national diabetes programs to tackle maternal health challenges.

Moreover, healthcare systems are shifting from episodic to continuous glucose monitoring (CGM) approaches. This transition allows real-time tracking of maternal glucose levels, personalized treatment, and data-driven interventions reducing hospital visits and improving pregnancy outcomes.

Technological Advancements Empowering Diabetes Management

Recent technological breakthroughs have transformed gestational diabetes care. Traditional glucose meters are being replaced by connected and wearable devices that offer real-time analytics and cloud-based data sharing between patients and healthcare providers.

Key advancements include:

- Continuous Glucose Monitoring (CGM) systems by companies like Abbott, Dexcom, and Medtronic that enable non-invasive, 24-hour monitoring.

- Smart insulin delivery systems developed by Insulet and Tandem Diabetes Care that integrate with smartphones and digital health platforms.

- Point-of-care testing devices for rapid glucose assessment, reducing the need for frequent lab visits.

- AI-driven analytics that predict insulin requirements and improve maternal nutrition and therapy plans.

By 2025, the global adoption of connected diabetes care solutions for pregnancy is expected to grow by over 30% year-on-year, reflecting a major shift toward precision maternal care.

Strategic Moves of the Leading Companies and Statistical Overview

| Company | Headquarters | Annual Revenue (2024, USD Billion) | Established Year |

| F. Hoffmann-La Roche Ltd. | Basel, Switzerland | 69.0 | 1896 |

| Biocon Limited | Bengaluru, India | 1.3 | 1978 |

| Johnson & Johnson | New Brunswick, New Jersey, U.S. | 88.6 | 1886 |

| Merck & Co., Inc. | Rahway, New Jersey, U.S. | 63.1 | 1891 |

| AstraZeneca plc | Cambridge, United Kingdom | 45.8 | 1999 |

1. F. Hoffmann-La Roche Ltd.

Overview

-

Headquartered in Basel, Switzerland, founded in 1896, Roche is a global leader in diagnostics and pharmaceuticals.

-

The company offers glucose monitoring systems, insulin delivery tools, and digital diabetes management platforms.

-

Roche’s diabetes care segment contributes significantly to its diagnostics business, valued at around USD 14.9 billion in 2024.

Partnerships, Launches, and Expansions

-

Partnered with Novo Nordisk to develop integrated diabetes care models for women with GDM.

-

Expanded its Accu-Chek product line with next-gen connected glucose meters featuring AI-based alerts for pregnant women.

-

Collaborated with healthcare providers in Asia-Pacific to improve access to point-of-care GDM diagnostics.

Global Impact

-

Strong market presence in Europe, North America, and Asia-Pacific.

-

Increased adoption of Roche’s digital diabetes ecosystem in India and China, improving early diagnosis rates.

-

Contributed to national health programs supporting maternal glucose monitoring.

Recent News or Updates

-

In 2025, Roche launched Accu-Chek Instant WomenCare, a device designed for pregnancy-safe glucose testing.

-

The company is investing in AI-driven data analytics for maternal diabetes management.

-

Announced sustainability initiatives in production facilities for healthcare diagnostics.

2. Biocon Limited

Overview

-

Headquartered in Bengaluru, India, established in 1978, Biocon is a global biopharmaceutical company specializing in biosimilars, generics, and insulin products.

-

The company produces Insulin Glargine and Insulin Aspart, widely used in GDM management.

-

Biocon’s insulin franchise generated USD 1.3 billion in revenue in 2024.

Partnerships, Launches, and Expansions

-

Partnered with Viatris Inc. for commercializing insulin biosimilars across over 60 countries.

-

Expanded insulin manufacturing capacity in Malaysia to meet growing global demand.

-

Collaborated with India’s Ministry of Health to support national gestational diabetes screening programs.

Global Impact

-

A key insulin supplier to Asia, Africa, and Latin America.

-

Biocon’s affordable insulin has significantly reduced the cost of GDM management in developing nations.

-

Plays a crucial role in advancing equitable access to maternal diabetes therapy.

Recent News or Updates

-

In 2025, Biocon launched Insugen SmartPen, a user-friendly insulin delivery device designed for pregnant women.

-

The company announced expansion into Europe’s biosimilar insulin market.

-

Introduced digital glucose tracking collaborations for maternal health programs.

3. Johnson & Johnson

Overview

-

Founded in 1886 and headquartered in New Brunswick, New Jersey, USA, Johnson & Johnson (J&J) is one of the largest healthcare conglomerates in the world.

-

Operates through its MedTech and Innovative Medicine divisions, providing glucose monitoring, medical devices, and maternal care solutions.

-

Reported USD 88.6 billion in total revenue in 2024.

Partnerships, Launches, and Expansions

-

Partnered with Google’s Verily Life Sciences to develop next-generation smart diabetes management platforms.

-

Expanded J&J’s LifeScan glucose monitoring brand in developing markets.

-

Investing in R&D for AI-enabled pregnancy health tracking technologies.

Global Impact

-

Strong footprint in North America, Europe, and Asia-Pacific.

-

Implements community maternal health initiatives in Africa and Latin America.

-

Actively contributes to global maternal well-being programs supported by WHO.

Recent News or Updates

-

In 2025, J&J launched OneTouch Verio Advance, a smart glucose system with pregnancy mode features.

-

The company announced collaborations to integrate glucose data into electronic maternal health records.

-

Received recognition for sustainability and women’s healthcare initiatives globally.

4. Merck & Co., Inc.

Overview

-

Headquartered in Rahway, New Jersey, USA, founded in 1891, Merck is a leading biopharmaceutical company with strong expertise in endocrinology and women’s health.

-

Offers insulin analogs and oral antidiabetic drugs used in GDM management.

-

Generated USD 63.1 billion in revenue in 2024.

Partnerships, Launches, and Expansions

-

Partnered with Bill & Melinda Gates Foundation to improve maternal diabetes management in low-income regions.

-

Expanded its women’s health R&D portfolio to include pregnancy-safe glucose control medications.

-

Strengthened collaborations with digital health firms to enhance maternal care monitoring.

Global Impact

-

Merck’s diabetes medications are approved in over 120 countries.

-

Major presence in North America, Europe, and Asia-Pacific.

-

Supports programs improving maternal health in developing countries.

Recent News or Updates

-

In 2025, Merck announced new clinical data for its oral insulin candidates.

-

The company launched a maternal health education initiative in India and Sub-Saharan Africa.

-

Investing in AI-driven predictive analytics for gestational health risks.

5. AstraZeneca plc

Overview

-

Headquartered in Cambridge, United Kingdom, established in 1999 through the merger of Astra AB and Zeneca Group.

-

AstraZeneca focuses on metabolic diseases, with drugs like Farxiga (dapagliflozin) being evaluated for safe use in gestational diabetes.

-

Reported USD 45.8 billion in revenue in 2024.

Partnerships, Launches, and Expansions

-

Collaborated with Sanofi and Oxford University for diabetes and maternal metabolic research.

-

Expanded its metabolic R&D centers in Sweden and the U.S.

-

Partnered with NHS England for clinical evaluation of diabetes drugs during pregnancy.

Global Impact

-

Strong market presence across Europe, North America, and Asia-Pacific.

-

Supports maternal health initiatives in developing regions via AstraZeneca Foundation.

-

Plays a major role in metabolic health awareness and research collaborations.

Recent News or Updates

-

In 2025, AstraZeneca began clinical trials on novel pregnancy-safe glucose modulators.

-

Expanded its digital patient engagement tools for pregnant women with GDM.

-

Announced sustainability goals focusing on green manufacturing for metabolic drugs.

Top Companies & Their Offerings in the Gestational Diabetes Market

- Eli Lilly and Company: The company offers resources and support for diabetes management, including Insulin Lispro, GLP-1 analogs, and other anti-diabetic medications.

- Sanofi S.A.: Sanofi is a French multinational pharmaceutical and healthcare company that provides insulin aspart, insulin glargine, and metformin hydrochloride.

- Medtronic plc: The American-Irish company offers the MiniMed 780G system, an automated insulin delivery system, the InPen Smart Insulin Pen, and Smart MDI.

- Dexcom, Inc.: Dexcom specializes in continuous glucose monitoring devices, offering Dexcom G7 for gestational diabetes patients.

Recent Developments in the Gestational Diabetes Market

- In June 2025, USV announced the launch of a first-of-its-kind Concordance Tool for Gestational Diabetes Mellitus (GDM) in India to improve short-term pregnancy outcomes and support long-term health. The tool is a structured, visual aid to diagnose GDM and emphasize screening and lifestyle interventions.

- In February 2025, researchers from the Universities of Leicester and Cambridge found that a reduced-calorie diet in late pregnancy is safe and beneficial for women with gestational diabetes living with overweight or obesity. Reduced-calorie diet promotes weight loss and improves sugar levels.

Partner with our experts to explore the Gestational Diabetes Market at sales@towardshealthcare.com

Keypoints

- Company Overview

- Locations Subsidiaries/Geographic reach

- Key Executives

- Company Financials

- Patents registered

- SWOT Analysis

- Applications Catered

- Strategic collaborations

- Recent Developments

- Competitive Benchmarking