Gestational Diabetes Market Size, Key Players with Trends and Forecast

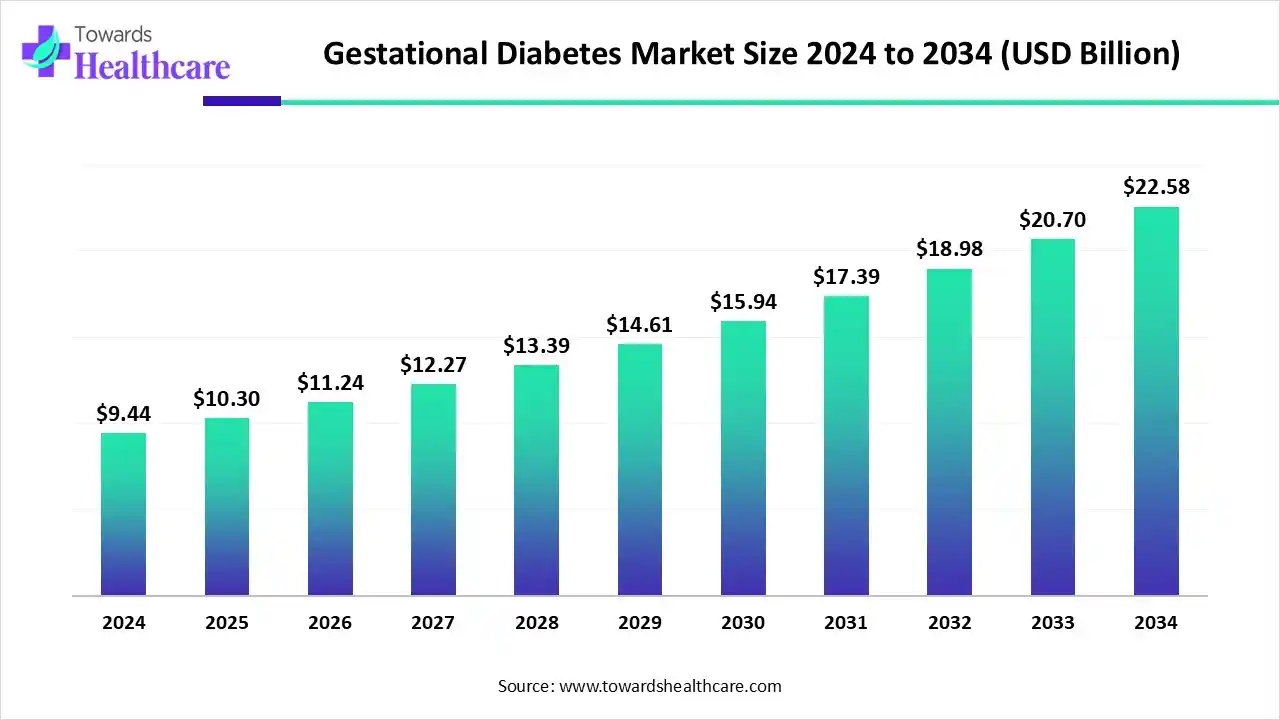

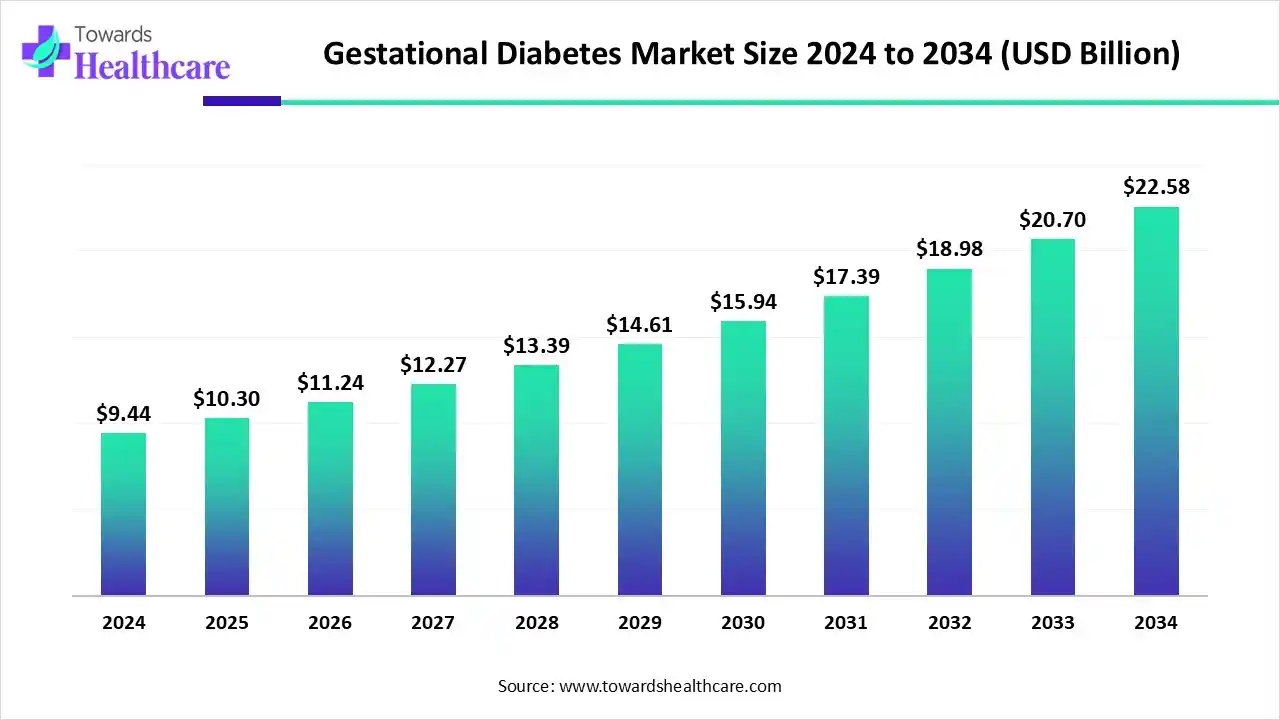

The global gestational diabetes market size is calculated at USD 10.3 billion in 2025, grew to USD 11.24 billion in 2026, and is projected to reach around USD 22.58 billion by 2034. The market is expanding at a CAGR of 9.15% between 2024 and 2034.

The gestational diabetes market is primarily driven by the increasing risk of gestational diabetes, especially in obese patients or those with a family history of diabetes. Government organizations launch initiatives to encourage pregnant women to undergo screening tests, thereby avoiding possible complications. Artificial intelligence (AI) revolutionizes the diagnosis and monitoring of gestational diabetes. Novel therapeutic innovations and effective management strategies drive the market’s future.

Key Takeaways

- The gestational diabetes market will likely exceed USD 10.3 billion by 2025.

- Valuation is projected to hit USD 22.58 billion by 2034.

- Estimated to grow at a CAGR of 9.15% starting from 2024 to 2034.

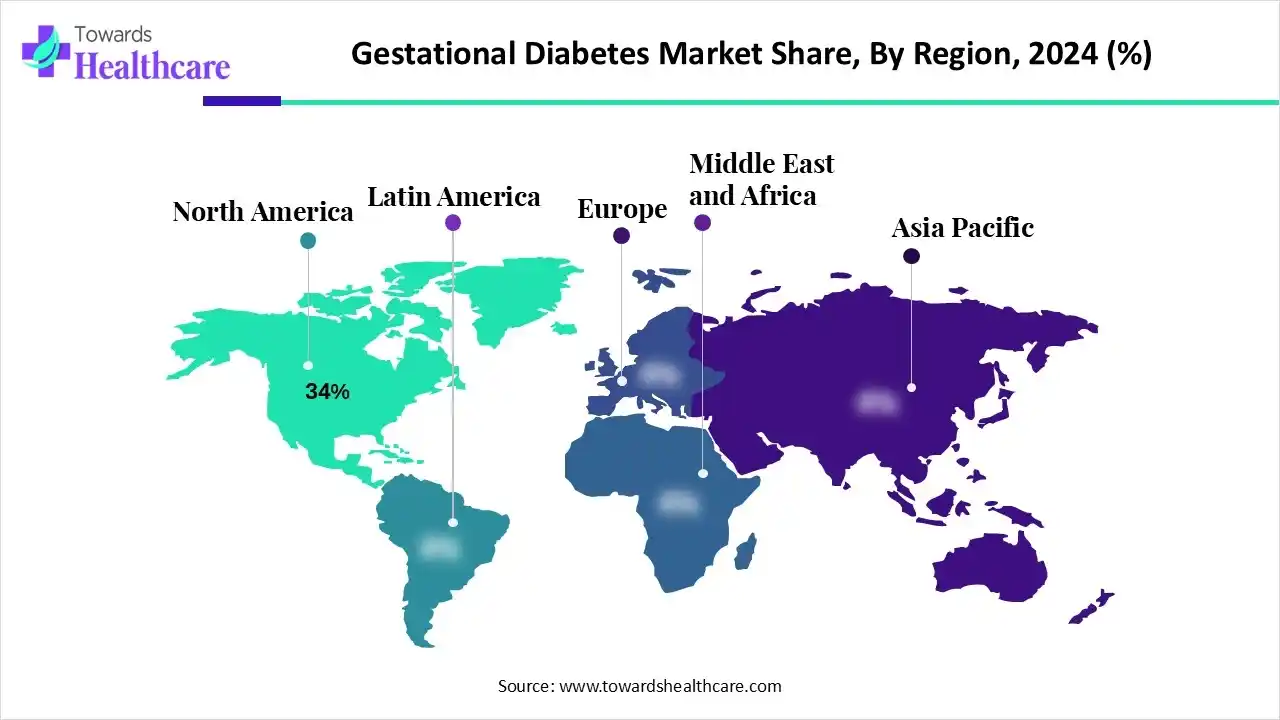

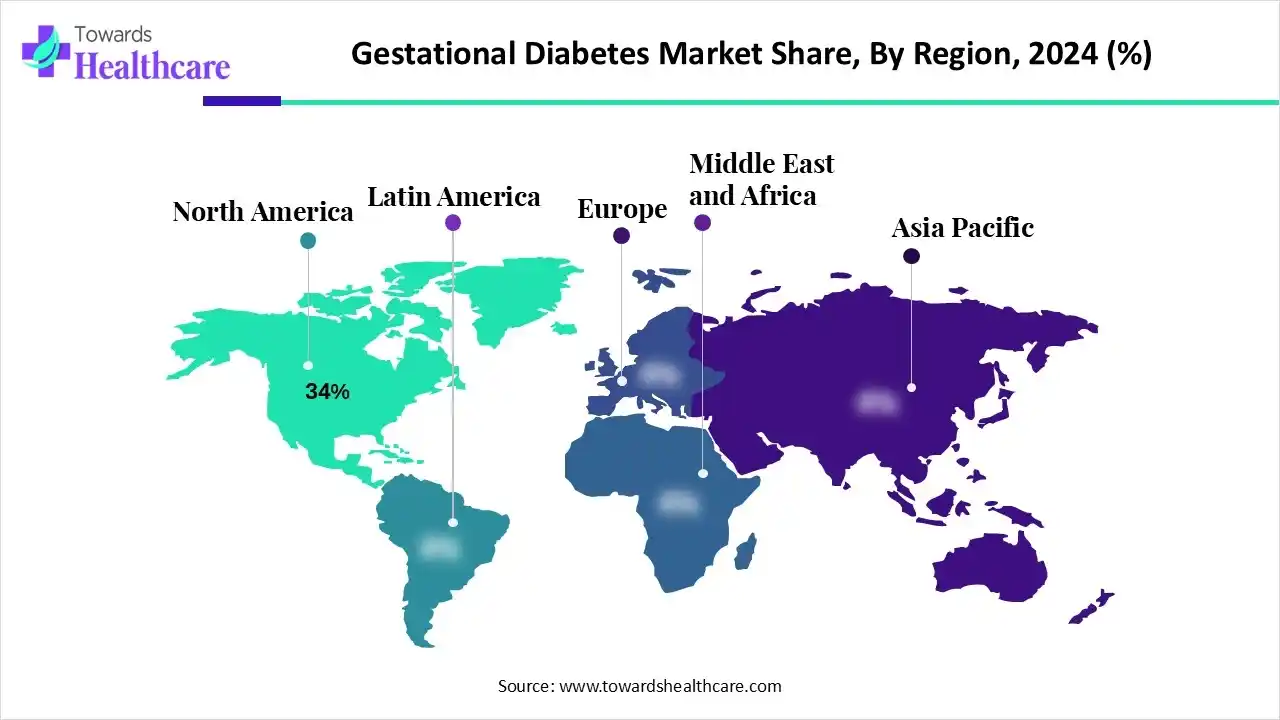

- North America held a major revenue share of 34% in the market in 2024.

- Asia-Pacific is expected to witness the fastest growth during the predicted timeframe.

- By treatment type, the lifestyle & medical nutrition therapy (MNT) segment dominated the gestational diabetes market with a share of 45% in 2024.

- By treatment type, the insulin therapy segment is expected to witness the fastest growth in the market over the forecast period.

- By product/drug formulation, the insulin injectables segment contributed the biggest revenue share of 40% in the market in 2024.

- By product/drug formulation, the glucose monitoring devices & consumables segment is expected to show the fastest growth over the forecast period.

- By dosage form/delivery device, the prefilled pens/pen cartridges segment led the market with a share of 45% in 2024.

- By dosage form/delivery device, the CGM sensors/consumables segment is expected to grow at the fastest CAGR in the gestational diabetes market during the forecast period.

- By diagnostic & monitoring method, the oral glucose tolerance test (OGTT) segment accounted for the highest revenue share of 45% in the market in 2024.

- By diagnostic & monitoring method, the CGM (real-time & intermittent) segment is expected to account for the highest growth in the forecast period.

- By end-user/care provider, the hospitals & maternity centers segment registered its dominance over the global market with a share of 40% in 2024.

- By end-user/care provider, the home care/self-management segment is expected to expand rapidly in the gestational diabetes market in the coming years.

- By distribution channel, the retail pharmacies segment held a dominant revenue share of 40% in the market in 2024.

- By distribution channel, the direct-to-patient/home delivery segment is expected to grow with the highest CAGR in the market during the studied years.

Executive Summary Table

| Table |

Scope |

| Market Size in 2025 |

USD 10.3 Billion |

| Projected Market Size in 2034 |

USD 22.58 Billion |

| CAGR (2025 - 2035) |

9.15% |

| Leading Region |

North America by 34% |

| Market Segmentation |

By Treatment Type, By Product/Drug Formulation, By Dosage Form/Delivery Device, By Diagnostic & Monitoring Method, By End-User/Care Provider, By Distribution Channel, By Region |

| Top Key Players |

Novo Nordisk, Abbott Laboratories, F. Hoffmann-La Roche Ltd., Biocon Limited, Johnson & Johnson, Merck & Co., Inc., AstraZeneca plc, Boehringer Ingelheim GmbH, Becton, Dickinson and Company (BD), Ascensia Diabetes Care, Insulet Corporation, Tandem Diabetes Care, Inc., Ypsomed Holding AG, Thermo Fisher Scientific, Sun Pharmaceutical Industries Ltd., Nipro Diagnostics |

Managing Two Lives: Trends in Gestational Diabetes

The gestational diabetes market is experiencing robust growth, driven by favorable screening programs, growing awareness of maternal-fetal risks, and technological innovations. It comprises products and services used to detect, monitor and manage glucose intolerance first identified during pregnancy, including screening and diagnostic tests (OGTT kits, point-of-care glucose tests), blood glucose monitoring devices (glucometers, test strips, continuous glucose monitors), therapeutics (insulins and approved oral agents used in pregnancy), digital/telehealth care and pregnancy-specific care programs, and related clinical services.

Gestational Diabetes Market Outlook

- Industry Growth Overview: The market is expected to grow rapidly, due to increasing awareness among the general public and growing research activities to develop tech-driven monitoring and treatment regimens. The growth is observed in developing and underdeveloped countries with constant efforts to adopt effective strategies.

- Global Expansion: Key players expand their global presence by launching their products in multiple countries or collaborating with other companies. This helps them serve a larger patient population, generate more revenue, and strengthen their market position.

- Major Investors: Numerous government and private bodies invest in firms that focus on gestational diabetes prevention, diagnosis, monitoring, and treatment. Some investors include Alpine Social Ventures Fellow, Diabetes UK, and the Gates Foundation.

Artificial Intelligence: Evolving Landscape of the Gestational Diabetes Market

AI plays a crucial role in advancing gestational diabetes care, improving prediction, screening, and management. AI and machine learning (ML) algorithms facilitate early risk prediction, continuous glucose monitoring, and insulin-dosing recommendations. They analyze vast amounts of data and predict potential treatment outcomes for individual patients. They enhance the efficiency and accuracy of gestational diabetes diagnosis and treatment. Leveraging AI in telemedicine enables healthcare professionals to provide remote monitoring, eliminating the need for patients to visit healthcare organizations.

Segmental Insights

Treatment Type Insights

Which Treatment Type Segment Dominated the Gestational Diabetes Market?

The lifestyle & medical nutrition therapy (MNT) segment held a dominant presence in the market with a share of 45% in 2024, due to the growing demand for natural products and increasing awareness of a healthy lifestyle. Plant-based diets can improve insulin sensitivity and increase its secretion. Therapeutics derived from natural products also provide antioxidant effects. Regular exercise has also been proven to be beneficial.

Insulin Therapy

The insulin therapy segment is expected to grow at the fastest CAGR in the gestational diabetes market during the forecast period. Insulin therapy is beneficial in restoring glycemia in women with gestational diabetes. Ongoing efforts are made to evolve insulin analogs and study their long-term effects on maternal and child health.

Oral Anti-Diabetic Agents

The oral anti-diabetic agents segment is expected to grow at a notable rate. Metformin and sulfonylureas (glyburide) are the most widely prescribed anti-diabetic medications as they are comparatively safer and cost-effective. They have lower adverse effects, like pre-eclampsia and neonatal hypoglycemia.

Product/Drug Formulation Insights

How the Insulin Injectables Segment Dominated the Gestational Diabetes Market?

The insulin injectables segment held the largest revenue share of 40% in the market in 2024, due to the need for insulin therapy among pregnant women. Commercial prefilled pens, cartridges, and vials are available for patients, eliminating the need for skilled healthcare professionals for insulin delivery. The demand for insulin injectables is increasing as it is estimated that 15% to 30% of women require insulin therapy.

Glucose Monitoring Devices & Consumables

The glucose monitoring devices & consumables segment is expected to grow with the highest CAGR in the gestational diabetes market during the studied years. Government organizations encourage patients to monitor glucose during pregnancy at regular intervals. Advanced monitoring devices can also send real-time alerts to providers. This helps healthcare professionals to make proactive clinical decisions.

Oral Tablets

The oral tablets segment is expected to witness significant growth. Oral tablets are more cost-effective and easier to administer, enhancing patient convenience. They regulate blood glucose levels and can be used as alternatives to insulin.

Dosage Form/Delivery Device Insights

Why Did the Prefilled Pens/Pen Cartridges Segment Dominate the Gestational Diabetes Market?

The prefilled pens/pen cartridges segment contributed the biggest revenue share of 45% in the market in 2024, due to advances in drug delivery systems and the increasing integration of advanced technologies. Prefilled pens/cartridges deliver insulin into the subcutaneous tissue. They are available in various forms, including disposable, reusable, and smart pens.

CGM Sensors/Consumables

The CGM sensors/consumables segment is expected to expand rapidly in the gestational diabetes market in the coming years. Sensors are embedded in CGM devices to accurately monitor blood glucose levels in pregnant women. The two different types of sensors include disposable and implantable sensors, which are inserted under the skin and placed inside the body, respectively.

Vials

The vials segment is expected to show lucrative growth in the coming years. Vials offer a more flexible dosing option, allowing healthcare professionals to provide tailored dosages. This is particularly useful for patients with fluctuating needs or specialized dosing instructions.

Diagnostic & Monitoring Method Insights

Which Diagnostic & Monitoring Method Segment Led the Gestational Diabetes Market?

The oral glucose tolerance test (OGTT) segment led the market with a share of 45% in 2024, due to the ability of the test to find problems with the way the body handles sugar after a meal. OGTT measures the body’s response to sugar. This test is usually conducted between 24 and 28 weeks of pregnancy.

CGM (Real-Time & Intermittent)

The CGM (real-time & intermittent) segment is expected to witness the fastest growth in the gestational diabetes market over the forecast period. CGM devices provide more precise and accurate results as they are measured in real-time. They help empower women to manage their diabetes during pregnancy, improving their pregnancy experience.

Self-Monitoring Blood Glucose (SMBG)

The self-monitoring blood glucose (SMBG) segment is expected to show notable growth over the upcoming years. People are becoming more aware of monitoring their blood glucose levels. SMBG during pregnancy is feasible and acceptable, improving maternal and neonatal health outcomes.

End-User/Care Provider Insights

What Made Hospitals & Maternity Centers the Dominant Segment in the Gestational Diabetes Market?

The hospitals & maternity centers segment accounted for the highest revenue share of 40% in the market in 2024, due to the increasing number of patient admissions and the presence of skilled professionals. Skilled professionals provide multidisciplinary expertise to patients. Efforts are made to enhance accessibility to maternity care services across diverse geographical locations.

Home Care/Self-Management

The home care/self-management segment is expected to show the fastest growth in the gestational diabetes market over the forecast period. Home care and self-management of gestational diabetes include managing blood sugar through diet and regular exercise. Non-pharmacological treatment offers superior benefits, including fewer side effects, enhanced patient comfort, and long-term benefits.

Outpatient Clinics/Diabetes Clinics

The outpatient clinics/diabetes clinics segment is expected to show remarkable growth. The increasing number of dedicated clinics and the availability of specialized equipment boost the segment’s growth. Skilled professionals in outpatient clinics and diabetes clinics provide personalized care to patients.

Distribution Channel Insights

How the Retail Pharmacies Segment Dominated the Gestational Diabetes Market?

The retail pharmacies segment held a major revenue share of 40% in the market in 2024, due to the availability of favorable infrastructure and suitable capital investments. Retail pharmacies offer numerous benefits, including free home delivery, 24/7 services, and special discounts.

Direct-to-Patient/Home Delivery

The direct-to-patient/home delivery segment is expected to account for the highest growth in the forecast period. Numerous e-commerce platforms, manufacturers, and retail pharmacies offer home delivery services to patients. This helps patients to order appropriate medications or devices in the comfort of their homes.

Hospital/Institutional Procurement

The hospital/institutional procurement segment is expected to grow significantly. Hospital/institutional procurement is essential as hospitals can provide advanced care to patients. The hospital procurement process covers various aspects, from the initial investment request from clinical staff to the final decision to purchase.

Regional Analysis

Which Factors Contribute to the Gestational Diabetes Market in North America?

North America dominated the global market share by 34% in 2024. The availability of state-of-the-art research and development facilities, the presence of key players, and the increasing prevalence of gestational diabetes are the major factors that contribute to market growth in North America. Government organizations launch initiatives and provide funding to accelerate research related to gestational diabetes.

United States Market Trends

Key players, such as Eli Lilly and Company, Abbott Laboratories, and Johnson & Johnson, are the major contributors to the market in the U.S. The International Diabetes Federation (IDF) reported that the prevalence rate of gestational diabetes in the U.S. was 21.4% in 2024. The U.S. has a well-established clinical trial infrastructure, accounting for 259 studies related to gestational diabetes as of October 2025.

How is Asia-Pacific Growing in the Gestational Diabetes Market?

Asia-Pacific is expected to grow at the fastest CAGR in the market during the forecast period. The burgeoning healthcare sector and the growing research and development activities boost the market. Sedentary lifestyles and a family history of diabetes are the major risk factors for developing gestational diabetes in women living in the Asia-Pacific. Favorable screening programs and campaigns encourage pregnant women to screen for diabetes.

India Market Trends

The Indian government is at the forefront of providing advanced maternal care through the “Pradhan Mantri Surakshit Matritva Abhiyaan (PMSMA)” initiative that aims to prevent maternal and newborn deaths and provide high-quality maternal care with dignity and respect. The program provides assured, comprehensive, and quality antenatal care, free of cost, universally to all pregnant women on the 9th of every month.

Increasing Diabetes Prevalence: A Notable Growth Factor in Europe

Europe is expected to grow at a notable CAGR in the gestational diabetes market in the foreseeable future. The increasing investments and the rising prevalence of gestational diabetes augment the market. According to a recent meta-analysis, the average prevalence rate of gestational diabetes in Europe is 10.9%. Favorable government support and increasing healthcare expenditure contribute to market growth. The growing awareness of maternal health enables healthcare professionals to provide early intervention.

United Kingdom Market Trends

The Scottish Government announced an additional funding of up to £8.8 million for diabetes technology to the Diabetes Scotland organization. The National Health Service (NHS) England recently launched the “artificial pancreas” initiative to offer an artificial pancreas to women with type 1 diabetes who are either pregnant or planning to become pregnant. The UK reported the third-highest prevalence rate of gestational diabetes in Europe, representing 23.1%.

Rising Awareness Driving Gestational Diabetes Care in South America

The gestational diabetes market in South America is expanding steadily, supported by increasing maternal health awareness, improved diagnostic access, government-led prenatal screening initiatives, and rising adoption of digital glucose monitoring and nutrition management solutions across Brazil, Argentina, and Chile.

Brazil’s Gestational Diabetes Uptick: A Spotlight on Maternal Health

In Brazil, the gestational diabetes landscape is increasingly visible, with recent national data estimating a prevalence of around 14 % among pregnant women. Driven by rising maternal age, obesity, and the expansion of prenatal screening programs, care efforts are scaling to engage education, digital monitoring tools, and integrated nutrition-and-exercise support across public and private maternity services.

Increasing Awareness Contributes to the Middle East & Africa Growth

The Middle East & Africa are considered to be a significantly growing area in the gestational diabetes market, due to the increasing adoption of advanced technologies and the growing risk of obesity, which propels market growth. People are becoming aware of the early detection and management of gestational diabetes. Several government and private organizations conduct seminars and conferences to share the latest updates about diabetes monitoring and management in pregnant women.

Egypt Market Trends

The Egyptian government announced that approximately 7 million Egyptians have undergone medical examinations as part of the Pre-Marriage Health Screening and Caring for the Health of Mothers and Newborns initiatives since February 2023. The government also formed an initiative to improve maternal and child health through a new mobile app.

Company Landscape

Novo Nordisk

- Company Overview: Novo Nordisk is a global healthcare company primarily focused on diabetes and obesity therapeutics, with growing activities in rare diseases and biopharmaceuticals.

- Corporate Information (Headquarters, Year Founded, Ownership Type): Headquarters: Bagsværd (Copenhagen suburb), Denmark. Year founded: 1923. Ownership type: publicly traded (Danish and international markets).

- History and Background: Founded nearly a century ago as a Danish insulin manufacturer, Novo Nordisk evolved into a leader in diabetes care. Over recent decades, it expanded into obesity treatments, driven by its GLP-1 therapy platforms, and more recently, rare disease research.

- Key Milestones / Timeline: Launch of major GLP-1 drugs such as Ozempic® and Wegovy®; licensing deals in 2025 for new therapeutic classes; major workforce restructuring announced in 2025; new CEO appointment in 2025. (AP News)

- Business Overview: Core business revolves around treatment options for diabetes, obesity, and related metabolic disorders, supported by biologics and peptide-based therapies. The company is diversifying into rare diseases and liver/metabolic conditions.

- Business Segments / Divisions: Main segments: Diabetes & Obesity care; Rare Diseases; International operations spanning multiple therapeutic areas.

- Geographic Presence: Global presence across the Americas, Europe, Asia-Pacific, and emerging markets. Products are marketed worldwide, with a strong focus on growth in non-U.S. markets.

- Key Offerings: Includes insulins, GLP-1 receptor agonists (such as semaglutide brands), obesity therapies, and a pipeline of new metabolic and rare-disease agents.

- End-Use Industries Served: Healthcare providers (hospitals, clinics), endocrinology specialists, primary care, payer/insurer networks.

- Key Developments and Strategic Initiatives: Strategic initiatives include large licensing deals (e.g., for next-gen cardiometabolic agents), organizational cost-reduction, global expansion of its core therapies, and pipeline diversification beyond GLP-1.

- Mergers & Acquisitions: Acquisition of U.S. biotech Akero Therapeutics (up to USD 5.2 billion) to bring in its MASH (metabolic dysfunction-associated steatohepatitis) asset.

- Partnerships & Collaborations: Licensing agreement with biotech Deep Apple Therapeutics (~ US$812 million) for AI-discovered cardiometabolic therapies.

- Product Launches / Innovations: Continued rollout of semaglutide-based therapies; pipeline includes next-gen non-incretin oral cardiometabolic agents.

- Capacity Expansions / Investments: Investments in manufacturing and global supply-chain readiness to support growth and regulatory filings.

- Regulatory Approvals: Plans to file for regulatory approval for next-generation obesity drug (CagriSema) in early 2026.

- Distribution channel strategy: Traditional pharma sales channels (hospitals, clinics), expansion into direct-to-consumer cash channels (in obesity treatments) to diversify access.

- Technological Capabilities / R&D Focus: Strong biologics/peptide platform, deep translational research in metabolic diseases, early-stage AI/licensing collaborations.

- Core Technologies / Patents: IP around semaglutide and GLP-1/peptide therapies, as well as rights to novel metabolic/obesity drug targets under licensing.

- Research & Development Infrastructure: Extensive global R&D capability, including discovery, clinical development, and regulatory functions, with a large pipeline beyond its legacy products.

- Innovation Focus Areas: Obesity and metabolic disease, diabetes treatments, liver/metabolic disorders (MASH), rare disease therapeutics.

- Competitive Positioning: Market leader in diabetes & obesity with vast portfolio and pipeline; now facing intensified competition and needing to reposition.

- Strengths & Differentiators: Strong brand recognition, deep therapeutic expertise, scale in diabetes/obesity, global commercial reach.

- Market presence & ecosystem role: Influential in setting standards/high-volume treatments in diabetes/obesity; major pharmaceutical partner and market driver.

SWOT Analysis

- Strengths: scale, leading pipeline, global reach.

- Weaknesses: heavy dependence on GLP-1 products, slower growth in key markets.

- Opportunities: new therapeutic classes (non-GLP-1 oral agents), pipeline diversification, emerging markets.

- Threats: intensified competition (especially in obesity/GLP-1 class), regulatory/pricing pressure, generics/compounds.

Recent News and Updates

Announced job cuts of about 9,000 employees (~11% of workforce) to save ~DKK 8 billion by end-2026 amid competitive pressure in the obesity market. Also announced a major licensing deal worth up to US$2.1 billion with biotech Omeros Corporation for the MASP-3 inhibitor in rare diseases.

Industry Recognitions / Awards

Recognized widely for innovation in diabetes/obesity care and leadership in metabolic disease therapeutics.

Abbott Laboratories

- Company Overview: Abbott Laboratories is a major diversified global healthcare company offering medical devices, diagnostics, nutrition products, and pharmaceuticals, with a strong emphasis on diabetes care technologies.

- Corporate Information (Headquarters, Year Founded, Ownership Type): Headquarters: Abbott Park, Illinois, USA. Year founded: 1888. Ownership type: publicly traded (NYSE: ABT).

- History and Background: Over 130 years old, Abbott has grown from a general pharmaceuticals company to a diversified healthcare leader with major assets in devices (including diabetes monitoring) and diagnostics, along with nutrition and established pharmaceuticals.

- Key Milestones / Timeline: Launch and commercial success of FreeStyle Libre® continuous glucose monitoring (CGM) system; recent expansions in structural heart and electrophysiology segments; substantial manufacturing/R&D investments announced in 2025.

- Business Overview: The business spans four major segments: Medical Devices, Diagnostics, Nutrition, and Established Pharmaceuticals. It leverages interconnected technologies across these areas.

- Business Segments / Divisions: Medical Devices (largest growth driver), Diagnostics, Nutrition, Established Pharma.

- Geographic Presence: Global operations covering the Americas, Europe, Asia-Pacific, and emerging markets with significant direct commercial presence and partnerships.

- Key Offerings: Continuous glucose monitors (FreeStyle Libre), vascular and structural heart devices (TriClip, etc.), diagnostics platforms, and nutrition products for various life stages.

- End-Use Industries Served: Hospitals, outpatient clinics, home care, pharmacies, and consumer health segments.

- Key Developments and Strategic Initiatives: In Q1 2025, Diabetes Care CGM revenue grew 18.3% (organic 21.6%), reaching US$1.7 billion, and the company reaffirmed full-year guidance. In Q3 2025, third-quarter sales rose 6.9% reported (7.5% excluding COVID-19 testing) and EPS of US$1.30 adjusted.

- Mergers & Acquisitions: Abbott invests in selective acquisitions to bolster its device/diagnostic pipeline, though specific large recent deals are not detailed here.

- Partnerships & Collaborations: Collaborates with healthcare systems, payers, and technology firms for connected health and home-monitoring ecosystems.

- Product Launches/Innovations: Introduction of the next-gen FreeStyle Libre CGM systems; early commercialization of Volt™ PFA (pulmonary vein isolation) system following CE mark; new structural heart/tricuspid therapies.

- Capacity Expansions/Investments: Two manufacturing and R&D investments in Illinois and Texas totaling ~ US$0.5 billion, expected to be operational by the end of 2025.

- Regulatory Approvals: Obtained CE mark for Volt™ PFA system in March 2025, allowing commercial PFA cases in the EU.

- Distribution channel strategy: Multi-channel: direct to hospitals/clinics, home health, pharmacy, and retail networks, and diagnostics labs. Strong global supply network.

- Technological Capabilities/R&D Focus: Expertise in sensor technologies, continuous monitoring, connected devices, electrophysiology, and diagnostic hardware.

- Core Technologies/Patents: Patents underpin the FreeStyle Libre CGM platform and related connectivity/algorithm systems; device IP for cardiovascular interventions.

- Research & Development Infrastructure: Global R&D teams across devices, diagnostics, and therapy development, integrated with manufacturing and commercialization.

- Innovation Focus Areas: Diabetes Care (CGM and connectivity), structural heart interventions, electrophysiology, and diagnostics automation.

- Competitive Positioning: Leader in CGM and diversified medical technologies; strong device pipeline and global scale give it a competitive edge.

- Strengths & Differentiators: Broad portfolio (devices + diagnostics + nutrition), strong reputation in diabetes monitoring, global commercial reach, reliable dividend history.

- Market presence & ecosystem role: Key partner for healthcare providers and payers; its CGM systems are embedded in both clinical and home-monitoring ecosystems.

SWOT Analysis

- Strengths: technology leadership, diversified business, global scale.

- Weaknesses: exposure to diagnostic headwinds in certain geographies (e.g., China).

- Opportunities: growth in diabetes care monitoring, expansion of device portfolio, and emerging markets.

- Threats: regulatory/policy changes, margin pressures, competitive disruption in CGM and diagnostics.

Recent News and Updates

In July 2025, Abbott’s stock dropped over 8% after it cut its full-year revenue growth guidance to 7.5-8.0% due to headwinds in China's diagnostic volumes. In October 2025, analysts at UBS and Benchmark reiterated Buy ratings, highlighting strong MedTech growth and solid fundamentals.

Press Releases

Q1 2025 results (April) announced ~ US$1.7 billion CGM revenue growth and full-year guidance reaffirmed. Q3 2025 results (October) posted 6.9% sales growth and reaffirmed full-year guidance.

Industry Recognitions / Awards

Frequently recognized for innovation and strong device/technology leadership in diabetes care and medical devices.

Top Companies & Their Offerings in the Gestational Diabetes Market

- Eli Lilly and Company: The company offers resources and support for diabetes management, including Insulin Lispro, GLP-1 analogs, and other anti-diabetic medications.

- Sanofi S.A.: Sanofi is a French multinational pharmaceutical and healthcare company that provides insulin aspart, insulin glargine, and metformin hydrochloride.

- Medtronic plc: The American-Irish company offers the MiniMed 780G system, an automated insulin delivery system, the InPen Smart Insulin Pen, and Smart MDI.

- Dexcom, Inc.: Dexcom specializes in continuous glucose monitoring devices, offering Dexcom G7 for gestational diabetes patients.

Other Companies

Read Further how top manufacturers are transforming the global Gestational Diabetes market: https://www.towardshealthcare.com/companies/gestational-diabetes-companies

Recent Developments in the Gestational Diabetes Market

- In June 2025, USV announced the launch of a first-of-its-kind Concordance Tool for Gestational Diabetes Mellitus (GDM) in India to improve short-term pregnancy outcomes and support long-term health. The tool is a structured, visual aid to diagnose GDM and emphasize screening and lifestyle interventions.

- In February 2025, researchers from the Universities of Leicester and Cambridge found that a reduced-calorie diet in late pregnancy is safe and beneficial for women with gestational diabetes living with overweight or obesity. Reduced-calorie diet promotes weight loss and improves sugar levels.

Segments Covered in the Report

By Treatment Type

- Lifestyle & Medical Nutrition Therapy

- Insulin Therapy

- Basal Insulin

- Prandial/Rapid-Acting Insulin

- Pre-mixed Insulin

- Oral Anti-diabetic Agents

- CGM & SMBG-linked Therapies

- Adjunctive Therapies/Supplements

By Product/Drug Formulation

- Insulin Injectables (pens, vials)

- Prefilled Pens/Cartridges

- Vials

- Glucose Monitoring Devices & Consumables

- RT-CGM

- Intermittent-scan CGM

- SMBG Meters & Strips

- Oral Tablets

- Digital Therapeutics & Apps

- Pumps & Consumables

- Supplements/Medical Foods

By Dosage Form/Delivery Device

- Prefilled Pens/Pen Cartridges

- Disposable Prefilled Pens

- Reusable Pens + Cartridges

- Vials (liquid)

- CGM Sensors/Consumables

- Cartridges for Pumps

- Pumps/Patch Pumps Consumables

- Novel/Inhaled/Other

By Diagnostic & Monitoring Method

- Oral Glucose Tolerance Test (OGTT)

- One-step (75 g)

- Two-step (50 g screen + OGTT)

- CGM (real-time & intermittent)

- Self-Monitoring Blood Glucose (SMBG)

- Fasting Plasma Glucose/HbA1c adjunct

- Biomarker/Point-of-Care Tests

By End-User/Care Provider

- Hospitals & Maternity Centers

- Home-Care/Self-Management

- Outpatient Clinics/Diabetes Centers

- Retail Pharmacies/Community Pharmacies

- Public Health/Community Programs

By Distribution Channel

- Retail Pharmacies

- Direct-to-Patient/Home Delivery

- Hospital/Institutional Procurement

- Online Pharmacies/E-Pharmacies

- Government/Tender Procurement

- Specialty Distributors/Others

By Region

- North America

- US

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Turkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific (APAC)

- China

- Taiwan

- India

- Japan

- Australia & New Zealand

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- Middle East and Africa (MEA)

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA