Explore How Infant Nutrition Market Companies are Transforming Healthcare

- FrieslandCampina

- Arla Foods amba

- Hero Group

- Perrigo Company plc

- Ausnutria Dairy Corporation Ltd.

- Beingmate Baby & Child Food Co., Ltd.

- Meiji Holdings Co., Ltd.

- Synutra International

- Hain Celestial Group

- Holle Baby Food GmbH

- Bellamy’s Organic

- Yili Group

- Feihe International

- Wyeth Nutrition

- HiPP GmbH & Co. Vertrieb KG

Infant Nutrition: Nourishing the Next Generation

The infant nutrition market is experiencing robust growth, driven by urbanization, rising female workforce participation, increased awareness of infant health, and the premiumization of baby nutrition products. It encompasses breast milk substitutes, fortified baby foods, and nutritional supplements designed to support healthy growth and development in infants (aged 0–24 months). It includes products such as infant formula, follow-on formula, growing-up milk, and complementary baby foods, fortified with essential nutrients, such as DHA, ARA, iron, calcium, and vitamins.

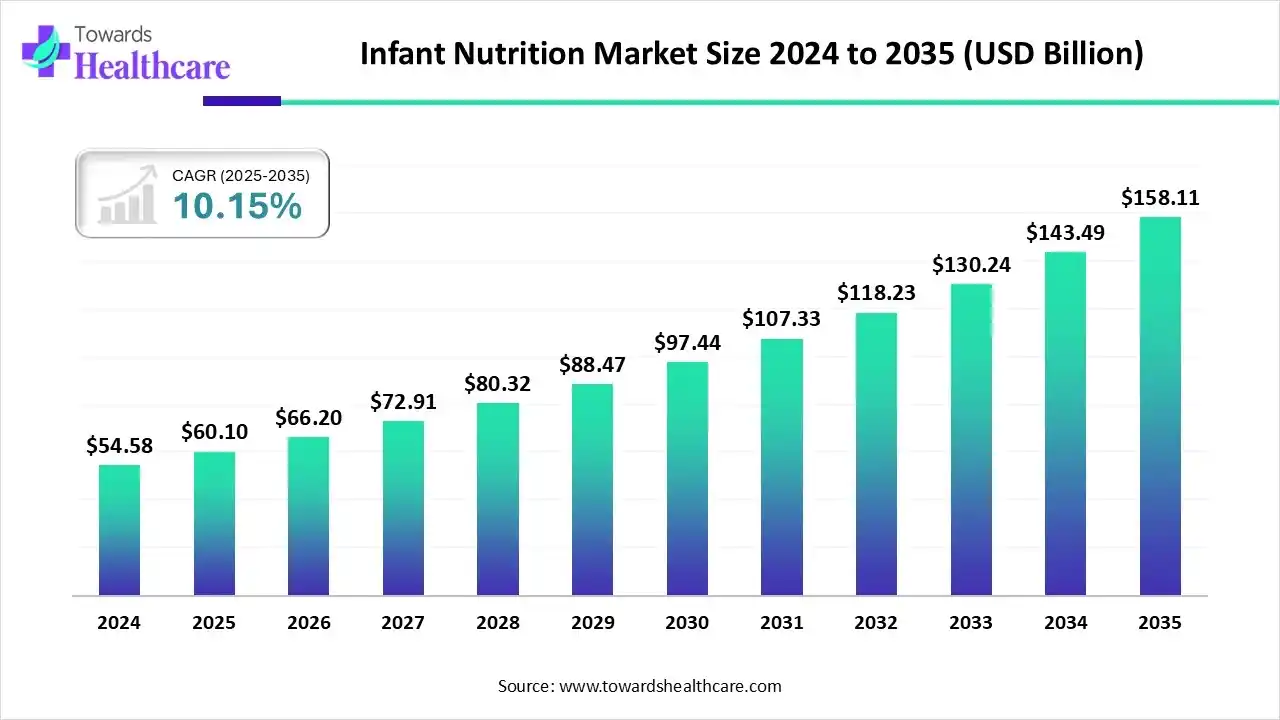

Market Growth

The global infant nutrition market size is calculated at USD 60.1 billion in 2025, grew to USD 66.2 billion in 2026, and is projected to reach around USD 158.11 billion by 2035. The market is expanding at a CAGR of 10.15% between 2026 and 2035.

Infant Nutrition Market Outlook

- Industry Growth Overview: The market is expected to grow rapidly in the coming years, driven by the shifting trend towards personalized and evidence-based approaches in developing infant nutrition. The demand for infant nutrition is increasing in emerging countries as disposable incomes rise.

- Major Investors: Venture capitalists invest in nutrition firms to develop and manufacture personalized infant nutrition. Investments help companies to strengthen their local market capabilities, support, and commitment, as well as expand their product pipeline.

- Sustainability Trends: Companies focus on optimizing the production process that could lead to reducing energy costs and improving process sustainability, while limiting the impact of technological treatment and ensuring high nutrient quality. Sustainable methods help develop biomimetic formulas and comply with the food challenge.

Value Chain Analysis – Infant Nutrition Market

R&D

Infant nutrition R&D involves formulating novel combinations and evaluating their role in improving the physical and mental development of infants.

Key Players: Nestlé S.A., DSM-Firmenich, and Carbery.

Clinical Trials & Regulatory Approval

Clinical studies are essential to ensure the safety of infant formulas and any systematic deviation from normal physical growth. Regulatory agencies like the FDA, EMA, and NMPA support product innovation.

Key Players: IQVIA Consumer Health, Abbott Nutrition, and Puleva Biotech.

Patient Support & Services

Patient support & services refer to offering counseling, education, and financial or food assistance to parents and caregivers about infant nutrition.

Company Landscape

Nestlé S.A.

Corporate Information

- Headquarters: Vevey, Switzerland.

- Year founded: 1866 (by Henri Nestlé)

- Ownership type: Publicly listed company (Swiss stock exchange: NESN)

History and Background

- Founded in 1866, evolved into a diversified global food & beverage company.

- Over time, built a major position in infant & early childhood nutrition via acquisitions, brand launches, and global expansion.

Key Milestones/Timeline

- 2023: Nutrition segment (including Early Childhood Nutrition) sales at CHF 15.8 billion.

- 2024: Full-year results: organic growth 2.2%, real internal growth 0.8%.

- 2024: Capital Markets Day (Nov 2024) emphasised growth in Early Childhood Nutrition and Kids & All-Family Nutrition.

Business Overview

- Business Segments / Divisions

- Early Childhood Nutrition (infants/toddlers) – a core part of the Nutrition division.

Kids & All-Family Nutrition

Adult Nutrition and other food & beverage segments

Geographic Presence

Operates globally across Europe, the Americas, the Asia Pacific, etc. E.g., Nutrition sales: Europe ~11%, North America ~55%, Latin America ~10% for 2023.

Key Offerings

- Infant formulas, follow-on formulas, growing-up milks

- Complementary foods for toddlers

- Nutrition products for children, and broader family nutrition

End-Use Industries Served

- Infant & toddler feeding market

- Family nutrition market

- Health & wellness consumer food market

Key Developments & Strategic Initiatives

- Mergers & Acquisitions

Broad portfolio expansion; specific recent infant-nutrition M&A details are limited in public sources.

- Partnerships & Collaborations

Focus on science-based nutrition, leveraging R&D and collaborations; capital markets documentation notes the scale of tech and innovation.

- Product Launches / Innovations

Emphasis on “Accelerate market share gain in Early Childhood Nutrition” and “Drive volume growth in Kids & All Family Nutrition”.

- Capacity Expansions / Investments

Notably, in the 2024 Capital Markets Day slide deck, the company mentions scaling production, global footprint to target growth in early childhood nutrition.

- Regulatory Approvals

As a global infant‐formula producer, subject to local regulatory approvals in each geography (e.g., China, India), though specific recent approvals were not found in my searched sources.

- Distribution Channel Strategy

- Global multi-channel: retail (mass, pharmacy, specialty), e-commerce, and emerging markets focus (Asia Pacific).

- Leveraging a large global supply chain and brand reach.

Technological Capabilities / R&D Focus

- Core Technologies / Patents

Nutrition science, infant gut-health formulation, probiotic/human-milk-oligosaccharide (HMO) technology (implicit in documents)

- Research & Development Infrastructure

Large global R&D network (Nestlé Research) covering nutrition science, infant & maternal nutrition.

- Innovation Focus Areas

- Early Childhood Nutrition: ingredients, premiumization, specialized formulas

- Kids & All Family Nutrition: health & wellness positioning

Competitive Positioning

- Strengths & Differentiators

- Global scale and deep distribution network

- Strong brand portfolio and presence in major markets

- Significant R&D and innovation in infant nutrition

- Market Presence & Ecosystem Role

- Market leader in infant nutrition globally (>20 % share)

- Plays a central role in shaping industry standards, ingredient innovation, and premiumisation.

SWOT Analysis

- Strengths: Scale, brand equity, global footprint, strong nutrition R&D

- Weaknesses: Mature markets with slower growth, regulatory complexity, price/volume pressures

- Opportunities: Emerging markets (Asia Pacific, India), premium and organic formulas, digital/e-commerce channels

- Threats: Regulatory scrutiny (e.g., marketing of breast-milk substitutes), rising input costs, competition from local/regional players

Recent News and Updates

Press Releases : 2024 full-year results: organic growth 2.2%.

Industry Recognitions / Awards

The Access to Nutrition Initiative (“ATNI”) scorecard shows Nestlé upholds infant formula marketing commitments globally (85% of its infant formula sales).

Recent News

In China, Nestlé reported 1.9% annual growth in Greater China in 2024.

Danone S.A.

Corporate Information

- Headquarters: Paris, France.

- Year founded: 1919 (as Danone)

- Ownership type: Publicly listed company (Euronext: BN)

History and Background

- Originated in the Barcelona/Paris regions, expanded into dairy, bottled water, early life nutrition, and medical nutrition.

- Its Early Life & Medical Nutrition business (Nutricia) has grown global footprints in infant formula and toddler nutrition.

Key Milestones/Timeline

- 2024: Recurring operating income €3,558 m for full‐year 2024.

- 2024: Like-for-like sales growth in Q3 in China/North Asia & Oceania +8.0% (volume/mix +10.2%).

- 2025 Q1: Reported 4.3% like‐for‐like sales growth driven by infant formula demand in China.

Business Overview

- Early Life & Medical Nutrition (includes infant formulas, follow-on, toddler)

- Waters & other beverage categories

- Specialized Nutrition (adult/medical)

Geographic Presence

Strong presence in China, India, North Asia & Oceania; also Europe, Americas. For 2024 Q3: China/North Asia & Oceania delivered +10.2% volume/mix.

Key Offerings

- Infant milk formulas, toddler growing-up milks, specialized formulas for medical use

- Premium and niche infant nutrition brands (e.g., Aptamil)

End-Use Industries Served

- Infant/toddler feeding market

- Medical nutrition (infants & paediatrics)

- Health-focused consumer nutrition

Key Developments & Strategic Initiatives

- Mergers & Acquisitions

2024/2025: Acquired majority stake in US plant-based company Kate Farms to expand dairy-free infant formula portfolio.

- Partnerships & Collaborations

Published 2024 Baby Formula Marketing Standards and compliance framework.

- Product Launches / Innovations

Premium infant nutrition formulas in China, India, with faster-than-market growth (India super-premium growth “two times faster” than market in FY24).

- Capacity Expansions / Investments

The company is ramping up shipments to the United States to address the infant formula shortage.

- Regulatory Approvals

Adhering to global BMS (breast-milk substitute) marketing codes and publishing compliance reports.

- Distribution Channel Strategy

Focus on emerging markets (China, India) and premium segments; strengthening e-commerce and direct-to-consumer.

Technological Capabilities/R&D Focus

- Core Technologies/Patents

Innovation in plant-based infant nutrition (via Kate Farms acquisition)

- Research & Development Infrastructure

Global R&D centers, strong focus on early life nutrition science

- Innovation Focus Areas

Premiumisation, plant-based formulas, specialty/toddler nutrition in emerging markets

Competitive Positioning

- Strengths & Differentiators

- Strong growth in China, India (emerging markets)

- Focus on premium and differentiated infant nutrition products

- Commitment to responsible marketing (BMS standards)

- Market Presence & Ecosystem Role

- Ranked #2 in infant nutrition globally (>10% market share)

- Influential in shaping the premium segment in emerging markets

SWOT Analysis

- Strengths:

- Growth momentum in high-potential markets

- Premium brand positioning, innovation (plant-based)

- Weaknesses:

- Strong dependence on regionally volatile markets (China births declining)

- Cost pressures in the dairy/ingredient supply chain

- Opportunities:

- Addressing unmet needs (premium, organic, plant-based infant nutrition)

- Geographic expansion (India, Southeast Asia, Africa)

- Threats:

- Regulatory pressures around formula marketing (BMS), competition from local/regional players

- Demographic headwinds (declining birthrates in China)

Recent News and Updates

Press Releases: FY 2024 results: recurring operating income €3,558 m, margin 13.0% (up +39 bps).

Industry Recognitions / Awards

ATNI scorecard: Danone’s BMS marketing commitments for infant formula cover ~92% of global infant formula sales; geographic penalty 7%.

Recent News

Strong Chinese demand helped Danone beat forecasts in Q1 2025; infant formula is a driver.

Recent Developments in the Infant Nutrition Market

- In September 2025, Panacea Biotec Pharma Limited launched two new product lines in the Indian baby care market. Staart Prime is an infant milk substitute range for different stages of infant development. The product is focused on the domestic Indian market, with potential international launches planned for the future.

- In April 2025, Else Nutrition Holdings, Inc. announced the launch of a new campaign, Formula for Change, to accelerate the U.S. regulatory support for clinical trials of its breakthrough dairy-free, soy-free infant formula. The initiative helps to improve access to a safe, inclusive, and science-backed alternative to traditional dairy-based formulas.

Partner with our experts to explore the Infant Nutrition Market at sales@towardshealthcare.com

Keypoints

- Company Overview

- Locations Subsidiaries/Geographic reach

- Key Executives

- Company Financials

- Patents registered

- SWOT Analysis

- Applications Catered

- Strategic collaborations

- Recent Developments

- Competitive Benchmarking