February 2026

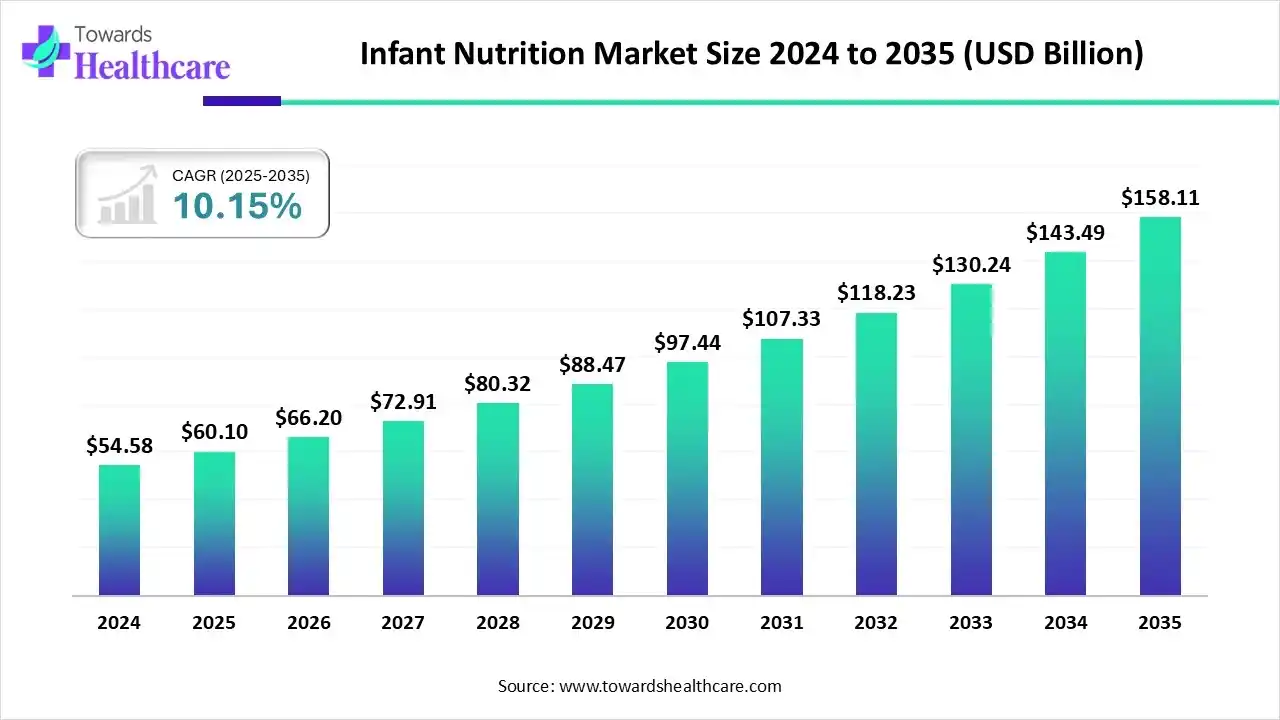

The global infant nutrition market size is calculated at USD 60.1 billion in 2025, grew to USD 66.2 billion in 2026, and is projected to reach around USD 158.11 billion by 2035. The market is expanding at a CAGR of 10.15% between 2026 and 2035.

The infant nutrition market is primarily driven by the growing awareness of infant nutrition and the increasing development of organic and non-GMO formulations. Favorable regulatory support and rising investments support new product development. Increasing female workforce participation is driving demand for infant nutrition products. Artificial intelligence (AI) helps provide personalized nutritional formulas for infants.

| Table | Scope |

| Market Size in 2025 | USD 60.1 Billion |

| Projected Market Size in 2035 | USD 158.11 Billion |

| CAGR (2026 - 2035) | 10.15% |

| Leading Region | Asia-Pacific |

| Market Segmentation | By Product Type, By Ingredient/Source, By Formulation, By Distribution Channel, By Age Group, By Region |

| Top Key Players | FrieslandCampina, Arla Foods amba, Hero Group, Perrigo Company plc, Ausnutria Dairy Corporation Ltd., Beingmate Baby & Child Food Co., Ltd., Meiji Holdings Co., Ltd., Synutra International, Hain Celestial Group, Holle Baby Food GmbH, Bellamy’s Organic, Yili Group, Feihe International, Wyeth Nutrition, HiPP GmbH & Co. Vertrieb KG |

The infant nutrition market is experiencing robust growth, driven by urbanization, rising female workforce participation, increased awareness of infant health, and the premiumization of baby nutrition products. It encompasses breast milk substitutes, fortified baby foods, and nutritional supplements designed to support healthy growth and development in infants (aged 0–24 months). It includes products such as infant formula, follow-on formula, growing-up milk, and complementary baby foods, fortified with essential nutrients, such as DHA, ARA, iron, calcium, and vitamins.

AI plays a vital role in transforming the market, leading to the development of precision nutrition formulas containing desirable nutrients. AI and machine learning (ML) algorithms facilitate nutritional assessment to identify or prioritize infants who need early interventions and monitoring responses. They reduce manual errors in assessing nutritional status and enhance the efficiency and accuracy of the assessment.

For instance,

The Government Initiatives Related to Infant Nutrition are as follows:

Which Product Type Segment Dominated the Infant Nutrition Market?

The infant formula segment held a dominant presence in the market with a share of approximately 60-65% in 2024, due to a lack of natural breast milk, the reliance of working mothers on convenient feeding options, and strong retail availability. Infant formula serves as an alternative to breast milk and provides the desired nutrition for the infants. Low milk supply is believed to occur in approximately 10% to 15% of mothers, due to the increased prevalence of obesity and diabetes.

Baby Cereals & Purees

The baby cereals & purees segment is expected to grow at the fastest CAGR in the market during the forecast period, due to the growing demand for organic, minimally processed, and additive-free baby foods. Baby cereals & purees include fortified cereals, fruit/vegetable purees, and snack products for weaning infants. They are an excellent energy source and are preferred after 6 months. Moreover, they are an optimal vehicle for iron fortification and provide non-digestible carbohydrates.

Growing-Up Milk & Toddler Formula

The growing-up milk & toddler formula segment is expected to grow in the coming years, due to intolerance to cow milk among toddlers. Toddler formula, derived from almond milk and oat milk, is an easier-to-digest protein, benefiting toddlers who face digestive discomfort with cow’s milk. They contain micronutrients that cow’s milk may not offer in sufficient quantities, such as iron, DHA, and zinc.

Why Did the Cow Milk-based Segment Dominate the Infant Nutrition Market?

The cow milk-based segment held the largest revenue share of the market in 2024, due to cost-effectiveness and widespread availability. Cow milk-based products offer superior advantages over plant-based alternatives, such as better nutrition and digestion abilities in infants. They offer important nutrients for toddlers, including protein, vitamin D, fat, and calcium. They are mostly provided to infants of 1 year and above.

Soy-based & Plant-based

The soy-based & plant-based segment is expected to expand rapidly in the market in the coming years. The increasing preference for vegan foods and the chances of lactose intolerance in infants promote the demand for soy-based and plant-based formulas. Lactose intolerance is caused by a deficiency of the lactase enzyme in infants. Studies have found that approximately 20% of Hispanic, Asian, and African children below 5 years of age have lactase deficiency.

Organic/Natural Ingredients

The organic/natural ingredients segment is expected to show lucrative growth, due to increasing disposable incomes and strong premiumization trends, especially in Europe and North America. People are aware of chemical-free products and their potential long-term benefits. Infants are more sensitive to harmful chemicals, augmenting the segment’s growth. Key components include organic grains, legumes, and meat.

How the Powder Segment Dominated the Infant Nutrition Market?

The powder segment contributed the biggest revenue share of approximately 70 % of the market in 2024, due to high stability and ease of transportation, storage, and reconstitution. Parents can prepare personalized doses of infant nutrition based on the infants’ requirements. Powders have improved shelf life, enhanced absorption, and greater flexibility for dosing and consumption.

Liquid

The liquid segment is expected to witness the fastest growth in the market over the forecast period. Liquids eliminate the need for reconstituting formulations, as they are available in ready-to-use formats. They are highly preferred among working parents for convenience. They provide superior benefits, such as ease of administration, flexible dosing, and faster therapeutic effects.

Solid

The solid segment is expected to show a notable CAGR, due to higher stability, accurate dosing, and convenience. Solids are preferred for children of greater than 1 year of age. They contain more appropriate, digestible ingredients. They decrease the risk of having feeding problems later in life.

What Made Supermarkets/Hypermarkets the Dominant Segment in the Infant Nutrition Market?

The supermarkets/hypermarkets segment accounted for the highest revenue share of the market in 2024, due to the largest retail share and strong brand visibility. Supermarkets contain a large variety of infant nutrition products for a wider consumer base. This eliminates the need for customers to visit multiple stores, saving them valuable time. They also provide competitive prices and special discounts during festivals, propelling the segment’s growth.

E-Commerce

The e-commerce segment is expected to grow with the highest CAGR in the market during the studied years. The burgeoning e-commerce sector and the increasing adoption of smartphones foster the segment’s growth. Online shopping enables customers to compare price ranges of similar products and order products from trusted brands. It offers numerous benefits, such as free home delivery and virtual consultations.

Pharmacies/Drug Stores

The pharmacies/drug stores segment is expected to grow significantly, due to the availability of prescription-based formulations. Pharmacies are trusted channels for prescription-based or special formulas. They possess skilled professionals to guide parents about dosage and the time of infant nutrition formula administration. They also suggest appropriate products based on the infants’ health.

Which Age Group Segment Led the Infant Nutrition Market?

0-6 Months

The 0-6 months segment led the market in 2024, due to the need for balanced nutrition and the availability of infant formula and breast milk substitutes. They must be fed with appropriate nutritional products, containing an iron-fortified formula and a vitamin D supplement. The amount of these nutrients in breast milk is significantly lower, necessitating parents to give infant nutrition, either in addition to or as an alternative to breast milk.

1-2 Years

The 1-2 years segment is expected to show the fastest growth over the forecast period. A variety of products are available for infants of 1-2 years in all formulations, such as solids and liquids. UNICEF recommends 4 to 5 meals a day, plus 2 healthy snacks, for infants of 1-2 years. This potentiates the need for infant nutrition to fulfill suitable nutrient requirements.

6-12 Months

The 6-12 months segment is expected to grow due to the transition to complementary foods. Infants of 6-12 months are advised to consume a variety of soft, mashed, and small pieces of food, along with breast milk. Infant nutrition products are available in the market that have the desired consistency, such as fruit or vegetable purees and baby cereals.

Asia-Pacific dominated the global market with a share of 45% in 2024. The increasing number of female employees, rising disposable incomes, and growing population are the major factors that govern market growth in the Asia-Pacific. Countries like China, India, Japan, and Southeast Asia are the major developers and consumers of infant nutrition globally. The rapidly expanding middle-class population and rapid urbanization boost the market.

China’s progress toward gender equality is shifting from a compliance-driven to a value-driven approach. In 2023, women accounted for 320 million of the nation’s workforce, representing 43.3% of total employment. The increasing birth rate potentiates the demand for infant nutrition. According to China’s National Bureau of Statistics, the nation saw an increase of 520,000 in the birth rate.

North America is expected to host the fastest-growing market in the coming years. Favorable regulatory policies and the growing product innovation foster the market. The region focuses on safety compliance and the manufacturing of infant nutrition products to deliver a larger consumer base. Government organizations launch initiatives and provide funding to support the development and delivery of infant nutrition in North America. People are becoming aware of infant formulas and their benefits.

The Centers for Disease Control and Prevention (CDC) states that numerous U.S. infants rely on infant formula for some or all of their nutrition. A recent national survey among 1,500 mothers and caregivers with children less than 12 months of age found that 79% of mothers and 89% of caregivers feed their infants at least some formula in their first year. It is estimated that about 5% of mothers are unable to breastfeed in the U.S. due to health reasons.

Europe is expected to grow at a notable CAGR in the foreseeable future. The growth is mature, but a premium market with high organic product penetration. Key players contribute a major market share globally. The European Medicines Agency (EMA) regulates the approval of scientifically backed infant formulas based on their safety and nutrition. Favorable government support, along with increasing investments and collaborations, contributes to market growth.

The UK government recently released strict guidelines for baby food manufacturers to reduce sugar and salt levels within 18 months in baby foods for children up to 36 months, benefiting almost 1.7 million children. The government aims to support parents to make easier, healthier choices that will have long-term benefits. The increasing female workforce participation also augments market growth. About 10.42 million women were working full-time, while 5.96 million were working part-time in 2024.

The infant nutrition market in South America is thriving as modern parents prioritize healthy beginnings for their babies. Around 6.8 million babies were born across the region in 2024, driving strong demand for fortified and organic infant foods tailored to evolving family lifestyles.

Brazil continues to lead with innovation in infant nutrition despite its fertility rate of 1.6 children per woman. Over 2.7 million babies born in 2024 are fueling demand for premium milk formulas, probiotic infant foods, and locally sourced nutritional products that blend science with natural ingredients for better infant wellness.

Across the Middle East and Africa, infant nutrition is gaining momentum with over 30 million babies born in 2024. Rapid urbanization and higher parental awareness are accelerating the shift toward ready-to-feed and fortified infant formulas, supporting early development and maternal confidence.

In the UAE, about 92,000 babies were born in 2024, fueling demand for organic and nutrient-rich baby foods. Affluent families are embracing scientifically balanced infant nutrition that aligns with modern health values and government support for early childhood well-being.

Infant nutrition R&D involves formulating novel combinations and evaluating their role in improving the physical and mental development of infants.

Key Players: Nestlé S.A., DSM-Firmenich, and Carbery.

Clinical studies are essential to ensure the safety of infant formulas and any systematic deviation from normal physical growth. Regulatory agencies like the FDA, EMA, and NMPA support product innovation.

Key Players: IQVIA Consumer Health, Abbott Nutrition, and Puleva Biotech.

Patient support & services refer to offering counseling, education, and financial or food assistance to parents and caregivers about infant nutrition.

Corporate Information

History and Background

Key Milestones/Timeline

Business Overview

Kids & All-Family Nutrition

Adult Nutrition and other food & beverage segments

Geographic Presence

Operates globally across Europe, the Americas, the Asia Pacific, etc. E.g., Nutrition sales: Europe ~11%, North America ~55%, Latin America ~10% for 2023.

Key Offerings

End-Use Industries Served

Key Developments & Strategic Initiatives

Broad portfolio expansion; specific recent infant-nutrition M&A details are limited in public sources.

Focus on science-based nutrition, leveraging R&D and collaborations; capital markets documentation notes the scale of tech and innovation.

Emphasis on “Accelerate market share gain in Early Childhood Nutrition” and “Drive volume growth in Kids & All Family Nutrition”.

Notably, in the 2024 Capital Markets Day slide deck, the company mentions scaling production, global footprint to target growth in early childhood nutrition.

As a global infant‐formula producer, subject to local regulatory approvals in each geography (e.g., China, India), though specific recent approvals were not found in my searched sources.

Technological Capabilities / R&D Focus

Nutrition science, infant gut-health formulation, probiotic/human-milk-oligosaccharide (HMO) technology (implicit in documents)

Large global R&D network (Nestlé Research) covering nutrition science, infant & maternal nutrition.

Competitive Positioning

SWOT Analysis

Recent News and Updates

Press Releases : 2024 full-year results: organic growth 2.2%.

Industry Recognitions / Awards

The Access to Nutrition Initiative (“ATNI”) scorecard shows Nestlé upholds infant formula marketing commitments globally (85% of its infant formula sales).

Recent News

In China, Nestlé reported 1.9% annual growth in Greater China in 2024.

Corporate Information

History and Background

Key Milestones/Timeline

Business Overview

Geographic Presence

Strong presence in China, India, North Asia & Oceania; also Europe, Americas. For 2024 Q3: China/North Asia & Oceania delivered +10.2% volume/mix.

Key Offerings

End-Use Industries Served

Key Developments & Strategic Initiatives

2024/2025: Acquired majority stake in US plant-based company Kate Farms to expand dairy-free infant formula portfolio.

Published 2024 Baby Formula Marketing Standards and compliance framework.

Premium infant nutrition formulas in China, India, with faster-than-market growth (India super-premium growth “two times faster” than market in FY24).

The company is ramping up shipments to the United States to address the infant formula shortage.

Adhering to global BMS (breast-milk substitute) marketing codes and publishing compliance reports.

Focus on emerging markets (China, India) and premium segments; strengthening e-commerce and direct-to-consumer.

Technological Capabilities/R&D Focus

Innovation in plant-based infant nutrition (via Kate Farms acquisition)

Global R&D centers, strong focus on early life nutrition science

Premiumisation, plant-based formulas, specialty/toddler nutrition in emerging markets

Competitive Positioning

SWOT Analysis

Recent News and Updates

Press Releases: FY 2024 results: recurring operating income €3,558 m, margin 13.0% (up +39 bps).

Industry Recognitions / Awards

ATNI scorecard: Danone’s BMS marketing commitments for infant formula cover ~92% of global infant formula sales; geographic penalty 7%.

Recent News

Strong Chinese demand helped Danone beat forecasts in Q1 2025; infant formula is a driver.

| Companies | Headquarters | Offerings | Revenue (2024) |

| Nestlé S.A. | Vevey, Switzerland | NAN Excella PRO, Lactogen PRO, PreNAN, Cerelac | 91.4 billion CHF |

| Danone S.A. | Paris, France | Protinex, Farex, Dexolac, Aptamil | €27.37 billion |

| Abbott Laboratories | Illinois, United States | Similac, Ensure, Glucema, PediaSure | $42 billion |

| Reckitt Benckiser Group plc | Slough, United Kingdom | Enfamil, Nutramigen | €14.16 billion |

| The Kraft Heinz Company | Illinois, United States | Heinz Baby, Plasmon, Nipiol, Dieterba | $25.84 billion |

Read further to see how top players are reshpaing the Infant Nutrition Market : https://www.towardshealthcare.com/companies/infant-nutrition-companies

By Product Type

By Ingredient/Source

By Formulation

By Distribution Channel

By Age Group

By Region

February 2026

February 2026

February 2026

February 2026