Let's Learn About the Top Giants in the Respiratory Health Supplements Market

- Amway Corporation

- Herbalife Nutrition Ltd.

- Glanbia PLC

- Haleon plc (brands include Otrivin, Theraflu, etc.)

- Nu Skin Enterprises, Inc.

- Nature's Sunshine Products, Inc.

- The Bountiful Company

- Vitabiotics Ltd.

- NOW Foods

- Nature's Bounty

- Unijules Life Sciences Ltd.

- Pristine Organics Pvt. Ltd.

- Zoic Pharmaceuticals

- Nutra Healthcare Pvt. Ltd.

- Lifegenix

- Gummies India

- BeastLife

- MuscleBlaze

- GNC India

- Optimum Nutrition (ON)

What are Respiratory Health Supplements?

Products with vitamins, minerals, herbs, and other dietary components that support lung function and general respiratory health are known as respiratory health supplements. They frequently do this by lowering inflammation and enhancing immunity. The respiratory health supplements market is fueled by rising respiratory disease prevalence, consumer awareness of preventive healthcare, and the need for natural, immunity-boosting supplements in a variety of convenient forms.

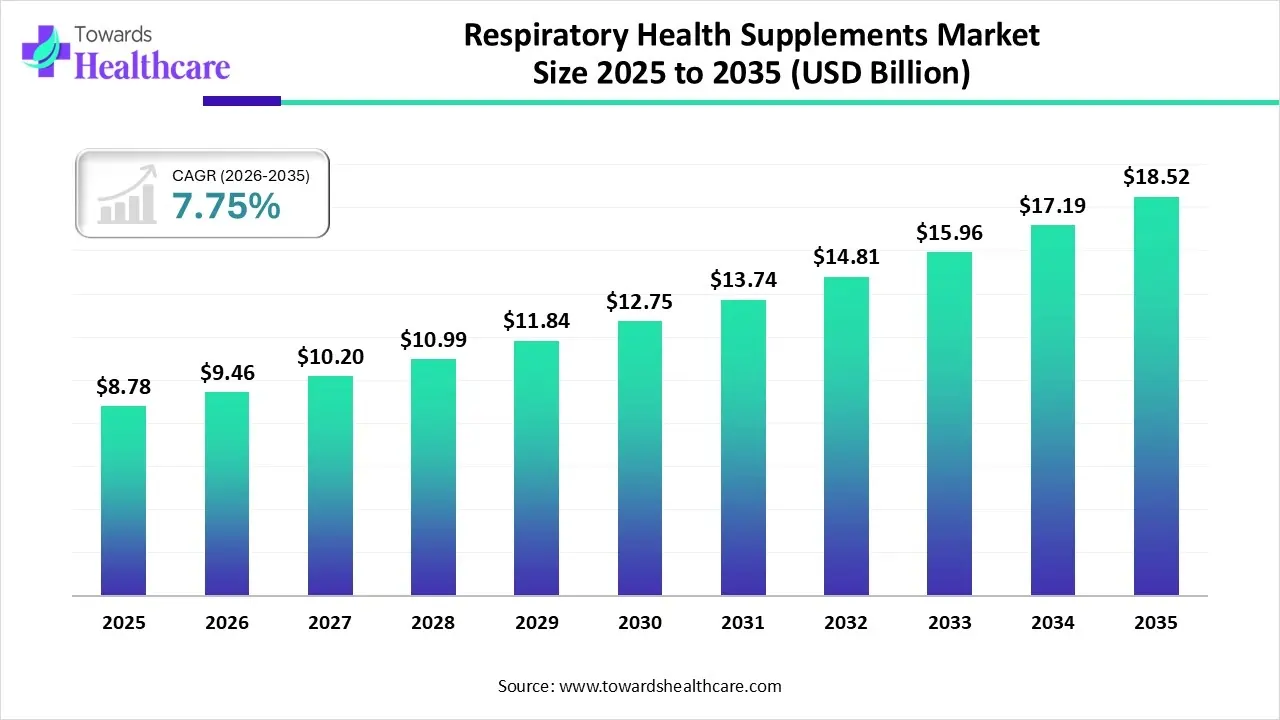

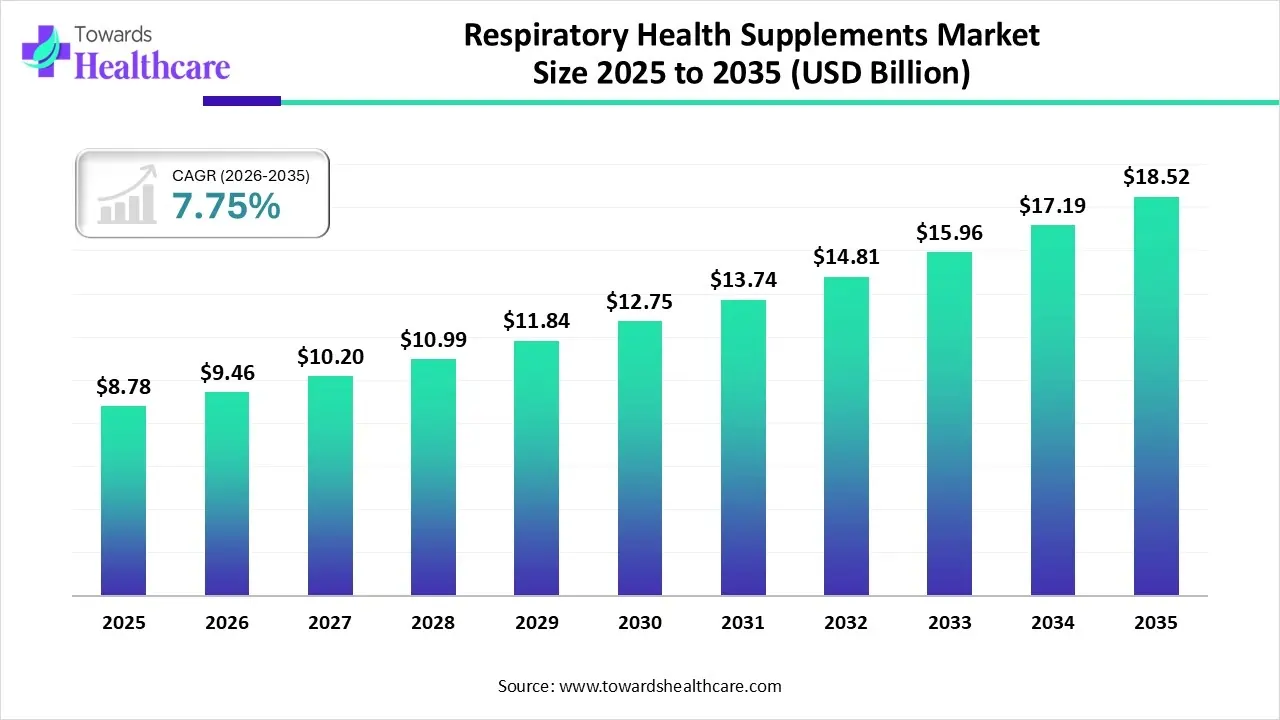

Market Growth

The global respiratory health supplements market size is calculated at US$ 8.78 in 2025, grew to US$ 9.46 billion in 2026, and is projected to reach around US$ 18.52 billion by 2035. The market is expanding at a CAGR of 7.75% between 2026 and 2035.

Respiratory Health Supplements Market Outlook

- Industry Growth Overview: The market is expected to grow significantly due to the demand for natural, immunity-boosting ingredients, growing respiratory disorders, and increased consumer awareness of preventive healthcare. Convenient gummies and integrated technology are examples of product innovation that further accelerate this growth.

- Major Investors: Amway Corporation, Herbalife Nutrition, Haleon plc, Glanbia plc, The Bountiful Company, Vitabiotics Ltd., NOW Foods, and Nature's Bounty are some of the leading investors and businesses in the respiratory health supplement market. These companies are important participants.

- Startup Ecosystem: The demand for natural, immunity-boosting products and the integration of digital health are driving the rapid growth of the startup ecosystem in the respiratory health supplements market. Resbiotic, a startup that provides probiotic supplements for respiratory support, is one example.

Top Vendors' Offerings in the Respiratory Health Supplements Market

1. Herbalife Nutrition Ltd.

-

Key Offerings for Respiratory Health: Immunity VMS (Vit C, Probiotics, Herbal Blends).

-

Distribution Channel: Direct Selling (IBOs)

-

Contribution to Market Growth: Promotes daily immune support via coaching and network.

2. Glanbia PLC

-

Key Offerings for Respiratory Health: Supplies B2B ingredients (Vit C, D, Zinc) to finished product makers.

-

Distribution Channel: B2B Ingredients

-

Contribution to Market Growth: Provides scientifically backed micronutrients essential for immunity products.

3. Nu Skin Enterprises, Inc.

-

Key Offerings for Respiratory Health: Pharmanex line (CordyMax, ReishiMax) for cellular defense.

-

Distribution Channel: Direct Selling

-

Contribution to Market Growth: Focuses on premium, clinically studied ingredients for targeted immunity.

4. Nature's Sunshine Products, Inc.

-

Key Offerings for Respiratory Health: Strong Herbal Supplements (HistaBlock, Echinacea) for comfort.

-

Distribution Channel: Direct Selling

-

Contribution to Market Growth: Boosts the natural/herbal segment with traditional respiratory solutions.

5. The Bountiful Company

-

Key Offerings for Respiratory Health: VMS brands (Nature's Bounty, Solgar) with Vit C, D, Zinc, Quercetin, NAC.

-

Distribution Channel: Retail/E-commerce

-

Contribution to Market Growth: Expands reach through mass-market availability for daily immune boosting.

Company Landscape

1. Company: Haleon plc

Company Overview:

- Haleon is a leading global consumer health company dedicated to delivering better everyday health.

- Its vast portfolio includes world-class brands across five major categories, including VMS (Vitamins, Minerals, and Supplements) and Respiratory health.

Corporate Information:

- Headquarters: Weybridge, United Kingdom

- Year Founded: 2022 (as a standalone company following demerger from GSK)

- Ownership Type: Public (LSE: HLN, NYSE: HLN)

History and Background:

- Haleon was formed in July 2022 following the demerger of the Consumer Healthcare division of GlaxoSmithKline (GSK).

- The company was built upon the joint venture between GSK's consumer brands and Pfizer's consumer health business, positioning it as a pure-play consumer health leader.

Key Milestones/Timeline:

- 2024: Completed the sale of its non-US Nicotine Replacement Therapy business for approximately £458 million.

- March 2025: Pfizer sold its remaining stake in Haleon for approximately £2.5 billion, completing its full exit.

Business Overview:

- Haleon operates globally, managing a portfolio of market leading brands such as Otrivin, Theraflu, and Centrum.

- The company aims to improve access to better health for over 1.2 billion people and drives growth through scientific innovation.

Business Segments/Divisions:

- Primary Segments: Oral Health, Pain Relief, VMS (Vitamins, Minerals, and Supplements), Respiratory, and Digestive Health.

Geographic Presence:

- Key Markets: North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA).

- Products are available in over 100 countries.

Key Offerings:

- Respiratory: Otrivin (nasal sprays), Robitussin (cough relief), Theraflu (cold and flu).

- VMS (Supplements): Centrum (multivitamins) and Caltrate, which include critical immunity boosters like Vitamin C and Zinc.

End-Use Industries Served:

- Focus: Consumer Health, Over-The-Counter (OTC) drugs, and Dietary Supplements.

Key Developments and Strategic Initiatives:

- Mergers & Acquisitions: No major respiratory supplement M&A since the spin-off, focusing on organic growth and optimizing the portfolio.

- Product Launches/Innovations: 2024 saw the launch of the Otrivin Nasal Mist with innovative dispensing technology, gaining share in every market launch.

- Distribution channel strategy: Multi-channel, with e-commerce accounting for approximately 12% of net revenue in 2024.

Technological Capabilities/R&D Focus:

- Innovation Focus Areas: Utilizing scientific substantiation and behavioral science to develop new VMS and Respiratory products, with a focus on natural and plant-based ingredients.

Competitive Positioning:

- Strengths & Differentiators: Strong portfolio of trusted, category-leading brands; significant scientific heritage derived from GSK and Pfizer.

- Market presence & ecosystem role: Global leader in consumer health with high influence in VMS and OTC Respiratory segments.

SWOT Analysis:

- Strength: Strong global brand equity, deep R&D heritage.

- Weakness: Pressure from private label brands, high operational costs.

- Opportunity: Growth in emerging markets, increasing consumer focus on self-care and immunity.

- Threat: Intense competition in supplements, regulatory changes.

Recent News and Updates:

- Press Releases: Mid-2025 results highlighted resilience in VMS and Respiratory, driven by new product formulations and successful price realization.

- Industry Recognitions/Awards: Received recognition for its digital transformation efforts and brand advertising in 2024.

2. Company: Amway Corporation

Company Overview:

- Amway is the world's largest direct-selling company, specializing in nutrition, beauty, and home care.

- Its Nutrilite brand is a global leader in the Vitamins, Minerals, and Supplements (VMS) market, which includes key respiratory support products.

Corporate Information:

- Headquarters: Ada, Michigan, USA

- Year Founded: 1959

- Ownership Type: Private (Owned by the DeVos and Van Andel families)

History and Background:

- Amway was founded by Jay Van Andel and Richard DeVos, establishing the direct-selling model.

- The acquisition of the Nutrilite brand in 1972 was foundational to its dominance in the nutritional supplement space, driven by its seed-to-supplement philosophy.

Key Milestones/Timeline:

- 1972: Acquired Nutrilite, becoming a leader in VMS.

- 2024: Continued strategic investments in its organic Nutrilite farms and digital platforms for IBOs.

Business Overview:

- Amway operates through a vast network of Independent Business Owners (IBOs).

- The company generates annual revenue of over $8 billion, with nutrition being the largest category.

Business Segments/Divisions:

- Primary Segments: Nutrilite (Nutrition/VMS), Artistry (Beauty), and Home.

- The Nutrilite division provides the core respiratory and immunity supplements.

Geographic Presence:

- Key Markets: Asia (particularly China and India), North America, and Europe.

- Operates in over 100 countries and territories.

Key Offerings:

- Respiratory/Immunity: Nutrilite Triple Protect (Vitamin C, Turmeric, Licorice), Nutrilite Vasaka, Mulethi & Surasa (Traditional Herbs Range), and immunity-focused Vitamin C products.

- The Traditional Herbs Range is specifically formulated to support respiratory health with expectorant and anti-inflammatory benefits.

End-Use Industries Served:

- Focus: Dietary Supplements, Skincare, Home Care.

Key Developments and Strategic Initiatives:

- Product Launches/Innovations: June 2025 saw the launch of Nutrilite Triple Protect in key markets like India, a plant-based supplement offering triple-action benefits for immunity, gut, and anti-inflammatory support.

- Capacity Expansions/Investments: Continuous investment in organic farms ensures a traceable, high-quality ingredient source for Nutrilite supplements.

- Distribution channel strategy: Primarily Direct Selling via IBOs, complemented by a strong digital and e-commerce presence for order fulfillment and business support.

Technological Capabilities/R&D Focus:

- R&D Infrastructure: Operates the Nutrilite Health Institute and global R&D facilities with a focus on ingredient traceability.

- Innovation Focus Areas: Personalized Nutrition (tailored supplement recommendations), microbiome health, and leveraging Ayurvedic wisdom for new herbal formulations like the Vasaka, Mulethi & Surasa blend.

Competitive Positioning:

- Strengths & Differentiators: Unique direct-selling model fosters exceptional customer loyalty; vertical integration with certified organic farms ensures purity and quality.

- Market presence & ecosystem role: Dominant player in the global VMS category, especially in high-growth Asian markets where herbal supplements are highly valued.

SWOT Analysis:

- Strength: Unrivaled direct-selling reach, farm-to-supplement quality control.

- Weakness: High reliance on the IBO network, brand perception challenges in some markets.

- Opportunity: Rapid growth in Asia, increasing demand for organic and traceable health products.

- Threat: Intense competition from e-commerce brands, regulatory scrutiny in the direct sales sector.

Recent News and Updates:

- Press Releases: Q4 2024 announced significant initiatives to accelerate digital transformation, including AI tools for IBOs to enhance customer engagement and product education.

- Industry Recognitions/Awards: Continuously recognized as the World's No. 1 Selling Vitamins & Dietary Supplements Brand.

Respiratory Health Supplements Market Value Chain Analysis

Research & Development (R&D)

R&D focuses on finding and verifying active ingredients, such as vitamins, probiotics, or herbal extracts, that can successfully support respiratory health as demonstrated by scientific research and clinical trials.

Key Companies: Johnson & Johnson, Roche, Pfizer, Novartis, Merck & Co., AstraZeneca, and Eli Lilly.

Formulation & Final Dosage Preparation

To deliver the active ingredients effectively and ensure optimal bioavailability for targeted action in the respiratory system, this stage involves developing stable, effective dosage forms (such as capsules, syrups, and powders).

Key Companies: Sun Pharmaceutical Industries, Cipla, Dr. Reddy's Laboratories, Lupin, Aurobindo Pharma, Abbott India, and Glenmark Pharmaceuticals.

Patient Support & Services

To increase patient compliance and satisfaction and ensure the supplements are used appropriately and effectively, value is added through educational materials, clear usage instructions, and support programs.

Key Companies: Roche, Pfizer, Novartis, Sanofi, Lupin, Dr. Reddy's Laboratories, and Mylan.

Recent Developments in the Respiratory Health Supplements Market

- In November 2025, during the illness-prone cold season, LifeBridge developed a natural dietary supplement to boost lung immunity. Known as a "smart lung vitamin," IQ Air combines functional ingredients like cordyceps mushroom extract with vitamins like vitamin D3.

- In July 2025, Dr. Reddy's Laboratories announced the launch of CeleHealth Kidz Immuno Plus Gummies in India, marking its entry into the child nutrition market. According to the pharmaceutical company, the product's goal is to meet India's child immunity-related nutritional needs.

Partner with our experts to explore the Respiratory Health Supplements Market at sales@towardshealthcare.com