December 2025

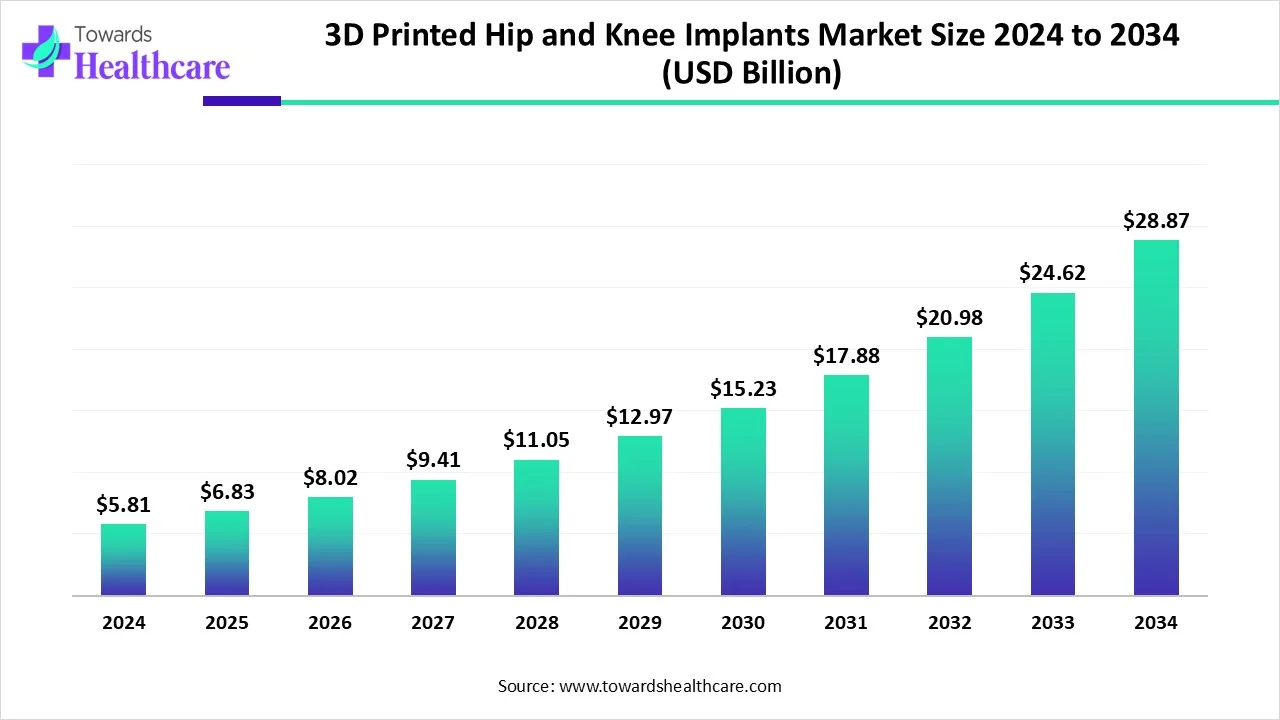

The global 3D printed hip and knee implants market size is calculated at US$ 5.81 in 2024, grew to US$ 6.83 billion in 2025, and is projected to reach around US$ 28.87 billion by 2034. The market is expanding at a CAGR of 17.49% between 2025 and 2034.

The use of 3D-printed hip and knee implants is increasing as they are being considered as ideal solutions for surgeries. At the same time, the integration of AI is enhancing its various parameters. New launches and collaboration among the companies are also driving their development. Additionally, their use is also increasing in different regions due to the presence of well-developed healthcare, growing orthopedic disorders, and growing demand. Thus, all these developments are promoting the 3D printed hip and knee implants market growth.

To manufacture objects by using materials such as metals, plastics, and ceramics through three-dimensional (3D) model data is known as three-dimensional printing (3DP). During the ideal surgeries to enhance the survival and functional outcomes, the placement and positioning of implants are important. These outcomes can be affected by the limited bone stock or anatomical variations. Thus, with the use of 3DP technology, patient-specific implants considering anatomical variations are being developed. Thus, its use in hip and knee arthroplasties and joint reconstruction surgeries is increasing.

The use of AI in the development of 3D-printed hip and knee implants is increasing. With the use of AI, personalized 3DP implants with the exact bone structure of the patient can be developed. Additionally, it is also used to improve the design and development of implants with its decision-making capacity. It also provides a prediction for the surgeries, minimizing the risk of complications. Furthermore, the defects are also identified, which in turn, reduces the errors in the development of 3DP implants.

Growing surgeries

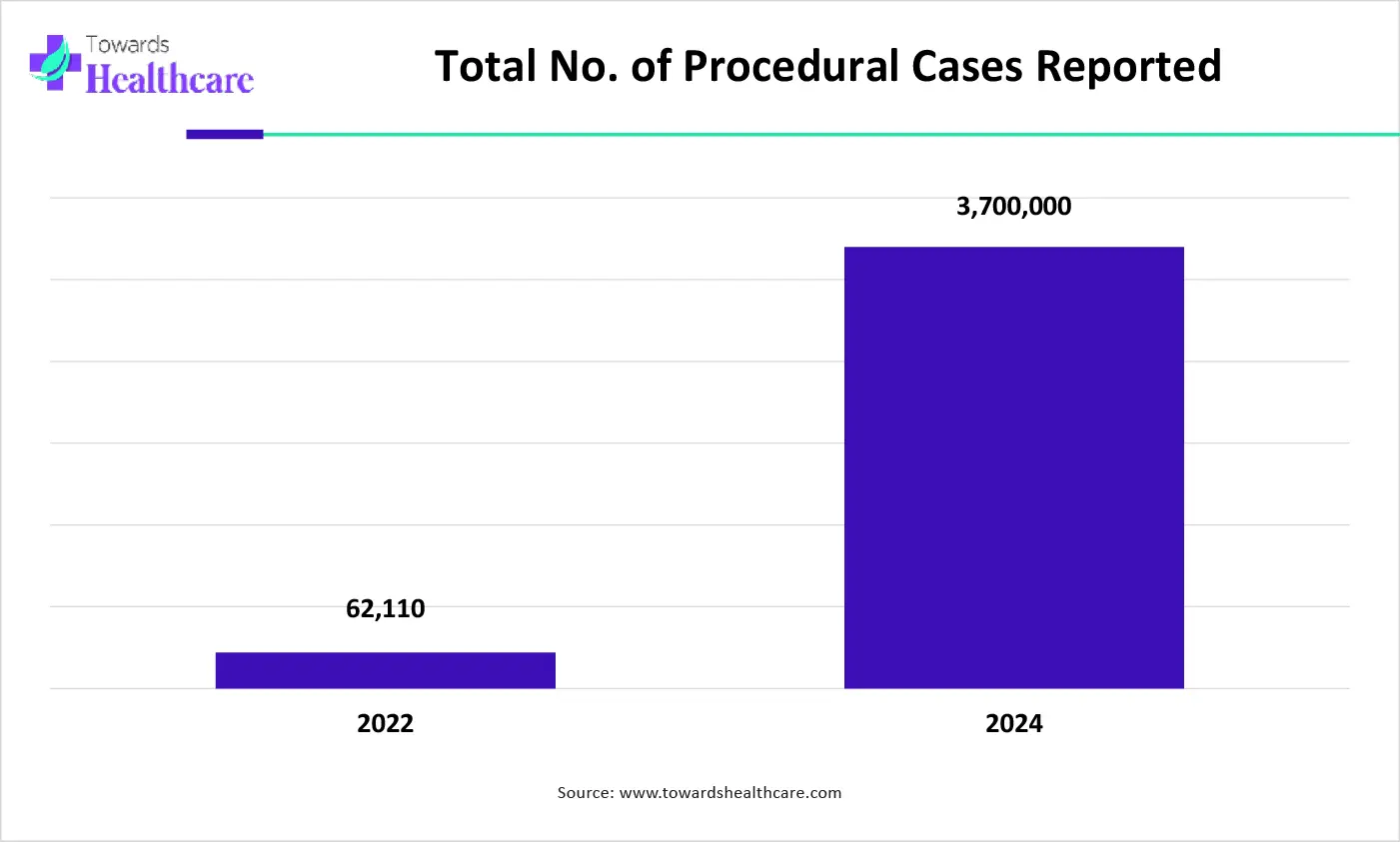

The increasing hip and knee surgeries are increasing the demand for 3D printed hip and knee implants. At the same time, growing cases of osteoarthritis, mobility issues, etc, are increasing their use. The traditional surgeries are often associated with complications, which increases their use. Additionally, the demand for personalized or patient-specific implants is also growing. Furthermore, the short surgery time, reduced complications, and failures with quick recovery are promoting their use. Thus, this drives the 3D printed hip and knee implants market growth.

The graph represents the total number of procedural cases for hip and knee surgeries reported in America in year of 2022 and 2024. It indicates that there is a rise in the procedural cases for surgeries. Hence, it increases the demand for 3D-printed hip and knee implants. Thus, this in turn will ultimately promote the market growth. (Source: Outpatient Surgery)

Enhanced cost and limited material availability

The 3D printers are expensive due to which restricts their adoption. At the same time, the materials used are also costly. Thus, this increases the cost of the implants developed, limiting their use. At the same time, the materials used for 3D printing are limited, affecting the development of the implants.

Growing Use of Ceramic Implants

The ceramic implants don’t show any inflammation or adverse immune responses, as well as a longer lifespan, reducing the need for revision surgeries. With the use of advanced 3D printing technologies, their shape as well as hardness are being modified. Additionally, due to their corrosion-resistant properties, new developments in the implants are also being considered. This, in turn, increases their use in allergy-prone patients, pediatric patients, as well as in cancer patients. Thus, this promotes the 3D printed hip and knee implants market growth.

For instance,

By product type, the hip implants segment held the largest share in the market in 2024. The use of hip implants due to growing cases of osteoarthritis increased. The hip implants were mostly used in revision surgeries. Their demand for personalized implants also increased due to anatomical availability. This contributed to the market growth.

By product type, the knee implants segment is expected to show the fastest growth rate at a notable CAGR during the upcoming years. The growing knee disorders is increasing the demand for the use of knee implants. Moreover, their demand for the development of personalized knee implants is also growing.

By material type, the metals segment held the dominating share in the market in 2024. The metals provided high strength, making them ideal for 3D printed hip and knee implants. Moreover, due to the enhanced biocompatibility also contributes to the same, enhancing its use.

By material type, the polymers segment is expected to show a significant growth rate during the predicted time. The use of polymers is growing due to their biocompatibility as well as lightweight property, as it is enhancing patient comfort. Moreover, personalized implants are also being developed, increasing their use.

By application type, the primary segment led the market in 2024. Due to a rise in awareness about 3DP implants, their use in the primary application was enhanced. At the same time, the geriatric population increased its use to avoid revision surgeries. The use of patient-specific implants with long-term effects contributed to the same.

By application type, the revision segment is expected to show the highest growth rate during the predicted time. The growing failures in the primary surgeries are increasing the use of 3DP hip and knee implants in revision applications. Moreover, their biocompatibility, potential to develop complete bone structure, and personalized solutions are promoting their use.

By surgical approach type, the minimally invasive surgery segment held the largest share in the market in 2024 and is expected to show the fastest growth rate during the forthcoming years. The minimally invasive surgeries provided short surgery times and quick recovery, increasing the use of 3DP hip and knee implants. Furthermore, it also enhanced their acceptance rate as well as the patient outcomes, promoting the market growth.

By end user, the hospital segment led the global market in 2024. A large volume of patients were successfully treated in hospitals with the use of 3DP hip and knee implants. Furthermore, the presence of advanced technologies and skilled personnel helped in improving the patient outcomes in the complex surgeries.

By end user, the ambulatory surgical centers (ASCs) segment is expected to grow significantly during the upcoming years. The use of advanced 3D printing facilities in ASCs is enhancing patient outcomes. At the same time, it is also offering affordable solutions and personalized implants. Moreover, the presence of specialized professionals is also contributing to the same.

North America dominated the 3D printed hip and knee implants market in 2024. North America consisted of a well-developed healthcare sector with the presence of advanced technologies and skilled personnel, which enhanced the development of 3D printed hip and knee implants. This contributed to the market growth.

The healthcare sector in the U.S. is well developed. This, in turn, is increasing the development as well as the production of 3D printed hip and knee implants. At the same time, the use of advanced technologies is also improving their quality and minimizing errors. These developments are supported by the regulatory bodies as well.

The presence of advanced industries in Canada is increasing the manufacturing of 3D printed hip and knee implants, as well as the development of personalized implants. This, in turn, is also enabling new collaborations. Additionally, the growing hip and knee surgeries is also driving their demand.

Asia Pacific is expected to host the fastest-growing 3D printed hip and knee implants market during the forecast period. The growing population with orthopedic disorders in the Asia Pacific is increasing the use of 3D printed hip and knee implants. At the same time, expanding healthcare is also increasing its adoption. Thus, this enhances the market growth.

China consists of a large population, which in turn increases the number of patients with various orthopedic disorders, increasing the use of 3D printed hip and knee implants. At the same time, the use of advanced technologies and robotic surgeries is also attracting patients.

The expanding healthcare sector in India is increasing the use as well as adoption of 3D-printed hip and knee implants. At the same time, new developments for personalized implants are also being considered. These developments are also supported by the government investments to make them affordable.

Europe is expected to grow significantly in the 3D printed hip and knee implants market during the forecast period. The aging population in Europe is increasing the demand for 3D-printed hip and knee implants. Additionally, the presence of advanced industries is also increasing their manufacturing, promoting the market growth.

The industries in Germany consist of advanced technologies, which help in improving various parameters of these implants. The growing demand for personalized implants is also driving their development, leading to new collaborations. Furthermore, the fast approvals are also contributing to the same.

The adoption of 3D printed hip and knee implants in the UK is growing due to the presence of a robust healthcare sector. These healthcare sectors are providing various reimbursement policies, which are attracting patients. Moreover, the growing use of minimally invasive surgeries is also increasing their acceptance rates.

In January 2025, the chief executive officer and co-founder of restor3d, Kurt Jacobus, stated that the use of data-driven and personalized solutions to transform orthopedic care has been the aim of restor3d. They are improving the mobility and lives, which may help patients to walk without pain, return to work, or play golf, with the use of advanced 3D printing and AI-driven design. Thus, this is supporting them to enter a new segment of the market, broaden the market shares, and strengthen their growth in the coming years. (Source: North Carolina Biotechnology Center)

In October 2024, after developing a novel solvent free polymer for DLP printing at Duke University, a MEMS PhD candidate working at Matthew Becker, the Hugo L. Blomquist Distinguished Professor of Chemistry at Duke, Maddiy Segal stated that she wanted to develop a material that can be used for medical applications which was her another goal besides making it stronger along with no shrinkage. Moreover, new prototype devices that are degradable and biocompatible are also being developed. (Source: Nano Werk)

By Product Type

By Material

By Application

By Surgical Approach

By End User

By Region

December 2025

November 2025

November 2025

November 2025