February 2026

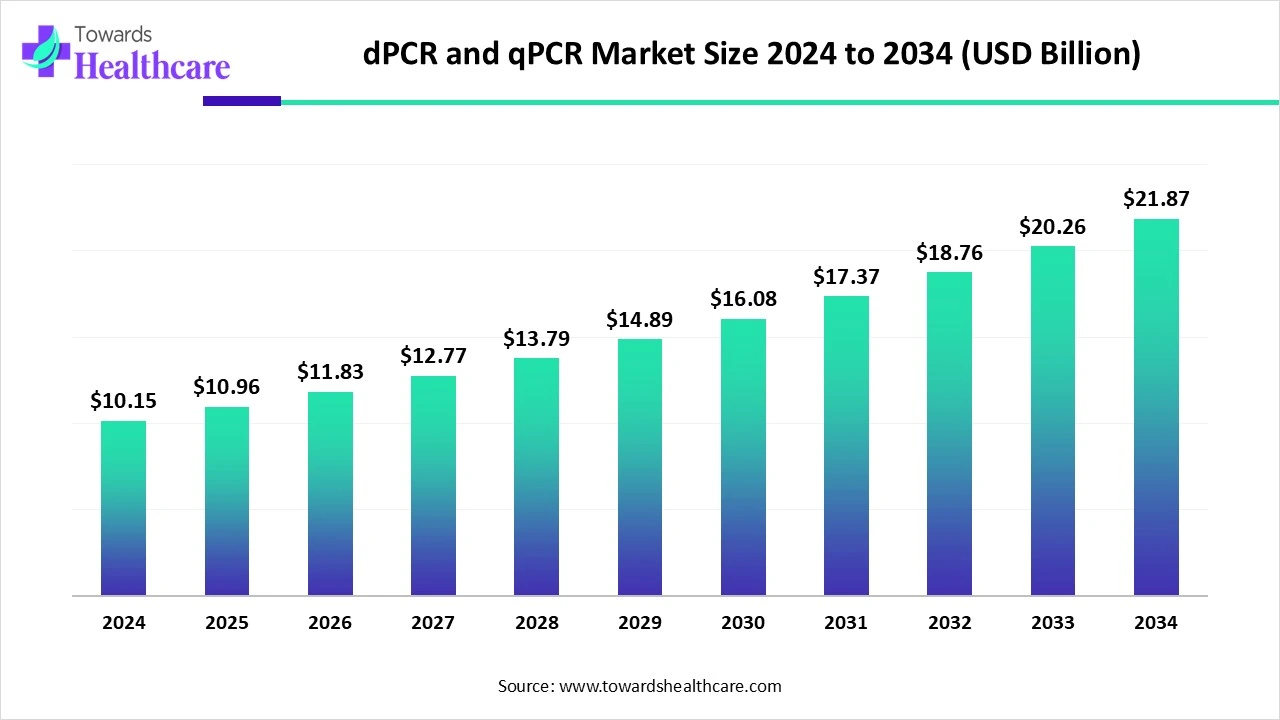

The global digital PCR (dPCR) and real-time PCR (qPCR) market size is calculated at US$ 10.15 in 2024, grew to US$ 10.96 billion in 2025, and is projected to reach around US$ 21.87 billion by 2034. The market is expanding at a CAGR of 7.97% between 2025 and 2034.

The main reasons driving demand for technologically sophisticated PCR tests over the projected period are the successful completion of the Human Genome Project, the elevated usage of biomarker profiling for illness diagnosis, and the growing incidence of major infectious diseases and genetic disorders. In the upcoming years, there will likely be a greater need for digital PCR in a variety of applications due to significant technology advancements, higher investments, financing, and awards.

| Table | Scope |

| Market Size in 2025 | USD 10.96 Billion |

| Projected Market Size in 2034 | USD 21.87 Billion |

| CAGR (2025 - 2034) | 7.97% |

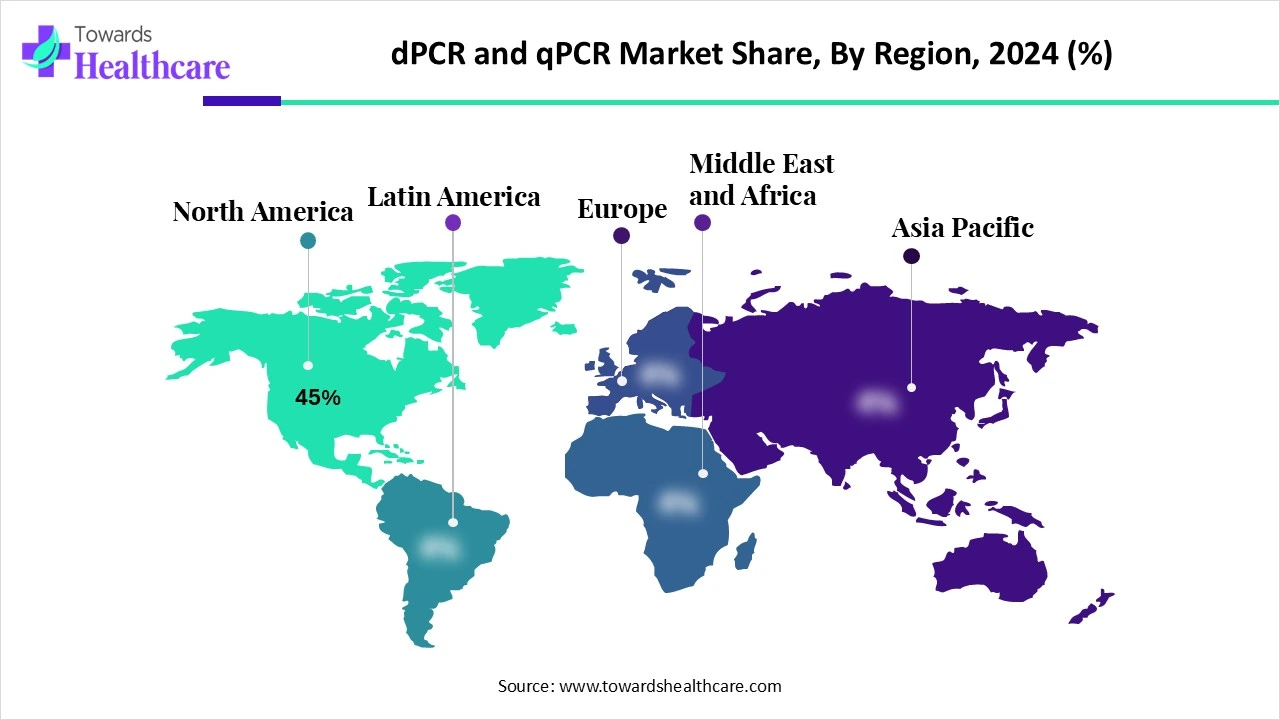

| Leading Region | North America Share 45% |

| Market Segmentation | By Technology, By Product Type, By Application, By End User, By Region |

| Top Key Players | Thermo Fisher Scientific, Inc., Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche Ltd., QIAGEN N.V., Agilent Technologies, Inc., Fluidigm Corporation, Stilla Technologies, Eppendorf AG, Analytik Jena GmbH, Merck KGaA (Sigma-Aldrich), Promega Corporation, Illumina, Inc., Cepheid (Danaher Corporation), GenScript Biotech Corporation, Bioer Technology, Takara Bio Inc., Bioneer Corporation, Enzo Life Sciences, Inc., Seegene, Inc., Sysmex Inostics (Sysmex Group) |

The digital PCR (dPCR) and real-time PCR (qPCR) market involves molecular diagnostic and research platforms that enable quantitative detection and amplification of nucleic acids (DNA/RNA). The market is driven by the rise in genetic testing, infectious disease outbreaks, precision diagnostics, and liquid biopsy applications.

qPCR (Real-Time PCR) monitors the reaction in real time and is widely used for gene expression analysis, infectious disease detection, oncology, and pathogen quantification. dPCR partitions the sample into thousands of individual reactions, providing absolute quantification with higher precision and sensitivity, especially useful in rare mutation detection, copy number variation, and minimal residual disease monitoring.

Growing Research in Molecular Biology: Molecular biology has a central place in the life sciences as a science that investigates the composition and operation of biomolecules and uncovers the fundamentals of living phenomena. Particularly in the diagnosis and treatment of genetic illnesses, cancer molecular biology, and other fields, molecular biology has demonstrated significant promise for use in medicine, offering fresh concepts and methods for illness prevention, diagnosis, and therapy.

For Instance,

The digital PCR (dPCR) and real-time PCR (qPCR) market is expanding mostly due to the development of AI-powered PCR technology. The AI-powered technology improves PCR performance, which is essential for clinical and forensic diagnostics, by increasing the success of amplification for damaged or trace DNA material. In a variety of applications, including environmental monitoring and healthcare, machine learning increases PCR efficiency, allowing for faster results while lowering mistakes. Researchers believe AI will transform forensic DNA testing, enhancing the quality and precision of evidence utilised in criminal investigations.

Demand for Pecise Diagnostic Tools

Demand for diagnostic testing is driving the digital PCR (dPCR) and real-time PCR (qPCR) market. Complex PCR technology is being used as a result of the increasing need for accurate, reliable, and rapid diagnostic solutions in hospitals and diagnostic centres. For these institutions, qPCR is an essential tool for precision testing for disease detection, patient monitoring, and therapy effectiveness.

The Chances of Contamination are a Challenge

The PCR method is extremely vulnerable to environmental or other DNA/RNA contamination. This may lead to inaccurate data interpretation. Although PCR has a big influence on a lot of study fields, stringent quality control should be used when planning and analysing PCR experiments.

Rising Demand for Single-Cell Sequencing

Single-cell analysis is a powerful method for exposing cellular diversity and offering fresh insights into the biological process and pathophysiology. At a single-cell level, it also advances scientific and clinical research in other disciplines. A digital polymerase chain reaction (dPCR) is a very sensitive and accurate quantitative analysis method for proteins or DNA/RNA. As microfluidic technology has advanced, digital PCR has been utilised to quantify single-cell proteins and single-cell gene expression in an absolute manner. Digital PCR has shown to be very beneficial for single-cell specific gene or protein identification.

By technology, the real-time PCR (qPCR) segment held the largest share of the digital PCR (dPCR) and real-time PCR (qPCR) market in 2024. Amplification target sequence (the starting number of copies of template DNA) may be determined with great sensitivity and accuracy across a broad dynamic range using real-time PCR, which is its primary benefit over PCR. Both qualitative (the existence or lack of a sequence) and quantitative (copy number) findings are possible from real-time PCR.

By technology, the digital PCR (dPCR) segment is estimated to grow at the highest rate during the forecast period. The advantages of digital PCR (dPCR) are numerous and include improved sensitivity, accuracy, repeatability, and inhibitor tolerance. It is particularly useful for certain applications, such as gene expression measurement and copy number variation (CNV) assessment.

By product type, the instruments/systems segment held the major share of the digital PCR (dPCR) and real-time PCR (qPCR) market in 2024. PCR machines, also known as thermocyclers, use cyclical programmes to control temperature in order to amplify DNA. With improvements in lid security, heat block dependability, hardware functionality, and other areas, these highly specialised instruments, which are essential tools in molecular applications, progressively benefit from design and mechanical developments throughout time.

By product type, the software & services segment is anticipated to witness the fastest growth during the forecast period. Polymerase Chain Reaction (PCR) software and services provide a variety of tools for controlling, evaluating, and facilitating PCR studies, including real-time PCR (qPCR). These services frequently include instrument support, data analysis software, and specialised services like on-site maintenance and training.

By application, the infectious disease diagnostics segment led the digital PCR (dPCR) and real-time PCR (qPCR) market in 2024. Approximately 3 million people die from infectious illnesses each year. Their diagnosis has greatly improved with the introduction of molecular methods, both in terms of sensitivity and specificity as well as the speed at which a clinically meaningful result may be produced. Based on a number of technological advancements, digital PCR and real-time PCR are more sensitive methods that are more resistant to inhibitor activity and can be directly quantified without the need of standard curves.

By application, the oncology segment is estimated to be the fastest-growing during the forecast period. As the field of cancer research keeps developing, new technologies are becoming more and more crucial to improving our knowledge of the illness. These technologies, which include digital PCR (dPCR) and quantitative real-time PCR (qPCR), are enabling researchers make significant contributions to cancer research and other fields.

By end-user, the hospitals & clinical laboratories segment was dominant in the digital PCR (dPCR) and real-time PCR (qPCR) market in 2024. The diagnosis of several human microbial illnesses in clinical microbiology labs and hospitals has been completely transformed by real-time PCR. Various machineries are employed according to their requirements. The optimal approach for varying lab sizes and test quantities may depend on workload and workflow concerns.

By end-user, the pharmaceutical & biotechnology companies segment is expected to grow at the highest rate during the predicted time frame. Technology is used by biotech and pharmaceutical industries for several purposes, such as quality control, medication development, gene analysis, and illness diagnostics. By amplifying certain DNA sequences, PCR makes it possible to identify and examine genetic material pertinent to a range of scientific and business endeavours.

North America dominated the digital PCR (dPCR) and real-time PCR (qPCR) market share by 45% in 2024. due to favourable regulations, the high rate of disease in the area, and a number of government-sponsored initiatives to improve the healthcare system. The significant number of well-known manufacturers in the region and the growing need for rapid diagnostic testing would also be major factors propelling the North American market throughout the forecast period.

The U.S. genetics and healthcare environment is as vast and varied as the nation itself. Numerous globally recognised research institutes, noteworthy genomics initiatives, and significant figures may be found in the U.S. The U.S. of America is renowned for its high adoption rate of preventive measures, including BRCA testing, in the context of adult genetic screening. As a result, prophylactic procedures like mastectomies became more common. This resulted partly from easier access to genetic services.

From the discovery of stem cells and the T-cell receptor to the identification of genes linked to early-onset Alzheimer's disease and cystic fibrosis, Canada has a long history of genetic achievements. Important genetics topics are being actively researched in Canada, and there are continuous initiatives to educate the public and workforce. Through the implementation of a precision health plan, Canada is also revolutionising the healthcare experience for patients.

Asia Pacific is estimated to host the fastest-growing digital PCR (dPCR) and real-time PCR (qPCR) market during the forecast period. High unmet clinical requirements, unexplored business prospects, and rising healthcare costs are the main drivers. The need for digital, endpoint, and real-time systems is also anticipated to rise as a result of technological improvements and the increasing prevalence of various target illnesses. The markets for real-time PCR, digital PCR, and end-point PCR will also be driven throughout the projected period by the need for healthcare goods and government programmes to enhance population health.

The necessity and desire for CAR-T therapies, government backing, cash flow, and local research led by Chinese scientists, including the creation of Investigator New Drugs (IITs), are some of the distinctive reasons propelling this explosion in CAR-T advancements in China. Of the 10 businesses developing the most CAR-T therapies, China is the one vying for a major presence in this industry.

India is becoming a pioneer in this field by breaking new ground in the development of a more functional gene editor. By creating chances for the employment of locally produced goods for gene editing, such initiatives would aid in the development of more appealing and financially significant treatments for the Indian populace. It is also encouraging to see Indian academic institutions collaborate with business on these projects.

Europe is expected to grow significantly in the digital PCR (dPCR) and real-time PCR (qPCR) market during the forecast period. Favourable government efforts, robust infrastructure for molecular biology research, and rising R&D funding all contribute to growth. Growing investments in proteomics and genomics, as well as the increasing incidence of genetic and cardiovascular diseases, are expected to propel regional market expansion. The market in Europe is driven by a variety of high-impact factors, including government financing, a growth in the number of genetic counselling programmes run by governments, and an increase in healthcare sector investments.

In June 2024, the National Strategy for Gene and Cell Therapies strategy document was sent to the German Federal Government. The purpose of the paper is to provide Germany a leading position in Europe's gene and cell therapy (GCT) industry by providing a foundation for policies. Although there are several legal, regulatory, and practical issues that hinder GCT research and development in Germany, the German government acknowledges that the era of GCT has begun.

The NHS has made strides in providing patients with more uncommon illnesses with cutting-edge treatments. The UK pharmaceuticals agency has authorised an average of two ATMPs annually over the last five years, but by 2030, this number is expected to rise to 10 to 15 annually. In the UK, the number of patients who potentially receive treatment with these medicines could increase from 2,500 in 2021 to as many as 10,000 annually by 2028.

In June 2025, according to Sang Rae Cho, CEO of GENCURIX, this strategic alliance with QIAGEN marks a significant turning point in the company's plans to introduce its cancer molecular diagnostic technology to the international market. We are sure that the combination of QIAGEN's platform and our diagnostic material will result in precision cancer diagnostics that are on par with international standards.

By Technology

By Product Type

By Application

By End User

By Region

February 2026

February 2026

February 2026

February 2026