February 2026

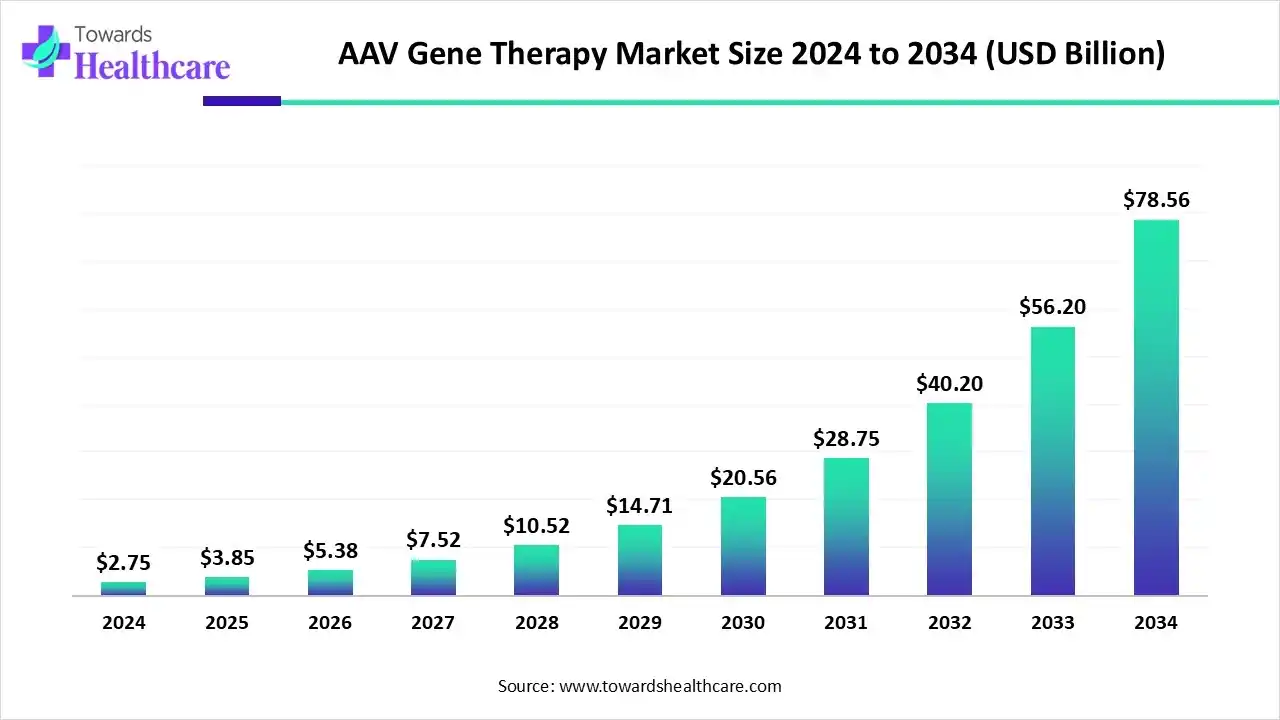

The AAV gene therapy market size was estimated at US$ 3.85 billion in 2025, projected to increase to US$ 5.4 billion in 2026 and reach US$ 112.24 billion by 2035, showing a healthy CAGR of 40.1% across the forecast years.

The AAV gene therapy market is primarily driven by the increasing demand for gene therapy, largely due to the rising prevalence of genetic disorders. The growing genomics research leads to the development of novel gene therapy products. Prominent key players collaborate to access advanced technologies and deliver innovative products in the market. The future looks promising, with the advancements in genomic technologies, an increasing number of clinical trials, and the use of AI/ML for research purposes.

| Table | Scope |

| Market Size in 2026 | USD 5.4 Billion |

| Projected Market Size in 2035 | USD 112.24 Billion |

| CAGR (2026 - 2035) | 40.1% |

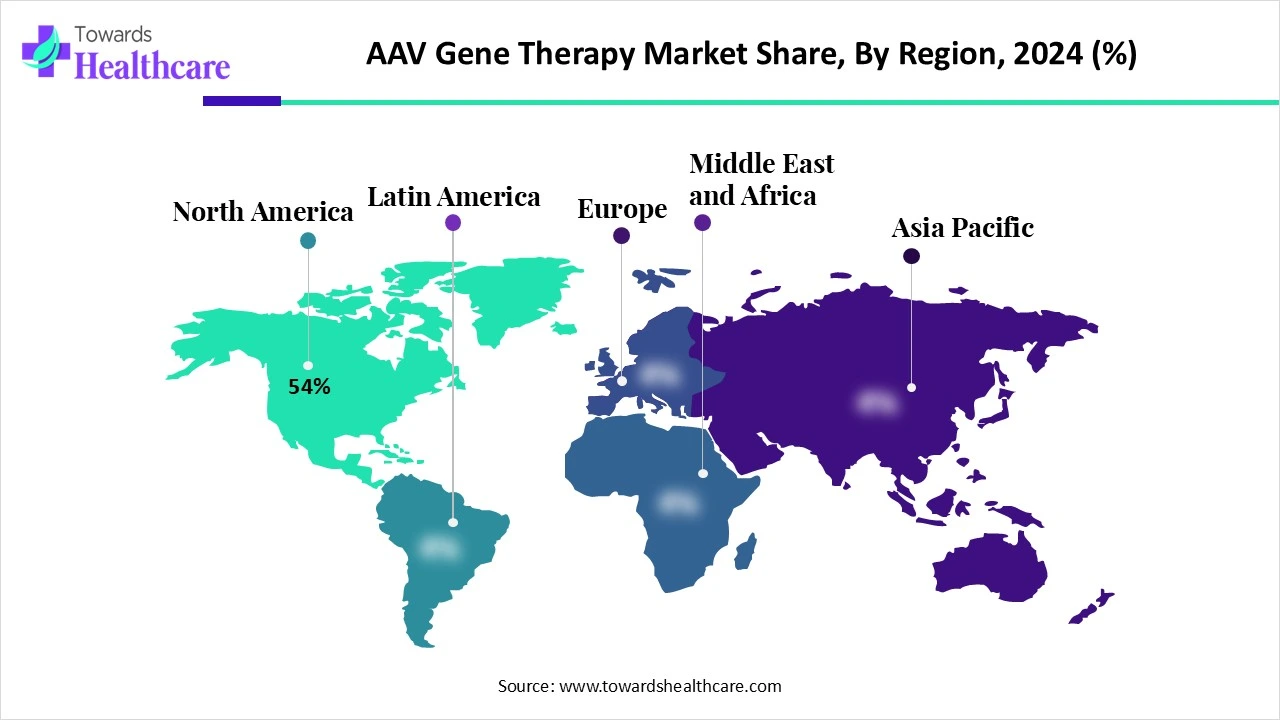

| Leading Region | North America by 54% |

| Market Segmentation | By Therapeutic Area, By Vector Serotype, By Route of Administration, By Application Stage, By Manufacturing Type, By End User, By Region |

| Top Key Players | Novartis (AveXis), Spark Therapeutics (Roche), BioMarin Pharmaceutica, Sarepta Therapeutics, uniQure, Regenxbio, Audentes Therapeutics (Astellas), Voyager Therapeutics, MeiraGTx, Asklepios BioPharmaceutical (AskBio - Bayer), Krystal Biotech, Genethon, BridgeBio Gene Therapy, Passage Bio, Solid Biosciences, Freeline Therapeutics, Capsida Biotherapeutic, LogicBio Therapeutics, Taysha Gene Therapies, Iveric Bio (part of Astellas) |

The AAV gene therapy market refers to the market for therapies based on adeno-associated virus (AAV) vectors, a leading delivery platform for in vivo gene therapy. AAV vectors are non-pathogenic and have low immunogenicity, making them ideal for long-term gene expression in non-dividing and slowly dividing cells. This market encompasses AAV-based therapeutics, vector manufacturing technologies, clinical-stage therapies, and commercial products used to treat rare genetic disorders, neurological diseases, ophthalmic conditions, hematologic disorders, and other conditions.

The market growth factors include the rising prevalence of genetic and rare disorders as well as the increasing demand for gene therapy. The growing research and development activities, supported by increasing investments from government and private organizations, drive the market. Technological advancements lead to the development of innovative products. The growing demand for personalized medicines globally and the burgeoning biotech sector contribute to market growth.

Artificial intelligence (AI) plays a vital role in designing AAV capsids and accelerating the research process. AI and machine learning (ML) algorithms can analyze vast amounts of data and suggest promising capsid designs, enhancing predicted AAV packaging efficiency and cell transduction efficiency. Integrating deep sequencing or next-generation sequencing into ML algorithms enables the development of novel functional AAV capsids. It also enables researchers to identify specific genetic mutations and their impact on capsid performance. AI and ML can improve the therapeutic efficacy and safety of AAV vectors. Thus, AI and ML can enhance the efficiency and accuracy of AAV viral vectors.

Demand for Gene Therapy

The major growth factor of the AAV gene therapy market is the growing demand for gene therapy. The rising prevalence of genetic and rare disorders, as well as cancer, potentiates the demand for gene therapy. According to a recent article published in The Lancet, approximately 300 million people are living with rare disorders. Of these, around 80% of rare diseases have a genetic origin. Gene therapy works by fixing a faulty gene or replacing a healthy gene to cure such diseases. The growing demand for personalized medicines due to rapidly changing demographics and increasing population also potentiates the need for gene therapy.

Manufacturing Challenges

AAV gene therapy faces considerable challenges during its large-scale manufacturing. It leads to aggregation and loss of efficacy during manufacturing, storage, and use. Thus, preparing stable viral vectors and preventing their degradation during manufacturing, handling, storage, and maintaining their long-term stability and efficacy are major challenges.

What is the Future of the AAV Gene Therapy Market?

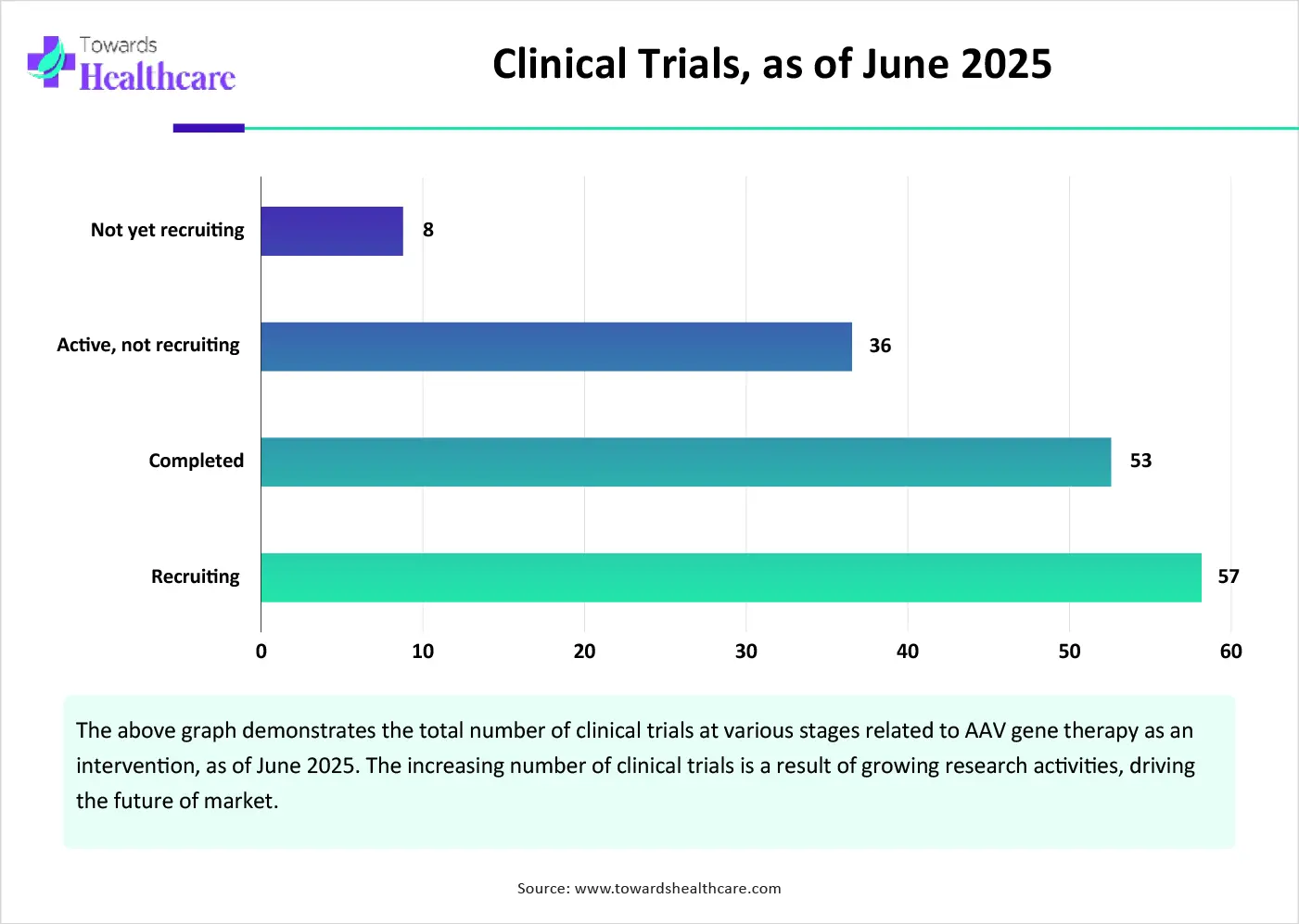

The future of the market is promising, driven by growing research and development activities. Researchers make consistent efforts to find extended applications of AAV gene therapy for various disorders. They are also developing novel drug delivery systems for AAV to transfer to the central nervous system (CNS). New capsids are being developed to facilitate parenchymal penetration and intraparenchymal spread. Moreover, the growing research activities lead to an increasing number of clinical trials to assess the safety and efficacy of AAV gene therapy. As of June 2025, 176 clinical trials are registered on the clinicaltrials.gov website.

By therapeutic area, the neurological disorders segment held a dominant presence in the market in 2024. The segment dominated because of the rising prevalence of neurological disorders and their complexity. Neurological disorders are difficult to treat with conventional therapeutics. AAV gene therapy acts as a suitable vector to deliver genes to the brain. It has been studied for various CNS disorders, including spinal muscular atrophy, Parkinson’s disease, and Rett syndrome.

By therapeutic area, the hematologic disorders segment is expected to grow at the fastest CAGR in the market during the forecast period. Hematologic disorders, such as hemophilia A and B, are major health concerns. The global prevalence of hemophilia A is estimated to be 6.6-12.8 per 100,000, and that of hemophilia B is 1.2-2.7 per 100,000. From 2022-2024, 3 AAV gene therapy has been approved by the U.S. Food and Drug Administration (FDA) for treating hemophilia. AAV vector inserts a functional copy of the missing clotting factor genes into patients’ hepatocytes.

By vector serotype, the AAV9 segment led the global market in 2024. The segment dominated because AAV9 has a rapid onset, better viral genome distribution, and the highest protein levels. It is mostly used for CNS and systemic delivery due to its ability to efficiently cross the blood-brain barrier (BBB) and distribute the transgene into the CNS. However, it is also used for other disorders, including cardiovascular and skeletal muscle disorders. It is proven to be more efficient than AAV1 and AAV8 for murine, NHP, and porcine cardiac muscle transduction.

By vector serotype, the engineered/hybrid capsids segment is expected to grow with the highest CAGR in the market during the studied years. The demand for engineered/hybrid capsids is increasing as they can be modified for various purposes. Capsid engineering is a primary strategy for developing recombinant AAV tailored for different clinical applications. Technological advancements, such as AI and ML, can automate capsid engineering, assisting researchers in designing capsids.

By route of administration, the intravenous segment held the largest revenue share of the market in 2024. The segmental growth is attributed to the faster onset of action and 100% bioavailability through intravenous (i.v.) administration. Through i.v. Route: AAV gene therapy is directly injected into the bloodstream. It can deliver a precise dose of therapy quickly and in a well-controlled manner. It is suitable during emergencies and acute attacks of chronic disorders.

By route of administration, the intrathecal segment is expected to be the fastest-growing with a CAGR in the upcoming years. The intrathecal route enables the delivery of gene therapy directly into the CNS. This is particularly helpful for CNS-related disorders. The intrathecal route provides immediate action at the target site, eliminating systemic side effects. Moreover, the delivery of gene therapy through this route bypasses the blood-brain barrier, resulting in higher drug concentration in the CNS.

By application stage, the commercialized therapies segment contributed the biggest revenue share of the market in 2024. This is due to favorable regulatory policies and the easy availability of AAV gene therapy. Commercialized therapies have proven safety and efficacy with a well-defined mechanism of action. They are specific for different disorders and approved by regulatory agencies from various countries. Ongoing efforts are made for the repurposing of existing commercialized therapies.

By the application stage, the preclinical therapies segment is expected to expand rapidly in the market in the coming years. Preclinical therapies are assessed for their safety, efficacy, and toxicity potential in laboratory animals. The increasing number of preclinical trials in various companies and academic research institutions enhances the potential for market approval of these therapies for human use. Researchers use AAV gene therapy for numerous disorders, including spinal muscular atrophy, hemophilia, and other neurological disorders.

By manufacturing type, the in-house manufacturing segment dominated the global market in 2024. This is because major key players have suitable manufacturing infrastructure and capital investment. In-house manufacturing provides manufacturers a complete control of the manufacturing process. Manufacturers can monitor their process and make proactive decisions about any defects in manufacturing.

By manufacturing type, the contract development and manufacturing organizations (CDMOs) segment is expected to witness the fastest growth in the market over the forecast period. Pharma & biotech companies prefer outsourcing their manufacturing services as CDMOs provide relevant expertise and access to state-of-the-art manufacturing infrastructure. CDMOs also provide tailored solutions to problems faced by companies. They enable companies to focus on product sales and marketing, rather than on development, manufacturing, and regulatory processes.

By end-user, the pharmaceutical and biotech companies segment held a major revenue share of the market in 2024. Pharmaceutical and biotech companies have suitable capital investment and the presence of skilled professionals. The increasing competition among key players facilitates them to develop novel and innovative AAV gene therapy. The rising number of new product launches also augments the segment’s growth.

By end-user, the CDMOs/vector production facilities segment is expected to show the fastest growth over the forecast period. The increasing number of pharma & biotech startups and the availability of advanced infrastructure promote the demand for CDMOs. Small and medium-sized enterprises do not have the suitable research and manufacturing infrastructure to develop AAV gene therapy products, necessitating CDMO services.

North America dominated the global market share by 54% in 2025. The availability of state-of-the-art research and development facilities, technological advancements, and favorable regulatory policies are the major growth factors of the market in North America. The rising prevalence of genetic disorders and the growing demand for personalized medicines potentiate the demand for gene therapy. The increasing number of clinical trials also facilitates market growth.

The U.S. FDA has approved a total of 14 ex vivo and 29 in vivo gene therapies. Of these, 17 are non-viral and 26 are viral. Among the viral-based therapies, 7 are AAV gene therapies. (Source - Nature)The American Society of Gene and Cell Therapy is the largest association of individuals related to cell and gene therapy research. Such collaborations boost research activities in the U.S. and lead to innovative solutions.

According to the Canadian Organization for Rare Disorders (CORD), 1 in 12 Canadians has a rare disorder, accounting for 3 million Canadians. (Source - Raredisorders) As of May 2024, Health Canada has approved 10 gene therapy products. Out of 176 clinical trials for AAV gene therapy, 20 are registered in Canada, of which eight are active. (Source - Clinical trials)

Asia-Pacific is expected to host the fastest-growing AAV gene therapy market in the coming years. The increasing investments and collaborations among key players and academic researchers favor genomics research. Numerous government and private organizations conduct seminars, workshops, and conferences to train individuals in developing innovative AAV gene therapy and to become aware of recent updates in gene therapy. Asia-Pacific countries have a favorable manufacturing infrastructure, enabling key players to set up their manufacturing facilities.

The American Society of Gene and Cell Therapy organized a virtual conference in April 2025 to explore cutting-edge advancements in the use of AAV vectors for gene therapy research in Japan. (Source - American Society of Gene and Cell Therapy) The Ministry of Health, Labor, and Welfare (MHLW), Japan, approved 20 regenerative medicinal products as of March 2024.

The growing awareness of managing rare disorders and the international approval of AAV gene therapy products have augmented the indigenous development of gene therapy. Currently, there are three clinical trials registered in India assessing AAV gene therapy for Leber congenital amaurosis, hemophilia B, and spinal muscular atrophy type 1 disorders.

Europe is expected to grow at a considerable CAGR in the AAV gene therapy market in the upcoming period. The growing research and development activities and favorable government support bolster market growth. The rising prevalence of rare disorders and the presence of key players propel the market. The European Medicines Agency (EMA) regulates the approval of gene therapies in Europe. Government organizations provide funding for advanced research activities. The burgeoning genomics sector also contributes to market growth.

The German Center for Infection Research (DZIF) has developed a roadmap for improving healthcare and strengthening Germany as a hub for cell and gene therapies. The federal government and the State of Berlin are providing funding of €48 million from 2023 to 2026, contributing 90% and 10%, respectively. (Source - German Center for Infection Research)

The UK government actively supports the development of gene therapies through funding. The UK Conservative Government provided a grant of $10 million in March 2023 to improve the country’s ability to develop cell and gene therapies. The UK NIHR also announced an investment of £17.9 million in the Advanced Therapy Treatment Centre Network (ATTC Network). (Source - Clinical trialsarena)

Eric Kelsic, Founder and CEO of Dyno Therapeutics, Inc., commented that granting the license of a Dyno capsid to a leading drug development company like Roche is a significant achievement for AI in gene therapy. He also stated that this latest advancement further validates the proven effectiveness of the company’s gene delivery and the continued and rapid advancement of the company’s sequence design capabilities. (Source - Businesswire)

By Therapeutic Area

By Vector Serotype

By Route of Administration

By Application Stage

By Manufacturing Type

By End User

By Region

February 2026

February 2026

February 2026

February 2026