February 2026

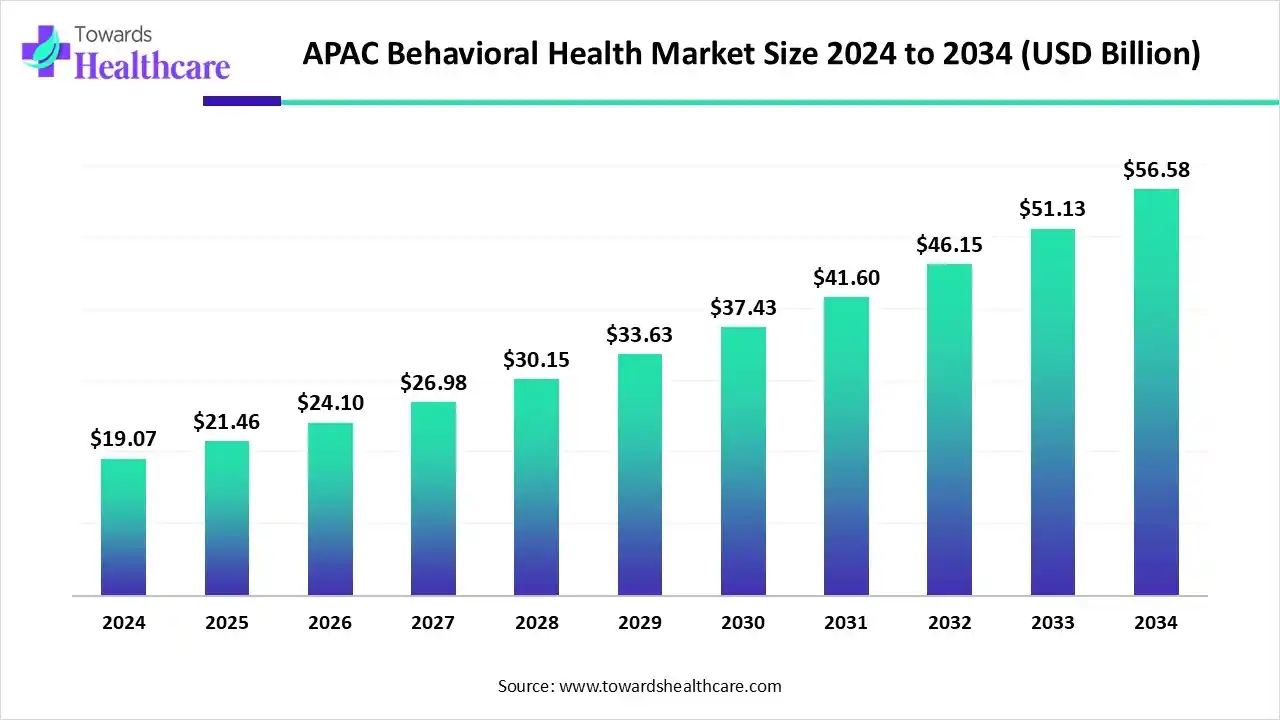

The APAC behavioral health market size is calculated at USD 19.07 billion in 2024, grew to USD 21.46 billion in 2025, and is projected to reach around USD 56.58 billion by 2034. The market is expanding at a CAGR of 11.49% between 2025 and 2034.

The APAC behavioral health market is primarily driven by the increasing awareness of mental health and growing research and development activities. Scientists focus on developing novel preventive, diagnostic, and therapeutic measures for behavioral health. Government and private organizations provide funding for research activities and launch initiatives to raise awareness of mental health. Artificial intelligence (AI) plays a crucial role in behavioral health by enabling remote monitoring and treatment suggestions. Community-led interventions and mobile health apps present future opportunities for market growth.

The major growth factors of the APAC behavioral health market include the growing demand for personalized medicines and the increasing adoption of digital health technologies. The market refers to encompassing clinical services, programs, and platforms to address mental health disorders. Behavioral health deals with mental distress, mental health conditions, suicidal thoughts, and substance use. It includes psychotherapy, medication management, crisis stabilization, outpatient/partial hospitalization, and telehealth.

AI plays a vital role in improving behavioral health through personalized interventions and early detection of symptoms. AI and machine learning (ML) algorithms can analyze vast amounts of patient data and suggest treatment outcomes. AI-based sensors enable remote monitoring of patients’ behavior, allowing healthcare professionals to make proactive clinical decisions. AI can optimize therapeutic interventions through personalized approaches, enhancing access to care, particularly for underserved populations.

Companies like Core Solutions, Inc. and Eleos Health aim to develop behavioral health IT to automate routine tasks, predict patient behaviors, and deliver data-driven insights.

| Countries | Dementia Prevalence (In Millions) | |

| 2024 | 2050 | |

| India | 3.8 | 11.4 |

| Japan | 4.4 | 5.84 |

| Australia | 0.43 | 0.81 |

| Thailand | 0.77 | 2 |

| South Korea | 1 | 2 |

| China | 15.07 | 31.4 |

By condition category, the mood & anxiety disorders segment held a dominant presence in the market in 2024, due to the rising prevalence of anxiety and the increasing awareness of its symptoms. Mood & anxiety are major public health concerns among individuals in the APAC region due to sedentary lifestyles, increasing stress levels, and genetic reasons. It is estimated that approximately 289 million people live with a mental, neurological, or substance use condition in the WHO South-East Asia Region.

By condition category, the substance use disorders (SUDs) segment is expected to grow at the fastest CAGR in the market during the forecast period. SUDs in APAC countries are a burgeoning health concern with the increasing consumption of drugs, alcohol, and tobacco. As of 2024, the number of current drug users in China was 747,000. Government organizations take several measures to address concerns regarding SUDs. Rehab centers with innovative technologies are being formed to treat SUDs.

By service modality, the outpatient counselling & psychiatry segment held the largest revenue share of the market in 2024, due to the growing need for saving healthcare costs. Outpatient services refer to providing flexible, effective solutions for those who need structured support. These services enable patients to continue with their daily tasks without impacting productivity. As patients do not need to stay overnight in healthcare organizations, outpatient counselling & psychiatry are more affordable.

By service modality, the tele-behavioral/virtual care segment is expected to grow with the highest CAGR in the market during the studied years. The growing demand for personalized treatment and remote monitoring boosts the segment’s growth. Virtual care eliminates the need for a patient to visit a healthcare organization. Patients can seek advanced care from providers practicing in different geographical locations. It is estimated that mental health apps have seen a 30% increase in downloads in India in 2023.

By patient age group, the adults segment contributed the biggest revenue share of the market in 2024, due to sedentary lifestyles and poor physical health. The increasing stress levels due to heavy workloads potentiate the chance of declining mental health conditions. Exposure to adversity, significant loss in intrinsic capacity, and a decline in functional ability can result in psychological distress. Adults are more aware of the symptoms and consequences of mental health conditions.

By patient age group, the children & adolescents segment is expected to expand rapidly in the market in the coming years. Mental health conditions are common among children & adolescents due to peer pressure and can lead to lifelong difficulties if left unaddressed. Early diagnosis and treatment can enable healthcare professionals to prevent more severe, long-lasting problems. The WHO estimates that depression affects around 1.3% of adolescents aged 10-14 years, and 3.4% of 15-19 years.

By payer/funding, the public & social insurance segment led the market in 2024, due to favorable government support and reimbursement policies. Behavioral health poses a significant economic burden on the healthcare sector. This encourages government organizations to launch various schemes to fund behavioral health services, increasing their accessibility and affordability. Public & social insurance reduce financial barriers for individuals and families.

By payer/funding, the commercial/employer-sponsored segment is expected to witness the fastest growth in the market over the forecast period. Employers are becoming increasingly aware of the importance of maintaining a better work environment. According to a report, 82% of employees in Asia are at moderate to high risk of developing mental health issues. Employers provide reimbursement or sponsor behavioral health treatment for their employees.

The APAC behavioral health market is experiencing robust growth, driven by the increasing awareness of mental health and the burgeoning population. The Asia-Pacific Economic Cooperation (APEC), a government organization for economic cooperation across APAC countries, reported that mental illness accounts for over 20% of the total years lost, and less than 50% of the people affected by mental illness received evidence-based treatment. Government organizations launch initiatives to create awareness of mental health disorders, promoting early intervention.

In 2024, 76,000 people abused methamphetamine and 21,000 abused opioids in China. This emphasized the Chinese drug authorities to implement the important instructions on drug control and the decisions and deployments of the central government. Additionally, a survey has reported that 13% to 20% of children experience mental, emotional, or behavioral disorders in China annually.

The market in India is primarily driven by the increasing use of telehealth platforms for mental health. The Indian government launched the Tele-MANAS app as part of its National Tele-Mental Health Programme. As of April 2025, the Tele-MANAS platform received more than 20 lakh calls. It is estimated that approximately 15% of the Indian population suffers from some form of mental health issue.

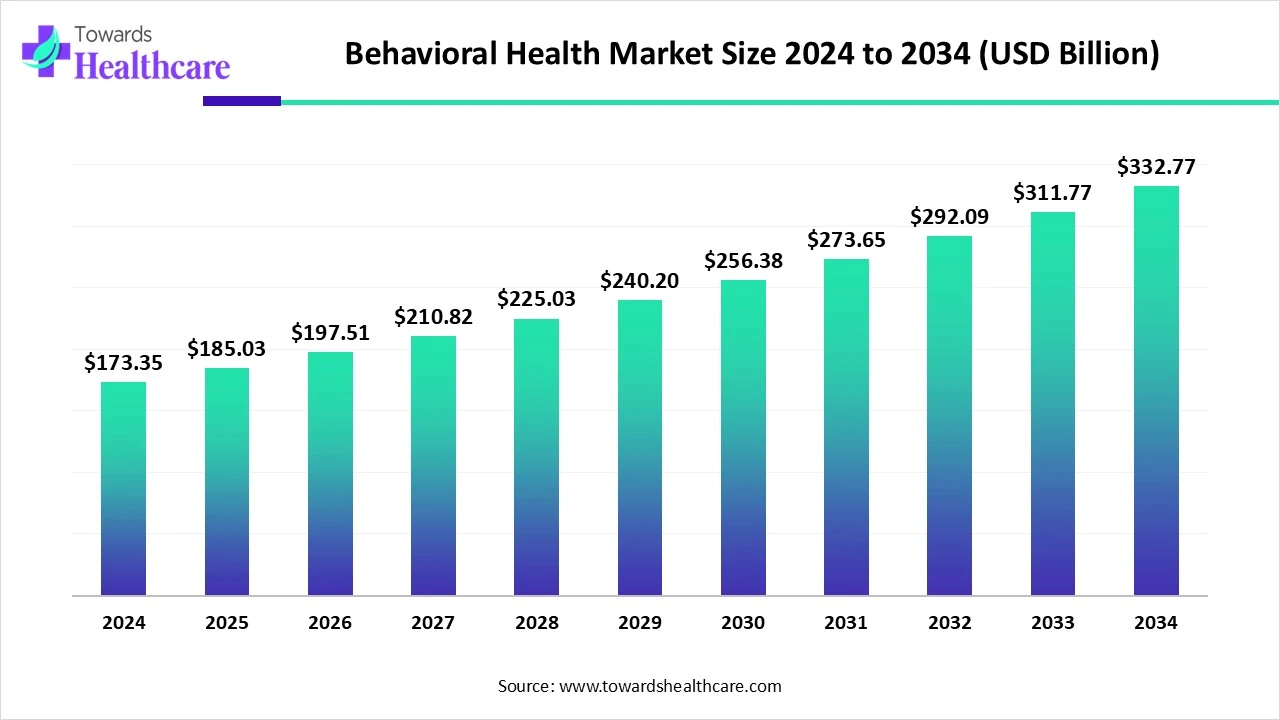

The global behavioral health market is valued at US$ 173.35 billion in 2024 and is expected to grow to US$ 185.03 billion in 2025. Forecasts indicate it could reach approximately US$ 332.77 billion by 2034, expanding at a CAGR of 6.74% between 2025 and 2034.

Our experts suggest that behavioral health in APAC countries is undergoing a shifting trend with government support and appropriate funding policies. Technological innovations facilitate the increasing use of telehealth platforms. According to our analysis, increasing collaborations among key players promotes the development of novel platforms and expands their services across different geographical locations.

By Condition Category

By Service Modality

By Patient Age Group

By Payer/Funding

By Region

February 2026

February 2026

January 2026

January 2026