February 2026

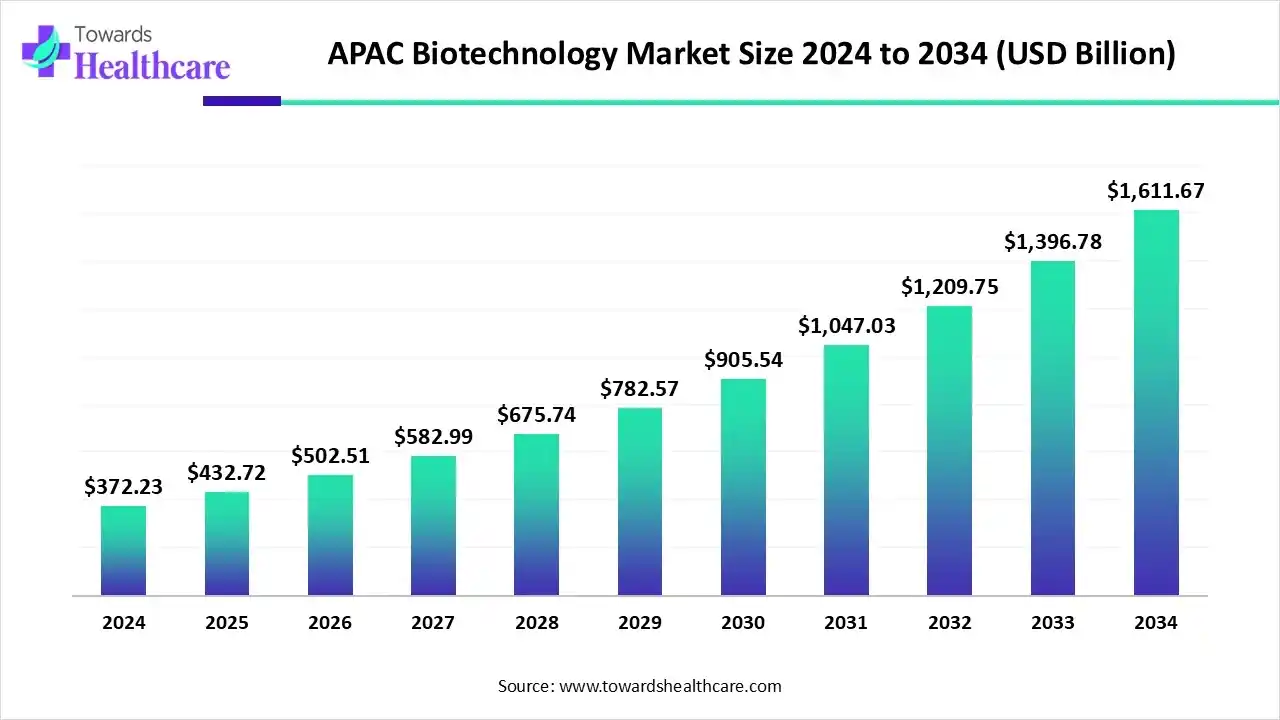

The APAC biotechnology market size is calculated at US$ 372.23 billion in 2024, grew to US$ 432.72 billion in 2025, and is projected to reach around US$ 1611.67 billion by 2034. The market is expanding at a CAGR of 14.80% between 2025 and 2034.

The availability of capital is a major factor driving the APAC biotechnology market. Governments and corporate investors in the area have made significant investments in biotech in recent years, seeing the industry's potential for expansion and innovation. Precision medicine's expansion is another element propelling biotech investment in the APAC area. Proteomics, genetics, and other advances have made it possible for researchers to create more specialised treatments. Lastly, technological developments are also propelling biotech investment in the Asia-Pacific area.

| Table | Scope |

| Market Size in 2025 | USD 432.72 Billion |

| Projected Market Size in 2034 | USD 1611.67 Billion |

| CAGR (2025 - 2034) | 14.80% |

| Market Segmentation | By Product/Service, By Technology, By Application, By End User, By Region |

| Top Key Players | WuXi AppTec (China), WuXi Biologics (China), BeiGene (China), Innovent Biologics (China), Samsung Biologics (South Korea), Celltrion (South Korea), SK Biopharmaceuticals (South Korea), Takeda Pharmaceutical (Japan), Astellas Pharma (Japan), Fujifilm Diosynth Biotechnologies (Japan), Daiichi Sankyo (Japan), Bharat Biotech (India), Serum Institute of India, Biocon Biologics (India), Dr. Reddy’s Laboratories (India, biosimilars), CSL Limited (Australia), Seegene (South Korea, molecular diagnostics), GenScript Biotech (China), Zai Lab (China), Chugai Pharmaceutical (Japan, Roche subsidiary) |

The APAC biotechnology market encompasses biopharmaceuticals, bioagriculture, bioindustrial applications, and bioservices across Asia-Pacific. It is one of the fastest-growing biotechnology markets globally, driven by strong government support (China’s “Made in China 2025,” India’s “Biotechnology Industry Research Assistance Council (BIRAC),” Japan’s regenerative medicine initiatives, and South Korea’s bioeconomy plan), expanding healthcare demand, large patient pools, and rising investments in biologics, cell & gene therapy, biosimilars, and agricultural biotech. The region is becoming a hub for clinical trials, outsourcing, and contract manufacturing due to cost advantages and advanced R&D clusters.

AI's application in biology has grown in popularity recently. In order to get better, quicker, and more accurate outcomes, the biotech sector is rethinking its operations with AI and ML technologies. AI and biotech are paving the way for further breakthroughs and improvements in a variety of fields including pharmaceuticals, healthcare, animal husbandry, and agriculture. AI's contribution to biotechnology extends beyond data flow organisation and repetitive task automation. Research, daily tasks, data analytics, medication production, and many more areas can benefit from artificial intelligence.

| Fellowship | Target Beneficiaries | Achievements |

| DBT Junior Research Fellowship (JRF) programme | Graduates and postgraduates interested in doing research in the biological sciences and biotechnology | 150 fellows selected for support in 2024-25 |

| DBT Research Associateship (DBTRA) programme | PhD graduates interested in postdoctoral research in cutting-edge fields of life sciences and biotechnology | 150 fellows selected for support in 2024-25 |

| Tata Innovation Fellowship | Scientists up to 55 who have demonstrated exceptional performance in the biological sciences and who are dedicated to developing novel solutions for significant issues in healthcare, agriculture, and other fields pertaining to biotechnology and life sciences | 25 fellows supported in 2024-25 |

| Har Gobind Khorana-Innovative Young Biotechnologist Fellowship (IYBF) | Young scientists up to 35 years old who are motivated to do research in cutting-edge biotechnology or biotechnology-related subjects and have creative ideas | 25 fellows supported in 2024-25 |

| Ramalingaswami Re-entry Fellowship (DBT-RRF) Programme | Indian nationals interested in conducting scientific research in India are employed abroad in a variety of biotechnology and life science sectors. | 230 fellows have been supported under this programme in 2024- 25. 422 previous fellows have already secured regular positions in Indian institutions |

| M K Bhan-Young Researchers Fellowship Programme | PhDs desirous of continuing their research in India | 63 fellows supported in 2024-25 |

| Biotechnology Career Advancement & Re-orientation (BioCARe) | PhD-holding women researchers up to the age of 55, particularly those who have taken professional pauses and need to return to mainstream biotechnology and related fields of study. | 57 fellows supported in 2024-25 |

By product/service, the biopharmaceuticals segment was dominant in the APAC biotechnology market in 2024, accounting for approximately 41% of the revenue. One of the most significant developments in contemporary medicine is biopharmaceuticals. They are changing the medical landscape by providing extremely effective and focused therapies for a variety of ailments. Biotechnology breakthroughs and the identification of novel therapeutic targets are driving the continued fast evolution of biopharmaceuticals.

By product/service, the bioservices segment is estimated to experience the highest CAGR during the forecast period. CROs, CMOs, and CDMOs play a crucial role in the biotechnology industry's product development process and go beyond being merely outsourced partners. They actively collaborate in the field of scientific research because of their knowledge, ongoing creativity, and flexibility, which greatly aids in the success of their sponsor.

By technology, the DNA sequencing & genomics segment was dominant in the APAC biotechnology market in 2024, with a revenue of approximately 28%. Real-time sequencing of complete genomes in clinical settings may be made possible by future developments that result in ever quicker, less expensive, and more precise sequencing techniques. The creation of portable sequencers may provide access to DNA sequencing in isolated locations or during infectious disease epidemics. Our knowledge of biology has been drastically altered by DNA sequencing, which has also created a plethora of new opportunities in biotechnology, research, and medicine.

By technology, the CRISPR & gene editing segment is estimated to experience the highest CAGR during the forecast period. With uses in the biotechnology, healthcare, and agricultural sectors, CRISPR is a new gene-editing technique that offers a precise, efficient, and effective alternative to genetic engineering. CRISPR holds great promise for improving food security, revolutionising medical treatments, and even assisting in the creation of biofuel.

By application, the healthcare/medical biotechnology segment was dominant in the APAC biotechnology market in 2024, accounting for approximately 46% of the revenue. A number of novel methods for illness prevention, diagnosis, and treatment have been developed as a result of the medical biotechnology field's recent explosive expansion. Polymerase chain reaction, gene sequencing, fluorescence in situ hybridization, microarrays, cell culture, genome editing, gene silencing with interference RNA, and other novel techniques have all made substantial contributions to the advancement of health research.

By end-user, the pharma & biotech segment was dominant in the APAC biotechnology market in 2024, accounting for approximately 44% of the revenue. The Asia Pacific region is making significant progress towards becoming a worldwide centre for biotechnology, despite mounting economic uncertainty. On the one hand, there is the incorporation of ongoing breakthroughs, technical adaptations, and prospective R&D expenditures. However, biotech firms are able to adjust to new technologies thanks to a surge of private capital and expanding government subsidies in the area.

By end-user, the CROs & CDMOs segment is estimated to experience the highest CAGR during the forecast period. CDMOs and CROs are not only players; they are innovators. These adaptable partners offer a range of vital benefits to different phases of biotechnology, going beyond simply serving as an outsourcing solution. They are the forces behind cost-cutting, the entry points to specialised knowledge, the force behind production scalability, and the catalysts in the sprint from laboratory to market. The key to turning concepts into practical, marketable health solutions is CDMOs.

China captured a revenue share of 35% of the APAC biotechnology market in 2024. Chinese pharmaceutical companies, who have advanced from their copycat days to threaten Western innovation dominance, are driving a seismic change in the biotechnology sector. According to an exclusive Bloomberg News research, the number of new medications being developed in China for conditions including cancer, weight loss, and more soared to over 1,250 last year, far exceeding the European Union's total and almost catching up to the US's figure of over 1,440.

Southeast Asia is estimated to host the fastest-growing APAC biotechnology market during the forecast period. Due to rising collaboration and government initiatives.

In July 2025, in order to promote innovation in biotechnology for future food and artificial intelligence (AI) for healthy ageing, the New Zealand government has established two new collaborative research initiatives with Singapore. The programme, which is funded by MBIE's Catalyst Fund, will spend up to $24 million over three years in seven cooperative initiatives.

In May 2025, Nuevocor, an IND-stage biotechnology business based in Singapore that is working to find treatments for cardiomyopathies caused by aberrant mechanobiology, reported that its US$45 million Series B fundraising was successfully completed.

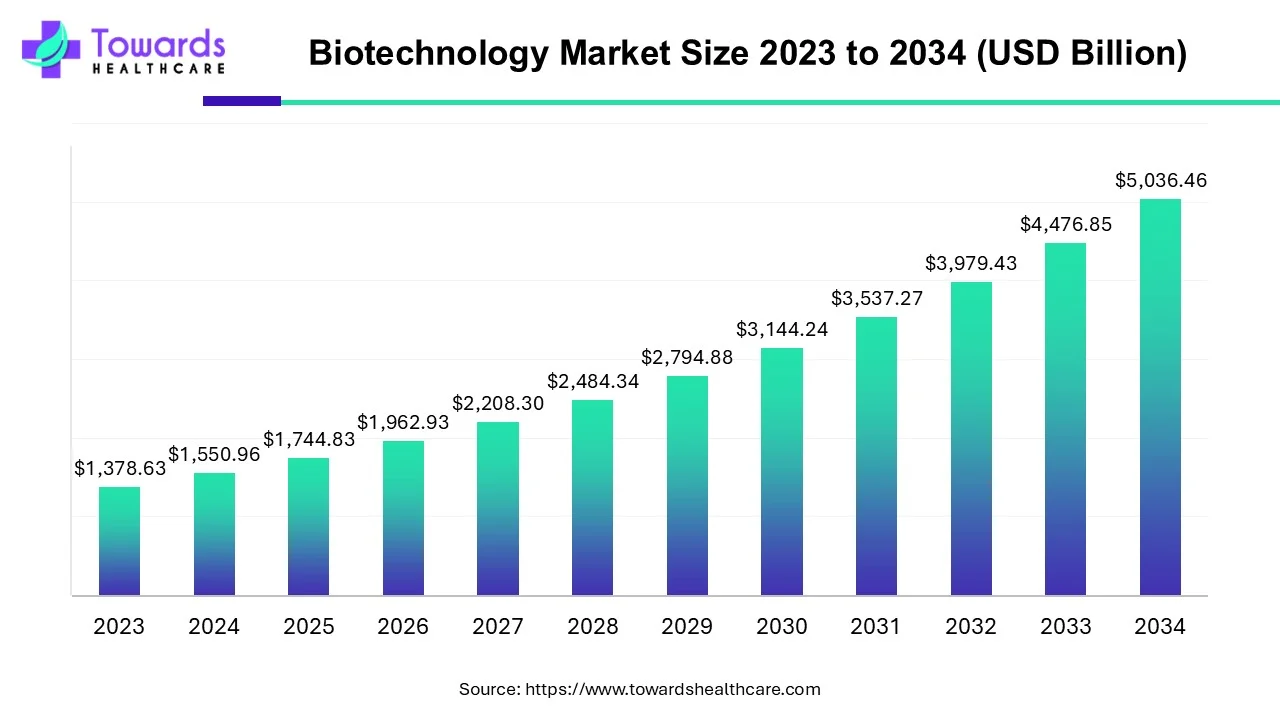

The biotechnology market is projected to grow from USD 1,744.83 billion in 2025 to USD 5,036.46 billion by 2034, reflecting a CAGR of 12.5% over the forecast period, driven by continuous innovation and technological advancements in the industry.

By Product/Service

By Technology

By Application

By End User

By Region

February 2026

February 2026

February 2026

February 2026