February 2026

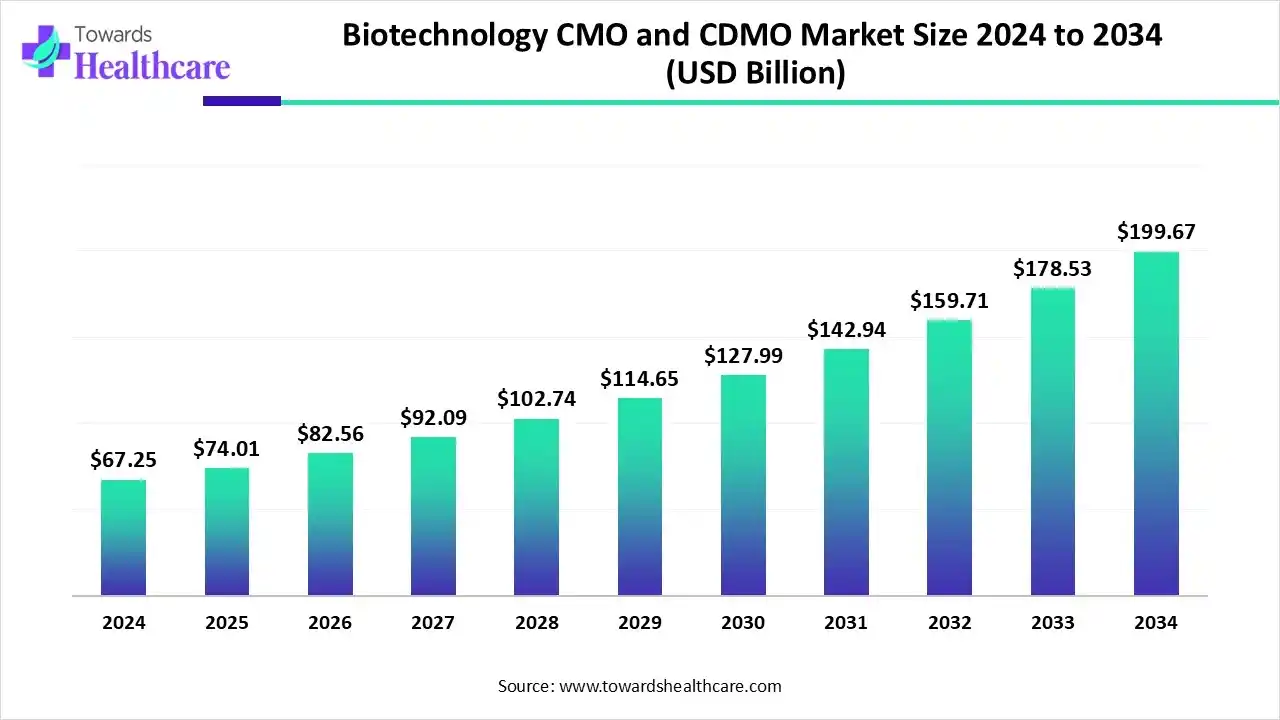

The global biotechnology CMO and CDMO market size is estimated at US$ 67.25 billion in 2024, is projected to grow to US$ 74.01 billion in 2025, and is expected to reach around US$ 199.67 billion by 2034. The market is projected to expand at a CAGR of 11.54% between 2025 and 2034.

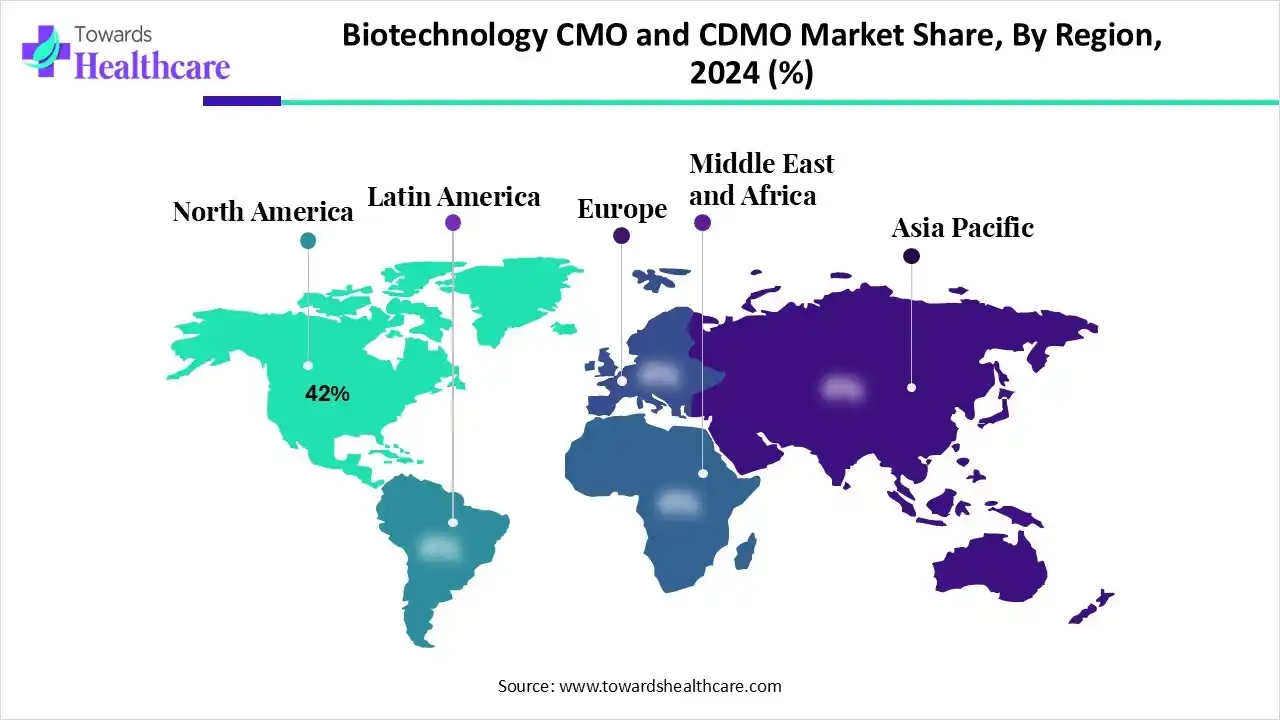

The biotechnology CMO and CDMO market is growing because of the increasing requirement for advanced medical treatment options such as cell and gene therapies, monoclonal antibodies, and vaccines. Growing trends of outsourced development and manufacturing of biological products by biotech and pharmaceutical companies. North America is dominant in the market as advancements in biologics, government support, and rising demand for personalized medicine, while the Asia Pacific is the fastest growing, as it is a cost-effective and advanced quality outsourcing hub.

| Table | Scope |

| Market Size in 2025 | USD 74.01 Billion |

| Projected Market Size in 2034 | USD 199.67 Billion |

| CAGR (2025 - 2034) | 11.54% |

| Leading Region | North America by 42% |

| Market Segmentation | By Service Type, By Product Type, By Scale of Operation, By Technology Platform, By End User, By Region |

| Top Key Players | Thermo Fisher Scientific (Patheon), Boehringer Ingelheim BioXcellence, Rentschler Biopharma SE, AGC Biologics, AbbVie Contract Manufacturing, KBI Biopharma, Emergent BioSolutions, Minaris Regenerative Medicine, Vibalogics (Recipharm), Charles River Laboratories (Biologics CDMO unit), Ajinomoto Bio-Pharma Services, Binex Co., Ltd., Evotec SE (Biologics CDMO division), Thermo Fisher Viral Vector Services, Cognate BioServices |

Incorporation of AI in biotechnology CMO and CDMO drives the growth of the biotechnology CMO and CDMO market, as AI-driven technology has transformed the large molecule CDMO field by improving drug discovery and development technology, enhancing manufacturing effectiveness, and quality control. This technology revolutionizes how CDMOs interact with sponsors. In its place of operating as outsourced vendors, AI-driven CMOs and CDMOs forecast challenges, model project results, and offer transparent progress reports. AI-based technology for quality control in manufacturing helps with supplier quality management. The technology influences historical information and inspection results to confirm the quality of the raw materials that the organization procures from various suppliers organization.

| Initiative | Description |

| BioE3 Policy | The "Biotechnology for Economy, Environment and Employment" policy was established to foster high-performance biomanufacturing. |

| Biotechnology Research, Innovation, and Entrepreneurship Development | The government continued this umbrella scheme with new components focused on biomanufacturing and biofoundries. It offers capital grants, seed funding, and other incentives to startups and small to medium-sized enterprises (SMEs). |

| Production Linked Incentive (PLI) Scheme | This program offers financial incentives to pharmaceutical companies that achieve production targets for critical raw materials, biologics, and complex generics. |

| National Biopharma Mission | Co-funded by the World Bank, this mission strengthens India's capabilities in biopharmaceuticals, including vaccines, biosimilars, and diagnostics. |

| BioSecure Act (Pending) | The proposed legislation banning federal funding for U.S. companies working with certain Chinese biotech firms has influenced planning within the CDMO sector throughout 2025. |

In the service type, the commercial manufacturing segment led the biotechnology CMO and CDMO market, with approximately 46% share, as it offers inclusive services from drug development to manufacturing. It also provides access to capacity with lower spending. Outsourcing services provides access to capacity without having to invest in a biotech firm. It enables biotech companies to speed up the launch of new treatments and enhance healthcare results without the immense cost and challenges of building in-house manufacturing abilities.

On the other hand, the fill–finish and packaging segment is projected to experience the fastest CAGR from 2025 to 2034, as fill-finish contract manufacturing is an important process that meets a growing demand while offering specialized services to biotech companies. The main aim is to ensure that biotech products remain free from contaminants through the manufacturing process, guaranteeing product efficiency and patient safety for the biotech companies that collaborate with the contract manufacturing organization (CMO).

By product type, the monoclonal antibodies (mAbs) segment was dominant in the biotechnology CMO and CDMO market in 2024, with approximately 41% share, as outsourcing plays an important role in the biopharmaceutical companies by offering end-to-end services for the development and manufacturing of biologics, such as monoclonal antibodies (mAbs). It provides a wide range of services from process development to large-scale business, allowing biotech and biopharma companies to outsource their manufacturing requirements to a specialized contract development and manufacturing organization. They offer inclusive services to help the production of antibodies, from target identification to end product release.

The cell and & therapy segment is projected to grow at the fastest CAGR from 2025 to 2034, as partnering with a contract development and manufacturing organization (CDMO) provides many benefits, including cost-effectiveness, flexibility, and expert project management. An outsourcing organization effectively manages materials, labor, operations, and quality, output at a low cost for drug inventors. Flexibility is supreme in the CGT industry, and a CDMO adapts to shifting product demand by intentionally allocating materials and using expansive factory services.

By scale of operation, the commercial scale segment led the biotechnology CMO and CDMO market in 2024 with approximately 53% share, as CROs is a significant tool in commercial manufacturing that allows businesses to easily, quickly capitalize on the resources of a manufacturer with a low initial spending, focus less on production and concentrate more on their core capabilities, lowers overhead and in-house head count and leverage the abilities of organization with skilled expertise in manufacturing, and larger economies of scale than production was not outsourced.

The flexible/hybrid manufacturing segment is projected to experience the fastest CAGR from 2025 to 2034, as contract manufacturing provides biotech businesses the flexibility to increase production up or down depending on demand. By collaborating with a contract manufacturer, organizations simply adjust their production levels without the challenges related to managing their own manufacturing facilities. By selecting to outsource manufacturing, companies focus on their essential activities.

By technology/platform, the mammalian cell culture segment led the biotechnology CMO and CDMO market in 2024 with approximately 48% share, as outsourcing mammalian cell culture has become a gradually popular strategy in the biotech and pharmaceutical organizations. By selecting to outsource, organizations improve efficiency and focus on their core capabilities. Major contract research organizations (CROs) employ experts with extensive experience in mammalian cell culture. These experts are aware of modern technology, government requirements, and standard practices.

The cell & gene therapy platforms segment is projected to experience the fastest CAGR from 2025 to 2034, as contract manufacturers play a significant role in de-bottlenecking cell and gene therapy manufacturing. CROs provide expertise that gains access to particular knowledge and proven track records in C> manufacturing and development. Influence state-of-the-art services, technologies, and tools unavailable internally. Access economies of scale and potentially lowers development costs as compared to building internal abilities.

By end user, the large pharmaceutical companies segment led the biotechnology CMO and CDMO market in 2024 with approximately 47% share. As large biotech companies partner with outsourcing organizations, it provides many advantages, such as reducing capital investment in services and equipment. It provides access to specialized technologies and expertise. Enhance scalability and operational flexibility, and speed up time to market for novel therapies. These manufacturing companies offer a broad variety of pharma products, such as packing, production, labelling, and delivery of the biotech products.

The biotechnology companies segment is projected to experience the fastest CAGR from 2025 to 2034, as contract manufacturing organizations are a significant choice for pharmaceutical and biotech companies looking to outsource their manufacturing requirement. Outsourcing manufacturing operations does not detract from the biotech company's quality and government efforts. Contract manufacturers offer established procedures and infrastructure, dedicated skills, and handle the difficulties of regulatory filings, enabling biotech firms to bring ground-breaking biotech products.

North America is dominant in the Market in 2024, with approximately 42% share, due to the growing outsourcing of drug manufacturing by biopharma and pharmaceutical companies. Major North American companies are shifting manufacturing operations either back to the U.S. or to neighbouring countries such as Mexico, a process called nearshoring. This results in lower lead times, transportation expenses, and challenges from geopolitical uncertainty.

In June 2025, German contract development and manufacturing organisation Vetter Pharma commenced construction of a new $285m clinical manufacturing facility in Des Plaines, in the US state of Illinois, with a ground-breaking ceremony. Contract manufacturing developed a dominant strategy in the U.S. because of the increasing investment by private organizations, as a combination of economic, strategic, and technological factors that incentivize organizations to outsource production instead of maintaining in-house facilities.

In August 2025, Delpharm announced a major milestone in the modernization of its Boucherville facility, made possible by a $60 million government contribution unveiled by Economy, Innovation and Energy Minister Christine Fréchette, alongside Health Minister Christian Dubé. Also, increasing demand for affordable and efficient production solutions, as well as the increasing need for modern biologic therapies, as contract manufacturers of Canada specify this demand, which drives the growth of the market.

Asia Pacific is the fastest-growing region in the biotechnology CMO and CDMO market in the forecast period, due to the presence of massive manufacturing infrastructure, an increasingly skilled workforce, and supportive regulatory policies. This creates the region a highly attractive and cost-efficient home for international companies seeking to outsource production. This type of production eliminates the requirement for companies to invest heavily in their own facilities, labor, and equipment, which drives the growth of the market.

Various R&D processes involved in biotechnology CMO and CDMO, such as the exploration and manipulation of biological systems and living organisms to create new solutions.

Key Players: ALTEN and Cheesecake Labs

Outsource manufacturing adheres to strict government guidelines, specifically present good manufacturing practices (cGMP), to confirm the quality, safety, and integrity of the Investigational Medicinal Product (IMP) through the clinical trial phases

Key Players: Qubit Labs and Riseup Labs

Biotech contract manufacturing majorly focuses on manufacturing drug substances and drug products for a client organization. Patient services are managed by the client's biotech or pharmaceutical company.

Key Players: NE and Tata Consultancy Services

By Service Type

By Product Type

By Scale of Operation

By Technology Platform

By End User

By Region

February 2026

February 2026

February 2026

February 2026