January 2026

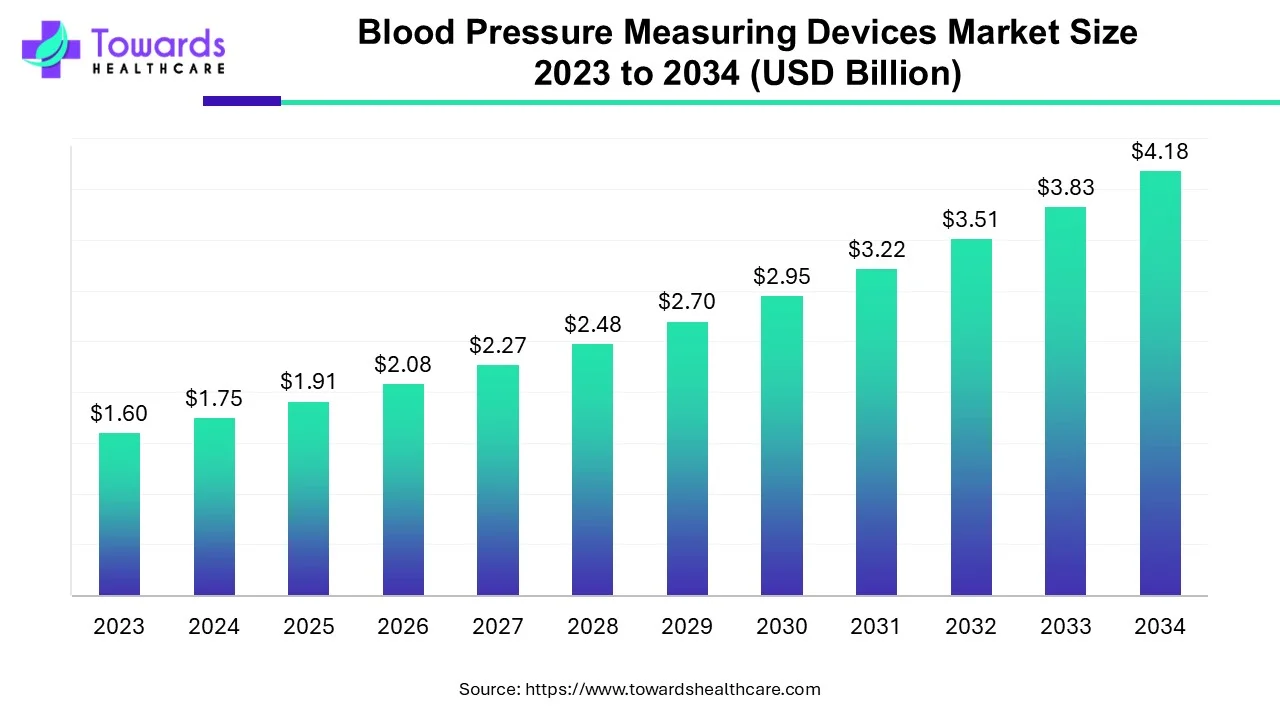

The global blood pressure measuring devices market size surpassed USD 1.91 billion in 2025, to reach USD 2.08 billion in 2026 is expected to be worth USD 4.56 billion by 2035, expanding at a CAGR of 9.1% from 2026 to 2035. The increasing prevalence of hypertension and the rising adoption of advanced technologies are the major growth factors of the market.

| Key Elements | Scope |

| Market Size in 2025 | USD 1.91 Billion |

| Projected Market Size in 2035 | USD 4.56 Billion |

| CAGR (2026 - 2035) | 9.1% |

| Leading Region | North America |

| Market Segmentation | By Type, By End-Use, By Region |

| Top Key Players | Omron Healthcare, A&D Medical Inc., American Diagnostic Corporation, Withings, Briggs Healthcare, Philips Healthcare, Rossmax International Ltd., GF Health Products Inc., Spacelabs Healthcare Inc., GE Healthcare |

According to the stats published by World Health Organization (WHO), approximately 1.28 million adults (between 30 and 79 years of age) have hypertension. Of these, as little as 42% of adults are diagnosed and treated correctly and the remaining population is unaware of this condition. The majority of this population resides in low to middle-income countries of the world. Despite this substantial number of untreated cases, the rising awareness among doctors and the general population regarding health illnesses associated with hypertension is expected to drive the demand for the required devices.

A sphygmomanometer, often known as a blood pressure monitor, is a device used to measure blood pressure. A monitoring gadget that gauges the pressure within the inflatable cuff and an arm cuff that is about level with the heart make up this device. Devices that measure blood pressure evaluate a patient's hypertension. One of the primary risk factors for strokes and chronic heart diseases, which are the world's leading causes of mortality, is blood pressure. This is because improved technology has emerged, and blood pressure monitoring devices have become increasingly important in care settings. Furthermore, the aging population, lifestyle changes, and the introduction of cutting-edge technology are the main drivers propelling the blood pressure monitoring market.

Artificial intelligence (AI) and machine learning (ML) algorithms are being investigated for effective monitoring of blood pressure. AI can aid in digital displays, enabling precise measurement. It eliminates the use of conventional sphygmomanometer in a healthcare setting. The advent of sensors and wearable devices has transformed the diagnostic sector. This allows patients to monitor their blood pressure at any place and at any time.

Machine learning has been used to study the diagnosis of hypertension, prediction of systolic BP from retinal fundal pictures, prediction of hypertension from clinical data in EHRs, and prediction of absolute risk reduction in cardiovascular events from data from clinical trials. These papers comprise a more limited subset of ML studies on cardiovascular illnesses in general and provide details on particular studies, performance metrics looked at, and the data set on which ML was applied. Over the past few years, there has been significant innovation in the BP monitoring devices field and patents have been applied and granted.

Due to longer life expectancies and falling fertility rates, the world population's age distribution has been changing dramatically over a lengthy period. The percentage and number of elderly people in the population are gradually rising as a result of individuals living longer lives. There will be 727 million persons on the earth who are 65 or older in 2020.

In the next 30 years, the number of senior people is predicted to more than double, crossing 1.5 billion in 2050. Every region will witness growth in the senior population between 2020 and 2050. Worldwide, the percentage of people 65 and older is likely to rise from 9.3% in 2020 to about 16% in 2050.

It was once believed that a rise in blood pressure was an inevitable consequence of aging. However, it is now well acknowledged that the causes of changes in blood pressure with age are complex and multifaceted and that becoming older may only increase the likelihood that environmental or lifestyle factors will have an impact.

Over 26 million people are affected by heart failure (HF), which continues to be one of the main causes of morbidity and mortality worldwide. This population is expected to increase by 50% by 2030, which will place further pressure on the global healthcare system and highlight the need for innovation in HF care.

The goal of remote patient monitoring (RPM) is to close any gaps in present heart failure treatment. Numerous techniques can be used to increase RPM. One tactic is to use an implantable biometric sensor to track the presence of HF. Examples include intracardiac pressure measurements using hemodynamic sensors (such as CardioMEMS) or intrathoracic impedance measurements using cardiac implantable electronic devices (CIEDs). Other applications include wearable biosensors, scales, and blood pressure cuffs as biometric sensors.

RPM is a field that is continuously developing today and is being used in cardiology procedures. RPM techniques, particularly those that rely on noninvasive biometric sensing, might all benefit from improvements in data collection, monitoring, analysis, and clinical practices. Additionally, the regulatory environment, which includes rewards for RPM projects and sanctions for HF readmissions, supports such improvements. A greater desire to handle patients outside of the conventional office environment has arisen as a result of COVID-19's impact on practice patterns.

Digital blood pressure monitors accounted for the largest share of the global blood pressure monitoring devices market in 2022. This trend is expected to continue throughout the forecast period. Chronic illness management is a crucial market for RPM technologies, which currently account for the majority of healthcare spending, as the world's population ages and life expectancy rises in the face of shrinking money and resources. Given the increased interest from tech companies in the healthcare sector as well as interest in the reimbursement of remote patient monitoring systems, RPM is expected to result in significant change.

Despite the above, ambulatory blood pressure monitors are expected to witness the highest growth in sales during the forecast period. A relatively recent development in blood pressure measurement technology is ambulatory blood pressure monitoring (ABPM). With ABPM, a doctor can take your blood pressure while you're out and about, as opposed to forcing you to squirm on the doctor's examination table.

The ABPM is particularly helpful in establishing whether a person has hypertension when blood pressure readings taken in a doctor's office are highly variable or otherwise perplexing. People with "white coat hypertension," which is brought on by anxiety before a doctor's appointment, have been evaluated with ABPM. With ABPM, blood pressure is monitored continuously for a lengthy period, typically 24 hours.

A case might be made that ABPM should be the standard for diagnosing and treating hypertension because it can be challenging to obtain accurate resting blood pressure measures in the doctor's office.

Some of the factors propelling the global ABPM devices market include the rise in demand for non-invasive blood pressure measuring techniques and the transition from a physician-centered to a patient-centered approach. The expensive cost of ABPM equipment and a lack of knowledge about ambulatory blood pressure in developing nations are predicted to hinder the worldwide market.

Compared to the office and self-measured BP monitoring, ABPM is more cost-effective equipment with better health outcomes. Self-measured blood pressure monitoring exhibited comparable healthcare expenditures and interventions as office BP monitoring. As a result, ABPM is the most economical method for diagnosing hypertension across all sexes and age groups.

Hospitals and clinics accounted for the largest consumption of blood pressure monitoring devices in 2022 and the trend will continue throughout the projected period. Entities that offer inpatient and outpatient care services, as well as related goods, make up clinics and hospitals (organizations, sole traders, and partnerships). In hospitals and clinics, blood pressure monitors are used as the part he patient monitoring services. The American Heart Association (AHA) describes remote patient monitoring (RPM) as a subclass of telemedicine that permits rapid patient-generated information transfer from patients to medical teams and back to the patients. The RPM system is made up of portable devices for monitoring vital signs like blood pressure, heart rate, temperature, blood glucose, cardiac rhythm, respiratory, and so forth in remote or home-care settings. It also includes a system for securely transmitting pertinent data to the care provider for evaluation and recommendations.

To keep track of patient data such as prescriptions, diagnostic, and analytical test results, as well as medical reports, many hospitals utilize an electronic patient data management system (PDMS). Hospitals with cutting-edge technology can also be found with modern PDMS, which helps to collect data in real-time from heart monitors, pulse oximetry, blood pressure, and other devices. This helps physicians fully optimize patient care, which saves a lot of time and prevents readmissions. The idea of an "ICU without walls," in which a patient is admitted to a hospital close to their family and is given physiological comfort by treating patients as though they are in ICU through remote monitoring, is one that many modern hospitals seek to implement.

As seen above, the home healthcare market segment is expected to witness the fastest growth. Over the forecast period, the demand for home healthcare services is anticipated to be driven by the growing trend of nuclear families and the aging population around the world. In addition, rising healthcare costs, particularly for chronic illnesses, are a significant factor in the market's expansion. The need for nursing care at the end of life is anticipated to be driven by elderly people's preference for the convenience of home.

North America dominated the global market in 2024. The presence of key players and favorable regulatory frameworks drive the market. Several key players in North America drive the latest innovations in blood pressure measuring devices to improve diagnostic ability. The burgeoning e-commerce sector also potentiates market growth in North America. The rising adoption of advanced technologies boosts the market. The increasing incidences of hypertension in the U.S. and Canada promote the sales of blood pressure measuring devices. In the U.S., nearly half of adults are estimated to have high blood pressure (119.9 million, 48.1%). While in Canada, 7.5 million people are reported to have hypertension.

Asia-Pacific is anticipated to show the fastest growth in the market during the forecast period. The rising geriatric population and increasing prevalence of hypertension drive the market. Favorable government policies and support increase awareness among the general public about hypertension management. The Indian government launched the "75/25" initiative to screen and put 75 million people with hypertension and diabetes on Standard Care by 2025. The increasing investments, collaborations, and mergers & acquisitions activities propel market growth. The favorable manufacturing infrastructure attracts foreign investors to manufacture their devices in Asia-Pacific.

For instance,

Europe is expected to experience notable growth in the blood pressure measuring devices market in the foreseeable future, driven by the increasing prevalence of hypertension and cardiovascular diseases. The rising demand for home-based health monitoring solutions, which indicates a shift toward self-managed health, also contributes to this growth. European healthcare systems are increasingly recognizing the importance of early diagnosis and continuous monitoring of chronic conditions, thereby propelling the market's growth. Several prominent key players, including OMRON Healthcare, Withings, B. Braun, and SunTech Medical, are active in the European market, focusing on developing and offering innovative blood pressure monitoring solutions.

Recognizing the potential of telemedicine, hospitals, clinics, solo practitioners, and healthcare start-ups are rapidly changing their business models to provide value-based healthcare services. On the other hand, the preferences and behavior of consumers of healthcare are always shifting. A new wave of consumerism is fuelling the trend in healthcare toward remote patient monitoring. Key players and trends are being noticed in the remote patient monitoring sector.

By Type

By End-Use

By Region

January 2026

January 2026

December 2025

December 2025