February 2026

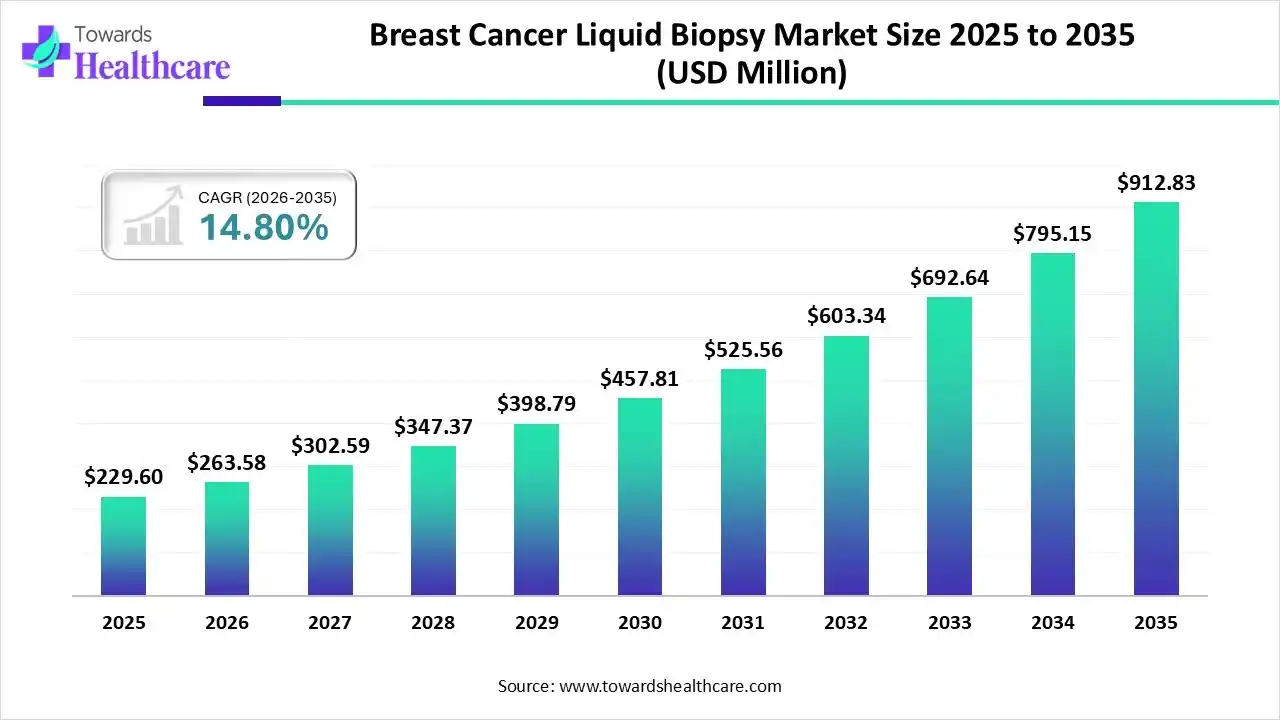

The global breast cancer liquid biopsy market size is calculated at US$ 229.6 million in 2025, grew to US$ 263.58 million in 2026, and is projected to reach around US$ 912.83 million by 2035. The market is expanding at a CAGR of 14.8% between 2026 and 2035.

The increased prevalence of breast cancer in the general population and the need to provide diagnosis results faster than traditional tissue biopsy techniques, so that doctors may make treatment decisions more readily, are two factors that may be responsible for the increase. The fact that the majority of liquid biopsies conducted now are for colorectal and breast cancer adds to the necessity. The notable shift from traditional screening to advanced liquid biopsies has been one of the primary factors propelling the market's expansion in recent years.

| Metric | Details |

| Market Size in 2026 | USD 263.58 Million |

| Projected Market Size in 2035 | USD 912.83 Million |

| CAGR (2025 - 2034) | 14.8% |

| Leading Region | North America |

| Market Segmentation | By Circulating Biomarkers, By Product & Service, By Technology, By Application, By End Use, By Region |

| Top Key Players | F. Hoffmann-La Roche Ltd., QIAGEN N.V., Thermo Fisher Scientific, Inc., Myriad Genetics, Inc., Guardant Health, Inc., NeoGenomics Laboratories, Biocept, Inc., Fluxion Biosciences, Inc., Epic Sciences, Inc., Sysmex Corporation, Illumina, Inc., Biodesix, Inc., Menarini Silicon Biosystems, Johnson & Johnson (Janssen Diagnostics), Foundation Medicine (Roche), Cynvenio Biosystems, Inc., Twist Bioscience, Datar Cancer Genetics, OncoDNA SA, Abcam plc |

A breast cancer liquid biopsy is a minimally invasive diagnostic test that detects biomarkers, such as cell-free DNA (cfDNA), circulating tumor cells (CTCs), and extracellular vesicles (EVs), in blood (and sometimes urine). It enables oncologists to screen, diagnose, select therapies, monitor disease progression, and detect minimal residual disease (MRD) in breast cancer patients without tissue biopsy.

The precision and therapeutic usefulness of liquid biopsy have significantly enhanced thanks to artificial intelligence (AI), particularly machine learning (ML) and deep learning (DL), which have enabled high-throughput biomarker discovery, multi-omics integration, and predictive modeling. Utilizing AI frameworks to enhance AI-powered liquid biopsy models might enable applications in precision oncology. AI machine learning technologies make it possible for liquid biopsies to follow patient health in real time, find more precise biomarkers, and detect cancer earlier.

Rising Cases of Breast Cancer

For women worldwide, breast cancer is the most prevalent form of cancer and the primary cause of cancer-related mortality. The International Agency for Research on Cancer estimates that 675,493 to 694,633 women worldwide lost their lives to breast cancer in 2020, with an age-adjusted incidence of 13.6 per 100,000. It is predicted that by 2040, the number of new instances of breast cancer might reach over 3 million per year, with 1 million fatalities per year, due only to population increase and an aging population.

High Cost of Equipment

The high cost of liquid biopsy testing for breast cancer is a major barrier to the market, particularly in low- and middle-income countries where healthcare funding is limited. This high cost barrier may limit the availability and widespread adoption of liquid biopsy by discouraging patients and medical professionals from selecting it over more traditional tissue biopsy methods.

Rising Focus on Minimally Invasive Diagnostics

Liquid biopsy is a state-of-the-art, minimally invasive diagnostic method that is revolutionizing the treatment of cancer by enabling the identification and analysis of cancer-related biomarkers from physiological fluids such as blood, urine, or cerebrospinal fluid.

Compared to traditional tissue biopsies, which require invasive procedures, liquid biopsies offer a more accessible and repeatable method of evaluating the success of treatment, identifying early-stage malignancies, and assessing the progression of disease.

By circulating biomarkers, the cfDNA/ctDNA segment dominated the breast cancer liquid biopsy market in 2024. cfDNA and ctDNA are potential biomarkers for the detection of breast cancer; however, their diagnostic values differ depending on the type of cancer. cfDNA is more suitable for screening methods and continuous monitoring due to its higher sensitivity, particularly when used in a multimarker model or in conjunction with conventional biomarkers. On the other hand, ctDNA offers a real-time perspective of tumor genetics and is more suited for definitive diagnosis due to its selectivity for tumor-associated alterations.

By circulating biomarkers, the extracellular vesicles (EVS)/exosomes segment is anticipated to grow at the highest CAGR during the upcoming time period. More and more research is being done on the potential of EVs to carry cancer biomarkers in liquid biopsy samples.

Extracellular vesicles (EVs) have emerged as intriguing indicators in liquid biopsy, as they are present in all physiological fluids and may carry disease-related cargo. Since EVs are crucial for the diagnosis and treatment of diseases, a significant amount of effort has been devoted to developing efficient methods for their separation, detection, and analysis.

By product & service, the consumables/reagent kits segment captured a major share of the breast cancer liquid biopsy market in 2024. Because significant players in the industry are increasing their R&D to provide more advanced kits and reagents. Extracellular vesicles and buffer solutions are among the key components used in liquid biopsy studies. They are a more cost-effective choice due to their reduced infrastructural requirements. Several companies provide kits and reagents, as they need to be replaced to conduct various experiments.

By product & service, the service & outsourced analytics segment is estimated to be the fastest-growing during 2025-2034. In the diagnosis and treatment of cancer, liquid biopsy analysis services and outsourced analytics are becoming increasingly important since they offer a less invasive way to monitor the progression of the illness and the efficacy of therapy. These investigations can be outsourced to get access to specialized expertise, state-of-the-art technology like as Next-Generation Sequencing (NGS), and tailored solutions for specific clinical or research requirements.

By technology, the next-generation sequencing (NGS) segment led the breast cancer liquid biopsy market in 2024. Next-generation sequencing (NGS) technologies have advanced quickly in recent years, resulting in a considerable decrease in sequencing costs and an increase in accuracy. NGS has been used to sequence circulating tumor DNA (ctDNA) in the field of liquid biopsy.

By technology, the digital PCR segment is anticipated to witness the highest CAGR during the predicted timeframe. An important technique that offers absolute nucleic acid measurement with a high level of sensitivity and accuracy is ddPCR. ddPCR has been proven to be a quick and precise method for identifying and tracking a growing variety of cancer forms.

By application, the diagnosis/treatment selection (companion dx) segment led the breast cancer liquid biopsy market in 2024. Physicians can use companion diagnostics to find individuals who might benefit from FDA-approved therapy alternatives. Furthermore, companion diagnostics offer information that is essential for the safe and efficient administration of targeted therapies, since the number of cancer clinical indications and approvals for these treatments continues to rise.

By application, the early detection/screening segment is estimated to grow at the highest rate during 2025-2034. Liquid biopsies have a high probability of detecting breast cancer early on, among other cancer types. Compared to tissue biopsies, which are invasive and may overlook tumor heterogeneity, liquid biopsies are a safer, more accurate, and more dynamic alternative. Breast cancer biomarkers, including cfDNA and exosomal miRNAs, can be found using liquid biopsies.

By end-user, the hospital & physician labs segment captured the largest share of the breast cancer liquid biopsy market in 2024. Due to their ability to integrate the results of liquid biopsies with a patient's entire clinical picture, which leads to more successful and customized treatment strategies, hospital and physician laboratories are increasingly doing liquid biopsies for breast cancer. This approach allows for a more thorough evaluation of the patient's state, perhaps detecting tumor heterogeneity and enabling long-term monitoring of treatment response.

By end-user, the reference laboratories segment is expected to exhibit the fastest growth during the forecast period. Many reference labs, particularly those focused on clinical and research applications, offer liquid biopsy testing for breast cancer. 4baseCare is a well-known provider in India, while others, such as MD Anderson's Lucci Laboratory, focus on research applications using liquid biopsy to detect cancer and monitor therapy response. The Johns Hopkins Kimmel Cancer Center is also developing a novel liquid biopsy test for breast cancer.

North America dominated the breast cancer liquid biopsy market in 2024. Because of the region's sophisticated healthcare system and rapid uptake of cutting-edge diagnostic tools, which has led to a rise in the use of liquid biopsy techniques, additionally, the demand for non-invasive diagnostic techniques has increased as patients and healthcare providers become more aware of the advantages of early cancer diagnosis and personalized treatment options. Large pharmaceutical and biotechnology firms, along with continuous research and development in North America, contribute to the market's expansion.

In the U.S., one in eight women (13.1%) will receive a diagnosis of invasive breast cancer, and one in forty-three (2.3%) will pass away as a result of the illness. The U.S. is expected to have 310,720 new cases of invasive breast cancer in women and 2,790 new cases of ductal carcinoma in situ in males in 2024. It is estimated that 530 men and 42,250 women will lose their lives to breast cancer in 2024.

With the exception of non-melanoma skin cancers, breast cancer is the most prevalent malignancy among Canadian women. For Canadian women, it ranks as the second most common cause of cancer-related deaths. In Canada, 30,500 women received a breast cancer diagnosis. In 2024, this amounts to a quarter of all new instances of cancer in women.

Asia Pacific is estimated to host the fastest-growing breast cancer liquid biopsy market during the forecast period. Mostly as a result of the region's improved healthcare regulations. An aging population, more competitors, and improved health care infrastructure will all contribute to the market's growth. Asia Pacific has a large population and a high incidence of cancer.

In China, breast cancer was the second most frequent kind of cancer and the fifth most common cause of cancer-related deaths among women, with rising rates. In 2020, there were around 74,200 breast cancer deaths and 352,300 incident cases in China, which resulted in 2.6 million disability-adjusted life years (DALYs). In 2030, there will be 3.2 million DALYs due to the rise in breast cancer diagnoses and deaths, which will reach 452,000 and 98,800, respectively.

An alarming indication of the disease's increasing prevalence is the fact that a woman in India receives a breast cancer diagnosis every four minutes. According to a recent study published in the Nature Journal, the number of Indian women undergoing treatment for breast cancer is predicted to rise by 50,000 per year over the next 10 years, with an average annual cost burden of US$19.55 billion.

Europe is expected to grow significantly in the breast cancer liquid biopsy market during the forecast period. As national payers consider value-based purchasing linked to outcome data, the European Liquid Biopsy Society is working to establish standardized protocols through harmonization.

Cross-border research collaborations expand sample sizes for early detection studies, providing the data needed for coverage extension. This positive environment is driving growth in the European market for liquid biopsies for breast cancer.

Germany is at the forefront of providing cutting-edge and efficient treatment options for breast cancer, which continues to be the most frequent disease among women worldwide. Germany maintains some of the greatest treatment results in Europe due to a mix of advanced therapeutic regimens, rigorous medical standards, and skilled doctors.

Breast cancer is the most common kind of cancer in the United Kingdom. Breast cancer is the most common illness among females, accounting for 30% of all new instances of cancer in the UK. This kind of cancer is among the least common in the UK, accounting for less than 1% of all new male cancer cases.

Latin America is expected to grow at a notable CAGR in the foreseeable future. The rising prevalence of breast cancer, the burgeoning healthcare sector, and growing research and development activities are factors that influence market growth in Latin America. People are becoming aware of advanced diagnostic tools for detecting cancer. The increasing R&D investments and collaborations among key players propel the market.

According to the Argentinian government, over 22,000 new breast cancer cases are diagnosed annually, and around 7,000 women die. The government is committed to expanding access to health services, empowering women to reach their full potential. An Argentinian-based research institution and hospital is conducting a clinical trial to assess Oncoliq, a novel early breast cancer detection test based on liquid biopsies and mRNAs.

The Middle East & Africa are considered to be a significantly growing area, due to the rising adoption of advanced technologies and the rapidly expanding biotech sector. Government bodies launch initiatives to encourage screening and early diagnosis of breast cancer among the general public. The presence of key players and favorable regulatory support also contributes to market growth.

The UAE National Cancer Registry recorded around 1139 breast cancer cases in the nation. In June 2025, M42 collaborated with AstraZeneca and SOPHiA GENETICS to bring cutting-edge liquid biopsy testing to the UAE, thereby advancing cancer diagnosis, informing treatment decisions, and enabling faster biomarker testing.

In June 2025, according to Joaquín Martínez-López, president of Altum Sequencing, our goal is not to diagnose cancer, but to provide physicians with a practical tool to track the disease's progression after treatment. He claims that NGS (next-generation sequencing) DNA sequencing technology enables us to identify a single tumor cell out of a million healthy cells in a basic blood sample. Early detection of recurrent relapses is challenging due to the sensitivity limits of existing diagnostic techniques. (Source - Healthcare in Europe)

By Circulating Biomarkers

By Product & Service

By Technology

By Application

By End Use

By Region

February 2026

February 2026

January 2026

January 2026