February 2026

The CAR T-Cell neurotoxicity detection market is emerging as a critical focus within oncology diagnostics, driven by the expanding use of CAR T-cell therapies and the urgent need to manage associated neurotoxic side effects. From 2024 to 2034, the market is expected to witness robust growth due to technological advancements in biomarker detection, improved neuroimaging techniques, and rising investment in personalized cancer treatment. North America is projected to dominate the market, while Asia Pacific is likely to show the fastest growth. Early detection tools and real-time monitoring solutions are reshaping the clinical approach to CAR T-cell-related neurotoxicity.

The CAR T-cell neurotoxicity detection market is primarily driven by the increasing use of CAR T-cell therapy, which is fueled by the growing demand for personalized medicines. The growing research and development activities lead to the creation of novel CAR T-cells. The rising prevalence of hematologic malignancies potentiates the need for CAR T-cell therapy. The future looks promising, with advancements in genomic technologies and the burgeoning medical device sector.

The CAR T-cell neurotoxicity detection market refers to the tools, technologies, and services used to identify, monitor, and manage neurotoxic side effects—particularly ICANS (immune effector cell-associated neurotoxicity syndrome)—in patients undergoing CAR T-cell therapy. Neurotoxicity is one of the most serious and potentially fatal side effects of CAR T-cells, making early detection critical to patient safety and regulatory compliance. It can be detected using blood tests, MRI, CT scan, EEG, and lumbar puncture.

Numerous factors govern market growth, including the rising prevalence of cancer and growing research and development activities. This enables researchers to develop novel CAR T-cell therapy for blood cancers. The increasing demand for personalized medicines, combined with favorable government support, promotes the market. The rising investments and collaborations among researchers and key players facilitate the development of early detection methods of neurotoxicity.

Artificial intelligence (AI) can revolutionize the detection of CAR T-cell-mediated neurotoxicity, which is otherwise difficult for humans. It can enhance the efficiency and accuracy of detection. Integrating AI in MRI enhances the image quality, accelerates scan times, and improves diagnostic accuracy. AI and machine learning (ML) algorithms can analyze vast amounts of data and detect the presence of potential signs of neurotoxicity. They can track disease progression and evaluate treatment effectiveness. Additionally, AI can transform brain imaging by improving disease detection and predictive modeling.

Personalized Medicines

The major growth factor of the CAR T-cell neurotoxicity detection market is the growing demand for personalized medicines. The increasing demand is a result of rapidly changing demographics, growing genomics research, and the rising geriatric population. Personalized medicines can treat complex and rare forms of cancer. CAR T-cell therapy is a type of regenerative medicine in which T-cells are extracted from the patient, modified, and then infused into the bloodstream. Several government organizations also launch initiatives to support the development of CAR T-cell therapies.

The table below lists seven CAR T-cell therapies approved by the U.S. Food and Drug Administration (FDA) as of January 2025. The increasing approvals of CAR T-cell therapy necessitate researchers to develop tools and techniques for neurotoxicity detection, propelling market growth.

| CAR T-Cell Therapy | Indication | Company Name | Approval Year |

| Kymriah (tisagenlecleucel) | Relapsed or refractory B-cell precursor acute lymphoblastic leukemia (ALL) and large B-cell lymphoma | Novartis Pharmaceuticals | 2017 |

| Yescarta (axicabtagene ciloleucel) | Relapsed or refractory large B-cell lymphoma after two or more lines of systemic therapy | Kite Pharma, Inc. | 2017 |

| Tecartus (brexucabtagene autoleucel) | Relapsed or refractory mantle cell lymphoma and B-cell precursor ALL | Kite Pharma, Inc. | 2020 |

| Breyanzi (lisocabtagene maraleucel) | Relapsed or refractory large B-cell lymphoma after two or more lines of systemic therapy | Juno Therapeutics, Inc. | 2024 |

| Abecma (idecabtagene vicleucel) | Relapsed or refractory multiple myeloma after four or more prior lines of therapy | Celgene Corporation | 2024 |

| Carvykti (ciltacabtagene autoleucel) | Relapsed or refractory multiple myeloma after four or more prior lines of therapy | Johnson & Johnson | 2022 |

| Aucatzyl (obecabtagene autoleucel) | Relapsed or refractory B-cell precursor ALL | Autolus Therapeutics | 2024 |

High Cost

The high cost associated with complex and advanced diagnostic tools and imaging techniques poses a significant challenge to the market. This limits the affordability of numerous people from low- and middle-income groups.

What is the Future of the CAR T-Cell Neurotoxicity Detection Market?

The future of the market is promising, driven by advancements in technology and the increasing number of clinical trials. The growing demand for early detection of neurotoxic side effects of CAR T-cell therapy encourages researchers to develop novel techniques for detecting neurotoxic side effects. Advanced genomic technology, such as the CRISPR-Cas9 technique, enables modification of CAR T-cells to reduce their toxicity. Moreover, phase 4 clinical trials are conducted to assess the toxicity of CAR T-cells. As of June 2025, 5 phase 4 clinical trials are registered on the clinicaltrials.gov website related to CAR T-cell therapy as an intervention. (Source: Clinical Trials.gov)

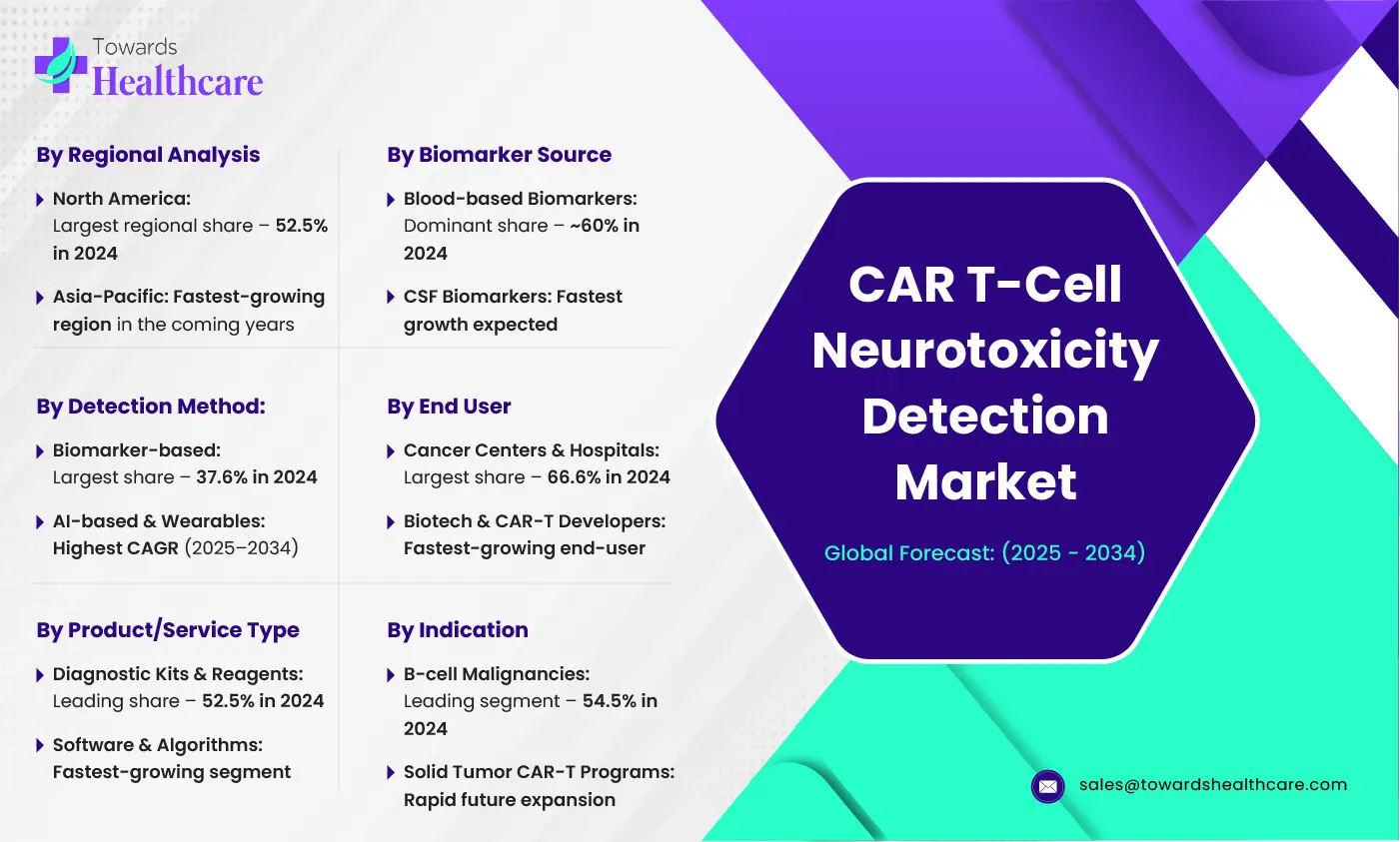

By detection method, the biomarker-based detection segment held a dominant market share of approximately 37.6% in 2024. This segment dominated owing to the ease of measuring biomarkers from body fluids. Some biomarkers can be easily detected from a simple blood test. Some common biomarkers involved in neurotoxicity include cytokines, S100B, GFAP, NfL, and endothelial markers. Biomarker-based detection tests are comparatively cost-effective and enable qualitative and quantitative assessment of biomarkers.

By detection method, the AI-based & wearable monitoring segment is expected to grow at the fastest CAGR in the market during the forecast period. Technological advancements, such as AI/ML, improve the detection capabilities of diagnostics. The advent of wearable devices enables continuous monitoring of a patient. This is possible with the use of AI-based sensors. A recent study reported that EEG is the diagnostic investigation for ICANS with the greatest therapeutic impact of 16% compared to MRI with 4% and lumbar puncture with 7%. (Source: Healio)

By product/service type, the diagnostic kits & reagents segment led the global market with a share of approximately 52.5% in 2024. The segmental growth is attributed to the easy availability of kits and reagents and the growing demand for point-of-care diagnostics. Kits & reagents allow healthcare professionals to detect potential side effects of CAR T-cell therapy near the patient, rather than in a central laboratory. They are cost-effective and can perform multiple experiments simultaneously. They are not only used in healthcare settings but also in research laboratories to analyze the effect of CAR T-cells.

By product/service type, the software & algorithms segment is expected to grow with the highest CAGR in the market during the studied years. Software and algorithms help in the constant monitoring of patients. They can provide real-time patient data to healthcare professionals and alert them to any minor changes in the patient’s health or symptoms. This enables healthcare professionals to make effective clinical decisions and provide appropriate treatment.

By biomarker source, the blood-based biomarkers segment held the largest revenue share of approximately 60% in the market in 2024. This is because the detection of blood-based biomarkers is easier. Neurotoxicity after CAR T-cell therapy is associated with cytokines, which are directly released into the bloodstream. Blood-based biomarkers are easily detected through blood tests. They offer a less invasive approach to detect neurotoxicity and provide faster results, leading to timely interventions.

By biomarker source, the cerebrospinal fluid (CSF) biomarkers segment is expected to expand rapidly in the market in the coming years. Since neurotoxicity refers to the harmful alteration of the nervous system, it can be detected through CSF biomarkers. CSF biomarkers provide an idea about the mechanism of neurotoxicity. CSF is in direct contact with the central nervous system; hence, it offers a unique window into brain health and disease processes.

By end-user, the cancer centers & hospitals segment contributed the biggest revenue share of 66.6% in the market in 2024. This segment dominated because of favorable infrastructure and suitable capital investment. The rising prevalence of blood cancers leads to an increasing hospitalizations of patients. Hospitals allow multidisciplinary expertise to patients and suggest appropriate treatment outcomes. Patients are under close monitoring in cancer centers and hospitals, enabling healthcare professionals to make proactive decisions.

By end-user, the biotech & CAR-T developers segment is expected to witness the fastest growth in the market over the forecast period. The growing research and development activities and the presence of skilled professionals boost the segment’s growth. Researchers in biotech companies analyze the effects of CAR T-cells and predict their behavior in patients. They enable earlier prediction of likely neurotoxicity after CAR T-cells in preclinical studies.

By indication, the B-cell malignancies segment held a major revenue share of 54.5% in the market in 2024. The rising prevalence of B-cell malignancies and their increasing complexity augment the segment’s growth. The prevalence of B-cell lymphoma in seven countries, such as the U.S., UK, Japan, France, Germany, Italy, and Spain, was 200,844 in 2023, and is projected to reach 229,804 in 2033. It is estimated that B-cell lymphoma cases will increase by 15% in the next decade.

By indication, the solid tumor CAR-T programs segment is expected to show the fastest growth over the forecast period. CAR T-cell therapies are currently evaluated for the treatment of solid tumors. Ongoing efforts are made to enhance T-cell persistence & cytotoxicity, target multiple antigens, and utilize innovative allogeneic CAR T-cell manufacturing. The increasing research efforts and the rising incentives by government and private organizations promote the development of CAR T-cell therapies for solid tumors.

North America dominated the global market with a share of 52.5% in 2024. The presence of key players, availability of state-of-the-art research and development facilities, and the rising prevalence of blood cancers are the major growth factors of the market in North America. Government organizations provide funding and launch initiatives to support research activities related to detecting neurotoxicity. Favorable regulatory support leads to the launch of novel CAR T-cells.

Key players, such as Thermo Fisher Scientific, Philips Healthcare, and Tempus AI, are major contributors to the market in the world. The U.S. FDA formed the NCTR Division of Neurotoxicology to identify and quantify neurotoxicity related to FDA-regulated products, develop and qualify quantitative biomarkers of neurotoxicity, and perform other functions. The primary aim of the division is to advance regulatory science research in neurotoxicology for the FDA. (Source: FDA)

In Canada, someone is diagnosed with blood cancer every 24 minutes. The Canadian Cancer Society estimated that 23,600 cases of blood cancer would occur in 2024. The federal government announced an investment of $80 million in Budget 2024 over 4 years for the Brain Canada Foundation. (Source: Canadian Cancer Society)

Asia-Pacific is expected to grow at the fastest CAGR in the CAR T-cell neurotoxicity detection market during the forecast period. The growing research and development activities and increasing awareness of early disease detection foster market growth. The burgeoning healthcare sector, along with growing investments, contributes to market growth. The increasing number of medtech startups favors the development of innovative detection tools for CAR T-cell-mediated neurotoxicity.

There are around 1,104 medical device startups in China. As of 2024, China’s National Medical Product Administration (NMPA) approved 2 CAR T-cell therapies for cancer treatment. The Chinese government actively supports research activities to develop tools and techniques for analyzing potential side effects of CAR T-cell therapies.

India hosts about 894 medical device startups. According to EY Panthenon’s analysis of 50 MedTech startups, 79% of all innovations are driven by medical technology solutions, and 21% by digital solutions. These startups focus on advancements in early disease detection, home-based care, advanced materials, and minimally invasive techniques. (Source: EY)

Europe is expected to grow at a notable CAGR in the CAR T-cell neurotoxicity detection market in the foreseeable future. The rising adoption of advanced technologies and a robust healthcare infrastructure boost the market. The growing demand for personalized medicines allows researchers to develop more CAR T-cell therapies. The presence of key players, such as Siemens Healthineers and Roche Diagnostics, contributes to market growth in Europe. Favorable government support and increasing investments propel the market.

The German Brain Council formed the “German Brain Plan – Agenda 2030” to address neurological and mental illness in Germany. Germany has world-class infrastructure, experienced professionals, and stringent ethical standards to conduct clinical trials related to CAR T-cells.

The MHRA announced that the UK is the first country to launch a tailored framework for the regulation of innovative products manufactured at a point where a patient receives care. This facilitates the development of novel and personalized medicines with short half-lives in a hospital setting or ambulance. (Source: UK Government)

Dr. Yuya Kunisaki, Professor in the Department of Clinical Chemistry and Laboratory Medicine, Kyushu University Hospital, commented that ICANS can present with mild symptoms, such as headache or lethargy, but in more severe cases, it can be life-threatening. He said that if the biomarker ratio shows a patient at high risk for ICANS, it can be detected using a predictive test by analyzing CSF, paving the way for a more personalized and safer approach to cancer treatment. (Source: Medical Xpress)

By Detection Method

By Product/Service Type

By Biomarker Source

By End-User

By Indication

By Region

February 2026

February 2026

February 2026

February 2026