February 2026

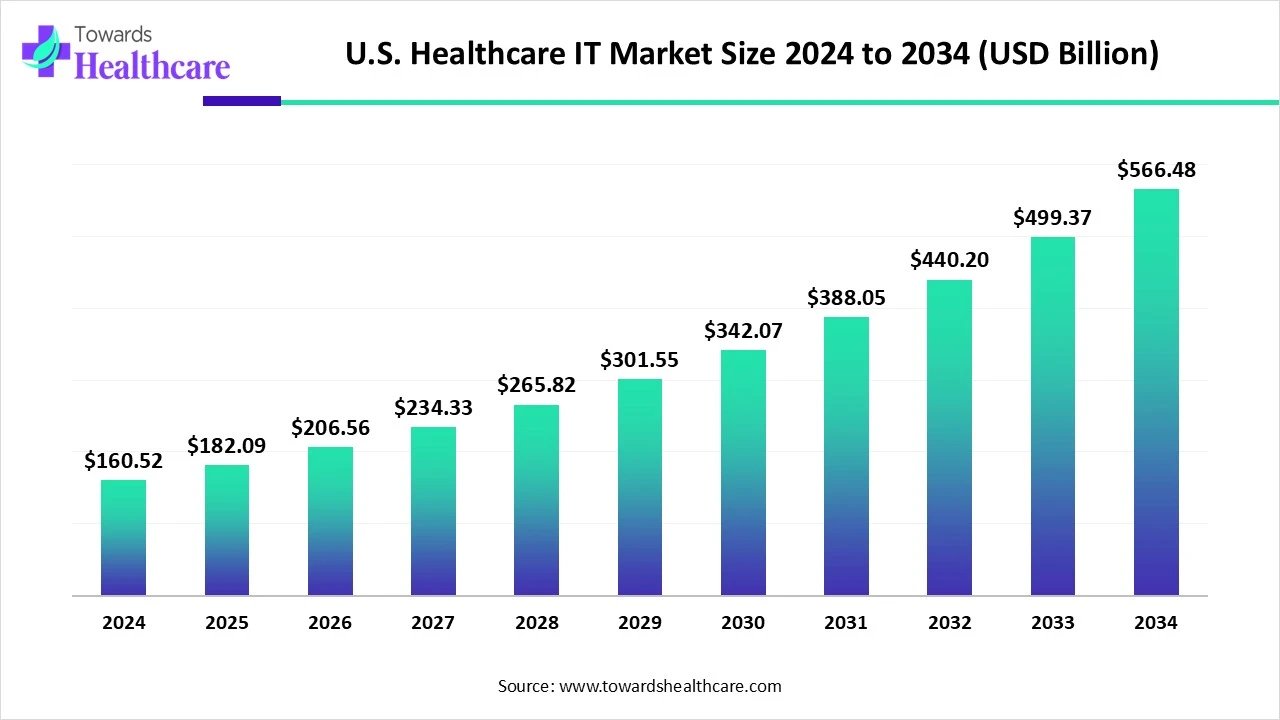

The U.S. healthcare IT market size reached USD 160.52 billion in 2024, grew to USD 182.09 billion in 2025, and is projected to hit around USD 566.48 billion by 2034, expanding at a CAGR of 13.44% during the forecast period from 2025 to 2034.

Some healthcare industry specialists are dedicated to enhancing the global competitiveness of health industry in the U.S. The U.S. markets are expanding, and exports are also increasing. A strong relationship between healthcare providers, payers, and patients supports the healthcare systems in the U.S. The U.S. strongly demands medical devices from the leading companies like GE Healthcare, which makes them profitable. Quantum computing technologies, precision medicine approaches, and other medical tools and techniques are expanding the portfolio of healthcare industries in the U.S.

| Table | Scope |

| Market Size in 2025 | USD 182.09 Billion |

| Projected Market Size in 2034 | USD 566.48 Billion |

| CAGR (2025 - 2034) | 13.44% |

| Market Segmentation | By Product / Solution Type, By Deployment Model, By End-User, By Buyer Type, By Technology Focus, By Region (within U.S. – broad geographic clusters) |

| Top Key Players | Epic Systems, Cerner, Allscripts, MEDITECH, Athenahealth, McKesson, eClinicalWorks, NextGen Healthcare, Siemens Healthineers, Philips Healthcare, IBM Watson Health, Optum, GE Healthcare, Change Healthcare, athenaOne / athenahealth modules, Inovalon, Oracle Health, Cardinal Health, MEDHOST, Greenway Health |

The U.S. healthcare IT market comprises information technology solutions and services tailored to the U.S. healthcare ecosystem, including hospitals, outpatient clinics, payers, labs, pharmacies, and health systems. It spans electronic health records, clinical decision support, revenue cycle management, health information exchange, telehealth platforms, population health analytics, cybersecurity, patient engagement solutions, interoperability, and AI-enabled tools. These improve care quality, provider productivity, financial performance, regulatory compliance, and patient outcomes.

The growing strategic partnerships are aiming to enhance cancer care. For instance, in March 2025, the Government of Alberta announced the investment of $800 million CAD through a partnership with the Alberta Cancer Foundation and Siemens Healthineers to address the rising prevalence of cancer, reduce waiting times for patients, and support early detection of diseases. It will establish two centers of excellence for AI and training, for which Siemens Healthineers announced an additional investment of $175 million CAD.

The rising trend of quantum computing fuels the growth of the healthcare IT sector in the U.S. and across the globe. For instance, in April 2025, IBM announced the investment of $150 billion in America over the next 5 years to accelerate the economy and its presence as the global leader in computing. This encompasses the investment of $30 billion in research and development to improve the manufacturing of quantum computers by IBM.

AI algorithms are essential in medical imaging analysis, and AI improves diagnostic accuracy in pathology, dermatology, radiology, and ophthalmology. AI predicts disease progression and optimizes drug selection. AI-driven treatment planning for certain cancers, neurological diseases, and cardiovascular disorders. The management of patients and the reduction of clinician labor are experienced with the insertion of AI-powered virtual assistants and the automation of electronic health records.

What is the Digital Transformation in the U.S. Healthcare IT Market?

The quality management systems enable healthcare industries to incorporate and utilize advanced data analytics. It helps to optimize industrial and business processes. Healthcare industries are revolving around AI, IoT-powered wearable devices, augmented reality, virtual reality, blockchain, data equity, and greener practices. These are the digital trends in healthcare technology that can transform numerous setbacks in healthcare.

What are the Concerns associated with Healthcare Costs?

The increased costs of medications and treatments lead to reduced access to healthcare for the common patient population in the U.S. The increased costs of prescription drugs prevent their access to patients. Healthcare feels like a burden for many patients.

What is the Future of the U.S. Healthcare IT Market?

The U.S. Government and the World Health Organization are dedicated to managing international health issues. They make efforts to help several countries in public health emergencies. There are tremendous opportunities in clinical services, logistics, supply chain, data analytics, payment services, software, and platforms. There is a major role of dispensers, specialty pharmacies, distributors, and other healthcare professionals in expanding healthcare systems.

The electronic health records (EHR)/EMR systems segment dominated the market in 2024, owing to enhanced efficiency in healthcare systems and streamlined workflows. The electronic health records and electronic medical records protect patients' health information, treatment plans, and resulting outcomes in a confidential manner. These approaches help doctors to access any kind of data immediately and treat patients accordingly.

The telehealth/telemedicine platforms segment is expected to grow at the fastest CAGR in the U.S. healthcare IT market during the forecast period due to enhanced efficiency of these advanced platforms and reduced costs associated with telemedicine. They offer personalized and preventive care to patients and focus on better assessment of treatments. They facilitate seamless data transfer and improved data security.

The on-premises segment dominated the market in 2024, owing to enhanced data control and ownership through on-premises deployment in healthcare IT. They allow reduced dependency on third-party security and follow strict compliance with regulations. The on-premises are essential for businesses to achieve long-term cost efficiency, and they help businesses to gain control over expenses.

The cloud/SaaS segment is expected to grow at the fastest CAGR in the U.S. healthcare IT market during the forecast period due to the numerous benefits of cloud computing and software-as-a-service deployments in transforming healthcare systems. The integration of cloud or SaaS platforms into healthcare results in reduced costs of IT infrastructure while delivering scalability and cost efficiency in healthcare management. They enable patients to experience improved care through personalized treatments, telemedicine platforms, and remote patient monitoring devices.

The hospitals & health systems segment dominated the market in 2024, owing to the expansion of healthcare facilities across the globe. The integration of several cutting-edge technologies and tools into radiology, pathology, scientific laboratories, and many other medical facilities has raised the importance of scientific research and development. Patients can access personalized care and experience reduced medical errors due to information technologies.

The ambulatory clinics/physician practices segment is expected to grow at the fastest CAGR in the U.S. healthcare IT market during the forecast period due to the increased focus of healthcare providers on chronic disease management and better coordination for patient care. Healthcare IT results in better inventory management and improved revenue cycle management. Information technologies enable data-driven decision-making and management of the patient population.

The large integrated delivery networks (IDNs) segment dominated the market in 2024, owing to strategic reimbursement approaches and supportive initiatives for public health. These networks allow improved allocation of resources and offer reduced operational costs. Healthcare IT enables large integrated delivery networks to provide high-quality, coordinated, and cost-effective patient care.

The health plans/payers segment is expected to grow at the fastest CAGR in the U.S. healthcare IT market during the forecast period due to the rising efforts in proactive care and improved access to information. The adoption of various technologies reduces fraud, abuse, and waste in healthcare operations. Automated compliance monitoring reduces risks, conducts audits, monitors regulatory changes, and analyses claims data with the help of AI-powered tools.

The interoperability/FHIR-based tools segment dominated the market in 2024, owing to real-time data access and reduced data silos through improved data interoperability and access. The automated processes and optimized clinical workflows result in streamlined workflows and increased efficiency. Regulatory alignment, data accuracy, and data privacy bring enhanced security and compliance.

The AI/ML-enabled tools segment is expected to grow at the fastest CAGR in the U.S. healthcare IT market during the forecast period due to improved diagnostic accuracy and speed using AI algorithms in medical imaging analysis. AI and ML tools can potentially analyze medical information of patients, genetic health information of patients, lifestyle factors, and many other related aspects of health. AI-powered robots assist surgeons in delivering precision care while reducing the manual errors and risks associated with it.

The U.S. Department of Health and Human Services (HHS) contributes to supporting and implementing programs that accelerate the health, safety, and well-being of the American people. HHS provides integrated care and high-quality services to all Americans through its highly skilled workforce. In May 2025, the Philips Foundation announced the expansion of its investments and portfolio of social ventures to India and Latin America. The Philips Foundation expanded accessibility to quality healthcare for 46.5 million people globally. The World Health Organization (WHO) makes great efforts to bring healthcare to every part of America.

In August 2025, the WHO and UNICEF invited governments and health systems to invest in a breastfeeding support initiative to improve the health and development of infants. The Pan American Health Organization supported this call to encourage breastfeeding and protect mothers from commercial pressures. These efforts were taken on the occasion of World Breastfeeding Week in Washington, D.C. According to the U.S. Food and Drug Administration, the digital health center of excellence focuses on empowering digital stakeholders to advance healthcare.

According to the Texas Higher Education Coordinated Board, the Texas healthcare workforce or task force aims to build the healthcare workforce through collaborations across agencies. It also focuses on expanding the number of pharmacy technicians in Texas and providing a start-up fund for sponsors of apprenticeship programs. In March 2024, Florida announced its plan to raise expenditure on several healthcare programs by prioritizing funds for these purposes.

The World Bank Group is transforming healthcare access in the Pacific Islands. In October 2024, the WHO reported that 10 additional countries in the Western Pacific region aim to invest in the WHO by providing an additional US$12.1 million to the WHO through the first investment round. In April 2024, Apple proclaimed that it would raise its expenditure in the U.S. by more than $500 billion over the next 4 years. Apple will also expand its teams and facilities in California, Washington, Texas, North Carolina, Michigan, Arizona, Iowa, Oregon, and Nevada.

The global healthcare IT market was estimated at US$ 238.30 billion in 2023 and is projected to grow to US$ 1404.55 billion by 2034, rising at a compound annual growth rate (CAGR) of 17.5% from 2024 to 2034.

In October 2024, Seema Verma, executive vice president and general manager of Oracle Health and Life Sciences, reported that Oracle Health Data Intelligence works with any EHR and the company feels proud to make this available to all health systems. This avoids blind spots due to data silos and uses advances in AI. This aims to empower healthcare organizations with more predictive and proactive approaches to their care plans and reporting.

By Product / Solution Type

By Deployment Model

By End-User

By Buyer Type

By Technology Focus

By Region (within U.S. – broad geographic clusters)

February 2026

February 2026

February 2026

February 2026