February 2026

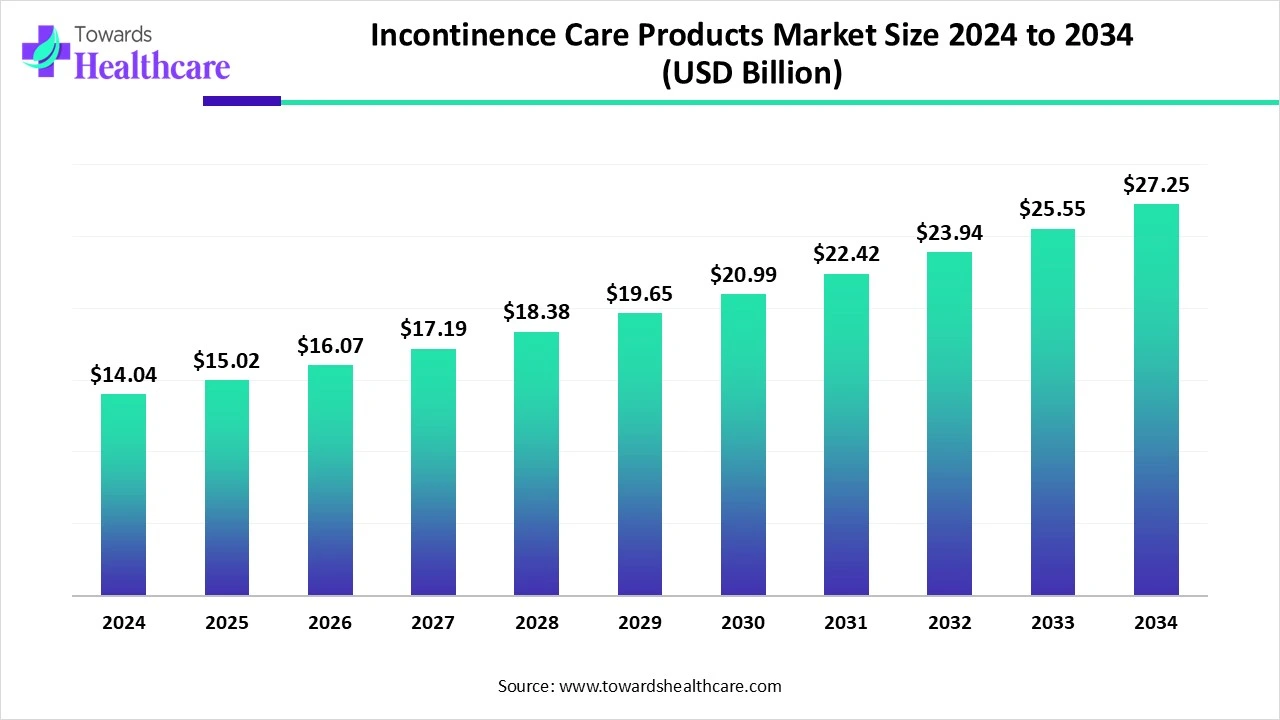

The global incontinence care products market size stood at US$ 14.04 billion in 2024, grew to US$ 15.02 billion in 2025, and is forecast to reach US$ 27.25 billion by 2034, expanding at a CAGR of 7.06% from 2025 to 2034.

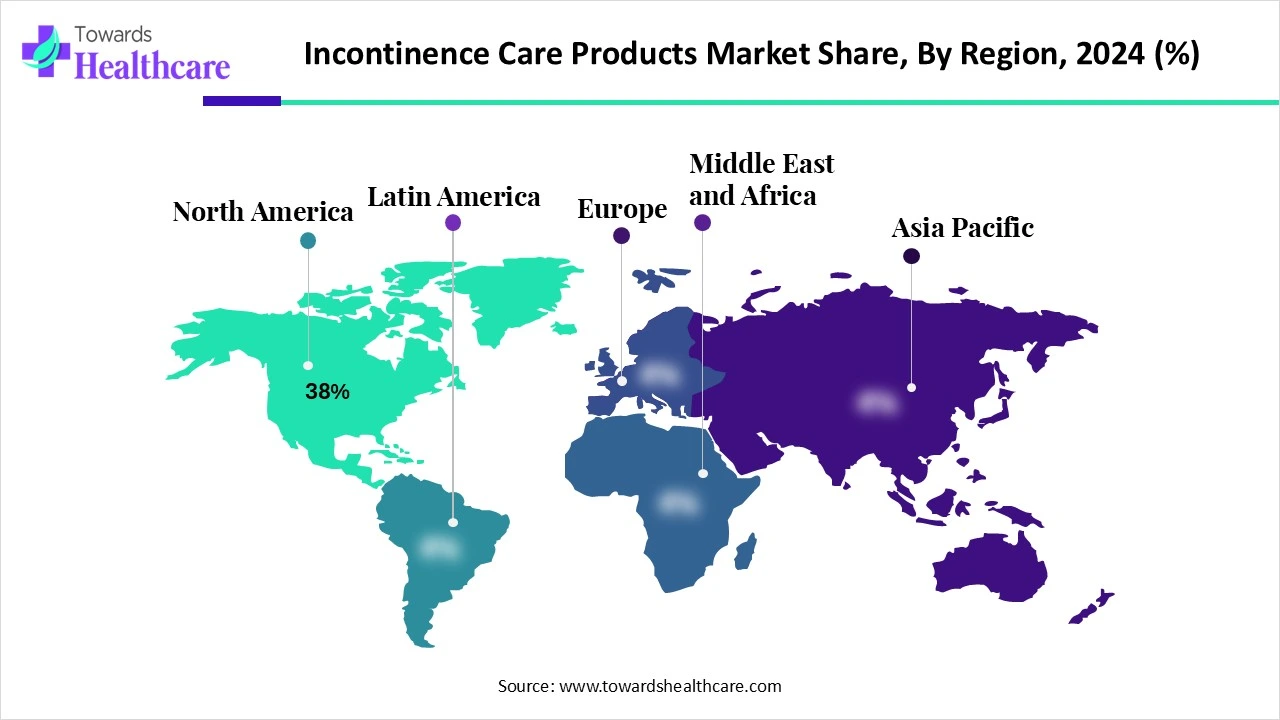

The incontinence care products market is expanding due to the increasing prevalence of fecal and urinary incontinence in the aging population, growing awareness, and improved medical care infrastructure. North America dominates the market as technological advancements in incontinence product manufacturing led to more comfortable, discreet, and highly absorbent products. Asia Pacific is the fastest growing an increasing aging population and also rising government initiatives for elderly care.

| Table | Scope |

| Market Size in 2025 | USD 15.02 Billion |

| Projected Market Size in 2034 | USD 27.25 Billion |

| CAGR (2025 - 2034) | 7.06% |

| Leading Region | North America Share 38% |

| Market Segmentation | By Product Type, By Absorbency / Use Case, By End User / Distribution Channel, By Material / Technology, By End-User Demographic, By Region |

| Top Key Players | Kimberly-Clark Corporation, Procter & Gamble, Essity AB, Unicharm Corporation, Ontex Group, First Quality Enterprises, Abena A/S, HARTMANN GROUP (Seni), Medline Industries, Cardinal Health, Drylock Technologies, Domtar Corporation, Coloplast A/S, Hollister Incorporated, ConvaTec Group, Becton, Dickinson and Company (BD), Teleflex Incorporated, Drycare / regional private-label specialists, Mölnlycke Health Care, Numerous private-label & regional producers |

The incontinence care products market comprises disposable and reusable products, accessories, and services used to manage urinary and fecal incontinence across home care, long-term care, acute care, and community settings. Products include adult diapers/briefs, protective underwear, pads & liners, underpads (bed pads), skin care & cleansing products, odor control, catheter supplies, and disposal systems. Growth is driven by an aging population, higher prevalence of incontinence (age- and disease-related), growing home-care adoption, rising awareness and destigmatization, and product innovation (skin-friendly materials, discrete designs, sustainable materials).

Women are more likely to have stress incontinence. Pregnancy, childbirth, menopause, and normal female anatomy account for this difference.

For instance,

Increasing the use of incontinence products can significantly improve hygiene and quality of life for individuals experiencing incontinence.

For Instance,

Integration of AI in incontinence care products drives the growth of the market as AI-driven urinary incontinence sheds light on the technology solutions involving more efficient and targeted management approaches. AI-driven technology plays a significant role in renovating the landscape of urinary incontinence supervision, offering advanced solutions to improve the quality of care. Advanced wearables, like sensors and intelligent diapers, provide real-time monitoring, allowing the person and care caregiver with timely understanding. Electrical stimulation tools offer technical interventions to improve pelvic floor muscle tone. Implantable devices, such as sacral neuromodulation systems, provide a long-term management solution. Advanced toilets equipped with sensors analyse health indicators, paving to a further inclusive strategy to urinary incontinence care. Virtual reality and augmented reality technologies add an attractive dimension to rehabilitation exercises, which drives the growth of the market.

Increasing Applications of Incontinence Products

The ability of disposable products to contain urine without leakage and protect skin has improved steadily in recent years. Using incontinence products significantly enhances comfort. To reduce discomfort and prevent leaks, these products are designed with high absorbency and a snug fit. Besides preventing wetness and stains on clothes, this protection also boosts users’ confidence. While they may seem costly initially, quality incontinence products are cost-effective over time. They reduce laundry needs and decrease reliance on medical aids, which helps lower healthcare costs. This consideration fuels the growth of the incontinence care market.

Major Challenges in Using Incontinence Care Products

Using diapers and similar products can worsen skin issues. While they help keep bedding and clothing cleaner, these products keep urine or stool in continuous contact with the skin. Over time, this can lead to skin breakdown. To prevent this, it's important to keep the skin clean and dry, which can limit the growth of the incontinence care products market.

Increasing Advancement in Assistive Technologies (ATs)

Assistive Technologies (ATs) are essential in managing intractable incontinence, addressing toilet use issues, and helping people stay independent. Affordable items like absorbent pads or handheld urinals can support maintaining function and independence, possibly avoiding unnecessary care home admissions. The World Health Organization recognized the significance of ATs in incontinence management, listing absorbent continence products as one of its top 50 Priority Assistive Technologies. To connect end-users with the best AT for their specific needs and situations, the first step is to identify the full range of problems and potential AT solutions. This approach helps foster the growth of the incontinence care products market.

For Instance,

By product type, the adult diapers/briefs (disposable) segment led the incontinence care products market, due to its support to manage incontinence challenges proficiently, keeping the skin dry and lowering the challenges of irritation or infections. They allow the patients to continue with routine activities without worrying about accidents, providing freedom and confidence. They offer outstanding protection, simplicity, and appropriateness, and aid in maintaining dignity and privacy. These diapers are equipped with advanced odour-control features, resolving any unpleasant scents.

On the other hand, the pads & liners (disposable) segment is projected to experience the fastest CAGR from 2025 to 2034, as it is applied to retain and absorb menstrual fluid and separate menstrual fluids from the body. They have significant and targeted features, are non-leaking, have no anaesthetic arrival or colour, no sound, no smell, stay in place, are simple to wear, and preserve a high level of hygiene. Liners are an appropriate solution for preserving freshness during the day, predominantly during ovulation or in between periods.

By absorbency/use case, the moderate–severe absorbency segment is dominant in the Incontinence Care Products Market in 2024, as it is applied for handling incontinence in patients. This level of absorbency is appropriate for patients with moderate to heavy urinary or fecal incontinence, offering satisfactory comfort and protection. Moderate Absorbency products are usually used in nursing homes, hospitals, and by patients at home who involvement moderate to heavy incontinence because of age, healthcare conditions, or disabilities. Related devices to moderate absorbency products include high absorbency incontinence products, like overnight adult diapers or supreme absorbency pads, for individuals with heavier incontinence requirements.

The light absorbency/stress & urgency leakage segment is projected to grow at the fastest CAGR from 2025 to 2034, as they are designed to absorb and lock away minor amounts of urine and offer reliable protection against leaks. These pads are inconspicuous, slim, and comfortable, enabling patients to maintain an active lifestyle without fearing embarrassment or discomfort. They are specifically tailored to meet the requirements of those experiencing light bladder leakage and provide an alternative to bulky adult diapers. Light incontinence pads are discreet and designed to fit seamlessly into normal life.

By end user/distribution channel, the home care/OTC retail segment led the incontinence care products market in 2024, as in home care, these products asserted the likely benefits of evidence‐based continence training, including more sensible use of products, decrease in associated infection, healthier patient skin care, and more facilitative communication with patients. Physician also recognised the preferred technique of continence training, based on their role and workload. To ensure improved take‐up of, and engagement with, continence training. Home health care provides tailored help for patients dealing with incontinence. Care takers create modified routines and guarantee that residents receive the right products and assistance, improving dignity and comfort.

The hospitals & long-term care facilities segment is projected to experience the fastest CAGR from 2025 to 2034, as in hospital settings, incontinence care products are used for patients with urine incontinence. This product aims to clean the perineum area, removing skin irritants. These products are available for acquisition, advertised as being pH-balanced to minimize irritation and a non-rinse formula to enhance efficiency and usability for care staff.

By client type, the disposable non-woven/SAP (super absorbent polymer) core segment led the incontinence care products market in 2024, as disposable non-woven are super absorbent pads that protect the mattress from urine damage. They play a significant role in absorbing the leaking liquid. It uses patience on a broad scale in long-term care hospitals and facilities to protect the furniture and mattresses from urine. They play a vital role in absorbing the leaking liquid. It is used for long-term care hospitals and facilities to protect the furniture and mattresses from urine or body fluids.

On the other hand, the biodegradable/paper-based/kraft alternatives segment is projected to experience the fastest CAGR from 2025 to 2034, as these incontinence products absorb and lock away urine and feces, therefore that leakage does not occur and the patient’s skin is kept healthy and dry. These products are available in both sheet and diaper forms, with the latter used as bedding materials. Disposable diapers are complex characteristically consist of an inner covering layer, an absorbent layer.

By end-user, the geriatric/elderly segment led the incontinence care products market in 2024 due to incontinence care products usually employed in the care of aging patients with incontinence. Elderly individuals use it at home, throughout outings, or in social settings, to prevent the awkwardness caused due to incontinence, and maintain their privacy. These products support the toileting needs of aging patients toileting needs and disabled persons toileting needs by creating a bathroom extra accessible. The use of modern disposable absorbent incontinence products lowers the amount of time needed to clean and care for incontinent elderly or weak patients, the expense and time needed to wash soiled clothing and bedding, and the challenges of spreading illness in the institution over contamination.

On the other hand, the women segment is projected to experience the fastest CAGR from 2025 to 2034, as incontinence care products help women feel confident, avoid leaks, and have peace of mind. They also offer emotional support by lowering stress and social awkwardness. Adult diapers for women are specifically intended hygiene products to manage urinary incontinence, recovery from surgery, or movement issues. They provide comfort, good absorbency, and unseen protection, enabling women to sustain confidence and independence in daily routines. This product is available in various sizes and types to meet women's requirements and preferences.

North America is dominant in the market share by 38% in 2024, as the increase in the older population increases demand for incontinence products. The National Association for Continence reported that over 25 million adult North Americans experience temporary or chronic urinary incontinence. This situation is twice as common in women as men, whereas stress urinary incontinence is most common among pregnant women. The Government launches advanced incontinence products to make their use, driving the growth of the market.

For Instance,

In the U.S., growing incontinence awareness programmes, education, and primary prevention involve informing and educating the public and health care professionals related urinary incontinence. The United States has risen to the forefront of healthcare innovation by spending heavily on research, which has led to advanced therapy and medical products. It provides a healthcare education system that drives highly dedicated providers who, in turn, administer patient-centered care rooted in a patient’s freedom of choice, which contributes to the growth of the market.

In Canada, incontinence affects over 3 million Canadian men and women of all ages. Canadian women make about 500,000 visits to the hospital each year due to UTIs, which increases demand for incontinence care products. Increasing awareness related to incontinence challenges and development in product technology, like improved absorbency and skin-friendly materials. Drives the growth of the market.

Asia Pacific is the fastest-growing region in the incontinence care products market in the forecast period, as the presence of leading players such as Abena AS, B. Braun Melsungen AG, Coloplast Corporation, ConvaTec, and Hollister Inc., which drive the growth of the market. This region is experiencing significant economic growth, which has ultimately increased disposable incomes. Also, the presence of a developed distribution network, like supermarkets, pharmacies, and e-commerce platforms, drives the growth of the market.

In China, a growing aging population and awareness of personal health management, and prevalence rates in adult Chinese women ranged from 8.7 to 69.8%, which shows 43–349 million women, driving the growth of the market. Major progress has been made in achieving equal access to insurance coverage, basic health technology, and inpatient reimbursement, most remarkably for hospital delivery, and use of outpatient and inpatient care, contributing to the growth of the market.

The Indian healthcare sector is increasing demand for modern medical devices and products, with private equity and venture capital investment. For Instance, the government has allocated Rs. 99,858 crore to the healthcare sector in the Union Budget 2025-26 for the advancement, maintenance, and improvement of the indias medical care system. This reflects a 9.78% increase from the previous allocation of Rs. 90,958 crores, which drives the growth of the market.

Europe is notably growing in the incontinence care products market, as women have a higher prevalence of chronic diseases, it lower precise diagnoses, and have less access to specific therapies, which increases the demand for advanced incontinence products. The increasing growth of online distribution channels is allowing many Incontinence products to be available in rural and urban regions.

In July 2024, Women managing bladder leaks no longer have to choose between superior protection and underwear that makes them feel great. First Quality Products, LLC. has launched Prevail® Neutral, protective underwear now available in a sleek black design with an ultra-soft feel and body-hugging fit.

In Germany, around six to eight million people experience urinary incontinence, also called bladder weakness. In this region, treatment options include surgeries to restore the pelvic floor and urethral function, or removal of drainage issues and particular toilet training, which contributes to the growth of the market.

In the UK, increasing cases of incontinence, such as 14 million people in the UK have certain types of urinary incontinence, while over half a million adults have faecal incontinence, which is increasing demand for modern incontinence products. Growing sling operations, bladder neck suspension, and artificial urinary sphincter implantation are the treatment options available in the UK, which contributes to the growth of the market.

In January 2024, Meghan Scanlon, senior vice president and president, Urology, Boston Scientific, stated, “We are excited to add Axonics technologies to the Boston Scientific portfolio, a combination that we expect will further strengthen our ability to serve urologists who are treating patients living with these often-chronic conditions.”

By Product Type

By Absorbency / Use Case

By End User / Distribution Channel

By Material / Technology

By End-User Demographic

By Region

February 2026

February 2026

February 2026

January 2026