January 2026

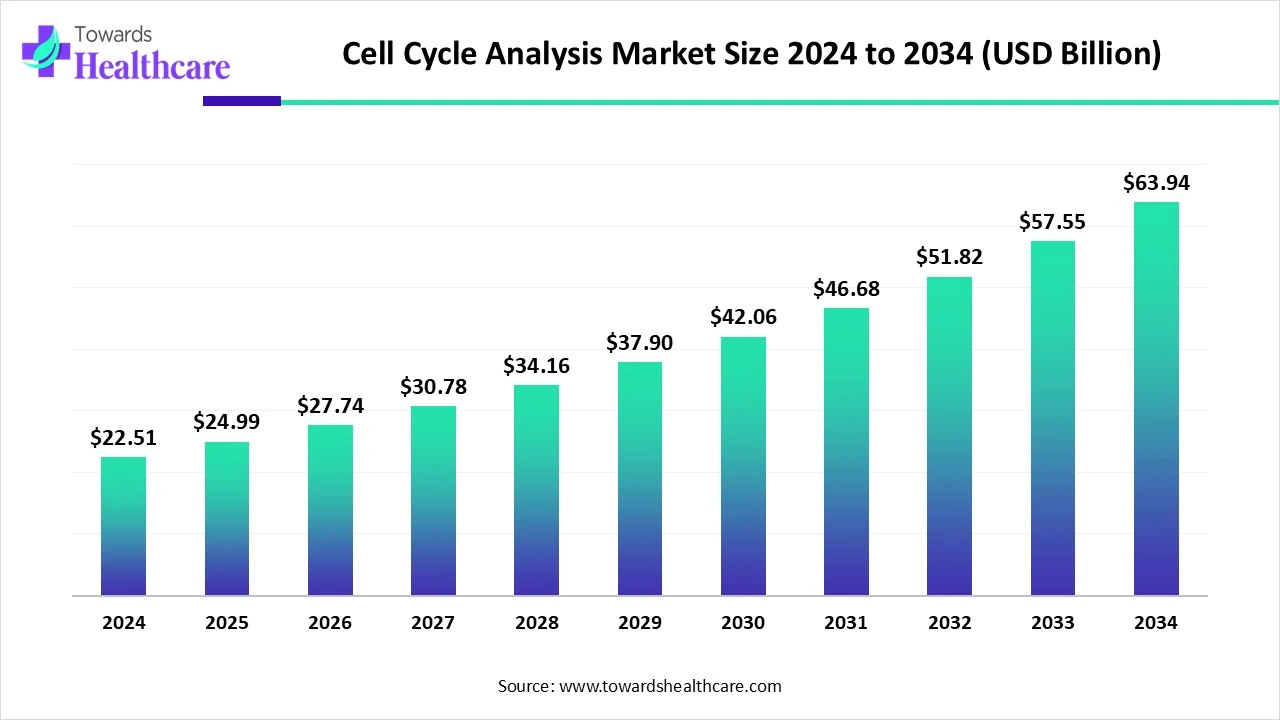

The global cell cycle analysis market size is calculated at US$ 22.51 in 2024, grew to US$ 24.99 billion in 2025, and is projected to reach around US$ 63.94 billion by 2034. The market is expanding at a CAGR of 11.02% between 2025 and 2034.

The use of cell cycle analysis is increasing to deal with the growing disease burden. Therefore, its use in research and development is increasing. Moreover, various advancements are also being made to enhance its application and workflow. AI integration is helping to accelerate its workflow, avoiding errors. Hence, new collaborations to support these developments and for their adoption are being formed. This, in turn, is increasing its use in different regions as well. Thus, all these developments are promoting the market growth.

| Metric | Details |

| Market Size in 2025 | USD 24.99 Billion |

| Projected Market Size in 2034 | USD 63.94 Billion |

| CAGR (2025 - 2034) | 11.02% |

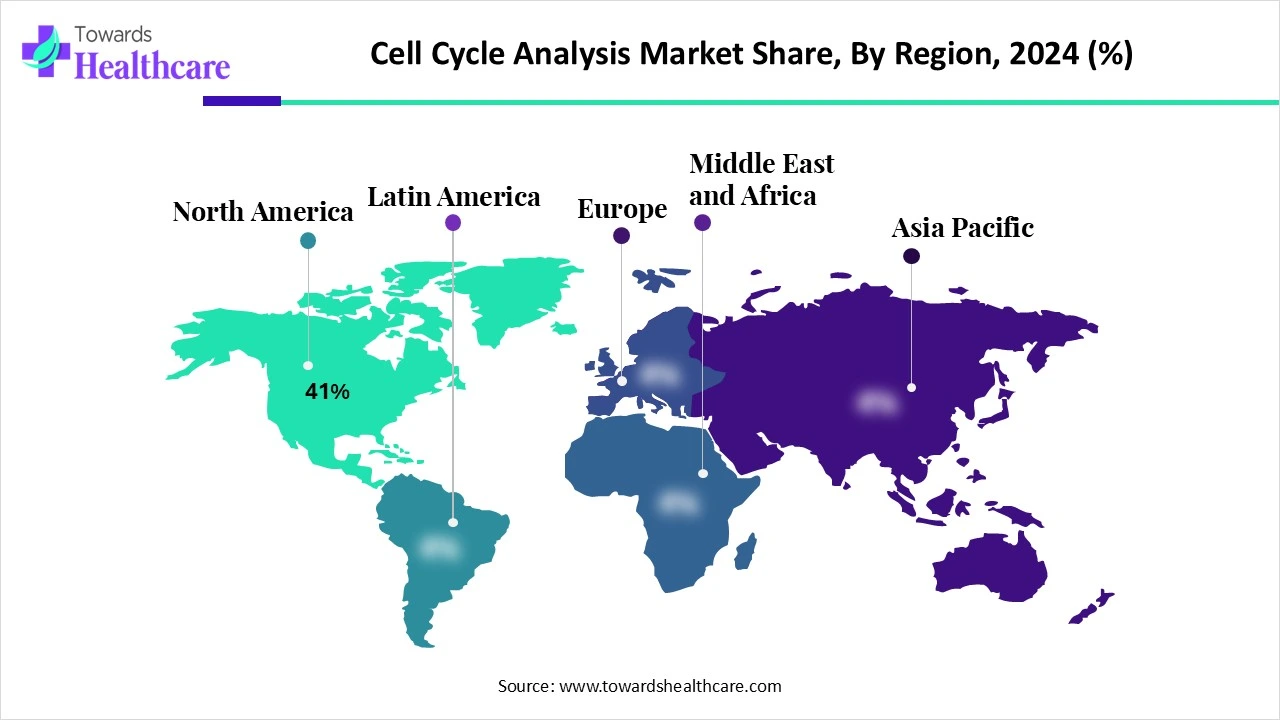

| Leading Region | North America share by 41% |

| Market Segmentation | By Product Type, By Technology, By Cell Type, By Application, By End-User, By Region |

| Top Key Players | BD Biosciences (Becton, Dickinson and Company), Thermo Fisher Scientific, Merck KGaA (MilliporeSigma), Agilent Technologies, Bio-Rad Laboratories, Danaher Corporation (Beckman Coulter), GE Healthcare, PerkinElmer Inc., Promega Corporation, Enzo Life Sciences, Sysmex Corporation, Miltenyi Biotec, Abcam plc, Luminex Corporation, Attune NxT (Thermo Fisher brand), Cell Signaling Technology, Nexcelom Bioscience, Sartorius AG, Partec GmbH (acquired by Sysmex), Cytek Biosciences |

The cell cycle analysis market refers to the global industry focused on the tools, techniques, reagents, and software used to study the progression of cells through the cell cycle phases (G0/G1, S, G2/M). This analysis is pivotal in cancer research, drug discovery, genomics, and stem cell studies, where understanding cellular proliferation and regulation is critical. Moreover, new methods such as image flow cytometry, microfluidic technology, Raman spectroscopy, and mass flow cytometry are emerging to enhance single-cell analysis, image analysis, sample reduction, and accuracy of the cell cycle analysis.

The AI algorithms can interpret the large number of complex datasets obtained from flow cytometry. It helps in reducing the error as well as enhances the speed of the workflow. At the same time, it can detect the changes in the cell cycles, reducing the chances of failure. Additionally, it can help drug discovery by integrating with cell cycle and genetic data. Moreover, new AI platforms are also being developed for effective and accurate differentiation of DNA and protein expression.

Innovations in Flow Cytometry

The use of flow cytometry in the cell cycle analysis is increasing as to provides deeper insights into the phases of the cell cycle. The high-throughput flow cytometer is being developed, which can quickly analyze numerous samples. Moreover, innovations are also being made to enhance its sensitivity for identifying and differentiating the DNA and protein content. In addition to enhancing its specificity, fluorescent dyes to label the cell cycle-specific proteins are also being developed. Thus, these innovations are driving the cell cycle analysis market growth.

Intricate Data Analysis

The data generated in the cell cycle analysis is multidimensional. Therefore, its misinterpretation may lead to incorrect results, affecting the research. Moreover, its analysis of the data can be time-consuming, which can slow down the workflow. This, in turn, increases the need for expertise.

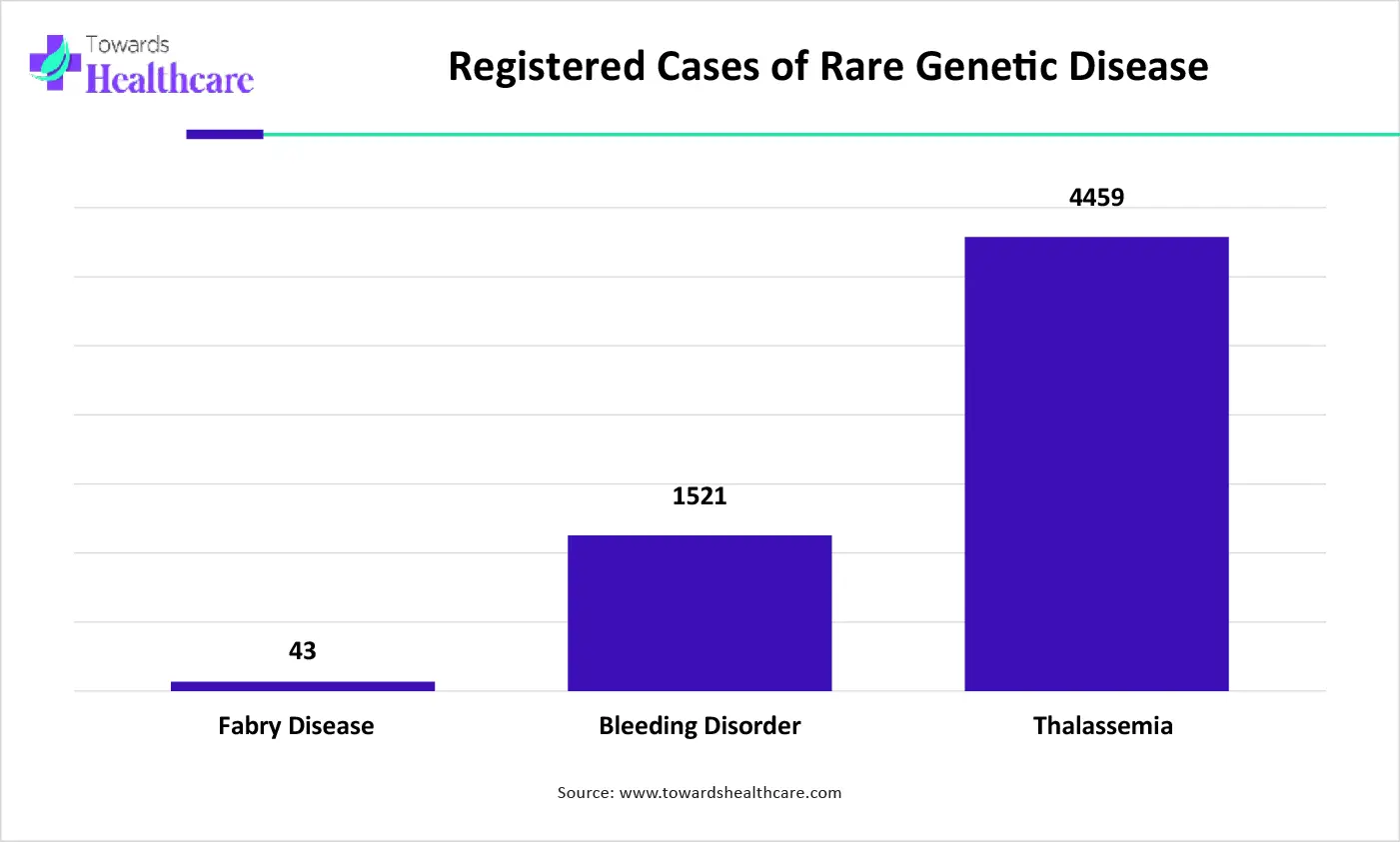

Why are the Advances in Genetic Research an Opportunity in the Cell Cycle Analysis Market?

The genetic disease that can affect the cell cycle checkpoints, mutations, gene expressions, etc., can be identified by genetic research. Moreover, advanced technologies are being used in this research to discover or alter the gene function to control the cell cycle. The detection of gene targets can also be enhanced by cell cycle analysis. Furthermore, the genomic, proteomic, and transcriptomic data are being combined with cell cycle analysis to get deeper insights into the diseases. Thus, this promotes the cell cycle analysis market growth.

For instance,

The graph represents the total number of registered cases of rare genetic diseases. It indicates that there is a rise in cases of rare genetic diseases. Hence, it increases the use of cell cycle analysis in genetic research for the development of new diagnostic and treatment options for their effective management. Thus, this in turn will ultimately promote the market growth.

By product type, the instruments segment led the market with a 40% share in 2024. The instruments were the basic requirement for cell cycle analysis. Moreover, they were mostly used in industries for research and drug discovery purposes. This contributed to the market growth.

By product type, the consumables segment is expected to show the fastest growth rate at a notable CAGR during the predicted time. The use of consumables is increasing due to growing advances in research and development. At the same time, they are also being used in the development of personalized medications.

By technology type, the flow cytometry segment held a dominating share of 55% in the market in 2024. The flow cytometry was widely used in cell cycle analysis as it provided accurate and rapid results. At the same time, various parameters were effectively and simultaneously analyzed. Thus, their use in cancer research increased.

By technology type, the high-content screening segment is expected to show the highest growth during the upcoming years. The high-content screening is used to provide deeper insights during the cell cycle analysis. It is also being used in single-cell analysis, cancer research, and personalized medication development.

By cell type, the human cells segment held the largest share of 45% of the market in 2024. The research conducted on cancer, genetic diseases, etc., preferred the use of human cells. Furthermore, they were also used in drug testing to identify their side effects. This, in turn, enhanced the market growth.

By cell type, the stem cells segment is expected to show the fastest growth rate during the forthcoming years. The use of stem cells is increasing in the development of stem cell therapies. At the same time, its use in research as well as drug screening is also increasing.

By application type, the cancer research segment dominated the market with a 35% share in 2024. The use of cell cycle analysis in cancer research has been enhanced to understand its progression as well as to identify the targets. Moreover, it was also used in drug development and biomarker discovery.

By application type, the stem cell research segment is expected to show the highest growth during the predicted time. To understand the development and mechanisms of stem cells, the use of the cell cycle is increasing. At the same time, it is also used for the development of regenerative medicines.

By end user, the academic & research institutes segment led the market with 38% share in 2024. The academic & research institutes focused on the research of various diseases. This, in turn, increased the demand as well as the use of cell cycle analysis. Moreover, funding provided supported these developments, promoting market growth.

By end user, the pharmaceutical & biotechnology companies segment is expected to show the fastest growth rate during the upcoming years. For drug discovery, development, and research purposes, the use of cell cycle analysis is increasing in pharmaceutical & biotechnology companies. Moreover, its growing advancements as well as collaborations are promoting its use.

North America dominated the cell cycle analysis market share by 41% in 2024. The industries in North America are robust, along with the advanced technologies. These companies are highly invested in cancer research, enhancing the use of cell cycle analysis. This contributed to the market growth.

The industries in the U.S. are well developed and are developing various innovative platforms with the use of advanced technologies to improve cell cycle analysis. This, in turn, is increasing the investments for their development as well as new research. Moreover, the use of cell cycle analysis in clinical applications is also increasing.

The industries and the institutes present in Canada are focusing on cancer research, which is increasing the demand for cell cycle analysis. The hospitals are also contributing to the same. Furthermore, the use of the automated cell cycle platform for accurate results is also increasing.

Asia Pacific is expected to host the fastest-growing cell cycle analysis market during the forecast period. The healthcare sector in Asia Pacific is expanding due to growing research and investment. This, in turn, is increasing the use of cell cycle analysis in research and development. Thus, this enhances the market growth.

The industries in China are expanding by forming new collaborations and research in oncology. Therefore, the use of cell cycle analysis is enhanced. At the same time, the government initiatives are encouraging their innovations. Thus, various advancements are also being conducted in the cell cycle analysis to improve its performance.

The healthcare sector in India is growing, which in turn is increasing the adoption of cell cycle analysis to identify the disease mechanism and promote drug development. At the same time, various institutions are using them for research in infectious disease progression. Funding is supporting these developments.

Europe is expected to grow significantly in the cell cycle analysis market during the forecast period. Europe consists of advanced industries and institutions, which are focusing on the development of a variety of treatment and diagnostic approaches. Thus, this is increasing the use of cell cycle analysis, promoting the market growth.

The academic research and institutes, as well as industries present in Germany, are researching in the field of cancer, genetics, stem cells, etc, which utilizes the cell cycle analysis. Moreover, the growing investment is increasing the development of personalized treatment options, increasing their use.

The industries in the UK are robust, which are leveraging the cell cycle to understand the nature of diseases and develop appropriate treatment options. Moreover, automated cell cycle platforms are also being developed as well as used. This, in turn, is leading to new collaborations.

By Product Type

By Technology

By Cell Type

By Application

By End-User

By Region

January 2026

January 2026

January 2026

January 2026