January 2026

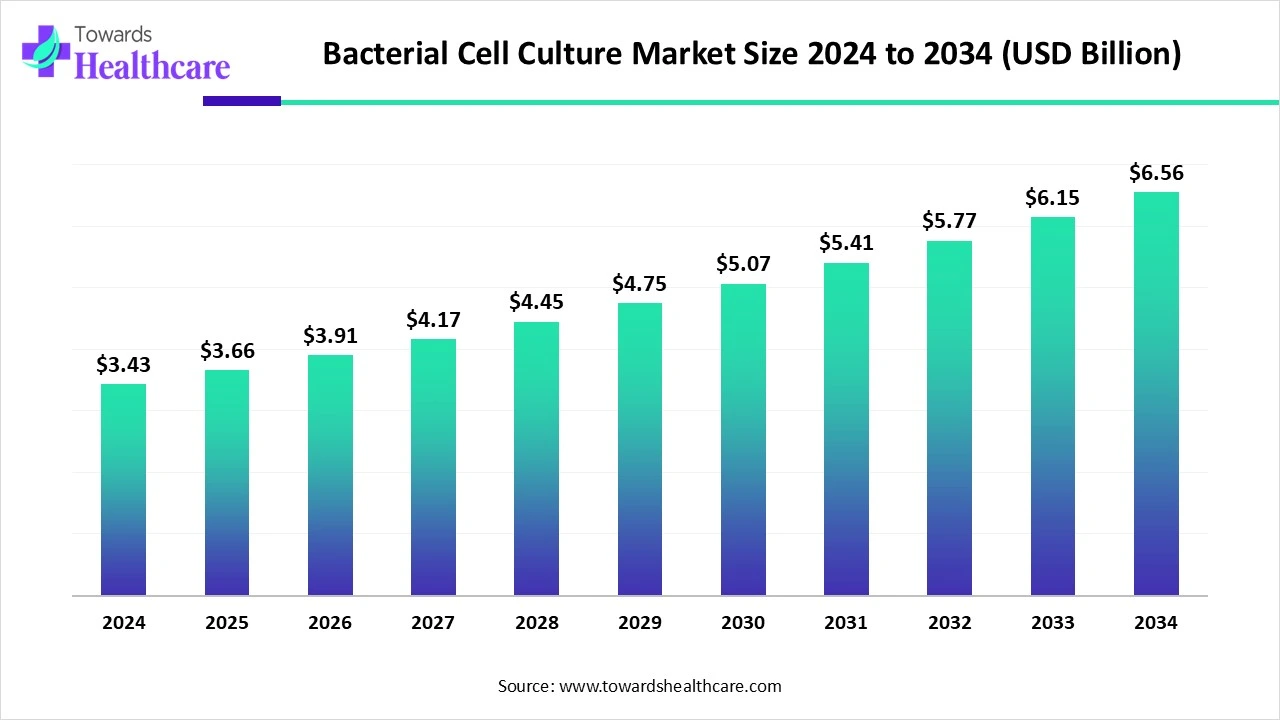

The global bacterial cell culture market size is calculated at US$ 3.43 in 2024, grew to US$ 3.66 billion in 2025, and is projected to reach around US$ 6.56 billion by 2034. The market is expanding at a CAGR of 6.7% between 2025 and 2034.

As researchers work to understand the behavior and interactions of microorganisms, there is a growing demand for bacterial cell culture techniques in the fields of molecular biology and microbiology. Additionally, the creation of vaccines has increased due to the rising incidence of infectious illnesses, which calls for effective bacterial culture techniques. Bacterial cell culture is expected to find new applications as a result of the global focus on personalized medicine and tailored therapies, which would expand the market.

| Metric | Details |

| Market Size in 2025 | USD 3.66 Billion |

| Projected Market Size in 2034 | USD 6.56 Billion |

| CAGR (2025 - 2034) | 6.7% |

| Leading Region | North America share by 40% |

| Market Segmentation | By Product Type, By Technique, By Cell Type, By Application, By End Use, By Region |

| Top Key Players | Thermo Fisher Scientific, Merck KGaA / MilliporeSigma, Danaher Corporation (BD, Cytiva), Becton Dickinson, Sartorius AG, Bio-Rad Laboratories, bioMérieux, HiMedia Laboratories, Neogen Corporation, ScienCell Research Laboratories, Eiken Chemical Co., Ltd., Fujifilm Diosynth Biotechnologies, Lonza Group, Corning Incorporated, Promega Corporation, Scharlab S.L., Hardy Diagnostics, ATCC (American Type Culture Collection), EMD (MilliporeSigma brand), Science Research Laboratories |

The bacterial cell culture market encompasses the products and technologies used to cultivate bacterial cells for various applications, including disease diagnostics, food and water safety testing, biopharmaceutical manufacturing and research. This market includes culture media, reagents, sera, consumables, and specialized culturing techniques adapted to different bacterial cell types. Culture medium is a nutrient-rich gel or liquid that is used to cultivate bacteria or other microorganisms. Another name for them is growth media. Different kinds of media are used to grow different kinds of cells. For microorganisms, nutrient broths and agar plates are the most common growth medium. Certain bacteria or germs require specialized medium to flourish.

Enhancing the repeatability of cell culture methods through the use of AI and automated cell culture techniques can reduce variability, improve results, and ultimately enhance in-depth research and medication discovery. By analyzing sensor and camera data, artificial intelligence (AI) algorithms may identify changes in cell activity, such as modifications in growth rate, morphology, or appearance, and adjust the culture conditions in real-time to maximize the cells' development and well-being. Tasks related to cell culture are automated by robotic equipment, and AI algorithms track cell activity and instantly modify the culture parameters.

What Factors are Driving the Bacterial Cell Culture Market?

The market for bacterial cell culture is expanding due to a number of causes. Bacterial culture techniques are in high demand due to the need for reliable diagnostic tools brought on by the growth in infectious illnesses. Cell culture methods are essential to biotechnology advancements, such as the creation of novel medications and therapeutic agents. The significance of advanced bacterial culture techniques for customizing treatments for each patient is further highlighted by the rising desire for customized medicine. Lastly, the efficiency and dependability of cell culture procedures are being improved by technology developments such automated systems.

Supply Chain Disruptions

Supply chain interruptions like raw material shortages or shipment delays might affect the availability of components needed to produce MCCs. This might lead to increased costs and production hold-ups, which could affect market price and supply.

Automation in Cell Culture

The market for bacterial cell culture has seen a revolution thanks to automation. Bacterial culture procedures are now more faster and more efficient because to the emergence of automated equipment for medium preparation, sample handling, and monitoring. Automated methods and high-throughput screening enable the testing of several bacterial strains under various circumstances at the same time, speeding up research timelines and boosting output. More effectively than ever before, researchers can find novel germs, antibiotics, and other therapies thanks to these automated technologies that collect enormous volumes of data rapidly. The market for bacterial cell culture has seen a surge in prospects as a result of this automation shift, as biotech and pharmaceutical businesses want to take advantage of these technical developments.

By product type, the media segment captured the dominant share of the bacterial cell culture market in 2024. By creating culture media that satisfy the needs of the organisms, it is feasible to grow microorganisms in the lab by simulating their natural habitat or environment. As a result, scientists have developed a variety of culture media tailored to the specific microbial species that will be cultivated. In laboratories, culture media are used for various tasks, including isolating specific microbial strains, detecting pathogens that cause disease, creating pure cultures of microbial species, differentiating between bacterial species, and examining their reactions to particular drugs.

By product type, the reagents segment is anticipated to grow at the highest CAGR during 2025-2034. To cultivate and maintain cells in vitro and enable researchers to create controlled environments that closely resemble physiological conditions, cell culture reagents are essential. To stimulate cell development, proliferation, and differentiation, these reagents, which include medium, supplements, growth factors, and sera, are crucial. Cell culture reagents are crucial for research in genetics, biochemistry, and cellular and molecular biology. The synthesis of biologics, vaccines, and recombinant proteins is among the biotechnological applications that depend heavily on these reagents.

By technique, the batch culture segment led the bacterial cell culture market in 2024. Low investment costs, straightforward management and operation, and easy-to-maintain total sterilization are the benefits of batch fermentation. Temperature, pH, and ventilation are all important process factors for batch fermentation, which is frequently utilized in conventional biological fermentation. At the start of batch bioprocesses, the growth rate is often the highest.

By technique, the fed-batch segment is estimated to grow at the highest CAGR during the upcoming period. The industrial standard is fed-batch fermentation because the output and productivity of the process may be enhanced by the controlled input of substrate. In the production of biopharmaceuticals, fed-batch fermentation is an essential phase that is well recognized for boosting the yields of bioproducts, such as proteins, enzymes, and other substances having biological origin.

By cell type, the gram-negative bacteria dominated the bacterial cell culture market in 2024. Gram-negative bacteria are the most common type of pathogens that cause a large variety of disease, which may lead to pandemics and epidemics. Due to this a large amount of bacterial culture is done for disease diagnostics as well as development of vaccines. As the cases of infectious diseases/communicable diseases due to gram-negative bacteria will grow, the demand for vaccines and need for disease diagnostics services are going to increase in the future.

By cell type, the anaerobic bacteria segment is expected to be the fastest-growing during the predicted timeframe. To isolate, identify, and investigate bacteria that flourish in oxygen-free settings, anaerobic bacterial cultures are used. Anaerobic bacteria, which may be found in many regions of the body, especially in deep wounds, abscesses, and the gastrointestinal system, are the source of infections that these cultures are essential for identifying and treating. Appropriate antibiotic therapy can be guided by knowledge of the particular microorganisms implicated.

By application, the food testing segment held the dominant share of the bacterial cell culture market in 2024. When evaluating the safety of food and feed products, microbiological quality is crucial. To find food-borne diseases and spoilage organisms, microbial food testing is crucial. Food items' ongoing safety throughout the supply chain may be guaranteed by this testing. It is similarly crucial to keep an eye on functional microorganisms that could enter during production or end up in the finished product.

By application, the disease diagnostics segment is anticipated to be the fastest-growing during 2025-2034. To establish or confirm the diagnosis of a bacterial infection, a laboratory performs a number of tests. While a comprehensive history and physical examination are essential, laboratory testing can assist the physician in making a diagnosis. The study of bacteria's susceptibility to antibiotics is also made possible via bacterial culture, which likewise serves as the foundation for developing treatment recommendations.

By end-user, the biotech & pharmaceutical companies segment held the largest share of the bacterial cell culture market in 2024. The production of vaccines, enzymes, antibiotics, and other beneficial biological products are just a few of the applications in the biotechnology and pharmaceutical sectors that depend on bacterial cultures. Additionally, they are essential for genetic engineering, environmental cleanup, and the production of biofuel.

By end-user, the academic & research institutes segment is estimated to grow at the highest CAGR during the upcoming period. Various studies, including those in taxonomy, genetics, and biotechnology, are conducted in bacterial cultures by academic and research institutes. Numerous institutions in India provide services for industry and research in addition to housing cultural assets. Bacterial strains are preserved and spread via these collections, usually in active or freeze-dried forms.

North America dominated the bacterial cell culture market in 2024, primarily because of its remarkable financing for research and development, sophisticated health care infrastructure, and strong regulatory oversight. Numerous top-notch diagnostic labs, pharmaceutical companies, and research institutes in the area frequently employ microbial culture methods. The U.S., with its substantial number of clinical laboratories and biotechnology companies, is a region with significant demand.

Vaccine development increases the need for developing bacterial culture. The development of the Vaccines National Strategic Plan: 2021–2025 (Vaccine Plan) was a thorough process that included consulting with stakeholders in the medical and associated industries. The Vaccine Plan's goals, objectives, and strategies have been shaped in part by partners across the federal government and hundreds of nonfederal stakeholders, such as state, tribal, territorial, and local governments, researchers, health plans and providers, community groups, and national and local organizations.

The Canadian Food Inspection Agency's (CFIA) primary goal is to protect Canada's food supply in order to protect consumers. The Agency carries out testing and sampling to identify hazards to food safety and confirm that industry is complying with federal regulations. A total of 29,297 food samples were examined for the presence of parasites, viruses, bacterial pathogens, and indications between April 1, 2020, and March 31, 2024.

Asia Pacific is estimated to host the fastest-growing bacterial cell culture market during the forecast period, driven by population growth, rising healthcare costs, and increased understanding of infectious disease diagnosis. According to a March 2025 CDC research, India accounted for 26% of all TB cases and deaths globally in 2023. To tackle this issue, the CDC and India's CTD worked together on the E2 Project, which improved real-time data processing abilities to improve early diagnosis and treatment outcomes nationwide. Expanding pharmaceutical production, greater industrialization, and the expanding use of microbiological testing in the food safety and healthcare industries are all contributing factors to the demand for improved culture media.

In April 2025, China's Law on the Prevention and Control of Infectious Diseases was modified in order to better prevent epidemics and protect the lives and health of its populations. Liu said the new law will significantly improve China's fundamental capabilities in the fields of medical treatment, detection and diagnosis, emergency response, and early warnings and monitoring of contagious diseases.

With an emphasis on the special requirements of developing countries and India's crucial role in the world's vaccine manufacturing, this summit aims to promote collaborations, information exchange, and innovation to improve vaccine availability, affordability, and equity. The event intends to promote universal vaccination and enhance public health outcomes in developing nations by utilizing India's capabilities in the vaccine business and giving these countries' demands top priority.

Europe is expected to grow significantly in the bacterial cell culture market during the forecast period, due of the increasing demand for quality control in several industries, such as pharmaceuticals, food, and water treatment. Significant motivators include tighter regulatory requirements, expanding understanding of microbial contamination, and advancements in molecular diagnostics. The innovation and collaboration between businesses and researchers that this market expansion fosters contribute to a safer and healthier society.

Germany is well known for its strict regulations on food safety and quality. It has a strong culinary legacy with a focus on nutrition and complies with stringent food safety requirements. Researchers and other professionals may learn more about Germany's food system and laws by attending the next food safety seminars in 2025.

In October 2024, in order to counter this, Indian diagnostic facilities and hospitals are progressively implementing state-of-the-art technology to increase the precision and speed of infectious illness diagnosis. Even though there aren't many proven antiviral therapy alternatives, thorough diagnostic techniques can help practitioners throughout the world make safer decisions. According to a statement from HaystackAnalytics, the extension of the infexn test's use of NGS to identify the main respiratory RNA viruses is a step toward a universal, hypothesis-free paradigm for detecting infectious disorders. (Source - Financial Express)

By Product Type

By Technique

By Cell Type

By Application

By End Use

By Region

January 2026

January 2026

January 2026

January 2026