March 2026

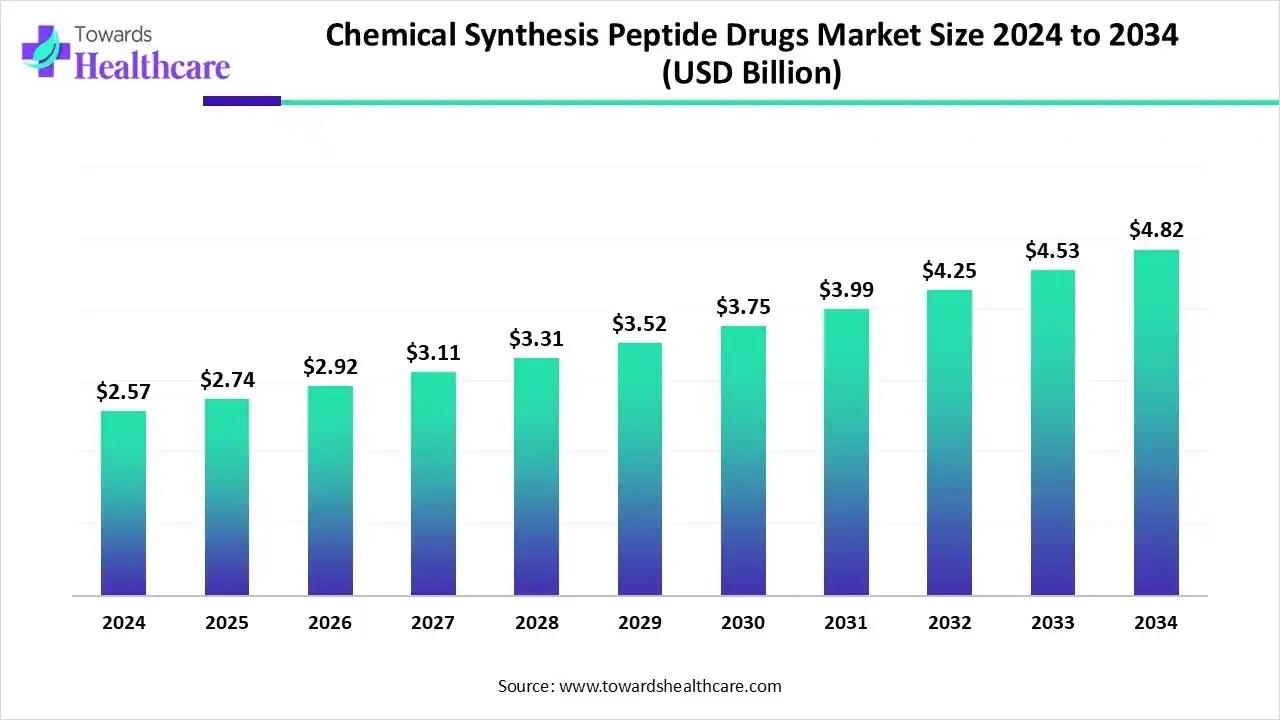

The global chemical synthesis peptide drugs market size is calculated at US$ 2.57 billion in 2024, grew to US$ 2.74 billion in 2025, and is projected to reach around US$ 4.82 billion by 2034. The market is expanding at a CAGR of 6.54% between 2025 and 2034.

In the Asia Pacific, China and India are facing a huge burden of diverse chronic diseases, especially cancers, diabetes, as well as they are encouraging their R&D hubs through government support. The global chemical synthesis peptide drugs market is further bolstering automation in synthesis, green chemistry, with the reduction of solvent use, and is also exploring the application of numerous AI platforms to make a feasible peptide manufacturing process.

| Table | Scope |

| Market Size in 2025 | USD 2.74 Billion |

| Projected Market Size in 2034 | USD 4.82 Billion |

| CAGR (2025 - 2034) | 6.54% |

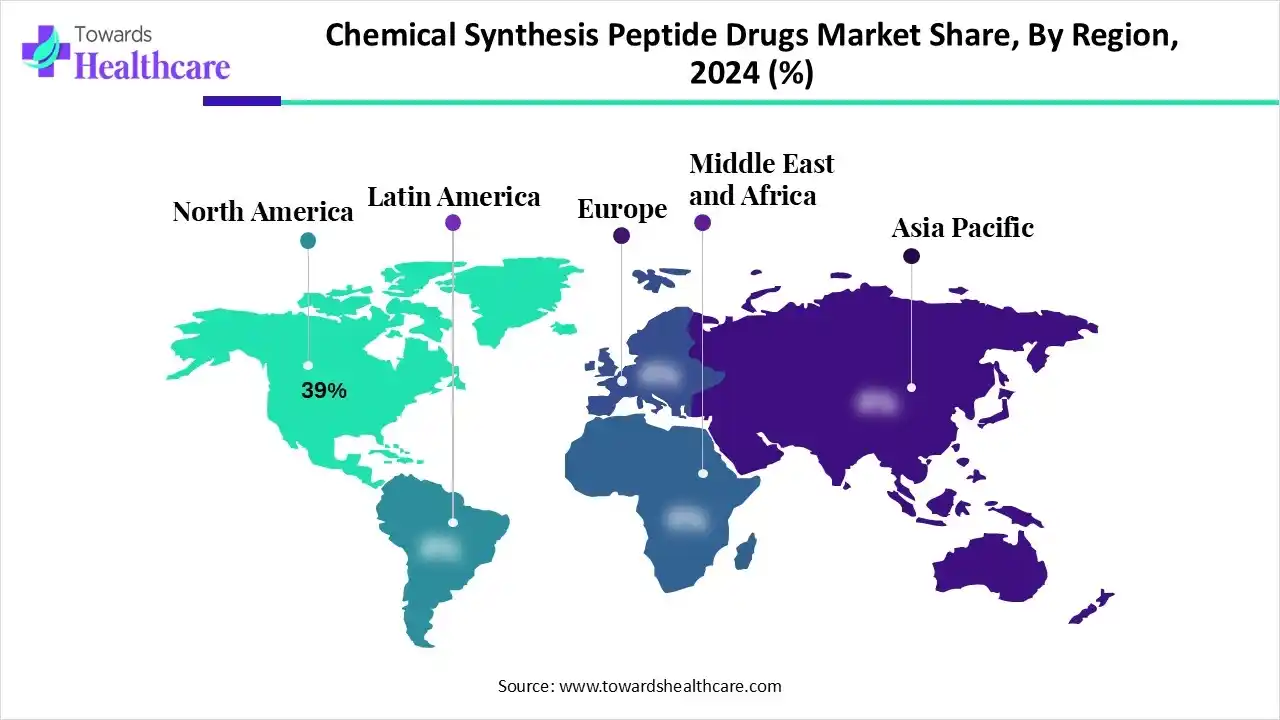

| Leading Region | North America by 39% |

| Market Segmentation | By Synthesis Method, By Synthesis Technology, By Product Type, By End-User, By Application, By Region |

| Top Key Players | Takeda Pharmaceutical Company Limited, AstraZeneca PLC , Bristol-Myers Squibb (BMS), Merck & Co., Inc. (MSD), Amgen Inc., PolyPeptide Group, Bachem AG, Lonza Group Ltd., CordenPharma (part of Novacap/contract pharma group), AmbioPharm Inc., CPC Scientific / Chinese Peptide Company (CPC), ScinoPharm Taiwan Ltd., Peptide Institute, Inc., GenScript Biotech Corporation, JPT Peptide Technologies GmbH. |

Chemical-synthesis peptide drugs are therapeutic molecules made from short chains of amino acids that are produced using chemical (solid-phase or solution-phase) synthesis rather than biological expression systems. Demand is driven by peptides’ selectivity, favorable safety profiles, and expanding indications (endocrinology, metabolic disease, oncology, infectious disease, etc.), while supply is led by specialist CDMOs/peptide manufacturers and large pharma companies that develop or outsource peptide therapeutics. This chemical synthesis peptide drugs market covers the development, GMP manufacture, formulation, and commercial supply of synthetic peptide active pharmaceutical ingredients (APIs) and finished-dose peptide drugs for clinical and commercial use, including modified peptides (e.g., stapled, lipidated, PEGylated), peptide conjugates, and combination products.

The global chemical synthesis peptide drugs market has been putting wider efforts into leveraging automation and AI solutions, which further enhance reproducibility. Also, these sophisticated approaches will support designing and optimizing peptide sequences. Nowadays, the leading companies are exploring new chemical methods, coupled with significant techniques, like microwave irradiation, and the progress of novel building blocks (like thiocarbazate-based precursors) is further supporting synthesis.

In 2024, the chemical synthesis segment captured approximately 85% share of the market. Certain catalysts, such as a growing demand for more specific and efficient treatments, technological breakthroughs in automation, and the rising pipeline of peptide therapeutics, are impacting the overall market expansion. Current developments are fostering innovations in the synthesis of longer and more complex peptides and optimizing drug-like properties, particularly oral bioavailability through chemical modifications.

Besides this, the non-chemical synthesis segment is predicted to expand rapidly. This approach will accelerate with the vital benefits of biochemical and recombinant technologies for specific applications, such as producing biologics, especially insulin, which are also more efficient and scalable. In this era, it is explored by AI-enabled design and DNA/mRNA display technologies for discovery and libraries, with recombinant technology and site-specific modifications, including cyclization for large-scale manufacturing.

The solid-phase peptide synthesis (SPPS) segment captured nearly 72% share of the chemical synthesis peptide drugs market in 2024. It has a major advantage, like streamlined purification, which expands the peptide chain remains attached to a solid support, enabling excess reagents and byproducts to be simply washed away. A recent innovation in sustainable ultrasound-assisted SPPS (SUS-SPPS) is used to substantially minimize solvent consumption and wash steps by applying ultrasound.

Whereas the hybrid phase peptide synthesis segment is anticipated to register rapid growth. It mainly combines the advantages of SPPS and LPPS to offer greater effectiveness and enhanced yield, specifically for complex and long-chain peptides. In 2025, the market is leveraging this approach in large-scale production of peptide polymers and polymerization methods to facilitate simple operation and reduced expenses. The widespread adoption of AI solutions is assisting in optimizing synthesis conditions, designing better synthesis routes, and managing automated platforms.

By capturing approximately 48% share, the reagents & consumables segment led the market in 2024. Primarily, it encompasses resins, amino acids, coupling reagents, and solvents, which are important for both small-scale research and large-scale manufacturing. Eventually, the market is shifting towards green solvents, like 2-methyltetrahydrofuran (2-MeTHF) and ethyl acetate. In the synthesis of cyclic peptides, specific reagents for on-resin or off-resin cyclization are required, which encourages the use of PyBOP/DIEA and pentafluorophenyl esters (FDPP).

Moreover, the services segment is estimated to register the fastest expansion. The contribution of peptide synthesis, purification, analysis, and library creation is supporting the overall market growth. Companies are implementing custom peptide synthesis services that create specific peptide sequences based on a client's needs, such as alterations and various scales from milligram to multi-gram quantities. Alongside, they are using automation, robotic solutions, hybrid synthesis, and an expanded emphasis on complex peptides.

The pharmaceutical & biotechnology companies segment dominated with nearly 55% of the chemical synthesis peptide drugs market in 2024. Globally rising focus on custom peptides for research, diagnostics, and therapeutic applications, with companies facilitating combined solutions from design to commercial production. Additionally, they are transforming non-natural amino acids and lipidation for improved properties, employing automated and microwave-assisted synthesis for speed and scalability, and aligning continuous purification with techniques, such as MCSGP, to ensure high purity.

Eventually, the CDMOs/CROs segment will expand rapidly in the coming era. A rise in demand for complex APIs, especially for metabolic diseases, such as diabetes and obesity, and advancements in synthesis technologies are impacting the outsourcing of services. CDMOs are increasingly using automated, microwave-assisted SPPS to drastically escalate coupling reactions, lowering cycle times from hours to minutes. Also, the implementation of solvent recovery systems and the replacement of harmful solvents in both synthesis and purification steps are required to meet environmental mandates.

In 2024, the therapeutics segment held nearly 70% revenue share of the chemical synthesis peptide drugs market. The increasing cases of various concerns, such as diabetes, obesity, cancer, and cardiovascular disorders, are fueling demand for efficient, targeted peptide-based treatments. Currently, the market has raised focus on stability, delivery, and manufacturing through techniques, including chemical modification (e.g., PEGylation, D-amino acid substitution), sophisticated delivery systems, and more sustainable synthesis methods. According to NCBI, there will be a rise to 643 million (11.3%) by 2030 and to 783 million (12.2%) by 2045 in the number of diabetes patients.

However, the diagnostics segment is estimated to expand rapidly. Specifically, numerous peptides are employed in advanced diagnostics as biomarkers, biosensors, and imaging agents with their greater specificity and affinity for disease-associated targets. Ongoing advances in lipidation, PEGylation, and glycosylation are bolstering peptide solubility, extending their circulation time in the body, and optimizing how they are delivered to target sites for diagnostic imaging. Whereas, synthetic peptides are utilized as antigens for developing highly sensitive and specific immunoassays, which fuel the detection of antibodies or biomarkers.

North America’s chemical synthesis peptide drugs market captured an approximate 39% revenue share in 2024. The growing cases of chronic diseases, mainly cancer and diabetes, and developments in peptide therapeutics with high specificity and low toxicity are driving the regional market expansion. Also, this region possesses major key players, such as AmbioPharm, a full-service peptide manufacturer, and large pharmaceutical players, including Merck, Amgen, and Eli Lilly, who are increasingly investing in peptide R&D.

Primarily, the major expansion of the US market is driven by the ongoing pipeline of peptide drugs in development, developments in peptide therapeutics & synthesis technologies. They are widely adopting high-throughput automation, such as diverse automated synthesizers, which are highly sophisticated and enable the faster, simultaneous synthesis of multiple peptides in parallel.

For instance,

The chemical synthesis peptide drugs market in Canada is mainly fueled by a robust, supportive ecosystem and the increasing demand for innovative treatments for chronic and complex diseases. Alongside, regional researchers are working on the development of constrained and cyclic peptides, with accelerated stability against enzymatic degradation and optimized target selectivity.

In the coming era, the Asia Pacific is anticipated to expand at a rapid CAGR. This region is experiencing a huge burden of several chronic conditions, like cancer, diabetes, and cardiovascular disorders, which are propelling the demand for peptide-based drugs in the region. Along with this, a rise in affordable and regional demand is fostering ASAP pharmaceutical companies to widen their outsourcing peptide production to ASAP CDMOs.

| Country Name | 2021 (In millions) | 2045 (In millions) |

| China | 140.9 | 174.4 |

| India | 74.2 | 124.9 |

China’s chemical synthesis peptide drugs market is increasingly stepping into automation to boost effectiveness and lower errors. A fully automated, kilogram-scale SPPS lab, like BioDuro, is created for the large-scale manufacturing of numerous peptides, such as cyclic peptides and peptide-drug conjugates (PDCs). Additionally, they are bolstering digital systems for operations and automated solvent delivery.

In ASAP, India is also facing a wider growth in chronic disease cases, which are further boosting demand for personalized medicine. For this, peptide therapeutics are highly suitable with their greater specificity, which allows targeting specific molecules. Moreover, India comprises strong R&D facilities, mainly in Bangalore & Hyderabad, which are greatly involved in the development of complex peptides and managing lab-scale synthesis.

For instance,

Europe’s chemical synthesis peptide drugs market is experiencing significant growth due to rising emphasis on novel synthetic methods, like the use of AI in designing peptides and expanding delivery technologies for better bioavailability. They are implementing these innovations in the treatment of metabolic diseases, cancer, and neurodegenerative disorders, with the application of chemical modifications and promoting new delivery platforms.

For instance,

The lucrative expansion of the German market is emphasizing the establishment of peptides with specialized modifications, which consist of unusual amino acids, labels, and peptide conjugates. JPT Peptide Technologies in Berlin has a crucial role in excellent modified peptides, peptide libraries, and microarrays for research and clinical applications. Also, they are focusing on developing innovations in peptide therapeutics.

For instance,

The chemical synthesis peptide drugs market is exploring the discovery and design, subsequently synthesis (including protection, coupling, and purification), and finally, structural modification and activity evaluation.

Key Players: Aragen Life Sciences, Bachem, GenScript Biotech Corporation, etc.

After the successful phases of clinical trials for the study of efficacy, toxicity, potency, and adverse effects, applications follow the approval process of both the FDA and EMA.

Key Players: Cardiff University, Instituto de Medicina Regenerativa, Egymedicalpedia, etc.

Companies are facilitating different financial assistance, programs, and educational programs, whereas healthcare providers are supporting weight management in diabetic patients.

Key Players: Eli Lilly, Novartis, Merck & Co., etc.

By Synthesis Method

By Synthesis Technology

By Product Type

By End-User

By Application

By Region

March 2026

February 2026

February 2026

January 2026