February 2026

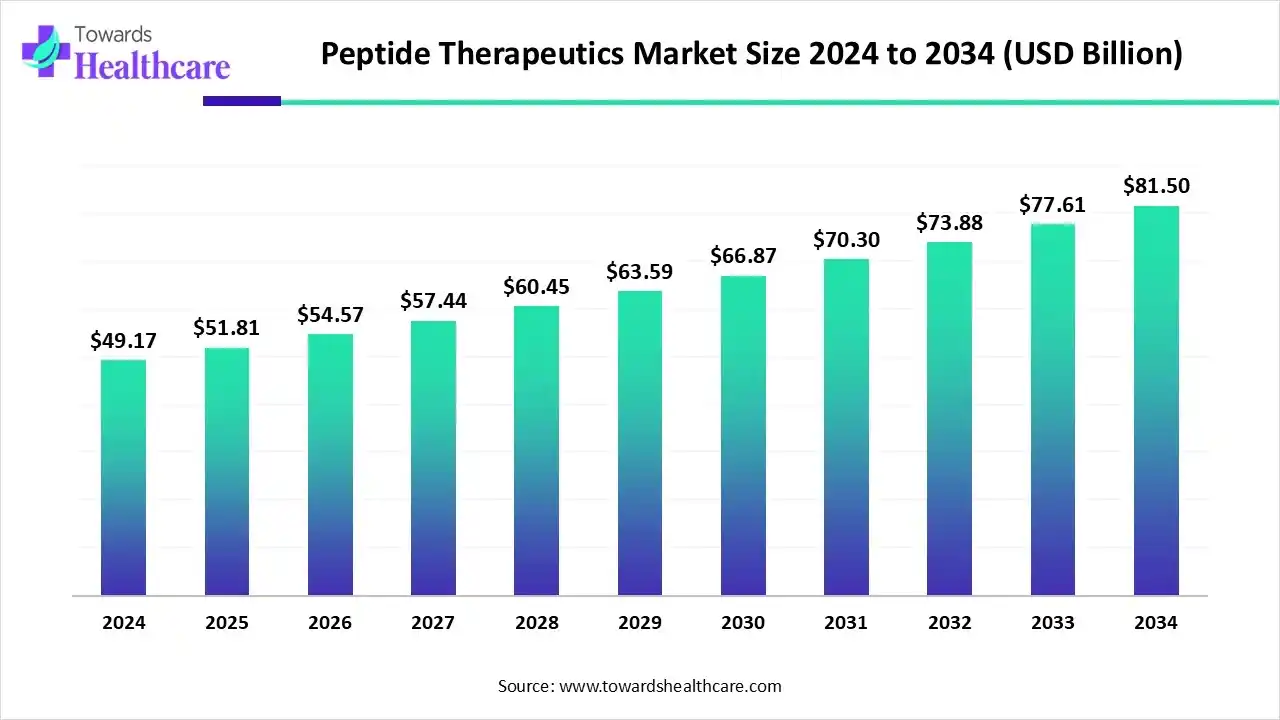

The global peptide therapeutics market size is calculated at US$ 49.17 billion in 2024, grew to US$ 51.81 billion in 2025, and is projected to reach around US$ 81.5 billion by 2034. The market is expanding at a CAGR of 5.35% between 2025 and 2034.

The size of the peptide therapeutics market is anticipated to be driven by the development of novel delivery systems and improvements in medical knowledge. The growing interest in therapeutic vaccines based on peptides is also anticipated to propel market advancement. The demand for innovative treatments is being fueled by an increase in the incidence rate of chronic illnesses, which is raising the market value for peptide therapeutics.

| Table | Scope |

| Market Size in 2025 | USD 51.81 Billion |

| Projected Market Size in 2034 | USD 81.5 Billion |

| CAGR (2025 - 2034) | 5.35% |

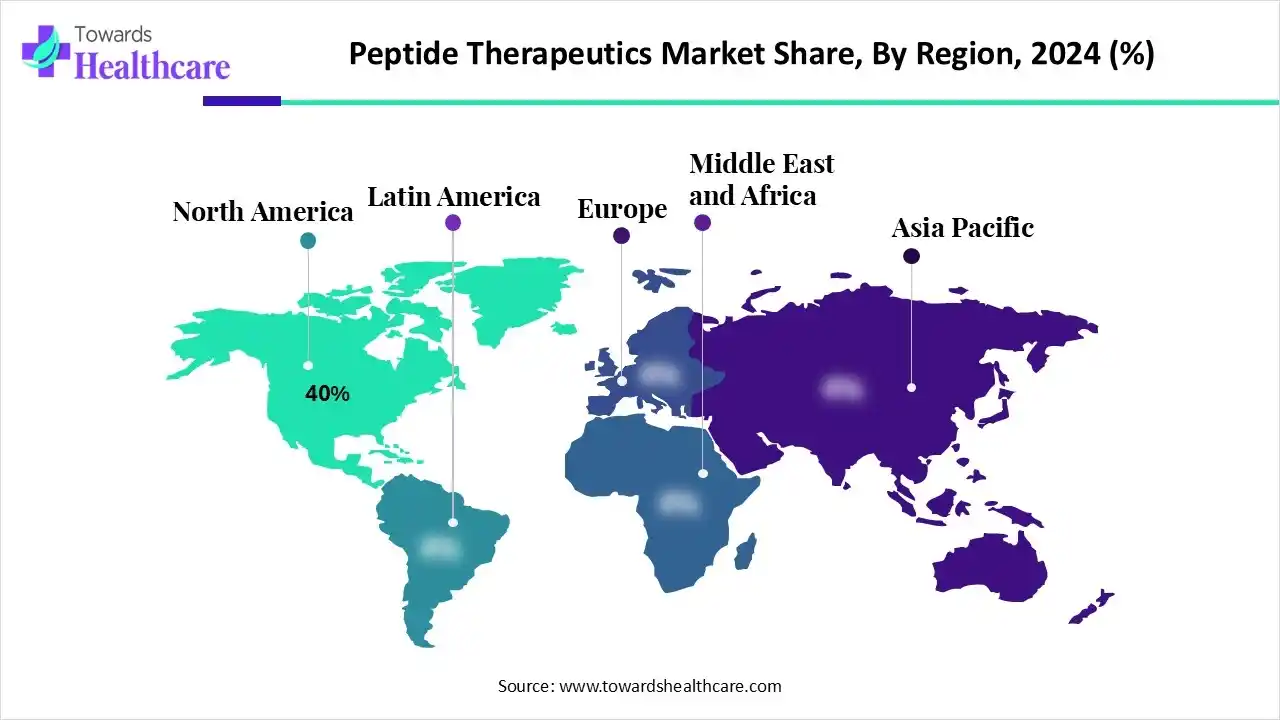

| Leading Region | North America by 40% |

| Market Segmentation | By Type, By Route of Administration, By Application/Therapeutic Area, By Synthesis Technology, By Distribution Channel, By Region |

| Top Key Players | Amgen Inc., Novo Nordisk A/S, Ipsen Pharma, Eli Lilly and Company, AstraZeneca PLC, Pfizer Inc., Takeda Pharmaceutical Company Limited, Sanofi S.A., F. Hoffmann-La Roche AG, Novartis AG, Bristol-Myers Squibb Company, Teva Pharmaceutical Industries Ltd., Bachem Holding AG, CordenPharma International, PolyPeptide Group, Pepscan Therapeutics, Zealand Pharma, Radius Health, Inc., BioGaia AB, Biocon Limited |

The peptide therapeutics market is driven by the rising demand for personalized medicine, and targeted biologics are further fueling growth. The market refers to pharmaceutical drugs developed using short chains of amino acids (peptides) that act as signaling molecules to regulate biological functions. These drugs are increasingly used in oncology, metabolic disorders, infectious diseases, and cardiovascular conditions due to their high specificity, low toxicity, favorable safety profiles, and ability to mimic natural biological pathways. Technological advances in peptide synthesis, drug delivery systems, and formulations (oral, injectable, transdermal) are driving adoption.

The vast area of drug discovery is always looking for new and creative ways to find and create peptide-based medicines. The development of novel peptide medications has undergone a radical change with the introduction of artificial intelligence (AI). AI provides a variety of algorithms and computational tools that let researchers speed up the development of therapeutic peptides. Large volumes of biological and chemical data may be analysed and interpreted thanks to a variety of platforms that fall under the umbrella of artificial intelligence (AI), such as machine learning, deep learning, natural language processing, and data mining.

Rising investments in peptide therapeutics: Peptide therapeutics hold great potential in providing advanced therapies. Hence, a lot of major players in the market are investing in the development of peptide therapeutics.

For instance,

| Sr. No. | Therapeutic Application Area | Total Number of Therapeutics |

| 1 | Anti-cancer | 31 |

| 2 | Infection | 17 |

| 3 | Diagnostic Agents | 15 |

| 4 | Cardiovascular Disease | 11 |

| 5 | Diabetes | 9 |

| 6 | Endocrinology | 8 |

| 7 | Obesity & Digestive Disorders | 8 |

| 8 | Reproductive | 6 |

| 9 | Skin Disorders | 5 |

| 10 | Autoimmune | 5 |

| 11 | Osteoporosis | 5 |

| 12 | Others | 4 |

By type, the branded peptide drugs segment dominated the peptide therapeutics market in 2024, accounting for approximately 70% of the revenue. The original goods created and sold by pharmaceutical corporations are known as branded medications. They need FDA (Food and Drug Administration) permission and go through a lot of clinical trials. In order to recoup their significant development expenses, pharmaceutical corporations usually maintain a patent for around 20 years.

By type, the generic peptide drugs segment is estimated to witness the highest growth in the peptide therapeutics market during 2025-2034. Products that mimic already-approved peptide medications are known as generic peptide pharmaceuticals. These medications, which are used to treat a number of illnesses, including as cancer, diabetes, and immunological problems, are usually made up of amino acids joined by peptide bonds. To guarantee that these generics are as effective and high-quality as the original medications, extensive study into synthesis procedures, formulation technologies, quality assurance, and bioequivalence is necessary.

By route of administration, the parenteral segment dominated the peptide therapeutics market in 2024, accounting for approximately 85% of the revenue. Parenteral preparations are non-pyrogenic, sterile formulations that are intended to be injected, infused, or implanted into the body of a person or animal. With more than 100 peptides prescribed globally and more than half of the pharmaceutical market, peptides are widely used as therapeutic aids in the healthcare industry.

By route of administration, the oral segment is estimated to witness the highest growth in the peptide therapeutics market during 2025-2034. Oral medication delivery methods provide advantages over parental administration in terms of long-term dosage, patient compliance, safety, and manufacturing costs. Furthermore, a variety of therapeutic compounds, ranging from tiny molecules to biomacromolecules, can be delivered locally and systemically by oral administration.

By application/therapeutic area, the oncology segment dominated the peptide therapeutics market in 2024, with a revenue of approximately 35% of the market. The development of peptides as medicines to treat a variety of illnesses, including cancer, is growing. Therapeutic peptides are advantageous because of their low toxicity and target selectivity. Numerous formulations and delivery systems have been developed, increasing the bioavailability and stability of therapeutic peptides.

By application/therapeutic area, the neurological disorders segment is estimated to witness the highest growth during 2025-2034. Globally, neurodegenerative illnesses represent a significant health concern. According to statistics, almost 12 million people in America alone are expected to have neurodegenerative disease by 2030. Modified neural peptide vaccination has shown promising outcomes in vivo and in vitro in a number of neurodegenerative disease models.

By synthesis technology, the solid-phase peptide synthesis (SPPS) segment was dominant in the peptide therapeutics market in 2024, with a revenue of approximately 65% of the market. Solid-phase peptide synthesis (SPPS) has recently been employed by peptide chemists to more precisely synthesise challenging and unusual peptide sequences. Solid-phase peptide synthesis may now be automated with the help of specially built instruments. A good technique for creating chemically modified peptides is automated solid-phase peptide synthesis, or SPPS.

By synthesis technology, the hybrid technology segment is estimated to witness the highest growth during 2025-2034. The advantages of both platforms are combined in hybrid SPPS/LPPS synthesis technology. This strategy provides a significant improvement in process efficiency for large-scale peptide manufacturing when combined with flow chemistry for fragment condensation and nanofiltration for intermediate purification.

By distribution channel, the hospital pharmacies segment dominated the peptide therapeutics market in 2024, accounting for approximately 50% of the revenue. The pharmacy and medication management departments of hospitals appear to play a critical role in giving patients high-quality treatment. A key component of every hospital's operations is pharmacotherapy. Automatic medication distribution models in hospitals provide significant organisational, financial, and therapeutic advantages and need to be the goal of systems in contemporary healthcare facilities.

By distribution channel, the online pharmacies segment is estimated to witness the highest growth during 2025-2034. Several reasons are driving the global e-drug store industry. These pharmacies provide a variety of benefit-added services and products in addition to reasonably priced and reasonable goods. These include, but are not limited to, arranging an appointment with an expert (E-counsel) and offering E-symptomatic services.

North America captured the largest revenue of approximately 40% of the peptide therapeutics market in 2024. driven by an increase in uncommon illnesses, metabolic disorders, and cancer. Together with improvements in drug delivery technology, the increasing use of synthetic and recombinant peptides is improving therapeutic effectiveness. The market is growing thanks to regulatory approvals and an expansion in biopharmaceutical R&D. Hospitals and pharmacies remain important distribution channels, especially as the need for tailored peptide-based treatments grows.

In July 2025, AstraZeneca announced that it will spend $50 billion in the US by 2030, enhancing America's position as a worldwide leader in pharmaceutical production and research and development. In addition to boosting growth and providing patients in America and around the world with next-generation medications, this investment is anticipated to generate tens of thousands of new, highly skilled direct and indirect employment nationwide. The new, cutting-edge facility will create oligonucleotides, peptides, and tiny molecules. In addition to the $3.5 billion announced in November 2024, this multibillion-dollar capital investment is being made.

In June 2024, building on their long-standing collaboration in research and innovation, Canada and the UK are further deepening their engagement in vital areas such as pandemic preparation and biomanufacturing. By working together, Canada and the UK are proving the effectiveness of international collaboration in tackling global issues. A joint fund between the UK and Canada has been formed, with the UK contributing £10 million and Canada contributing $16 million under the Biomanufacturing and Life Sciences Strategy.

Asia Pacific is estimated to host the fastest-growing peptide therapeutics market during the forecast period. The Asia Pacific market is expanding as a result of improved access to specialised therapies and growing healthcare costs in emerging nations. Furthermore, focused therapy techniques are needed to address the rising prevalence of lifestyle-related illnesses including diabetes and obesity, which is also raising demand for products.

Discovery, preclinical development, clinical trials, and regulatory approval are the several phases of the research and development process for peptide therapies. The goal of this process is to go from finding a good candidate to making sure it is secure, efficient, and prepared for the market.

Key Players Include: Eli Lilly, Novartis, Novo Nordisk, Takeda, Pfizer, and Amgen etc.

Phase I of a clinical trial is for safety in healthy volunteers; Phase II is for efficacy in a bigger patient group; and Phase III is for confirmation in a large population to compare with current therapies. Preclinical research is the first step in developing a peptide therapy. Following successful trials, a New Drug Application is sent to a regulatory body, such as the FDA, and if it is accepted, the medication is subjected to post-market surveillance to guarantee its long-term efficacy and safety.

Key Players Include: Eli Lilly, Novartis, Novo Nordisk, Takeda, Pfizer, and Amgen etc.

Beyond clinical trials, patient support and services are provided in the development of peptide therapies to assist address several important issues, especially those pertaining to medication adherence, administration, and accessibility. These actions guarantee that the therapy is accessible, patient-centered, and successful.

By Type

By Route of Administration

By Application/Therapeutic Area

By Synthesis Technology

By Distribution Channel

By Region

February 2026

February 2026

February 2026

February 2026