January 2026

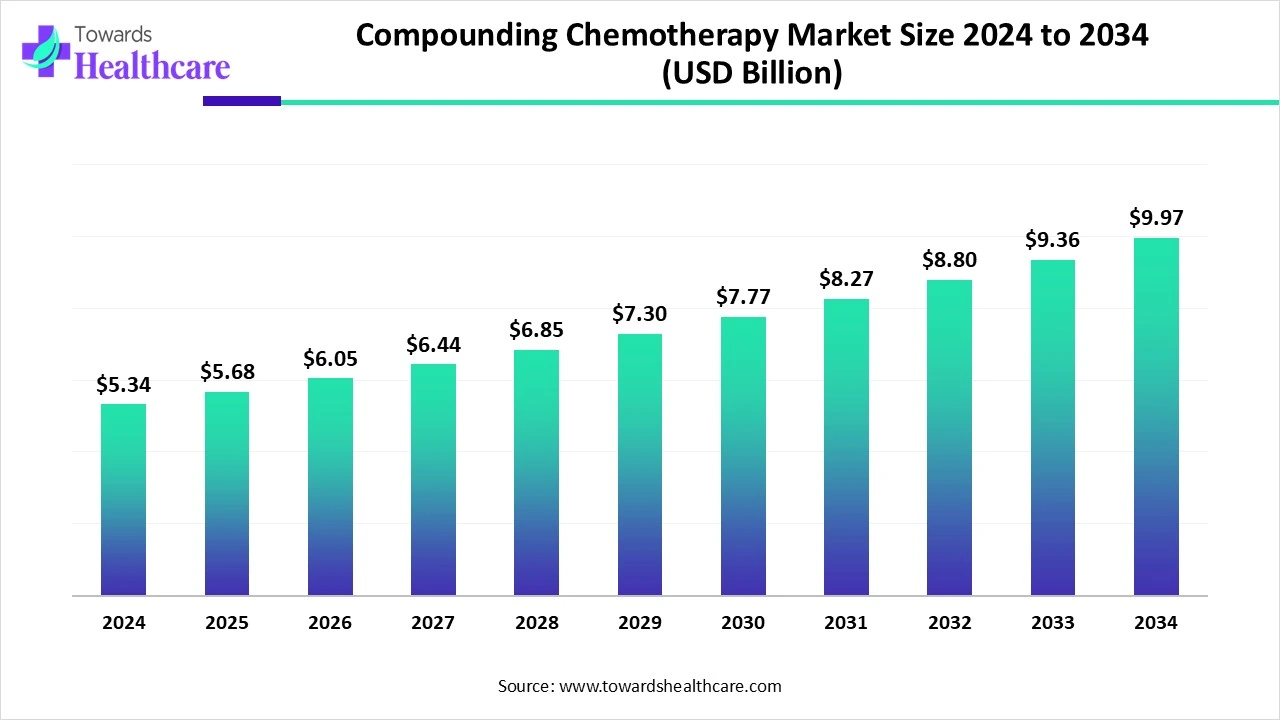

The global compounding chemotherapy market size is calculated at US$ 5.34 billion in 2024, grew to US$ 5.68 billion in 2025, and is projected to reach around US$ 9.97 billion by 2034. The market is expanding at a CAGR of 6.44% between 2025 and 2034.

A number of important variables are propelling the substantial growth of the worldwide compounding chemotherapy market. The rising rates of cancer and the ongoing developments in pharmaceutical compounding technology are major factors driving market expansion. The growing senior population, which is more prone to cancer, adds to the market's growth as individualized care becomes more and more important.

Future developments include the continued advancement of cutting-edge compounding technology and the growing use of precision medicine techniques, among other encouraging prospects.

| Metric | Details |

| Market Size in 2025 | USD 5.68 Billion |

| Projected Market Size in 2034 | USD 9.97 Billion |

| CAGR (2025 - 2034) | 6.44% |

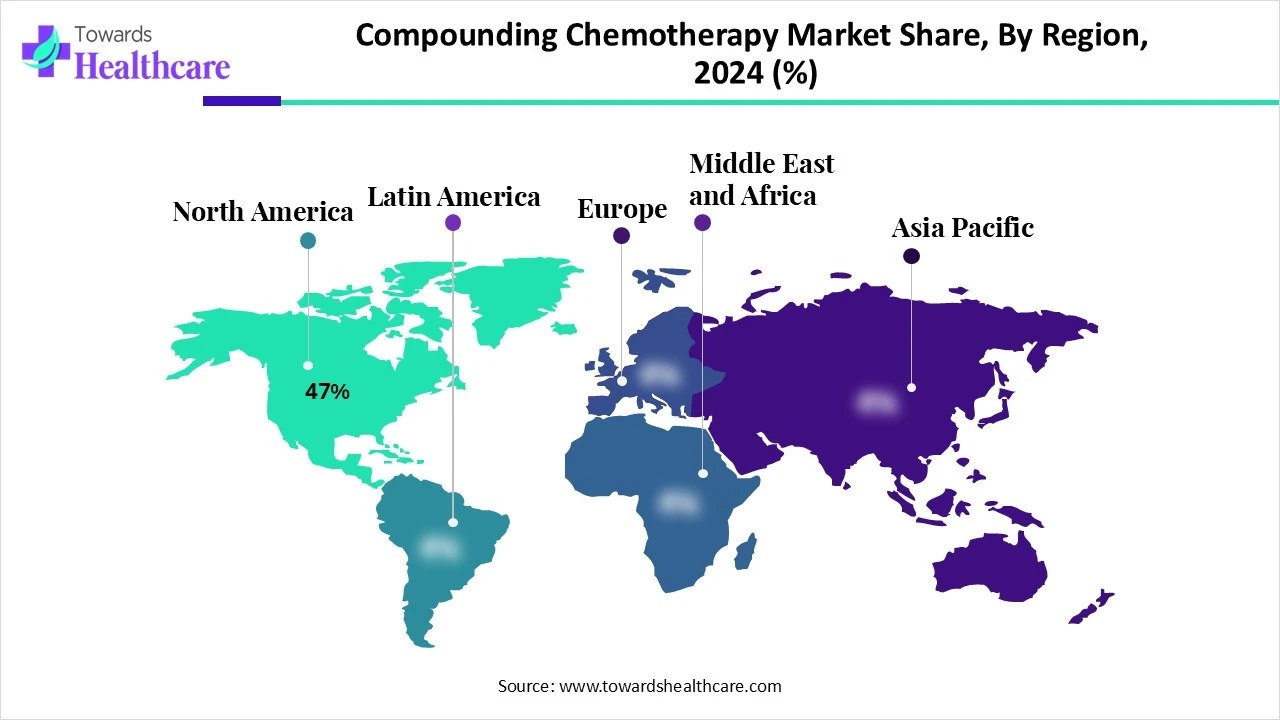

| Leading Region | North America share by 47% |

| Market Segmentation | By Compounding Type, By Drug Type, By Cancer Type, By Compounding Setting, By End User, By Region |

| Top Key Players | Baxter International Inc., B. Braun Melsungen AG, Fresenius Kabi AG, Grifols, S.A., ICU Medical, Inc., Pharmedium (AmerisourceBergen subsidiary), Nephron Pharmaceuticals Corporation, QuVa Pharma, Inc., Wells Pharma of Houston, LLC, Fagron NV, Wedgewood Pharmacy, Avella Specialty Pharmacy (now part of OptumRx), Cantrell Drug Company, Empower Pharmacy, Capsule Pharmacy, McKesson Corporation (Oncology & Specialty Division), CURA Pharmacy, Pencol Compounding Pharmacy, PharMEDium Healthcare Holdings, Inc. (Legacy), Central Admixture Pharmacy Services, Inc. (CAPS) |

The compounding chemotherapy market refers to the preparation of personalized chemotherapy drugs by compounding pharmacies or hospital pharmacies. It involves customizing chemotherapy drug formulations, concentrations, and dosages to meet the specific needs of patients, particularly those with pediatric, geriatric, or rare cancers. Compounding includes sterile preparation, dose adjustments, and drug combinations, ensuring safety, efficacy, and compliance with USP <797>/<800> standards. Growth is driven by increasing oncology burden, demand for personalized treatment, and outsourcing trends in oncology drug preparation.

Adding artificial intelligence (AI) to pharmaceutical compounding processes offers several benefits. AI algorithms can precisely measure and distribute drug components, ensuring accuracy and consistency in the final product. The compounding process can be continuously monitored by AI-powered systems, which can spot errors early on and correct them before they jeopardize patient safety.

Through the recognition of patterns and trends in historical data, artificial intelligence (AI) has the potential to constantly improve the compounding process and reduce the likelihood of future errors. Despite its significant impact today, artificial intelligence holds considerable unrealized promise in the pharmacy sector. AI might be used to automate increasingly complex tasks in the future.

Rising Demand for Personalized Medicine

The move to personalized treatment presents a big potential for the compounded chemotherapy business. As doctors become more conscious of the need for customized treatment strategies, there is a discernible rise in the demand for customized chemotherapy medications. By offering the chance to develop specialized treatments that are in accordance with patient-specific features, compounding chemotherapy positions itself to profit from this trend.

Gap in Infrastructure

The market for compounded chemotherapy currently has several operational and financial constraints, despite its apparent development potential. The primary obstacle is the lack of advanced aseptic compounding facilities, especially in low- and middle-income nations where there are few cleanrooms, isolators, and laminar airflow hoods.

Rising Focus on Rare Cancers

Many uncommon cancers do not have established conventional treatment approaches because of their low frequency. This may limit the amount of commercially available chemotherapeutic drugs that are licensed specifically for rare types of cancer. The emphasis on patient-centered care and tailored treatment has led to an increase in the use of personalized medicines. For rare malignancies, tailored chemotherapy treatments are often needed to meet the unique characteristics of each patient's disease.

By compounding type, the sterile compounding segment dominated the compounding chemotherapy market in 2024. A crucial component of a cancer center pharmacy is sterile compounding. To ensure that cancer patients receive the appropriate medication at the correct dosage, at the right time, and in the proper vehicle and container, quality assurance and control are essential. Patients and suppliers of sterile compounded medications are assured of quality by GMP in the pharmacy laboratory.

By compounding type, the non-sterile compounding segment is expected to be the fastest-growing during the forecast period. Non-sterile compounding can be used to meet the pharmacological needs of patients and medical professionals who have specific requirements that are not met by commercial medications. Despite being less rigorous than sterile procedures, non-sterile compounding still requires the proper personal protective equipment (PPE), clean work areas, and sanitary instruments.

By drug type, the cytotoxic drugs segment captured the major share of the compounding chemotherapy market in 2024. Cytotoxic medications can be used to eradicate tumors, improve the results of radiation or surgery, lessen metastases, and ease the symptoms of cancer. In addition to destroying minor tumors that have not been identified by testing, cytostatics can be effective outside of the major tumors.

By drug type, the targeted agents segment is expected to be the fastest-growing during 2025-2034. Monoclonal antibodies, small-molecule inhibitors, antibody-drug conjugates, and immunotherapy are all included in targeted oncology. For both potentially curative and palliative purposes, targeted therapies can be utilized in combination with radiation therapy, chemotherapy, and surgery to treat different tumor areas.

By cancer type, the breast cancer segment led the compounding chemotherapy market in 2024. Globally, four women are diagnosed with breast cancer every minute, and one woman dies from the illness. According to the researchers, breast cancer is the most frequent illness diagnosed in women, with an estimated 2.3 million new cases and about 670,000 deaths in 2022. Future projections also revealed a concerning rise, with over 1.1 million deaths and an estimated 3.2 million new cases expected by 2050.

By cancer type, the pediatric oncology segment is anticipated to witness the highest CAGR during the predicted timeframe. Often, commercially available drugs are insufficient to meet the needs of pediatric patients. For children and infants, taking prescription medications may be challenging due to the size of the capsules and tablets, high dosages, disagreeable tastes, or the presence of allergens. With our specially formulated solutions, the challenges of medication administration and the compliance of young patients will be greatly diminished.

By compounding setting, the hospital pharmacies segment dominated the compounding chemotherapy market in 2024. Speed and quality are crucial in any compounding pharmacy or hospital. Hospital pharmacists play a unique role in healthcare by regularly compounding prescription drugs (DPs) in response to hospital demands and procedures, such as medicine shortages. This aids patients who are weak and vulnerable, particularly those with infectious, chronic, or nutrition-related conditions.

By compounding type, the outsourcing facilities/503b registered compounding pharmacies segment is estimated to grow at the highest rate during 2025-2034. Often referred to as 503B approved compounding pharmacies, outsourcing facilities are a specialized type of compounding pharmacy that produces large quantities of medications without requiring individual prescriptions and delivers them directly to healthcare institutions. They are FDA-registered and subject to strict regulations, including the Current Good Manufacturing Practice (cGMP) guidelines. These facilities play a vital role in the drug supply chain by providing hospitals and clinics with clean, ready-to-administer drugs, frequently at a lower cost than traditional in-house compounding.

By end-user, the hospitals & cancer treatment centers segment held the largest share of the compounding chemotherapy market in 2024. Hospital and cancer treatment centers are highly specialized and equipped with an advanced healthcare system. Hence, a lot of people choose it over other facilities. Such hospitals and centers conduct their own research as well, leading to advancements in compounding chemotherapy.

By end-user type, the home infusion providers segment is anticipated to grow at a significant rate in the upcoming time. Home infusion providers are gaining interest as cancer patients, especially older adults and disabled people are unable to go out, or it is difficult for them to visit healthcare providers for chemotherapy frequently. Hence, home infusion providers not only provide personalized treatments, but also provide them at the ease of home.

North America dominated the compounding chemotherapy market share by 47% in 2024. In 2024, North America dominated the market in terms of revenue. The region's strong healthcare system, advanced medical technology, and rising cancer incidence all contribute to this. A strong network of compounding pharmacies, government backing for compounded drugs, and the growing demand for personalized care are other factors contributing to the region's market dominance. North America's market is expanding, in part, due to the presence of major pharmaceutical companies and the increasing use of advanced compounding technologies.

Universities, drug companies, biotechnology startups, government organizations, and private foundations are all intertwined in the intricate ecosystem that is U.S. cancer research. It is not reliant on any one organization or funding source. The U.S. has historically been at the forefront of cancer research. It has made more investments in cancer research than any other country, including over US$7.2 billion annually via the National Cancer Institute alone.

Relaunching the CCS Emerging Scholar Research Grants program (ESRG-26) is an exciting initiative of the Canadian Cancer Society (CCS). The goal of CCS is to fortify the future of Canada's cancer research ecosystem by investing heavily in the development of cutting-edge researchers. Promising early career investigators from throughout Canada who are dedicated to doing cancer research are the target of this opportunity.

Asia Pacific is estimated to host the fastest-growing compounding chemotherapy market during the forecast period. The Asia Pacific market for compound chemotherapy sales comprises China, South Korea, Japan, and India. Since the governments of many nations, particularly China and India, support ongoing research and development efforts, the healthcare sector has considerable room to expand. The region's market is increasing due to several factors, including high demand for efficient drugs, an aging population, a sharp increase in cancer incidence, and rising public awareness of cancer and the latest treatment options.

High-quality cancer research is increasingly coming from China. According to the Nature Index supplement, which evaluates contributions using the Count and Share criteria, China achieved a Share of 2,614.5 in cancer-related research in 2024.

In recent years, India has made significant strides in the study and treatment of cancer, giving millions of people suffering from this terrible disease hope. Investments are being made in cutting-edge research and treatment facilities in response to the country's growing population and rising cancer rates.

Europe is expected to grow significantly in the compounding chemotherapy market during the forecast period. With the UK, France, Germany, and other nations leading the way in adoption. A well-established healthcare system and widespread knowledge of customized cancer therapies support the industry. Stricter quality requirements and recommendations from regional regulatory organizations align with the growing demand for compounded chemotherapeutic medications, ensuring patient safety and treatment effectiveness.

Cancer Research UK will spend £173 million in the CRUK Cambridge Institute, the charity's largest grant ever awarded outside of London. More than £1.5 billion is expected to be spent on research by the organization throughout the five-year period from 2021–2022 to 2025–2026. Additionally, it is forming new partnerships and funding creative new research initiatives.

In December 2024, the study's primary researcher, Tim Witney, a professor of molecular imaging at King's College London, stated that there is currently no quick and early method to determine if malignant tumors are resistant to treatment. Time is of the essence, and many lung cancer patients cannot afford to wait to see if treatment is working. We aim to expand the window of opportunity for therapy for these individuals, providing them with more choices and a better chance at a better life. (Source - News Medical Life Sciences)

By Compounding Type

By Drug Type

By Cancer Type

By Compounding Setting

By End User

By Region

January 2026

December 2025

December 2025

December 2025