January 2026

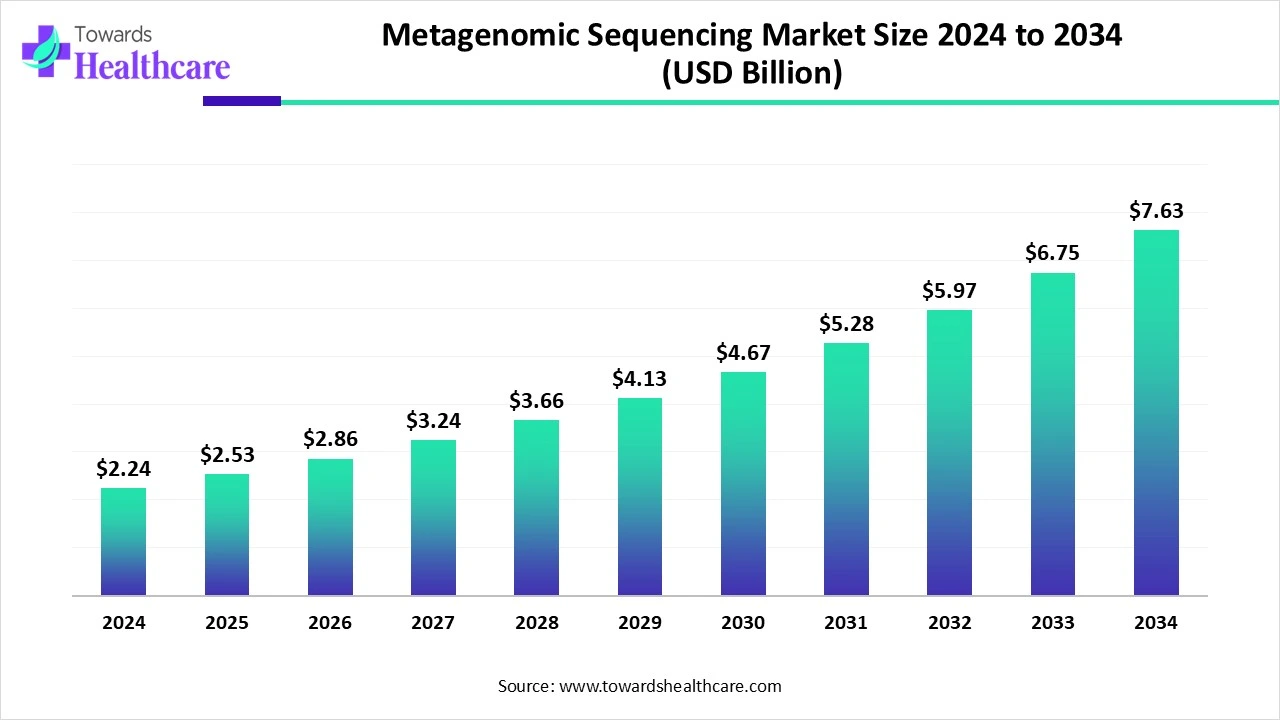

The global metagenomic sequencing market size is calculated at USD 2.24 billion in 2024, grew to USD 2.53 billion in 2025, and is projected to reach around USD 7.63 billion by 2034. The market is expanding at a CAGR of 13.04% between 2025 and 2034.

The metagenomic sequencing market is primarily driven by the rising prevalence of genetic and infectious disorders. The growing demand for biologics leads to the development of novel biologics. Point-of-care diagnostics play a vital role in detecting genetic and infectious disorders in humans. The demand for metagenomic sequencing is increasing due to its widespread applications in agriculture, biotechnology, and medicine. The future looks promising, with advancements in genomic technologies and the need for advanced diagnostic tools.

| Metric | Details |

| Market Size in 2025 | USD 2.53 Billion |

| Projected Market Size in 2034 | USD 7.63 Billion |

| CAGR (2025 - 2034) | 13.04% |

| Leading Region | North America |

| Market Segmentation | By Sequencing Approach, By Platform Technology, By Application, By End-User, By Workflow Component, By Region |

| Top Key Players | Illumina, Inc., Thermo Fisher Scientific, Oxford Nanopore Technologies, Pacific Biosciences (PacBio), Qiagen, BGI Genomics, Novogene, Zymo Research, CosmosID, IDbyDNA, Adaptive Biotechnologies, Diversigen (now part of GSK), BiomeSense, Helix, Microbiome Insights, GeneWiz (Azenta Life Sciences), Novartis Institutes for BioMedical Research, Aries Biosciences, Illumina BaseSpace Sequence Hub |

The market refers to the industry surrounding sequencing-based technologies used to analyze genetic material recovered directly from environmental or clinical samples. Unlike traditional sequencing that isolates and cultures organisms, metagenomic sequencing allows for the comprehensive profiling of entire microbial communities including bacteria, viruses, fungi, and archaea without prior culturing. This technique is used to discover new functional genes in uncultured microbes.

Numerous factors influence market growth, including the rising prevalence of genetic and infectious disorders and growing research and development activities. This leads to the development of novel drugs and biologics. The increasing investments and collaborations facilitate research activities. Government organizations launch initiatives to create awareness about early disease detection and its treatment.

Numerous government organizations launch initiatives to support genomics and metagenomic sequencing.

Artificial intelligence (AI) revolutionizes metagenomic sequencing by enhancing efficiency and accuracy. AI and machine learning (ML) algorithms can enable novel pathogen detection and sequence classification. They can predict disease outcomes and infectious disease outbreaks in a population by analyzing vast amounts of data. AI and ML can identify unknown pathogens based on a patient’s unique microbiome. The AI-based systems offer an advantage in the fast, accurate, and efficient evaluation and characterization of microbial datasets. They save costs and time for researchers by introducing automation. The advent of artificial neural networks (ANNs) and deep learning (DL) algorithms has immense potential to transform metagenomic sequencing in the future.

Demand for Marine-Based Drugs

The major growth factor of the metagenomic sequencing market is the growing demand for marine-based drugs. Marine organisms have proven to be a rich source of drug molecules for potential therapeutics. Metagenomic sequencing is emerging as a powerful tool in developing novel bioactive compounds. It allows researchers to explore the vast genetic potential of unculturable marine microorganisms. About 15-20 marine-derived compounds have been approved for clinical use against cancer, pain, viral infection, and heart disease. Drugs, such as cytarabine (anti-cancer), cephalosporins (antimicrobial), and vidarabine (antivirus), originate from marine organisms. These drugs are derived from metagenomic sequencing.

Lack of Awareness

Several researchers and healthcare professionals, especially in underdeveloped and developed countries, are unaware of metagenomic sequencing and its applications. Diagnostics derived from metagenomic sequencing are very expensive, limiting their widespread usage.

What is the Future of the Metagenomic Sequencing Market?

The market future is promising, driven by the need for point-of-care (PoC) diagnostics. Generally, PoC diagnostics are based on conventional culture techniques, such as PCR. Novel diagnostics based on metagenomic sequencing are the future for routine clinical diagnostics. Improvements in access to new diagnostics could improve patient treatment and management, thereby positively impacting population health. They can be used to detect pulmonary infections by analyzing and comparing the nucleic acid content in a patient sample to a reference database of organisms. Metagenomic sequencing can identify countless organisms directly from a patient specimen.

By sequencing approach, the whole-genome shotgun (WGS) metagenomics segment held a dominant presence in the market in 2024. This segment dominated as it is a comprehensive technique and enables simultaneous analysis of multiple microorganisms. Shotgun sequencing can deliver species-level taxonomic modifications, gene prediction, and identification of antimicrobial resistance genes. Researchers have developed a shallow shotgun sequencing method that provides shallower reads, enabling higher discriminatory and reproducible results compared to 16S sequencing.

By sequencing approach, the 16S rRNA amplicon sequencing segment is expected to grow at the fastest CAGR in the market during the forecast period. 16S rRNA sequencing is a rapid and cost-effective technique to identify microbes that are difficult to identify by conventional methods. This method is used to detect diversity in bacterial populations. Apart from bacteria and viruses, 16S RNA sequencing can be used for fungal identification, allowing researchers to gain deeper insights into mycobiomes.

By platform technology, the Illumina sequencing-by-synthesis segment held the largest revenue share of the market in 2024. This is due to its widespread applications in genomics, transcriptomics, and epigenomics. It is a rapid and accurate large-scale sequencing technology. Sequencing-by-synthesis (SBS) uses four fluorescently-labeled nucleotides to sequence tens of millions of clusters in parallel. It supports both single-read and paired-end libraries. It offers high-resolution genome sequencing, long-insert paired-end reads, and de novo sequencing.

By platform technology, the Nanopore long-read sequencing segment is expected to grow with the highest CAGR in the market during the studied years. Nanopore sequencing technique enables rapid, real-time results for short to ultra-long DNA and RNA reads. It is the only platform that offers real-time analysis and is fully scalable. The demand for this technique is increasing as it is highly accessible and affordable. Additionally, it derives more accurate data for numerous genetic variations.

By application, the human microbiome research & diagnostics segment held a major revenue share of the market in 2024. This segment dominated due to the rising prevalence of chronic disorders and the need for early disease diagnosis. Human microbiomes are involved in various diseases, like diabetes, liver diseases, tumors, and pathogen infections. This enables researchers to develop novel diagnostics and therapeutics for such microbiomes. Advances in sequencing technologies and the increasing use of computational tools boost the segment’s growth.

By application, the infectious disease pathogen identification segment is expected to expand rapidly in the market in the coming years. The increasing incidence of infectious diseases promotes the segment’s growth. According to the Centers for Disease Control and Prevention (CDC), approximately 47 million to 82 million influenza cases were estimated between October 1, 2024, and May 17, 2025. Metagenomic sequencing helps in identifying pathogens and detecting potential outbreaks in a population.

By end-user, the academic & research institutions segment contributed the biggest revenue share of the market in 2024. This segment dominated because of the growing research and development activities and the presence of favorable research infrastructure. Research institutions receive funding from the government and private organizations for conducting advanced research activities. Research activities enable researchers to develop novel therapeutics and diagnostics for various disorders.

By end-user, the clinical & diagnostic laboratories segment is expected to witness the fastest growth in the market over the forecast period. Suitable capital investment enables clinical and diagnostic laboratories to adopt advanced diagnostics. Clinical and diagnostic laboratories have specialized equipment to diagnose multiple microorganisms without culture techniques. The growing demand for rapid diagnosis and screening of infectious and chronic disorders augments the segment’s growth.

By workflow component, the library preparation & sample processing segment led the global market in 2024. Library preparation and sample processing are preliminary steps in metagenomic sequencing. They are essential as defects in these steps may alter final outcomes. Standardization of sample processing is vital to generate comparable data within a study. By introducing automation in library preparation, it offers numerous advantages, including increased throughput and scalability, reduced human errors, and enhanced consistency.

By workflow component, the bioinformatics & data analysis segment is expected to show the fastest growth over the forecast period. Computational tools are increasingly used in genomics to handle complex data and analyze that data. Bioinformatics can enable researchers to study species classification, system evolution, gene function activity, and metabolic networks. It analyzes the diversity and abundance of microbial populations. It also helps researchers to discover new genes with specific functions.

North America dominated the global market in 2024. The availability of state-of-the-art research and development facilities, the presence of key players, and technological advancements are the major growth factors that govern market growth in North America. Countries like the U.S. and Canada have a large clinical sequencing infrastructure and strong microbiome R&D. Government organizations provide funding for conducting research activities.

Most of the major players are located in the U.S., including Thermo Fisher Scientific, Pacific Biosciences, and Illumina. They are the major contributors to the market worldwide. The CDC supports 6 Influenza Sequencing Centers (ISCs) in the U.S. to sequence approximately 500 influenza viruses annually. The data enables the CDC to identify viruses with genetic differences to evade vaccine protection. (Source - Influenza)

The Government of Canada invested $81 million in the Canadian Precision Health Initiative (CPHI), developed by Genome Canada. The CPHI will receive other investments from industry, academia, and public sector partners, totaling $200 million. The funding will enable CPHI to build the largest-ever collection of human genomic data in Canada. (Source - Genome Canada)

Asia-Pacific is expected to grow at the fastest CAGR in the metagenomic sequencing market during the forecast period. The burgeoning genomics and proteomics sector and the rising prevalence of infectious disorders boost the market. The rapid expansion of genomics centers in China, Japan, India, and Singapore also facilitates market growth. Government and private institutions conduct seminars, conferences, and workshops to raise awareness and train individuals about novel techniques.

The winter season in Northeast China accounts for a 25.04% increase in influenza incidence after a one-month lag. The 20th International Conference on Genomics (ICG): The Future of Omics and AI will be held in Hangzhou in October 2025. The conference refers to covering fields such as genomics, synthetic biology, precision medicine, and human health. (Source - BGI)

As of December 2024, approximately 20,414 Swine flu cases have been reported in India. States like Delhi, Rajasthan, Maharashtra, Gujarat, Tamil Nadu, and Kerala reported the highest number of cases. Moreover, the “Genomics India Conference (GIC) 2025” is scheduled in August 2025 to gain insights into breakthrough research and cutting-edge technologies of the genomics sector, including microbes and microbiomes. (Source - India Bioscience)

Europe is expected to grow at a considerable CAGR in the metagenomic sequencing market in the upcoming period. Favorable government support and growing research and development activities drive the market. The increasing investments and collaborations among key players favor market growth. The growing demand for screening and early diagnosis of chronic disorders encourages researchers to develop novel diagnostic methods.

In January 2025, the UK Health Security Agency (UKHSA) launched the world’s first metagenomics initiative to aid in the rapid detection of infectious diseases affecting the UK population. The Metagenomics Surveillance Collaboration and Analysis Programme (mSCAPE) encourages the use of metagenomic data for public health surveillance and pathogen analysis. (Source - Gov.uk)

Dr. Nita Madhav, Head of Epidemiology & Global Risk Analytics at Ginkgo Bioworks, commented that the European Commission’s effort to fund RANGER accelerates access to innovative medical countermeasures and enables a step-change in the detection and response of novel respiratory pathogens. She also said that their integrated approach involving metagenomic sequencing, computational design, and predictive analytics enables clinicians and public health leaders to stay ahead of the curve. (Source - PR Newswire)

By Sequencing Approach

By Platform Technology

By Application

By End-User

By Workflow Component

By Region

January 2026

January 2026

January 2026

January 2026