January 2026

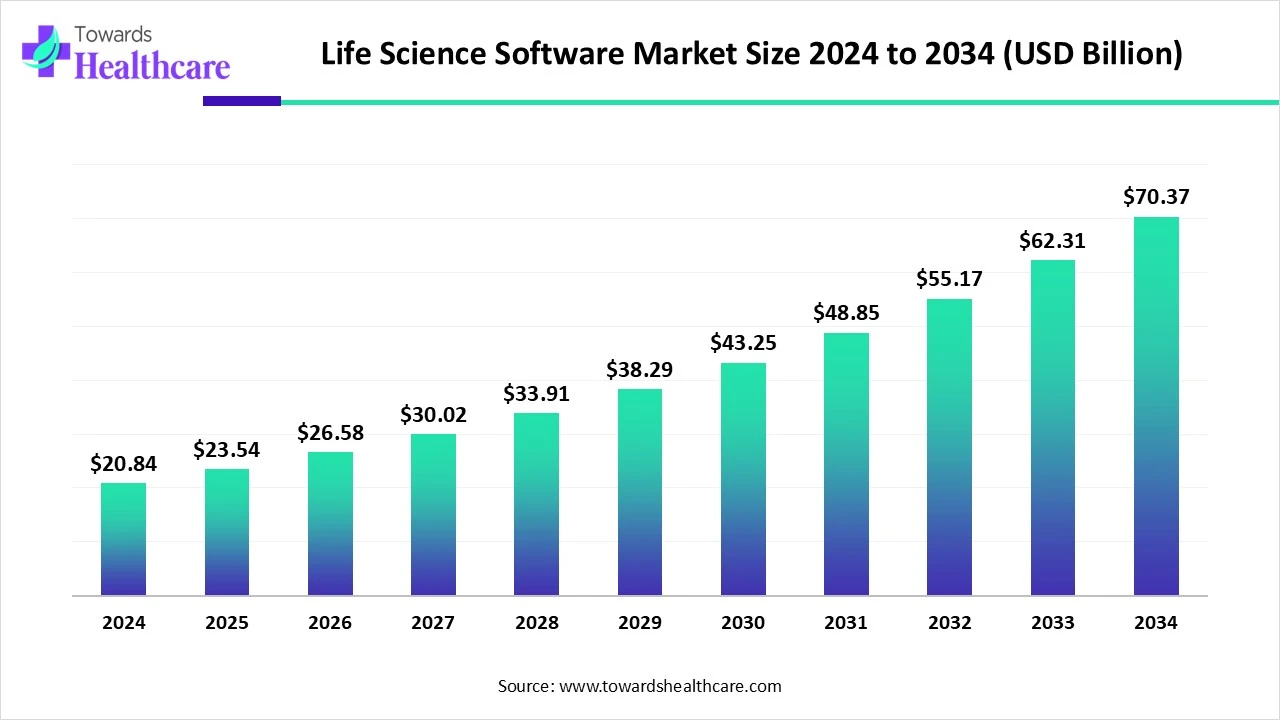

The global life science software market size is calculated at US$ 20.84 billion in 2024, grew to US$ 23.54 billion in 2025, and is projected to reach around US$ 70.37 billion by 2034. The market is expanding at a CAGR of 12.94% between 2025 and 2034.

Solutions for life science software are frequently seen as vital assets for industries such as biotech, clinical research, pharmaceuticals, and healthcare. There are products on the market that handle clinical trial data, improve drug development processes, speed up laboratory operations, and ensure regulatory compliance. Enhancing the accuracy and efficacy of research, treatment planning, and decision-making requires these tools. As the healthcare industry continues to shift toward tailored treatments based on individual patient data, there is a growing need for complex software applications that can analyze massive information, such as genetic, clinical, and molecular data.

| Metric | Details |

| Market Size in 2025 | USD 23.54 Billion |

| Projected Market Size in 2034 | USD 70.37 Billion |

| CAGR (2025 - 2034) | 12.94% |

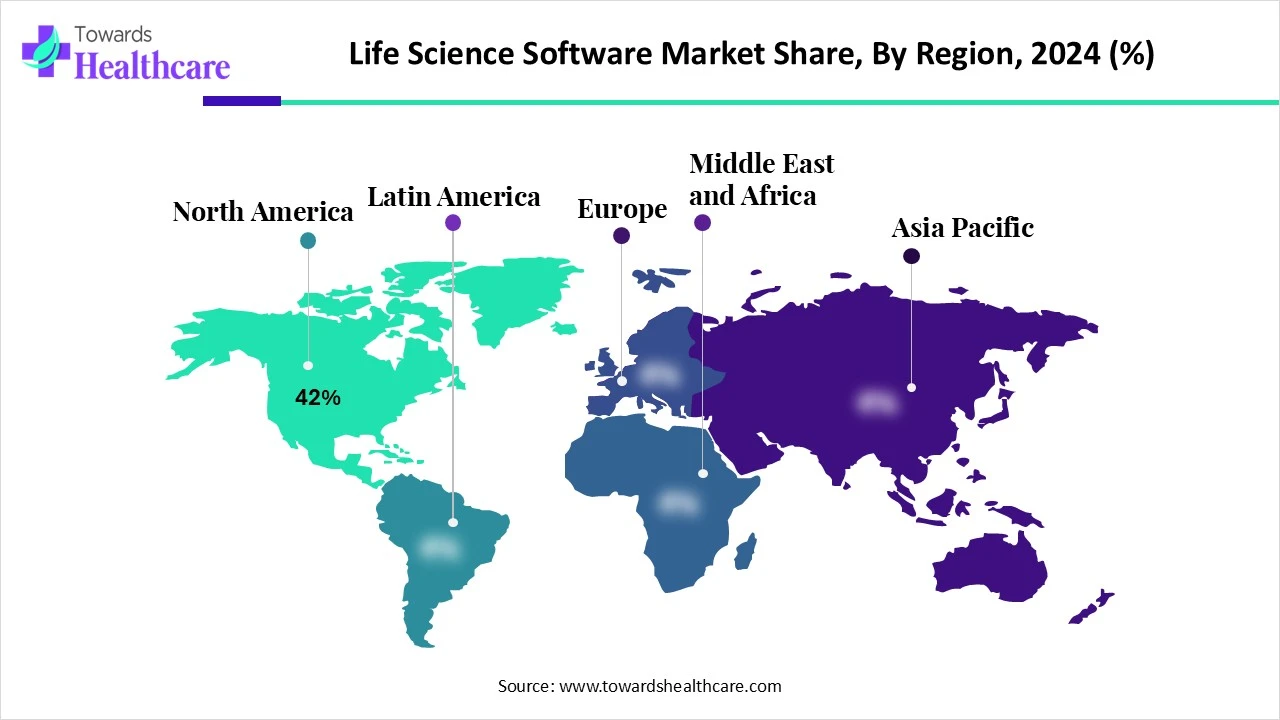

| Leading Region | North America share by 42% |

| Market Segmentation | By Solution Type, By Deployment Mode, By Function/Application, By End User, By Region |

| Top Key Players | Dassault Systèmes (BIOVIA, Medidata Solutions), Veeva Systems Inc., Thermo Fisher Scientific (Core Informatics), Oracle Health Sciences, IQVIA Technologies, SAP SE (SAP Life Sciences), PerkinElmer Informatics (now Revvity), LabWare (LIMS/ELN solutions), LabVantage Solutions, Agilent Technologies, Waters Corporation, Schrödinger, Inc., Benchling, Inc., Dotmatics (part of Insightful Science), ArisGlobal, OpenText (Life Sciences ECM/Documentum), Accenture Life Sciences Cloud, TIBCO Software (clinical analytics & data integration), IBM Watson Health (AI-powered drug discovery tools), Genedata AG (bioinformatics platforms) |

The life science software market includes digital solutions designed to support research, development, regulatory compliance, manufacturing, and commercialization processes in the pharmaceutical, biotechnology, medical device, and clinical research sectors. These software tools enable data management, workflow automation, predictive analytics, AI modeling, and regulatory tracking, ultimately enhancing productivity, data integrity, and time-to-market. Growth is driven by increased complexity in life sciences R&D, demand for digital transformation, and compliance with evolving global regulations.

The biological sciences are being revolutionized by artificial intelligence (AI), which is developing at a rapid pace. That's fantastic news for those who are waiting for a new medication or improved access to healthcare. The pressing need for AI innovation offers enormous potential for IT firms. AI will continue to see technological advancements like ChatGPT and BioGPT. To guarantee that AI models are properly trained and that the data used to train them is of the highest caliber, data specialists are essential.

Advancements in Genomics & Proteomics

The demand for specialized software to manage, store, and process enormous volumes of biological data is being fueled by developments in proteomics and genomics. This includes data analysis, simulation, and predictive modeling tools, all essential for comprehending illness causes and creating tailored treatments. Additionally, the market is expanding as a result of rising healthcare expenditures, particularly in nations with aging populations.

Data Privacy Concerns

In the life sciences industry, security is a major problem, particularly with regard to data management and storage. Pharmaceutical and healthcare organizations use patient data to deliver effective care and personalized medicines, but the digitalization of the sector raises additional privacy and cybersecurity concerns.

How is the EHR Transforming the Life Science Software Market?

Electronic Health Records (EHR) systems are becoming more and more in demand. According to data from the World Health Organization, more than 60% of medical professionals in several developed areas have switched to electronic health record (EHR) systems in recent years. The need for improved patient data management and accessibility, especially in light of the pandemic, which has sped up the digital transformation of healthcare, is the primary driver of this shift. In addition, government regulations in a number of nations are placing more and more emphasis on the use of EHRs in order to increase healthcare efficiency.

By solution type, the laboratory information management systems (LIMS) segment held the major life science software market revenue share in 2024. A Laboratory Information Management System (LIMS) is a cutting-edge digital platform that fundamentally transforms laboratory operations by centralizing data storage, automating procedures, and ensuring stringent regulatory compliance. LIMS for life sciences is the cornerstone of laboratory management, giving laboratories the tools they need to safely store data, handle samples, and keep an eye on studies.

By solution type, the drug discovery informatics segment is estimated to witness the fastest growth during 2025-2034. In addition to helping to streamline medical operations, informatics may speed up and improve the process of studying and developing new, effective medications. Precision medicine which aims to improve the effectiveness of medical treatment for certain patient groups based on genetic or molecular profiling, is another field that benefits from the continuous development of drug discovery informatics.

By deployment mode, the cloud-based software segment led the market in 2024 and is estimated to grow at the highest CAGR in the life science software market during the upcoming period. Beyond the financial savings that cloud migrations usually aim for, health sciences organizations are creating new avenues for commercial value as cloud technology advances. Prominent life sciences firms are seeing how effective cloud computing is at facilitating analytics, shortening innovation cycles, and harmonizing procedures across international operations, among other advantages.

By function/application, the research & drug discovery segment held the largest share of the life science software market in 2024. Over the last three decades, software-based approaches to drug discovery and development have significantly assisted the production of bioactive molecules. Molecular modeling, structure-based drug design, virtual screening, ligand interaction, and molecular dynamics are examples of modern software-based techniques that are thought to be helpful tools for examining the pharmacokinetic and pharmacodynamic characteristics of drugs as well as the structural activity relationship between ligands and their targets.

By function/application, the pharmacovigilance & safety monitoring segment is anticipated to be the fastest-growing during the predicted timeframe. Both active surveillance and spontaneous reporting must be incorporated into an integrated approach to medication safety monitoring for the pharmaceutical business to function. Active surveillance is particularly important for facilitating the introduction of new essential medications. The PharmacoVigilance Monitoring System (PViMS) facilitates active surveillance operations by managing all aspects of data collection, processing, and reporting.

By end-user, the pharmaceutical & biotechnology companies segment was dominant in the life science software market in 2024. In the rapidly evolving biotechnology and pharmaceutical sectors, specialized software solutions are essential for enhancing productivity, ensuring regulatory compliance, and accelerating drug development processes. Leading software vendors for the pharmaceutical industry provide a range of packages tailored to the unique challenges these industries encounter. Businesses that carefully select platforms that adhere to organizational and industry standards might position themselves for long-term success in a competitive climate.

By end-user, the contract research organizations (CROs) segment is estimated to witness the highest CAGR during the forecast period. Medical device, pharmaceutical, and biotechnology firms can contract with contract research organizations (CROs) to get specialized research services, including preclinical research, clinical trials, and a variety of other research-based services. Because CROs relieve the burden on sponsor resources and do not require full-time preclinical/clinical trial staff, they help bring innovative medication discoveries to market.

North America dominated the life science software market share by 42% in 2024. North America dominates the life science software industry due to the region's high rate of adoption of cutting-edge technologies and a substantial majority of expenditures. The market for life science software is dominated by North America because of the growing digitization of healthcare-related tasks and the use of this software by major healthcare organizations in this region. It is expected to expand rapidly during the next decade.

Despite comprising less than 5% of the world's population, the U.S. accounts for over three-quarters of global pharmaceutical revenues. President Donald Trump suggested altering that in April by levying taxes on imported medications of at least 25%. The argument is that by reducing reliance on nations that may suspend trade in the event of a war or other emergency, tariffs would encourage pharmaceutical companies to establish operations in the U.S., increase employment, and enhance national security. As a result, the pharmaceutical industry will increasingly utilize software.

Being a major hub for the life sciences worldwide, Canada attracts top biosciences, pharmaceutical, and medical technology companies. Strong R&D environments, highly skilled workers, excellent academic institutions, vast research networks, and opportunities for collaboration in research and skill development are the primary factors that influence firms' decisions to choose Canada. The medical technology industry in Canada is of the highest caliber, with more than 2,000 companies developing and manufacturing solutions for better health.

Asia Pacific is estimated to host the fastest-growing life science software market during the forecast period. Driven by rising medical research and technology spending, increased awareness of healthcare needs, and the rapid expansion of the healthcare system. The need for advanced software solutions in drug development, clinical data management, and genomics is growing, making countries like China, India, and Japan significant markets.

China has advanced space life science research significantly in recent decades. The goal of the Chinese government's state-led industrial strategy, "Made in China 2025," is to establish China as the world's leading high-tech manufacturing nation. Through the use of government subsidies, state-owned business mobilization, and intellectual property acquisition, the program seeks to catch up to, and eventually surpass, Western technical superiority in sophisticated sectors.

With a large and diverse population, a creative private sector, and digital public infrastructure, India provides a unique testing ground for developing adaptable and cost-effective solutions for life science systems globally. The World Health Organization's (WHO) Global Initiative on Digital Health (GIDH), unveiled at the 2023 G20 Summit during India's presidency, has positioned India as a global leader in promoting collaboration, interoperability, and equitable access to digital health solutions.

Europe is expected to grow significantly in the life science software market during the forecast period. France, Italy, Spain, Germany, the United Kingdom, and the rest of Europe are the five main nations that make up the European market. Researchers' need for analytics software to identify tailored medicine and new medications is also growing, driven by a sizable aging population and costly treatment options that increase health spending. The demand for affordable treatment, particularly in the European Union, and rising mortality rates are also expected to spur market expansion over the projected period.

Germany dominates the European healthcare industry in terms of market size, patient population, manufacturers of medical technology, and healthcare providers. Germany's healthcare sector is growing due to a number of global factors. Technological advancements like digitalization and societal ones like demographic changes are important examples. Innovative technology is frequently commercialized as a consequence of German research and development.

With rapidly evolving digital innovation, shifting NHS institutions, and shifting government policies, the UK health IT sector is poised to enter a transformative era. This presents both a challenge and an opportunity for health technology companies: to show their value, connect with system-wide goals, and integrate into the future of healthcare delivery.

The global life science market size is calculated at US$ 88.2 billion in 2024, grew to US$ 98.63 billion in 2025, and is projected to reach around US$ 269.56 billion by 2034. The market is expanding at a CAGR of 11.82% between 2025 and 2034.

In June 2025, IQVIA introduced new AI agents for the healthcare and life sciences industries. With the support of strong technological alliances and extensive industry knowledge, this presents a critical opportunity to deliver the accurate, effective workflows and insights required by the contemporary life sciences sector, according to Bhavik Patel, President of IQVIA Commercial Solutions. Our partnership with NVIDIA enables us to fulfill our mission of allowing smarter healthcare for all people worldwide.(Source - Iqvia)

By Solution Type

By Deployment Mode

By Function/Application

By End User

By Region

January 2026

January 2026

January 2026

January 2026