January 2026

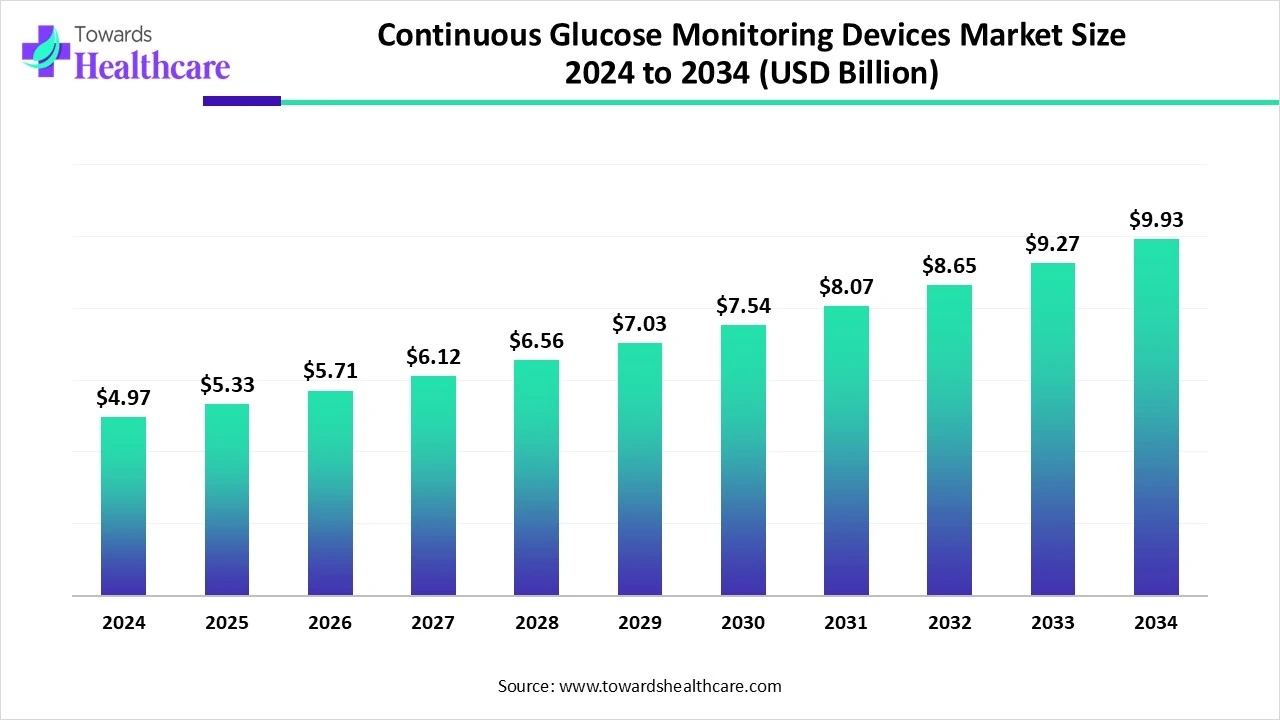

The global continuous glucose monitoring devices market size is calculated at USD 4.97 in 2024, grew to USD 5.33 billion in 2025, and is projected to reach around USD 9.93 billion by 2034. The market is expanding at a CAGR of 7.22% between 2025 and 2034.

| Metric | Details |

| Market Size in 2025 | USD 5.33 Billion |

| Projected Market Size in 2034 | USD 9.93 Billion |

| CAGR (2025 - 2034) | 7.22% |

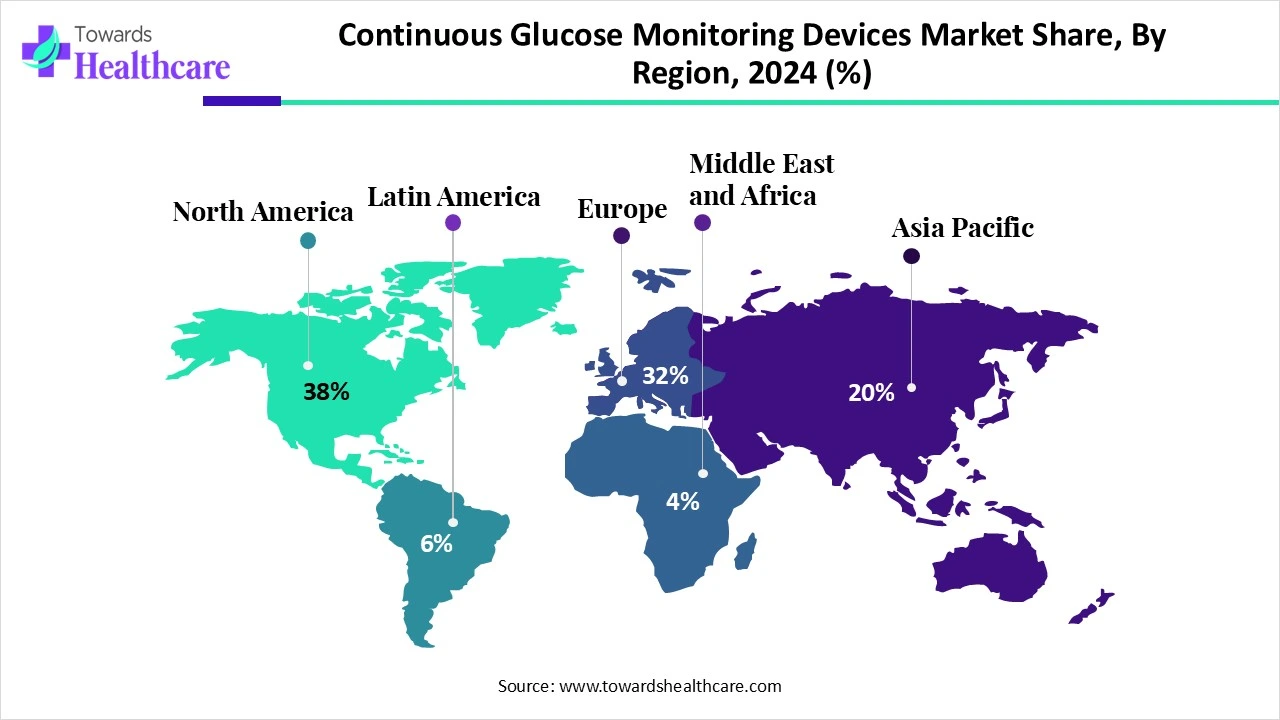

| Leading Region | North America share by 38% |

| Market Segmentation | By Component, By Connectivity, By End-use, By Region |

| Top Key Players | Dexcom, Inc., Abbott, Medtronic, Ypsomed AG, Senseonics Holdings, Inc., A. Menarini Diagnostics S.r.l., Signos, Inc. |

A wearable gadget called a continuous glucose monitor monitors glucose, or blood sugar. For blood sugar monitoring without finger pricks, CGM systems provide a more convenient and unobtrusive option than conventional techniques that require blood collection and finger pricking. In the last several decades, diabetes technology has advanced significantly, and one key development in the management of diabetes is Continuous Glucose Monitoring (CGM). For those with type 1 diabetes and those with type 2 diabetes, a doctor may recommend a continuous glucose monitor.

Recent developments in machine learning and artificial intelligence (AI) provide a viable path toward changing paradigms for diabetes care. There is a chance to improve the accuracy and customization of diabetes management by combining AI with glucose monitoring devices. Incorporating AI algorithms allows for the continuous monitoring of glucose levels, as well as the analysis of patterns, the prediction of future trends, the dynamic modification of treatment regimens, and even the automation of actions.

Rising Prevalence of Diabetes

One in eight individuals, or about 853 million people, will have diabetes by 2050, according to IDF forecasts, a 46% rise. Heart attack, stroke, and renal failure are among the health issues that people with diabetes are more likely to have. WHO wants to encourage and assist the implementation of efficient strategies for diabetes and its complications' monitoring, prevention, and management, especially in low- and middle-income nations.

CGM System Errors & False Alarms

"Set it and forget it" would be a stupid idea because CGM is not perfect. Sometimes the system could be "down," or the reading might not be accurate. The same alarms that are so useful when they identify an unknown low are equally frustrating when they ring for a false low, especially in the evening.

Are Technological Advancements Useful for Continuous Glucose Monitoring Devices?

Due to constant improvements in continuous glucose monitoring (CGM) devices, which enhance user experience and disease management, the market is growing. Advances such as smartphone connection, less intrusive sensors, and the lightning-fast sharing of real-time glucose data have made the use of CGMs much more feasible and user-friendly. Both physicians and patients find devices more appealing when they have longer sensor life, improved accuracy, and predictive alerts.

By component, the sensors segment led the market in 2024. This segment dominated because sensors are revolutionizing diabetes treatment and becoming a more commonplace technology, especially for diabetics who require insulin injections. CGM sensors greatly increase the quantity of data accessible on blood glucose trends and changes and lessen the need for SMBG by providing a practically continuous glucose trace with BG readings every 1 to 5 minutes. They may now provide patients with a range of sophisticated features to enhance their self-management, such as arrows displaying the current glucose rate-of-change and smart alarms to prevent hypo- or hyperglycemic episodes.

By component, the transmitters segment is anticipated to grow at the fastest CAGR in the continuous glucose monitoring devices market during the forecast period. The technology can wirelessly communicate blood glucose values thanks to the sensor's connection to a transmitter. Through communication with the sensor and monitor, the transmitter transmits the data to the monitor's display. A user may need to synchronize this component with their monitor in order to get readings because many systems combine the sensor and transmitter.

By connectivity, the Bluetooth segment captured the major share of the market in 2024. Through the use of Bluetooth wireless technology, glucose meter readings may be sent to smartphone apps that show trends and notifications to the user and their caregivers. For calibration, the glucose measurement devices are connected to the smartphone and to each other via Bluetooth. Lastly, an insulin pump may be connected via Bluetooth to receive data for closed-loop functioning.

By connectivity, the 4G network segment is anticipated to witness the fastest growth in the continuous glucose monitoring devices market during the predicted time. The advent of 4G blood glucose meters is revolutionizing the way individuals manage their diabetes. 4G blood glucose meters are an example of innovative medical equipment that uses 4G cellular technology. These meters can wirelessly communicate data over cellular networks and provide accurate blood glucose readings. This connectivity enables real-time data tracking and exchange, which has several advantages for both medical professionals and diabetics.

By end-use, the homecare segment dominated the market in 2024 and is expected to be the fastest-growing during 2025-2034. This segment dominated as all worldwide standards have aggressively promoted glucose self-monitoring as a means of facilitating diabetes control. When it comes to offering patients with mobility issues a pleasant setting, shielding them from hospital infections, and avoiding needless hospital stays, the usage of home health services is growing.

North America dominated the continuous glucose monitoring devices market share by 38% in 2024, driven by a high rate of diabetes and a sophisticated healthcare system. Rapid technical development is a defining feature of the region's market, as major companies consistently release cutting-edge CGM equipment. The market is expanding as a result of favorable reimbursement policies and growing knowledge about managing diabetes. While Canada is seeing tremendous growth as a result of government initiatives and an increase in the prevalence of diabetes, the United States still controls the majority of the regional market.

One of the most prevalent chronic diseases, diabetes affects more than 800 million people worldwide and more than 38 million in the U.S. In the U.S. and throughout the world, diabetes has significantly increased in prevalence within the last 20 years. It is anticipated that the prevalence of diabetes will increase until at least 2050. There are approximately 38.4 million adults and children with diabetes in the U.S.; 29.7 million of them have a diagnosis, while 8.7 million do not. Diabetes affects around 5.9 out of every 1,000 people in the U.S., and 1.2 million new cases are recorded each year.

In Canada, the prevalence of diabetes has increased by over 70% in the past decade. The number of people living with diabetes has increased in Canada despite a decline in the country's diabetes-related mortality rates due to an increase in new diabetes diagnoses. The Diabetes Canada Clinical Practice Guidelines aim to strengthen diabetes prevention efforts in Canada, set general treatment patterns, guide practice, and reduce the burden of diabetes-related complications. The federal government announced in February 2024 that it will establish a Device Fund to provide Canadians with access to syringes, insulin pens, insulin pumps, supplies, flash and continuous glucose monitoring devices, and other necessities for managing and monitoring diabetes and administering medication.

Asia Pacific is estimated to host the fastest-growing continuous glucose monitoring devices market during the forecast period. Because the firm produces continuous glucose monitoring equipment in the area, it has been able to expand its market. It is also expected that improvements in CGMs and an aging population would contribute to the expansion of the Asia-Pacific industry. Additionally, the development of clinics and hospitals, as well as improvements to the healthcare infrastructure, are anticipated to fuel the growth of the CGMs market in India. With this approach, hypoglycemia and hyperglycemic episodes are reduced, as is the frequency of fingerstick points of care capillary blood glucose monitoring in the critical care section. The need for a CGM increases as a consequence. Thus, data exchange and raising public awareness of CGMs promote market expansion.

The substantial financial burden that diabetes exerts on the Chinese healthcare system is demonstrated by the expectation that the direct costs of preventing and treating diabetes and its aftereffects would increase from US$190·2 billion in 2020 to $337·8 billion in 2030. It is anticipated that the indirect costs of early mortality, disability, and restricted work will increase from $60·0 billion in 2020 to $122·6 billion in 2030. The Healthy China 2030 strategy and Action strategy included a diabetes prevention and management program to help reduce this burden. The focus of China's diabetes management and action plan is shifting from a disease-centered to a health-centered approach, as well as from prevention to treatment.

Globally, an estimated 83 crore people have diabetes, a notable increase of 63 crore from 1990. Over 25% of them (21.2 crore) reside in India. On May 17, 2023, World Hypertension Day, the government announced the "75/25" initiative, which aims to provide standardized care to 75 million individuals with hypertension and diabetes by December 2025. As of March 5, 2025, 89.7% of the target has been reached, with 25.27 million individuals receiving treatment for diabetes and 42.01 million receiving treatment for hypertension.

Europe is expected to grow significantly in the continuous glucose monitoring devices market during the forecast period. According to the WHO, one of the primary drivers of the growth of CGM systems in Europe is the increased prevalence of diabetes. According to estimates from the WHO, up to 74 million people have diabetes, which accounts for 11.9% of men and 10.9% of women. This includes affecting more than 300,000 children and adolescents, with type 1 diabetes being the most common in Europe. The usage of CGM systems is being promoted more actively in Europe. It is anticipated that the growing accessibility and awareness of the devices would be the primary factors propelling the growth of the European CGM market.

Based on the duration of these reported increases in incidence, the number of T2D patients in Germany is predicted to increase from 6.8 million in 2015 to between 10.9 million and 14.2 million in 2040. These numbers show that the prevalence reached between 15.5% and 20.1% in 2040, up from 10.5% in 2015. The constant prevalence scenario for T2D in 2040 showed a total prevalence of 11.4% and a population of 8.1 million.

There are 5.8 million people with diabetes in the UK, which is an all-time high. According to research, around 4.6 million people in the UK have been diagnosed with diabetes. Additionally, an estimated 1.3 million people with type 2 diabetes may go undiagnosed. Numerous variables, such as housing, income, education, and access to nutrient-dense food, as well as a lack of healthcare, have been shown to be strongly linked to an increased risk of developing a number of illnesses, such as obesity and type 2 diabetes.

The Middle East & Africa are expected to grow at a considerable CAGR in the continuous glucose monitoring devices market in the upcoming period. The rising prevalence of diabetes and the rapidly expanding medical devices sector drive the market. The growing demand for personalized medicines and the increasing use of wearable devices also promote market growth. The rising adoption of advanced technologies enables researchers to develop innovative, needle-free glucose monitoring devices.

According to the IDF report, 24.9 million people were living with diabetes in Saudi Arabia in 2024. A recent study reported that 95% of individuals diagnosed with diabetes used commercial glucometers for self-monitoring of blood glucose. (Source: PubMed Central)

The IDF reported that approximately 7.7 million people had diabetes in the UAE in 2024. Abbott Laboratories, Noon, and Glucare.Health provides continuous glucose monitoring devices to people in the UAE. The UAE government also makes constant efforts to prevent, diagnose, and treat people living with diabetes.

In August 2024, Glucotrack Inc. received $4 million from a significant partner, John Ballantyne, to fund the company's initial in-human clinical study. This year has seen a tremendous advancement in our continuous blood glucose monitor (CBGM) technology. According to Paul V. Goode, Ph.D., CEO of Glucotrack, the funding from veteran investor John Ballantyne provides the company with greater financial flexibility as it begins human clinical trials for this simpler glucose monitoring technique. (Source - MPO)

By Component

By Connectivity

By End-use

By Region

January 2026

December 2025

December 2025

December 2025