February 2026

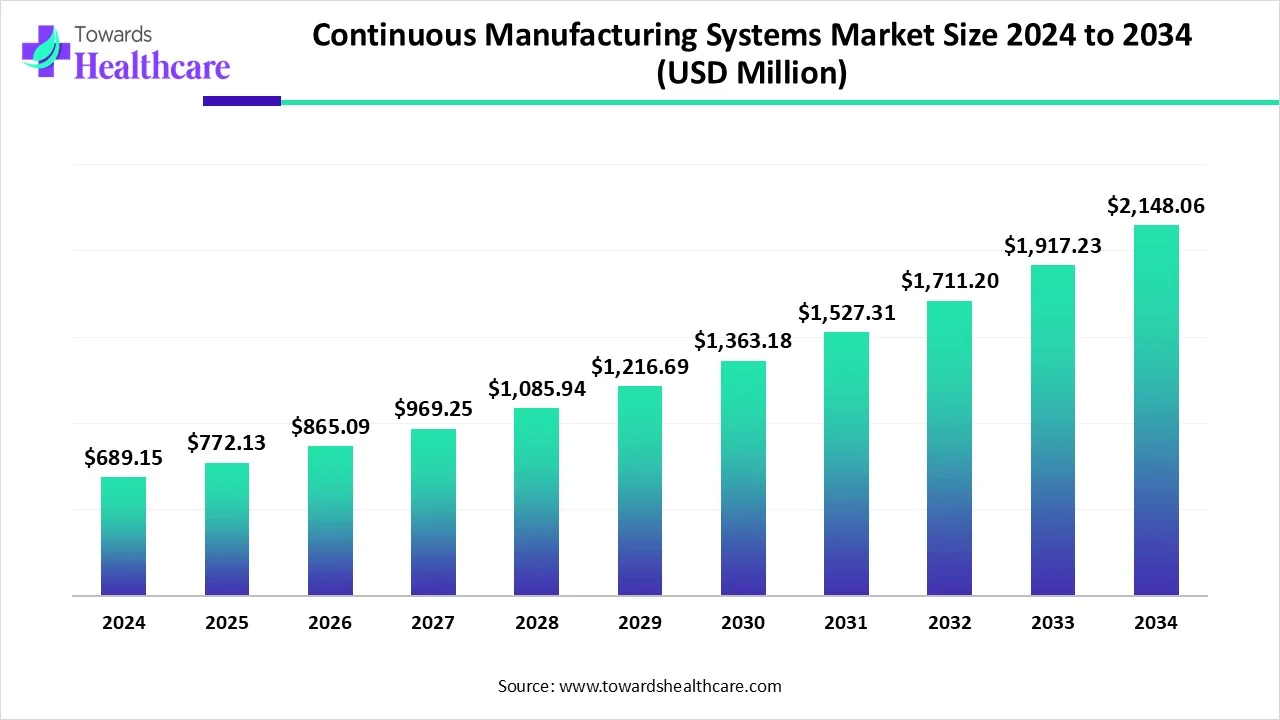

The global continuous manufacturing systems market size is calculated at USD 689.15 million in 2024, grow to USD 772.13 million in 2025, and is projected to reach around USD 2148.06 million by 2034. The market is expanding at a CAGR of 12.04% between 2025 and 2034.

The pharmaceutical industry's expansion and the pharmaceutical industry's increased productivity at lower prices are the main drivers of the continuous manufacturing systems market. A key element driving the growth of the worldwide market is the U.S. FDA's attempts to promote the use of pharmaceutical manufacturing systems, which modernize pharmaceutical manufacturing processes and provide advantages over batch production. One major problem impeding the expansion of the pharmaceutical sector is the high cost of continuous production.

A continuous manufacturing system is a method of production where raw materials are continuously input and transformed into finished products in a nonstop, integrated process, allowing for greater efficiency, consistency, and real-time quality control. The continuous manufacturing systems market is evolving rapidly as industries seek more efficient, flexible, and reliable production methods. This approach allows uninterrupted workflows, reduces human error, and ensures consistent product quality. Its ability to minimize waste and improve operational efficiency is attracting widespread adoption, especially in pharmaceuticals and chemicals. Additionally, advancements in automation and digital technologies are enhancing process control, making continuous manufacturing a preferred choice for modern, scalable production environments.

For Instance,

AI is significantly enhancing the continuous manufacturing system market by enabling real-time monitoring, predictive maintenance, and process optimization. It improves decision-making through data analytics, reduces downtime by anticipating equipment issues, and enhances product quality with precise control over variables. AI also supports adaptive manufacturing, where systems adjust automatically to changing conditions. These capabilities lead to increased efficiency, lower operational costs, and greater flexibility, driving wider adoption of continuous manufacturing across various industries.

Increasing Incidence of Chronic Disease

The increasing incidence of chronic disease drives the continuous manufacturing system market by creating a constant demand for large-scale, high-quality pharmaceutical production. Conditions like diabetes, cancer, and cardiovascular diseases require long-term medication, prompting drug manufacturers to adopt efficient, scalable systems. Continuous manufacturing system market ensures consistent drug supply, reduces production costs, and shortens time-to-market, enabling companies to meet the growing healthcare needs of aging and chronically ill populations more effectively and reliably.

For Instance,

Challenges Associated with Continuous Manufacturing

Challenges associated with continuous manufacturing act as a major restraint because the system requires complex process integration, advanced monitoring technologies, and specialized workflow training. Transitioning from traditional batch production to continuous processes involves technical hurdles, regulatory uncertainties, and significant time and cost investment. These difficulties can delay implementation, especially for smaller companies, limiting widespread adoption and slowing market growth despite the potential advantages of continuous manufacturing.

Regulatory Support in Manufacturing Process

Regulatory support offers a significant future opportunity for the continuous manufacturing system market by simplifying approval processes and encouraging innovation. Agencies like the FDA are providing clear guidelines and incentives, which help manufacturers adopt continuous methods with more confidence. This backing not only reduces regulatory uncertainties but also speeds up the implementation of advanced technologies, paving the way for more efficient, reliable, and scalable pharmaceutical production in the coming years.

For Instance,

The small molecules segment dominated the market due to its widespread use in treating various chronic and acute diseases. These drugs are easier to produce using continuous processes because of their simpler chemical structure and stability. Additionally, high demand, lower production costs, and faster development timelines make small molecules ideal for continuous manufacturing, driving their dominance in the market compared to complex biologics.

The biologic segment is projected to grow at the fastest CAGR due to increasing investments in biotechnology and the shift towards personalized medicine. Continuous manufacturing offers improved control over sensitive biologic formulations, reducing contamination risks and enhancing product consistency. As healthcare systems emphasize precision therapies and global biologics demand rises, manufacturers are adopting advanced production methods to meet regulatory and supply expectations, fueling the rapid expansion of the market.

The dominance of the continuous bioreactor segment in the market is driven by the efficiency of producing complex drugs with minimal variation. These systems support uninterrupted cell culture and product collection, which enhances overall yield and process consistency. As pharmaceutical companies prioritize flexible and cost-effective production methods, continuous bioreactors offer a scalable solution, particularly for biologics, making them a major modern manufacturing strategy.

The granulators segment is projected to witness the highest growth rate as manufacturers seek improved efficiency and precision in solid drug formulation. Continuous granulation enables real-time adjustments, ensuring consistent quality and reducing production variability. Its ability to integrate seamlessly with other equipment in continuous lines makes it highly attractive for modern pharmaceutical setups aiming to boost output while maintaining stringent quality standards, fueling its rapid adoption in the market.

The preclinical segment held the leading position in the continuous manufacturing systems market in 2024, as continuous manufacturing supports quicker formulation trials and efficient use of limited materials during early drug development. It enables streamlined testing, faster iteration, and precise control over process variables, which are essential when evaluating new compounds. This flexibility and speed in adapting production setups make continuous systems especially valuable in preclinical phases, where timelines and accuracy are critical.

The clinical segment is projected to grow rapidly due to the need for adaptable and time-efficient production methods during drug testing phases. Continuous manufacturing supports streamlined workflows, minimizing delays in materials availability, and maintains product consistency, which is vital for trial accuracy. As clinical pipelines expand and development cycles shorten, manufacturers are turning to continuous systems to meet evolving demand, making the market the fastest growing in terms of operational style.

North America dominated the market in 2024 due to the region's well-established pharmaceutical and chemical industries having been early adopters of continuous manufacturing technologies, driven by the need for efficient, scalable, and compliant production methods. Supportive regulatory frameworks, particularly from agencies like the FDA, have encouraged the transition from traditional batch processes to continuous manufacturing. Additionally, significant investments in research and development, along with a focus on Industry 4.0 and smart manufacturing, have further propelled market growth in North America.

The U.S. market is growing steadily due to strong support from regulatory bodies like the FDA, which encourages innovation and faster drug production. Advanced technologies such as real-time monitoring and automation improve efficiency and product quality. Additionally, increasing demand for faster, more reliable pharmaceutical manufacturing processes drives adoption. The well-established pharmaceutical industry and ongoing investments in modern manufacturing infrastructure also contribute significantly to the market’s growth in the U.S.

Canada’s market is growing due to an increasing focus on advanced pharmaceutical production and innovation. The country’s strong emphasis on research and development, along with supportive government policies, is encouraging the adoption of continuous manufacturing technologies. Additionally, rising healthcare demands and investments in biotech are driving improvements in efficiency and quality, making Canada an important player in the evolving pharmaceutical manufacturing landscape.

In 2025, the Asia-Pacific region is expected to grow at the fastest CAGR during the forecast period, driven by countries like China, India, Japan, and South Korea investing in modernizing pharmaceutical production to enhance efficiency and meet global standards. The adoption of continuous manufacturing is supported by favorable government policies and a growing emphasis on innovative bioprocessing techniques, particularly for producing biosimilars at scale. This shift aims to lower production costs and improve access to affordable therapies across the region.

China’s market is expanding due to strong government initiatives aimed at modernizing pharmaceutical production and reducing dependence on traditional batch processes. Programs like “Made in China 2025” support the integration of advanced manufacturing technologies. Additionally, the growing pharmaceutical sector, increasing demand for high-quality medicines, and rising partnerships with global firms are accelerating the shift toward continuous systems. These efforts are enhancing efficiency, product consistency, and competitiveness in China's pharmaceutical manufacturing landscape.

For Instance,

India's market is expanding due to Government initiatives like "Make in India" and the Production-Linked Incentive (PLI) scheme, promoting domestic manufacturing and technological advancement. The pharmaceutical sector, a significant component of India's economy, is increasingly adopting continuous manufacturing to enhance efficiency and product quality. Additionally, the integration of Industry 4.0 technologies, such as automation and real-time monitoring, is streamlining production processes. These developments are positioning India as a growing hub for advanced manufacturing.

Europe is expected to grow at a significant rate during the forecast period. Europe is accelerating the adoption of in 2025, driven by a combination of strategic initiatives and industry advancements. The region's commitment to innovation is evident through the integration of Industry 4.0 technologies, such as automation and real-time monitoring, enhancing production efficiency and product quality. Government support and favorable regulatory frameworks are encouraging pharmaceutical companies to transition from traditional batch processes to continuous manufacturing. Additionally, Europe's focus on sustainable practices and the need for flexible, scalable production methods to meet diverse healthcare demands are propelling the growth of continuous manufacturing systems across the continent.

For Instance,

Europe's market is expanding due to strong regulatory support, increasing demand for efficient pharmaceutical production, and the region’s focus on innovation. Agencies like the EMA are encouraging advanced manufacturing practices, while pharmaceutical companies seek faster, more flexible production methods to meet growing healthcare needs. Integration of digital technologies, automation, and sustainable practices is also driving adoption. These factors collectively support the shift from batch to continuous manufacturing across Europe’s pharmaceutical sector.

Germany’s market is growing due to its strong engineering expertise, advanced infrastructure, and focus on innovation in pharmaceutical production. The country hosts a number of leading pharma and biotech firms that are rapidly shifting from traditional batch processing to more efficient continuous systems. Collaborative efforts between research institutions and industry players, along with increasing emphasis on reducing production time and ensuring product consistency, are also propelling the adoption of continuous manufacturing technologies across the German market.

In July 2023, the U.S. Pharmacopeia (USP) and the National Institute for Pharmaceutical Technology and Education (NIPTE) launched the Continuous Manufacturing Knowledge Center (CMKC). This digital platform aims to support pharmaceutical continuous manufacturing by offering updated, easily accessible information for industry stakeholders, including researchers, regulators, and manufacturers. It also includes a collaborative online community, enabling experts to connect, share insights, and address challenges in continuous manufacturing through a centralized, searchable knowledge base. (Source: U.S. Pharmacopeia)

By type of molecule

By type of equipment

By scale of operation

By Region

February 2026

January 2026

January 2026

February 2026