February 2026

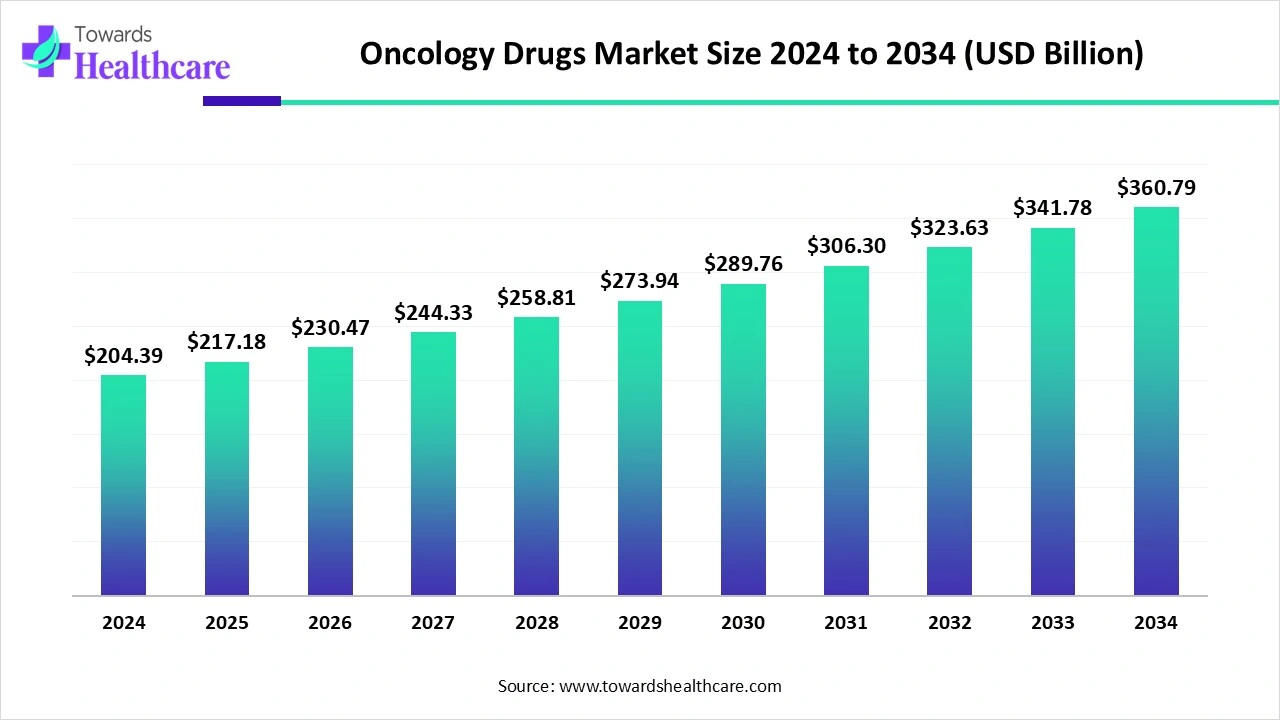

The global oncology drugs market size is estimated at US$ 204.39 billion in 2024, is projected to grow to US$ 217.18 billion in 2025, and is expected to reach around US$ 360.79 billion by 2034. The market is projected to expand at a CAGR of 6.29% between 2025 and 2034.

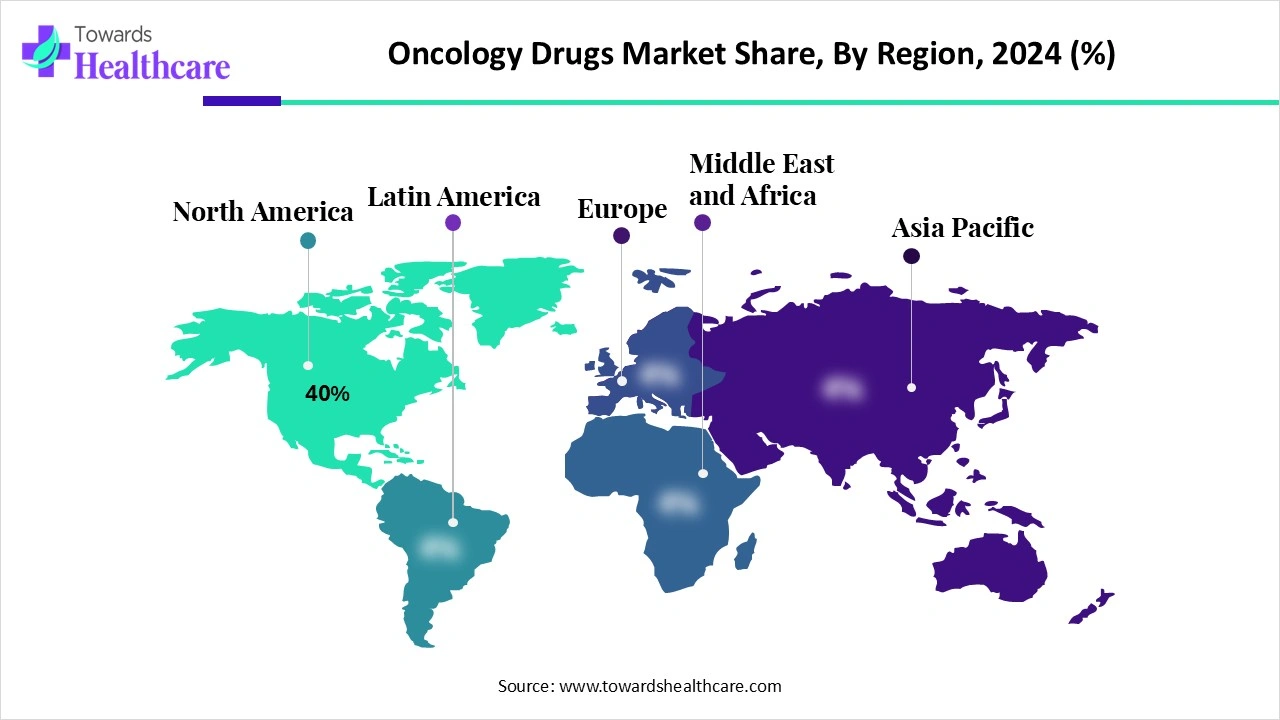

The oncology drugs market is growing due to the increasing prevalence of cancer and the growing demand for targeted and minimally invasive therapies. Expansion of research and development, technological development, and growing awareness of cancer in people are driving the growth of the market. North America is dominated in the market by a strong presence of key players and innovation in biotech processes, while the Asia Pacific is the fastest-growing region due to the increasing healthcare infrastructure.

| Table | Scope |

| Market Size in 2025 | USD 217.18 Billion |

| Projected Market Size in 2034 | USD 360.79 Billion |

| CAGR (2025 - 2034) | 6.29% |

| Leading Region | North America by 40% |

| Market Segmentation | By Drug Class, By Indication, By Therapy Type, By Distribution Channel, By Region |

| Top Key Players | Roche (Genentech), Novartis, Bristol-Myers Squibb (BMS), Merck & Co., Pfizer, Johnson & Johnson (Janssen), AstraZeneca, Amgen, Eli Lilly, Gilead Sciences, AbbVie, Takeda Pharmaceutical, Bayer, Sanofi, Daiichi Sankyo, Seagen (Pfizer subsidiary), BeiGene, Regeneron Pharmaceuticals, Exelixis, Ipsen |

Oncology drugs refer to pharmaceutical products designed to treat, slow, or prevent the progression of cancer through various mechanisms such as chemotherapy, targeted therapy, immunotherapy, and hormonal treatments. This market is driven by the rising global cancer incidence, aging population, innovation in drug discovery (biologics, cell & gene therapies), and expanding access to personalized medicine. Oncology remains the largest therapeutic area in pharmaceuticals, with significant investment from both large pharmaceutical companies and biotech firms.

For Instance,

Increasing government initiative for managing the rising global burden of cancer drives the growth of the market.

For instance,

Increasing innovative platforms for the distribution of oncology drugs and various therapies, which drives the growth of the market.

For Instance,

Integration of AI in oncology drugs drives the growth of the market as AI-driven technology is transforming oncology by enabling modified treatment approaches, growing early detection, and overcoming medicine resistance. AI-driven technology has allowed ground-breaking progressions in simulation techniques, molecular modeling, and the detection of new compounds, with anti-tumor and antibodies, while illuminating mechanisms of drug harmfulness. AI-based technology emerged as a significant tool in precision medicine, facilitating the formulation and release of intended therapies and increasing the development of management for oncology and central nervous system diseases. AI-driven clinical trial approaches further optimized the recruitment and stratification of patients, lowering the time and expenses of trials. Artificial intelligence is progressively used in oncology to promote early detection, diagnosis, prognosis, drug discovery, and treatment planning.

Growing Incidence of Cancer

The rising incidence of cancer is linked to various factors such as aging, lifestyle changes, environmental pollution, tobacco use, alcohol consumption, and obesity. With some cancer rates climbing among individuals under 50, researchers are investigating the underlying causes and possible prevention methods. Improved diagnostic tools and greater healthcare access result in higher detection rates, revealing cases that might have been overlooked previously. This contributes to the expansion of the oncology drugs market.

High Cost of Manufacturing Oncology Drugs

Increasing oncology drug prices due to variable access and results, with low- or middle-income countries being most profoundly affected. The increasing cost of cancer drugs is associated with various factors, such as performing all the regulatory studies, including phase 1, 2, and 3 clinical trials, to increase approval, which limits the growth of the oncology drugs market.

Increasing Advancement in Cancer Treatment

Cancer treatment has significantly advanced, shifting from traditional methods to cutting-edge innovations that provide renewed hope for diagnosed patients. Recent breakthroughs in immunotherapy, targeted treatments, and precision medicine enable more effective, personalized care. T-cells are engineered to better attack cancer cells and then reintroduced to the patient, demonstrating notable success in treating blood cancers such as leukemia and lymphoma. These developments also open up opportunities for growth in the oncology drug market.

For Instance,

By drug class, the targeted therapy segment led the oncology drugs market, as targeted therapy helps manage cancer by interfering with particular proteins that support tumors to grow and spread throughout the body. It stops cancer cells from dividing and multiplying. It seeks out cancer cells and kills them, and encourages the immune system. Targeted therapies have the unique capability to find cells that have precise proteins while leaving noncancerous cells unaffected.

On the other hand, the immunotherapy segment is projected to experience the fastest CAGR from 2025 to 2034, as immunotherapy is more effective compared to other cancer treatments, and it has lower side effects. Immunotherapy aims to increase the patient's immune system's capacity to destroy cancer cells.

By indication, the lung cancer segment is dominant in the oncology drugs market in 2024, as oncology drugs treat cells that have spread from the lung tumour and spread to other parts of the patient's body. Lung cancer is the third-most common type of cancer and the most common cause of cancer-related deaths. Commonly used medications comprise vinorelbine, pemetrexed, carboplatin, paclitaxel, docetaxel, gemcitabine, and cisplatin.

The breast cancer segment is projected to grow at the fastest CAGR from 2025 to 2034, as breast cancer is the most commonly diagnosed cancer in women. Advanced chemotherapy supports killing any residual cancerous cells. It supports lowering the challenges of recurrence of breast cancer. Chemotherapy, along with surgery, helps patients with breast cancer live longer than people who don’t have chemotherapy.

For Instance,

By therapy type, the monotherapy segment led the oncology drugs market in 2024, as monotherapy treatment is more susceptible to drug resistance, as the continuous treatment with a single compound encourages cancer cells to recruit alternative recovery pathways, which can efficiently control symptoms, lower medication interactions, reduce expenses, and improve patient compliance compared to numerous drug therapies.

The combination therapy segment is projected to experience the fastest CAGR from 2025 to 2034, as the increasing effectiveness of cancer medications when given in combination. The basis for combination therapy is to use medications that work by diverse mechanisms, so as to lower the likelihood that resistant cancer cells develop. Combination therapy has the strength to improve cancer cell death and cause deeper and more durable responses compared to monotherapy.

By distribution channel, the hospital pharmacies segment led the oncology drugs market in 2024, as these pharmacies have greater involvement in healthcare decision-making and patient care teams. This particularly provides opportunities for specialization in sectors such as oncology, infectious disease, or critical care. Access to continuous learning and expert development through hospital training programs. Hospital pharmacists are integral in each aspect of patient care, ranging from healthcare reviews in the pre-admission clinic to post-discharge care.

The specialty clinics segment is projected to experience the fastest CAGR from 2025 to 2034, as advanced care offered by specialized clinicians seems to be well-received both when assessed in relation to process indicators and to mortality. These services mainly focus on a particular area of medicine or a group of patients with precise types of symptoms and health conditions of cancer. Specialized care confirms that patients have great access to the novel technologies, skilled oncologists, and targeted treatment plans that exploit the chances of early recovery.

North America is dominant in the market share by 40% in 2024, due to the increasing demand for oncology physicians to manage complicated types of cancer. According to the Association of American Medical Colleges, specialists predict that the US could face a shortage of more than 10,000 oncology physicians by 2030. The Enhancing Oncology Model (EOM) aims to drive transformation and enhance care coordination in oncology care by conserving and improving the quality of care furnished to recipients undergoing treatment for cancer while lowering program expenditure under medicare fee-for-service, which contributes to the growth of the market.

For Instance,

In the United States, the increasing rate of cancer is due to growing obesity, highly processed foods, and sedentary lifestyles, which are widespread in the U.S. The most common cancers in the U.S. are prostate, breast, colon and rectum, and lung cancers. About one-third of deaths from cancer occur in the U.S. due to tobacco consumption, high body mass index, alcohol use, low fruit and vegetable eating, and less physical activity. All these factors increase the demand for advanced oncology drugs.

For Instance,

In Canada, as the population grows and ages, the incidence of new cancer cases and deaths from cancer is also increasing. Growing access to novel technology supports cancer research and development, enhances cancer diagnostics, and offers more treatment options to cancer patients, which drives the growth of the market.

Asia Pacific is the fastest-growing region in the market in the forecast period, due to increasing technological advancements that positively impact tumor patient care in the sectors of health transfer follow-up, symptom management, health education, and interventions. With growing biotech inventions and pharmaceutical development, the Asia Pacific region has developed as a hub in oncology clinical trials, which contributes to the growth of the market.

This process includes various stages by which a drug candidate must successfully develop through basic research of drug discovery, pre-clinical stages, clinical trials, and lastly review by the FDA. It involves the use of technical processes, methods, and procedures to detect consumer requirements and develop solutions that meet those needs.

Key Players: Bristol Myers Squibb and Merck

Phase I trials test a novel treatment to determine if it is safe and look for the best way to give the treatment. Physicians look for symptoms that cancer responds to advanced treatment. Phase II trials test whether one type of cancer responds to the novel treatment. Phase III trials test whether a novel treatment is better than a standard treatment.

Key Players: Novartis and Roche

Cancer patients who receive advanced therapy at a cancer center have better access to a broad diversity of resources, including skilled teams of experts. Patients experience lower stress and anxiety when their care is tailored around their precise physical, mental, and emotional requirements.

Key Players: Tata Memorial Hospital and the Fortis Hospitals network

In April 2025, Peter Guenter, member of the Executive Board and CEO of Healthcare at Merck, stated, “We have the unique opportunity with SpringWorks to establish a leadership position in rare tumors and build a strong foundation for further investments in this area, where a large unmet medical need exists. Together, Merck and SpringWorks are the perfect combination to improve outcomes for patients with rare tumors and bring therapeutic innovations to more patients worldwide.”

By Drug Class

By Indication

By Therapy Type

By Distribution Channel

By Region

February 2026

February 2026

February 2026

February 2026