February 2026

The global DNA damaging agents market size is calculated at US$ 15.33 billion in 2024, grew to US$ 17.12 billion in 2025, and is projected to reach around US$ 46.31 billion by 2034. The market is expanding at a CAGR of 11.67% between 2025 and 2034.

Globally increasing various cancer cases are boosting the development of novel drugs, with revolutionary gene editing tools in the global DNA damaging agents market. Alongside, major changes in radiation regulations are promoting advances in radiopharmaceuticals, which are widely used for cancer detection and treatment. Moreover, the market is leveraging many combination therapies, like immunotherapy & targeted therapy, and other biologics like antimetabolites.

| Table | Scope |

| Market Size in 2025 | USD 17.12 Billion |

| Projected Market Size in 2034 | USD 46.31 Billion |

| CAGR (2025 - 2034) | 11.67% |

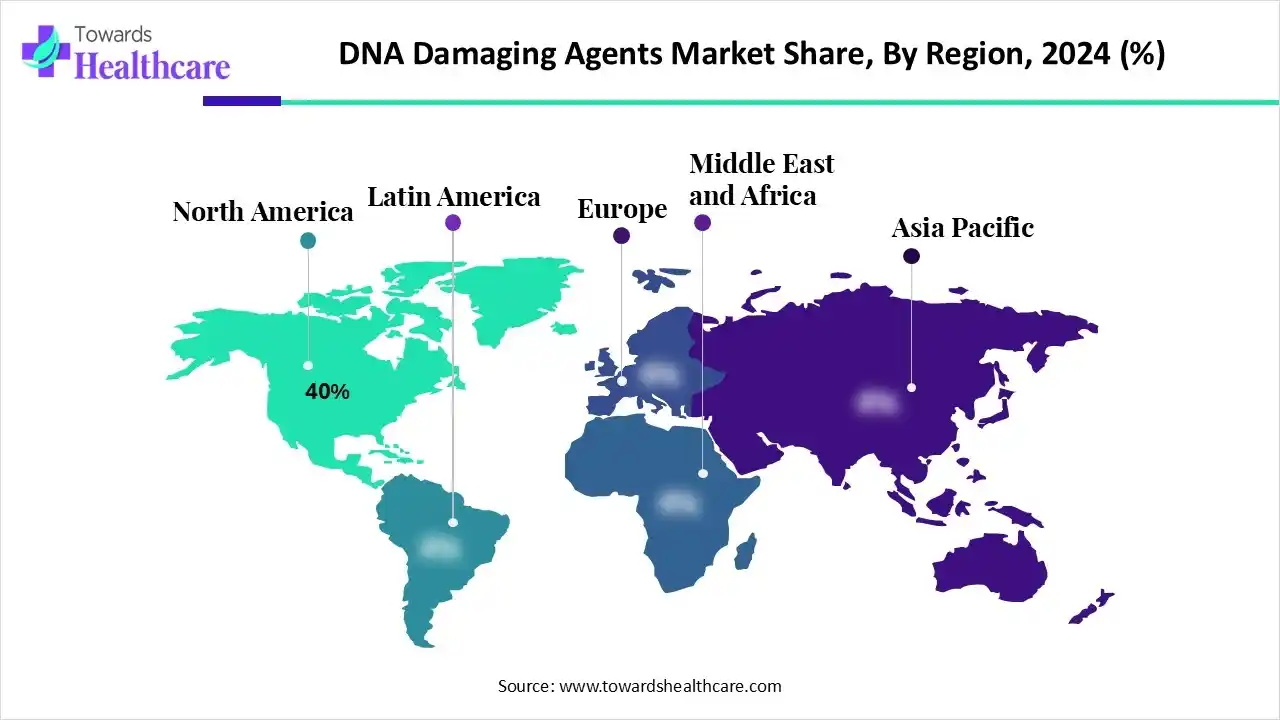

| Leading Region | North America by 40% |

| Market Segmentation | By Mechanism/Mode of DNA Damage, By Drug Class, By Therapeutic Indication, By End-User, By Region |

| Top Key Players | Merck & Co., Johnson & Johnson (Janssen), Sanofi, Eli Lilly, Takeda Pharmaceutical, Bayer AG, AbbVie, Seagen, Clovis Oncology, PharmaMar, Ipsen, Astellas Pharma, Servier, Oncopeptides, Spectrum Pharmaceuticals |

The DNA damaging agents market covers therapeutic drugs and associated services that induce DNA lesions to kill or incapacitate diseased cells, primarily used in oncology. It includes classical chemotherapeutics (alkylating agents, platinum compounds, topoisomerase inhibitors, antimetabolites), radiomimetic and radiopharmaceutical agents, formulae that create DNA cross-links or strand breaks, and combination regimens that exploit DNA damage (including DNA damage response [DDR] inhibitors as adjuncts). These agents are used across solid tumors and hematologic malignancies, as mono- or combination therapies with targeted drugs and immunotherapies. Market activity spans discovery, development, manufacturing, formulation, and clinical deployment, with major end-users being hospitals, cancer centres, specialty clinics, and oncology contract service providers worldwide.

A 2025 study fostered an innovation in computational models, which are further used for genomic and epigenomic data from cfDNA, with enhanced sensitivity for early cancer detection as compared to previous models. Moreover, a variety of tools from Google's DeepMind, AlphaMissense, are using AI trained on protein sequences from humans and primates to estimate the pathogenicity of all possible missense mutations. Alongside, AI is being increasingly employed in designing and optimizing nanomedicines, like nanoparticles and liposomes, for the effective delivery of DNA-damaging agents to cancer cells.

By capturing nearly 30% share, the alkylating agents segment dominated the DNA damaging agents market in 2024. A significant driver is the increasing instances of diverse cancers (such as lymphoma, leukemia, and breast cancer) and the breakthroughs in cancer research and treatment. Recent clinical studies have developed the combination of alkylating agents with immunotherapeutic drugs to explore their synergistic effects. Also, encapsulation of alkylating agents in liposomes or other nanoparticles assists their delivery to the tumor, lowering systemic exposure, and allows higher dosing.

Whereas the radiomimetics & radiopharmaceuticals segment is anticipated to expand rapidly. Primarily, they are using radioactive isotopes to diagnose and treat diseases like cancer through nuclear medicine techniques, including PET and SPECT scans.

In August 2025, Mayo Clinic started the first U.S. clinical trial by employing alpha-emitting radiopharmaceutical with actinium-225 for advanced breast cancer.

In 2024, the small-molecule cytotoxics segment held nearly 55% revenue share of the market. Mainly, cytotoxic drugs support by minimizing tumor burden, exposing more tumor antigens for the immune system to target. Also, the globe is moving toward targeted agents, which can selectively attack cancer cells while sparing healthy tissue. Furthermore, the market is using techniques, such as PROTACs and molecular glues, by employing small molecules to trigger the cell's own machinery to destroy cancer-causing proteins.

However, the radiolabeled therapeutics/radiopharmaceuticals segment is predicted to expand at a rapid CAGR. It mainly comprises alpha- and beta-emitters, which induce DNA double-strand breaks to destroy cancer cells with precision. In April 2025, the FDA accelerated coverage for this radiopharmaceutical to encompass pediatric patients aged 12 and older with MIBG-positive neuroblastoma; this can also be used in pheochromocytoma and paraganglioma. In 2025, the FDA approved Pluvicto (targeting PSMA for prostate cancer) and many other novel agents and strategies in clinical trials

In 2024, the solid tumors segment captured approximately a 65% share of the DNA damaging agents market. Expanding cases of genomic instability in cancers, resulting in dependence on DNA repair pathways that can be targeted for therapeutic gain. By 2030, it is anticipated that there will be nearly 26 million new cancer cases and 17 million cancer deaths per year. (PubMed. NCBI) However, these cases are widely using DNA damage response (DDR) inhibitors, alpha-emitting radiopharmaceuticals, and next-generation antibody-drug conjugates (ADCs).

Although the ovarian & gynecologic cancers segment will expand rapidly in the coming era. These cases are highly reliant on platinum-based chemotherapies and novel, targeted therapies that exploit deficiencies in the DNA damage repair (DDR) pathways. According to PubMed. NCBI, it is estimates that to a rise of 760,082 new cases of cervical cancer (a 14.8% increase) and 411,035 deaths (a 17.8% increase) by 2030.

At the 2025 ASCO meeting, the ROSELLA trial demonstrated bolstering results for adding the cortisol modulator relacorilant to nab-paclitaxel in platinum-resistant ovarian cancer.

The hospitals & cancer centers segment held nearly 60% revenue share of the DNA damaging agents market in 2024. These facilities are primary hubs for cancer diagnosis, treatment, and management, as well as for the administration of DNA damaging agents, like chemotherapy and radiation therapy. Alongside, they are widely adopting genomic profiling technologies, including Next-Generation Sequencing (NGS) to identify specific genetic mutations (like BRCA1/2) in tumors.

Moreover, the ambulatory infusion centers segment is anticipated to register rapid expansion. They basically lower issues regarding expenses those are in inpatient hospital settings, which makes them a more affordable choice for both patients and healthcare providers. Also, they possess well-trained staff and facilities for chemotherapy, immunotherapy, and other advanced treatments. In this era, AICs are widely exploring the use of smart infusion pumps, electronic health records (EHRs), and telehealth services to boost patient safety, treatment efficiency, and remote monitoring.

In 2024, North America dominated with an approximate 40% share of the market. The market is mainly fueled by a rise in cases of cancer, advancements in precision medicine, and major investments in R&D. Moreover, they are increasingly advancing modern ADCs that employ highly potent DNA-damaging agents as payloads, like calicheamicin, pyrrolobenzodiazepines (PBDs), duocarmycins, and camptothecin analogues. In 2020, there were an estimated 2.67 million new cancer cases in North America, a figure estimated to rise to approximately 3.83 million by 2030.

A major expansion of the U.S. market is propelled by a rise in cancer cases, with phenomenal advances in genomic profiling, like NGS. This advancement further enhances the accurate detection of patients who will most likely benefit from targeted therapies, including PARP inhibitors. Whereas the US is accelerating the application of these novel agents with the support of companion diagnostics.

For instance,

The DNA damaging agents market in Canada is impacted by a growing implementation of government funding and programs to boost cancer research and expand access to oncology treatments. Furthermore, it comprises the Pan-Canadian Oncology Drug Review (pCODR), which further supports simplifying the process for new drugs entering the market.

For instance,

During 2025-2034, the Asia Pacific is estimated to register the fastest growth in the DNA damaging agents market. This expansion will be fueled by the rising investments in R&D for the identification of novel molecular targets within DNA repair pathways. However, India and South Korea are expanding their clinical trials, which escalates the advantages from a huge patient pool and reduced expenditures. Ongoing strategic collaborations among multinational pharmaceutical companies, local biotech firms, and academic institutions are bolstering innovations.

Recently, the Indian market expanded the progress of a novel nitro-substituted organoselenium compound. This represents how they trigger DNA damage through raised reactive oxygen species (ROS), making it a robust candidate for treating aggressive triple-negative breast cancer. Although numerous Indian companies are providing genotoxic impurity testing services for pharmaceutical manufacturing.

Day by day, the DNA damaging agents market is boosting innovations in South Korea, with the development of sophisticated gene editing tools. This mainly consists of CRISPR/Cas9, in which companies like ToolGen have developed multiple generations of gene-editing tools.

For instance,

In this era, the European market is experiencing notable growth due to the growing focus on the expansion of antibody-drug conjugates (ADCs). Many European pharmaceutical companies and researchers are exploring next-generation ADCs that use DNA-damaging agents as their payload. In certain cases, they merge highly potent pyrrolobenzodiazepines (PBDs) and duocarmycins, which are being tested in clinical trials for hard-to-treat cancers like triple-negative breast cancer.

Newer German regulations apply to clinical trials comprising radiation and radioactive substances, which were effective from July 2025. This combines the process with the European Union's single-gate approach for approvals and notifications, streamlining the research process.

For instance,

It mainly involves a preclinical phase of discovery and lab testing, subsequent clinical trials to develop efficacy and safety, and ends with commercialization.

Key Players: Repare Therapeutics, IMPACT Therapeutics (China), Nodus Oncology, etc.

Mainly, different phases are exploring combining them with DNA damage response (DDR) inhibitors to overcome tumor resistance and expand efficacy.

Key Players: Centro Hospitalar Nordeste, Erasme University Hospital, Hospices Civils de Lyon, etc.

The DNA damaging agents market is promoting financial assistance, nutritional guidance, patient support programs (PSPs), and counselling therapies.

Key Players: Merck, Pfizer, Clovis Oncology, etc.

By Mechanism/Mode of DNA Damage

By Drug Class

By Therapeutic Indication

By End-User

By Region

February 2026

December 2025

November 2025

February 2026