November 2025

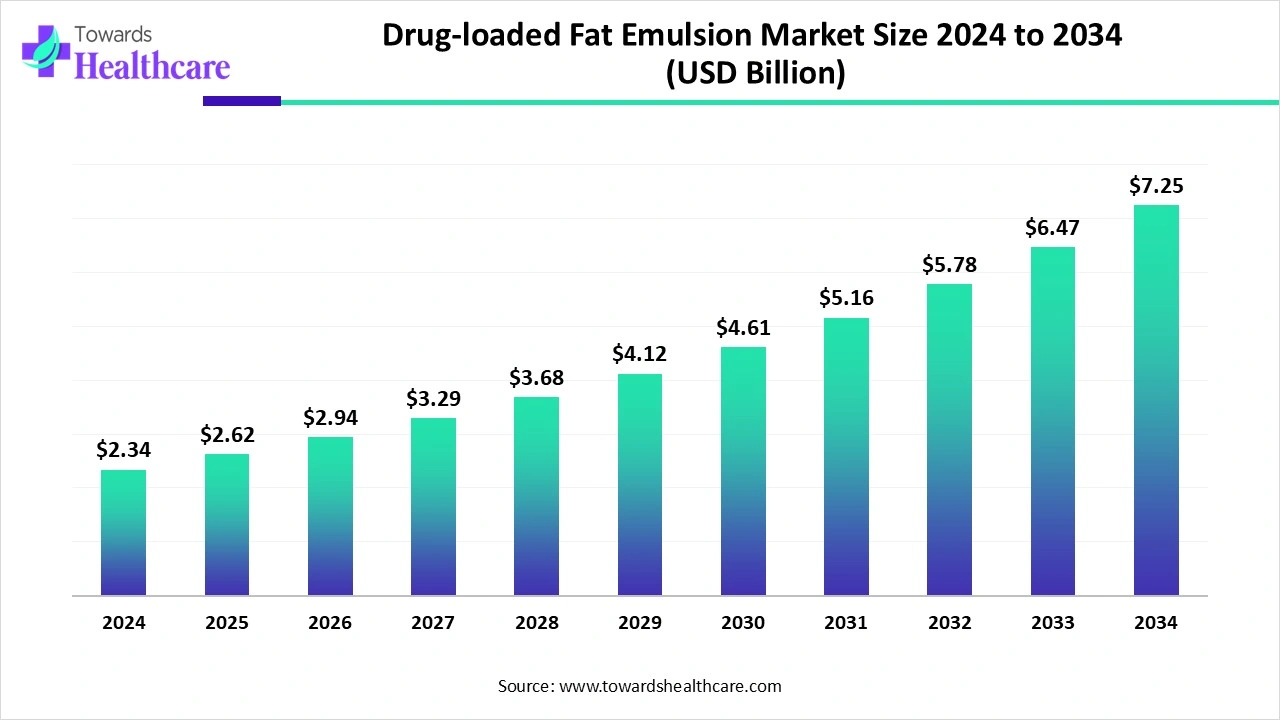

The global drug-loaded fat emulsion market size is calculated at US$ 2.34 billion in 2024, grew to US$ 2.62 billion in 2025, and is projected to reach around US$ 7.25 billion by 2034. The market is expanding at a CAGR of 12.04% between 2025 and 2034.

The drug-loaded fat emulsion market revolves around the proper use of medicinal drugs in fat emulsion dosage forms that are effective against several diseases and for people with fat sensitivity. Fat emulsions are good energy sources that provide arachidonic acid, palmitic acid, and other fatty acids. These solutions reduce irritation, pain, and toxicity and provide improved stability and solubility. They are ideal for targeted drug delivery and include nanoemulsions and other advancements.

| Table | Scope |

| Market Size in 2025 | USD 2.62 Billion |

| Projected Market Size in 2034 | USD 7.25 Billion |

| CAGR (2025 - 2034) | 12.04% |

| Leading Region | North America |

| Market Segmentation | By Type, By Application / Therapeutic Use, By Route of Administration, By Packaging / Format, By End-User, By Region |

| Top Key Players | Baxter, B. Braun Melsungen AG, Fresenius Kabi AG, Pharmacia (Pfizer), Teva Pharmaceutical, AstraZeneca, Chongqing Yaoyou Pharmaceutical Co., Ltd., Sichuan Guorui Pharmaceutical Co., Ltd., Jiangsu Hengrui Pharmaceuticals Co., Ltd., Sichuan Kelun Pharmaceutical Co., Ltd., Yangtze River Pharmaceutical (Group) Co., Ltd., Anhui Fengyuan Pharmaceutical Co., Ltd., Yichang Humanwell Pharmaceutical Co., Ltd., Yunnan Longhai Natural Phytopharmaceutical Co., Ltd., SSY Group Limited, Beijing Tobishi Pharmaceutical Co., Ltd., Jiabo Pharma, Jiangsu Yingke Biopharmaceutical Co., Ltd. |

The drug-loaded fat emulsion market is an integral segment of lipid-based drug delivery systems in which poorly soluble or unstable drugs are encapsulated within fat emulsions (oil-in-water dispersions, typically 100–300 nm particle size) to improve solubility, stability, reduce side effects, and enable parenteral or targeted administration. These emulsions often employ vegetable oil triglycerides and phospholipid emulsifiers and are used in therapeutic applications such as anesthesia, analgesia, cardiology, anticancer, and others.

Artificial intelligence contributes to drug formulation and its optimization, predictive modeling, and drug delivery. It has reduced the conventional trial-and-error approaches. AI algorithms help in the prediction and analysis of ligand-receptor interactions more effectively. The other forms of AI, like machine learning and deep learning, are contributing well to pharmaceutical drug discovery and development.

What are the Major Drifts in the Drug-loaded Fat Emulsion Market?

There are different drug delivery approaches, such as targeted drug delivery systems, nanoparticulate drug delivery systems, fast-dissolving drug delivery systems, osmotic drug delivery systems, and vesicular drug delivery systems. The advanced systems present numerous benefits, such as better patient compliance, reduced chances of side effects, a lower frequency of dose administration, and minimal alteration in drug levels in the body. The drug delivery systems, including polymers, carriers, biologically active agents, and polymer-drug formulations, are ideal for the diagnosis and therapy of various diseases.

What are the Potential Challenges in the Drug-loaded Fat Emulsion Market?

The biological challenges or issues are related to systemic drug distribution, while the physicochemical challenges are created by therapeutic proteins with high molecular weight and low water solubility. The difficulties arise in achieving targeted and controlled drug release. Micro-electromechanical systems (MEMS) for drug delivery present technical challenges such as device security risks, regulatory complexities, and medical packaging.

What is the Future of the Drug-loaded Fat Emulsion Market?

Drug discovery technologies make medicines possible to encompass in innovative delivery systems, which provide numerous medicinal and commercial benefits. Research investigations are done about quickly dissolving nanoparticulates and regulating drug administration to a specific target site. There is an emerging need for polymers with specific physical and biological properties and an increased focus on the synthesis of novel polymers.

The LCT/MCT blend emulsions segment dominated the market in 2024, owing to their benefits in nutrition, metabolism, malabsorption, formulation, etc. They are good energy sources and result in improved fat clearance and metabolism. They help in managing malabsorption syndromes, provide neurological support, and exhibit antimicrobial properties.

The fish-oil emulsions segment is expected to grow at the fastest CAGR in the market during the forecast period due to the benefits of emulsified fish oil for general consumers. These oils enable enhanced absorption, improved palatability, reduced side effects, and higher potency. They deliver anti-inflammatory and immunomodulatory effects, reduce the risk of infection, and improve outcomes in clinically ill patients.

The anesthesia & analgesia segment dominated the market in 2024, owing to the benefits of fat emulsions in toxicity management and improved patient outcomes. The lipid emulsions act as drug delivery vehicles and reduce the toxicity of other medications. They deliver metabolic effects and act in cytoprotective signaling.

The anti-cancer treatment segment is expected to grow at the fastest CAGR in the market during the forecast period due to improved safety and reduced side effects of fat emulsions. These emulsions present improved drug delivery efficiency, reduced toxicity, and enhanced therapeutic effects. They are versatile for combination therapies and are ideal for integrated diagnostics and therapy.

The intravenous injection segment dominated the market in 2024, owing to the improved solubility, stability, targeted drug delivery, and effectiveness of certain medications. Several medications are delivered through fat emulsions to treat various health conditions like anesthesia, anxiety, seizures, and fungal infections. The emulsion formulation presents enhanced drug targeting to the liver rather than to the solution.

The oral administration segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increased patient compliance with fat emulsions, driven by the taste masking of certain drugs and their easy administration. Encapsulating drugs are protected from degradation, hold a high drug-loading capacity, and achieve controlled and sustained release. The enhanced bioavailability, absorption, improved drug stability, and protection drive the acceptance of oral administration of certain medications.

The single-chamber vials segment dominated the market in 2024, owing to the longer shelf life, reduced preparation time, and risk reduction associated with encapsulated drugs. They enable less venous irritation and decreased systemic toxicity. Fat emulsions help in the delivery of poorly soluble drugs and propofol formulations.

The multi-chamber (co-formulation) segment is expected to grow at the fastest CAGR in the market during the forecast period due to enhanced stability for active ingredients and increased convenience and safety. The emulsified drug formulations deliver improved therapeutic effectiveness. Multi-chamber systems introduce reduced dosing errors and lower risk of contamination.

The hospitals & clinics segment dominated the market in 2024, owing to the benefits of emulsified drugs in toxicology and emergency care. They offer wide applications in drug delivery and other clinical purposes. The fat emulsions are used in parenteral nutrition and are effective for various drug overdoses.

The home healthcare segment is expected to grow at the fastest CAGR in the market during the forecast period due to the nutritional benefits of fat emulsions in providing essential calories and fatty acids. The emulsified drugs minimize metabolic complications and support inflammation and immune function. They reduce the risk of liver disease and improve the quality of life.

North America dominated the market in 2024 owing to the advancements in personalized medicine and the expansion of patient care and treatment methods. The National Library of Medicine (NLM) and the National Center for Biotechnology Information (NCBI) reported on lipid emulsion therapy as the standard treatment for local anesthetic systemic toxicity and local anesthetic-mediated cardiac arrest.

The American Society of Regional Anesthesia (ASRA) recognized and recommended this therapy in the medical field. The National Institutes of Health (NIH) and the Office of Research Infrastructure Programs (ORIP) conducted the strategic plan 2021-2025 archive, which has also focused on animal models to advance the study of human diseases. The National Cancer Institute (NCI) includes nutrition in cancer care. The Organization for Economic Co-operation and Development (OECD), having its regional center in Washington, D.C. and Mexico, secured medical supply chains in a post-pandemic world.

The U.S. Food and Drug Administration (FDA) gives new drug therapy approvals and advances health through innovations. The Center for Drug Evaluation and Research (CDER) introduced several new drugs for treating rare diseases and brought many efficient therapies to the market. The National Library of Medicine (NLM) and the National Center for Biotechnology Information (NCBI) reported the effectiveness of intravenous lipid emulsion therapy in drug overdose and poisoning.

In October 2024, the Government of Canada passed legislation for the first phase of national universal pharmacare and introduced the Pharmacare Act to provide universal access to contraception and diabetes medications.

The Innovative Medicines Canada focused on policies that support the innovations of transformative medicines and vaccines to transform lives in Canada.

In March 2025, Genome Canada launched the Canadian Precision Health Initiative with the investment of $200 million to drive precision health and economic growth.

Asia Pacific is expected to grow at the fastest rate in the market during the forecast period. This regional growth is attributed to advanced formulations, nanoemulsion technologies, and the growing adoption of home-based care. The Economic and Social Commission for Asia and the Pacific (ESCAP) introduced the Asia Pacific Forum on Sustainable Development for the year 2025. The Asian Development Bank (ADB) launched a program to advance knowledge solutions for major developments and challenges. In December 2024, the ADB approved a technical assistance grant of $14.8 million to boost innovation, drive climate action, and strengthen strong development of the private sector across its regional operations.

In May 2025, the Asian Development Bank (ADB) and the Government of Japan launched a market acceleration platform and a new multi-donor trust fund to boost the development of the private sector and build long-term investments in Asia and the Pacific.

The R&D process for drug-loaded fat emulsions includes preformulation, feasibility studies, formulation development, optimization, characterization, quality control, regulatory, and clinical development.

Key Players: Baxter International Inc., AstraZeneca, Fresenius Kabi AG, Johnson & Johnson, Pfizer, Teva Pharmaceutical, and Moderna.

The distribution channels to hospitals include inpatient and outpatient pharmacies, while pharmacies include retail pharmacies, e-pharmacies, and direct-to-consumer models.

Key Players: Baxter International Inc., Fresenius Kabi, B. Braun Melsungen, Nestlé Health Science S.A., Heron Therapeutics, Pfizer.

Patient support is driven through specialty pharmacies, which include services such as patient education and training, coordination of care, 24/7 clinical support, financial assistance, logistics, and supply management.

Key Players: Fresenius Kabi, Baxter International Inc., B. Braun Melsungen AG, Aculife Healthcare Pvt. Ltd., Sichuan Kelun Pharmaceutical Co., Ltd., Otsuka Pharmaceutical Co., Ltd., Lipoid GmbH.

In May 2025, Richard Francis, the President and CEO of Teva, proclaimed that Teva Pharmaceuticals experienced the past two years with growth and the establishment of a solid foundation. Today, Teva stands out as a more focused, more innovative, and more robust company, and the CEO feels proud to deliver on their commitments.

By Type

By Application / Therapeutic Use

By Route of Administration

By Packaging / Format

By End-User

By Region

November 2025