February 2026

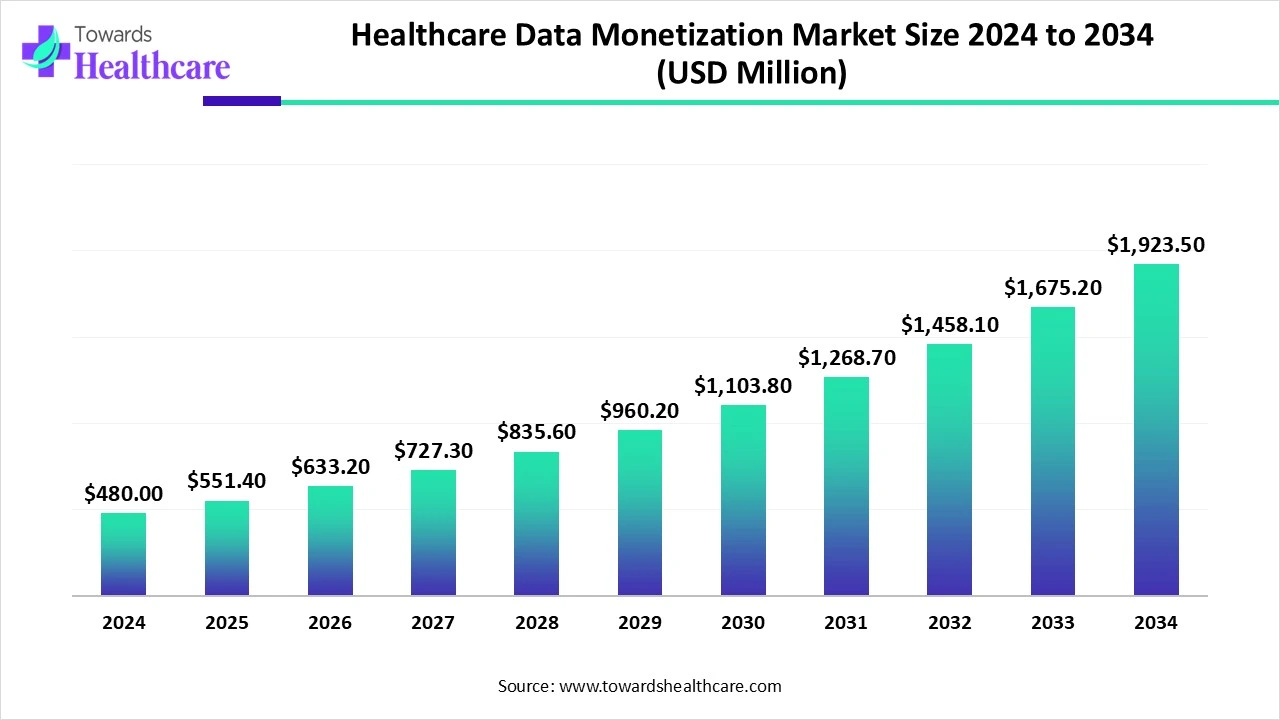

The global healthcare data monetization market size is calculated at USD 480 million in 2024, grew to USD 551.4 million in 2025, and is projected to reach around USD 1923.5 million by 2034. The market is expanding at a CAGR of 14.86% between 2025 and 2034.

The healthcare data monetization market is primarily driven by the growing demand for personalized medicines to improve patient care. The increasing number of healthcare startups encourages companies to generate more revenue. Government organizations support the development and deployment of advanced technologies such as electronic health records (EHRs) in healthcare organizations. Prominent players collaborate to access healthcare data and provide enhanced patient care. Artificial intelligence (AI) helps manage and analyze complex data and suggest ways to monetize. The future looks promising, with technological advancements.

| Table | Scope |

| Market Size in 2025 | USD 551.4 Million |

| Projected Market Size in 2034 | USD 1923.5 Million |

| CAGR (2025 - 2034) | 14.86% |

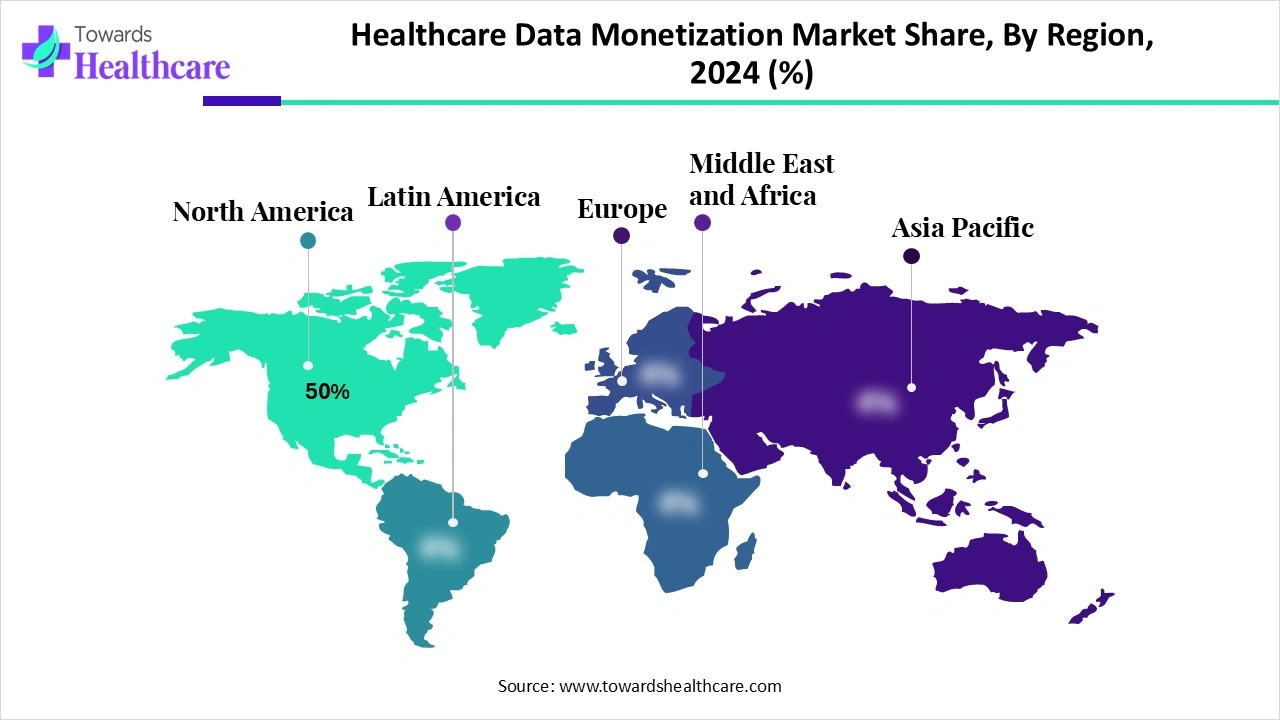

| Leading Region | North America Share 50% |

| Market Segmentation | By Data Type, By End-User, By Solution Type, By Deployment Mode, By Data Monetization Model, By Region |

| Top Key Players | IBM Corporation, Optum (UnitedHealth Group), Oracle Corporation, Allscripts Healthcare Solutions, SAS Institute, Health Catalyst, MedeAnalytics, Truven Health Analytics (IBM Watson Health), IQVIA, Flatiron Health, Datavant, Humana Inc., Change Healthcare, Explorys (IBM Watson Health), Epic Systems Corporation, Philips Healthcare, Innovaccer, Symphony Health, Parexel International |

The healthcare data monetization market refers to the practice of leveraging patient, provider, payer, and operational healthcare data to generate revenue streams, improve operational efficiency, and thereby enhance patient outcomes. This involves the collection, aggregation, analysis, and commercialization of healthcare-related datasets from electronic health records (EHRs), claims, diagnostic tests, clinical trials, wearable devices, and other digital health platforms.

Market participants offer services and technologies to extract actionable insights and monetize anonymized or de-identified data while maintaining regulatory compliance and ensuring patient privacy. The market growth is driven by the increasing adoption of digital health solutions, rising demand for real-world evidence in drug development, healthcare cost containment efforts, and advanced analytics capabilities.

Favorable Government Support: In July 2025, the U.S. government announced opening up app-based innovation and data sharing between patients and the wider healthcare system. The initiative, CMS Aligned Network, enables the sharing of patient medical records. This scheme also allows monetization of sensitive and personal health information.

Increasing Collaboration: In July 2025, Datavault AI, Inc. and IBM announced expanded commercialization of DataScore and DataValue. The integration of AI agents and expertise helps customers streamline their enterprise financial modeling, risk assessment, and pricing strategies.

AI plays an indispensable role in transforming healthcare data monetization by storing, managing, and analyzing vast amounts of patient data efficiently. It overcomes several challenges of conventional methods, such as organizing decentralized and fragmented data. AI and machine learning (ML) algorithms enable performance predictions, financial predictions, and cost-benefit analysis, allowing providers to make informed decisions. Generative AI (gen AI) can reason and make autonomous decisions, enabling the data-driven future of the enterprise. It can unlock structured data and turn raw data into actionable insights.

Increasing Competition

The major growth factor for the healthcare data monetization market is the increasing competition among healthcare organizations. The rising number of healthcare startups and venture capital investments enhances competition among healthcare organizations. In the first half of 2025, the total U.S. healthcare venture capital investment was around $3 billion, according to a report by Silicon Valley Bank.This enables them to expand their product portfolio and provide personalized services. In response to increasing competition, healthcare organizations adopt advanced technologies to manage and analyze huge amounts of patient data.

Fragmented Data

Healthcare data monetization becomes difficult due to a fragmented network of healthcare providers, payers, and patients, hindering data exchange. This limits the ability to create comprehensive patient views and derive valuable insights.

What is the Future of the Healthcare Data Monetization Market?

The market future is promising, driven by the increasing use of innovative technologies, such as blockchain technology and the Internet of Things (IoT) devices. Blockchain technology provides a decentralized infrastructure for managing healthcare data. It ensures transparency and security, allowing data owners to control access while maintaining data integrity. Blockchain-based smart contracts facilitate automated transactions, reducing dependency on intermediaries. This also enhances efficiency in data sharing agreements. Additionally, the data collection becomes easier with the use of IoT devices. IoT devices benefit healthcare companies, insurance firms and healthcare providers.

By data type, the clinical data segment held a dominant presence in the market in 2024. This is due to the need for high-quality patient care and the development of novel diagnostics and therapeutics. Clinical data is essential as it enables healthcare professionals to study patient behavior, allowing them to develop evidence-based medicines. It also provides insights into treatment effectiveness and potential risks, leading to better patient care. The increasing need for personalized medicines due to rapidly changing demographics potentiates the demand for clinical data.

The EHR/EMR data sub-segment held the largest revenue share. Many hospitals prefer adopting EHRs or electronic medical records (EMRs) to generate clinical data, allowing providers to provide personalized care. EHRs and EMRs also enable data sharing among different healthcare organizations.

By data type, the patient-generated data segment is expected to grow at the fastest CAGR in the market during the forecast period. Patient-generated data is a vital source for remote monitoring and offers a more complete picture of a patient. Advancements in technology, such as wearable medical devices and mobile apps, streamline the generation of patient data. Patient-generated data allows professionals to provide personalized care, improving health outcomes. Integrating patient-generated data into clinical care holds potential for the successful diagnosis and improved management of health conditions.

The wearables & remote monitoring sub-segment is expected to expand rapidly. The demand for wearable devices, such as smartwatches, rings, and fitness trackers, is increasing, driven by advances in biosensors and enhanced awareness of a healthy lifestyle. These devices aid in monitoring patient vital signs and increase patient-provider collaboration.

By end-user, the pharmaceutical & biotechnology companies segment contributed the biggest revenue share of the market in 2024. The segmental growth is attributed to the increasing need to expand the product portfolio. Pharmaceutical & biotech companies have suitable capital investments to adopt advanced technologies for research purposes. This enables them to develop novel healthcare products. They leverage patient information obtained from hospitals and clinics to generate revenue and strengthen their market position.

By end-user, the research organizations & CROs segment is expected to grow with the highest CAGR in the market during the studied years. Research organizations & CROs purchase healthcare data from hospitals, clinics, and other healthcare organizations. They also play a vital role in research activities and clinical trials, thereby generating healthcare data. They provide the relevant expertise and infrastructure to conduct clinical trials efficiently and effectively.

By solution type, the data analytics platform segment accounted for the highest revenue share of the market in 2024. This segment dominated because the data analytics platform simplifies the collection, processing, and analysis of huge healthcare data and gathers insights by integrating multiple data sources. It can also enable real-time data processing, allowing users to make informed decisions based on clinical data. It reduces manual errors in storing and analyzing data, as well as shares results across teams and shareholders.

The predictive analytics sub-segment held the largest revenue share. Predictive analytics uses historical and current patient data to predict future outcomes. This helps providers to deliver personalized care and detect potential adverse effects before providing treatment, improving the quality of care and saving costs.

By solution type, the data-as-a-service segment is expected to witness the fastest growth in the market over the forecast period. Certain organizations provide data on demand to various healthcare organizations irrespective of their location or infrastructure. Data-as-a-Service (DaaS) operates on a cloud platform, consolidating and organizing healthcare data in one place. The numerous benefits of DaaS include reduced risk, improved innovation, and lower costs.

The real-world evidence solutions sub-segment is expected to expand rapidly. Real-world evidence (RWE) solutions are commonly used to monitor and evaluate the postmarket safety of licensed drugs, supporting regulatory decisions. It is clinical evidence on a medical product’s safety and efficacy.

By deployment mode, the cloud-based segment led the global market in 2024. This is due to the ability of cloud-based solutions to store large amounts of healthcare data. Professionals can access data from anywhere and at any time. Cloud-based solutions operate on the internet, eliminating the need for a specialized infrastructure. They enable healthcare organizations to securely store, manage, and analyze their data for unlocking new paradigms.

By deployment mode, the hybrid segment is expected to show the fastest growth over the forecast period. Hybrid solutions leveraging on-premises and cloud-based solutions offer the benefits of both. Healthcare professionals can access healthcare data online and offline, thereby maintaining data privacy and security. Hybrid solutions favor scalability and cost-effectiveness. They also maintain sensitive data and enable data analytics and sharing.

By data monetization model, the direct monetization segment registered its dominance over the global market in 2024. This segment dominated because direct monetization refers to providing healthcare data to third parties, such as pharmaceutical companies, research institutions, and other healthcare organizations. Direct monetization reduces the risk of data leakage, maintaining patient privacy. It is the most common form of data sharing, providing accurate and precise insights into patient health and medical products.

The selling anonymized data sub-segment held the largest revenue. The growing need to protect patient privacy facilitates the de-identification and anonymization of healthcare data. Anonymizing healthcare data involves making the data untraceable to a specific individual by removing any information used to re-identify the person.

By data monetization model, the indirect monetization segment is expected to account for the highest revenue share of the market in 2024. Indirect monetization is achieved by enhancing patient outcomes, driving operational efficiency, and strategic partnerships among healthcare organizations. Healthcare professionals take several measures to achieve these, thereby generating revenue. This builds trust among patients and clients.

The strategic partnerships sub-segment is expected to expand rapidly. The increasing collaborations and merger & acquisition activities among healthcare companies foster the segment’s growth. This enables them to access their data and medical products, thereby ultimately generating revenue.

North America dominated the market share 50% in 2024. The presence of key players, a robust healthcare infrastructure, and favorable government support are the major growth factors of the market in North America. Government organizations provide incentives and launch initiatives to support healthcare data. The rising adoption of EHRs in healthcare organizations augments market growth. The increasing number of clinical trials in the region potentiates the chance of revenue generation.

It is estimated that over 96% of the hospitals in the U.S. have adopted EHRs. Key players, such as IBM Corporation, Oracle Corporation, and Wipro, are the major contributors to the market in the U.S. As of August 2025, 184,642 clinical trials were registered on the clinicaltrials.gov website in the U.S.

The Canadian government launched the “Working Together to Improve Health Care for Canadians” plan to improve health services in Canada. It aims to provide $200 million over 10 years, including $25 million in targeted bilateral funding for provinces and territories. The plan includes how governments can improve the collection, sharing, and storing of health data.

Asia-Pacific is expected to grow at the fastest CAGR in the healthcare data monetization market during the forecast period. The burgeoning healthcare sector and increasing investments by government and private organizations boost the market. The region is expanding due to the rising number of healthcare startups and the need for enhanced patient care. The increasing awareness of the value of patient data for various applications favors market growth.

China is home to more than 2,618 health tech startups, of which 1,113 are funded. The healthcare sector collectively raised about $25 billion in the last decade. As of August 2025, the total funding was $313 million. In 2024, 4 acquisitions happened in the healthcare sector. There are more than 3,000 internet hospitals in China, benefitting over 26 million people.

The Department for Promotion of Industry and Internal Trade (DPIIT) reported that there are over 1,000 startups in the healthcare sector in India. India raised the highest venture capital investment in the APAC region. In Q2 2025, PB Healthcare raised $218 million to focus on developing a tech-enabled health delivery platform, making it India’s largest VC investment of Q2 2025.

Europe is expected to grow at a considerable CAGR in the healthcare data monetization market in the upcoming period. The growing demand for personalized medicines and favorable government support bolster market growth. Government agencies encourage healthcare organizations to adopt digitalized solutions, improving patient care. The rising adoption of advanced technologies in healthcare organizations and the presence of major players propel market growth. The increasing collaborations and mergers & acquisitions among key players help access advanced data and technologies.

The UK government announced an action plan to accelerate the discovery of life-saving drugs. The government and the Wellcome Trust will invest up to £600 million to create a new health data research service. It also aims to fast-track to accelerate the development of medicines and therapies of the future.

Mitesh Rao, CEO of OMNY Health, commented that life science organizations and providers struggle with time and budget constraints that hinder their ability to learn from their data. The company’s AI-driven platforms can streamline this process by partnering with AI developers to leverage data and tools, thereby accelerating breakthrough therapies and monitoring new therapies for safety signals.

By Data Type

By End-User

By Solution Type

By Deployment Mode

By Data Monetization Model

By Region

February 2026

February 2026

February 2026

February 2026