January 2026

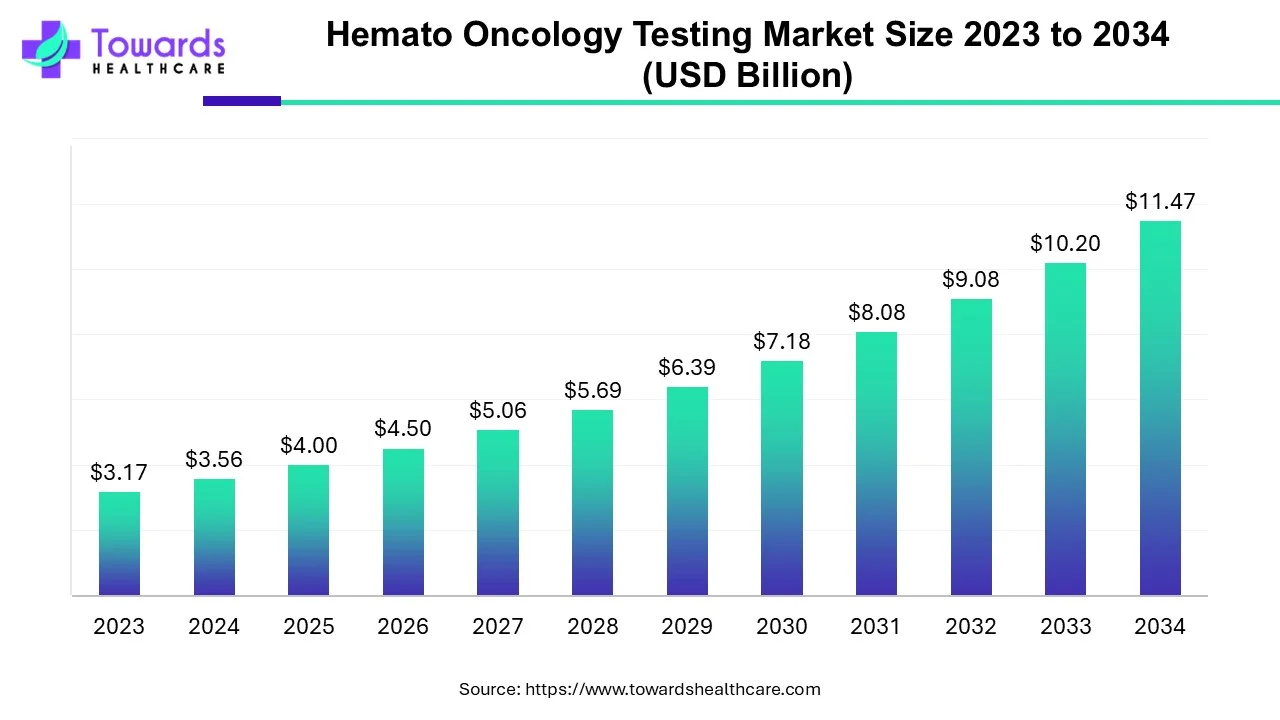

The hemato-oncology testing market size is anticipated to grow from USD 4 billion in 2025 to USD 12.88 billion by 2035, with a compound annual growth rate (CAGR) of 12.4% during the forecast period from 2026 to 2035.

| Key Elements | Scope |

| Market Size in 2026 | USD 4.50 Billion |

| Projected Market Size in 2035 | USD 12.88 Billion |

| CAGR (2026 - 2035) | 12.4% |

| Leading Region | North America |

| Market Segmentation | By Offerings, By Cancer Type, By Technology, By End User, By Geography |

| Top Key Players | F. Hoffmann-La Roche Ltd., Qiagen N.V., Abbott, EntroGen, Inc., Illumina Inc., Thermo Fisher Scientific, Inc., Bio-Rad Laboratories, Sysmex Corporation, Danaher Corporation, Beckman Coulter, Inc. |

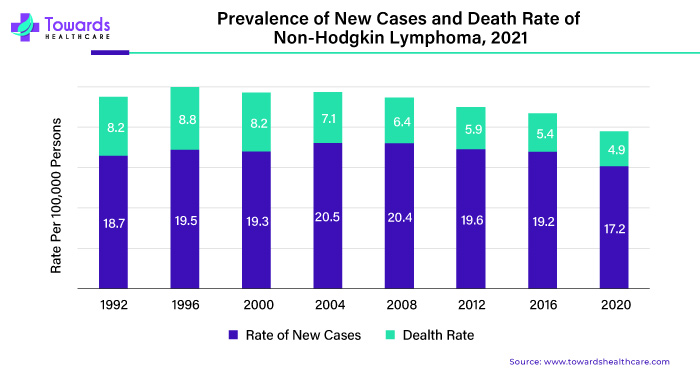

In 2024, non-Hodgkin lymphoma (NHL) comprised about 4% of all US cancers, with an estimated 80,620 new cases and 20,140 deaths. Early diagnosis and effective treatments have decreased NHL incidence and mortality rates.

Hemtao oncology is a medical specialty that diagnoses, treats, and manages cancers and blood disorders. Hemato oncology doctors are specially trained to handle various conditions related to blood cancers (like leukemia, lymphoma, and myeloma) and other types of cancers. They use treatments such as chemotherapy, targeted therapy, immunotherapy, radiation therapy, and stem cell transplantation to help patients. This field requires a good understanding of how cancer and blood disorders work, and hemato oncology often works closely with other specialists to provide the best care possible for patients.

It's super important to catch cancers and blood disorders early for many reasons. First, we can start treatment sooner when we find them early, which usually leads to better outcomes. Sometimes, we can even cure the cancer if we catch it early enough. When cancer is caught early, it's less likely to spread to other parts of the body, which makes treatment more accessible and lowers the chances of bad stuff happening. Early treatment also helps people feel better faster and improves their overall quality of life. If we don't treat blood disorders quickly, they can cause all sorts of problems like anemia or bleeding issues that mess with daily life. Another significant benefit of catching these things early is that it opens up more options for treatment. Some treatments work better in the early stages, so the sooner we see it, the more choices we have. And let's not forget about the money side of things – treating these conditions early can save a lot of money in the long run by avoiding extensive, expensive treatments or hospital stays down the road. So yeah, catching cancers and blood disorders early is a huge deal.

When more people need treatments for cancers and blood disorders, the market for stuff related to hematology gets bigger, too. Big drug companies spend money on new drugs and medicines that work better. Other medical tool companies are also trying to create better machines to find and monitor these problems early. And because more people need help, doctors who know much about hemato oncology get busier. They're in demand for things like talking to patients, doing tests, and giving treatments. So, as more people need help with these conditions, everyone involved in treating them gets busier, too.

In February 2025, Union Minister of Health & Family Welfare Shri JP Nadda inaugurates the Second AIIMS Oncology Conclave 2025 at NCI-AIIMS, Jhajjar. The AIIMS Oncology Conclave goal to bring together leading experts in cancer across all the Institute of National Importance (INIs) of India, to advancements in cancer care, treatment methodologies, and ongoing research initiatives. With a goal on breast cancers and neck and head cancers, the conclave emphasized collaborative efforts in the management and prevention of such cancers.

Hemato oncology tests are sophisticated and require specialized knowledge and equipment. These tests analyze blood cells or genetic material to detect cancer or blood disorders. Smaller healthcare facilities or regions with limited resources may need more high-tech machines and trained personnel to perform these tests accurately. As a result, patients in these areas may face challenges in accessing timely and accurate diagnosis and treatment. Addressing this issue is crucial to ensure equitable healthcare access and improve patient outcomes. Efforts to provide training, resources, and support to smaller healthcare facilities can bridge this gap and ensure that all patients, regardless of location or resources, receive quality hemato oncology care. This includes investing in infrastructure, training healthcare professionals, and implementing telemedicine solutions to enhance access to specialized expertise and testing services.

Which Offering Segment Dominated the Hemato Oncology Testing Market?

The services segment held a dominant position in the market in 2025, due to the availability of specialized equipment and the presence of skilled professionals. Services eliminate the need for patients or providers to purchase expensive tools, saving upfront and maintenance costs. They are comparatively cost-effective than assay kits. Service providers can provide tailored solutions to complex problems and detect blood cancer. They also offer high-end screening services, enabling professionals to study the future risk of the disease.

How the Lymphoma Segment Dominated the Hemato Oncology Testing Market?

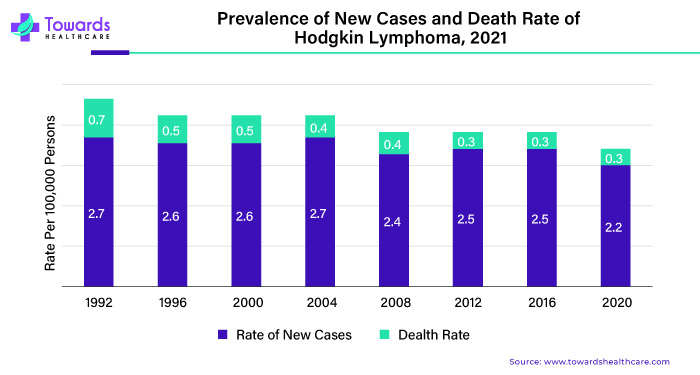

The lymphoma segment held the largest revenue share of the market in 2025. The rising prevalence of cancer, including Hodgkin lymphoma (HL) and non-Hodgkin lymphoma (NHL), is mainly due to various factors like people getting older, changes in lifestyle, and exposure to certain things in the environment. As people live longer, their chances of developing cancers, including lymphomas, increase. Lifestyle factors like smoking, unhealthy diets, and lack of exercise also contribute to the risk. Environmental factors such as pollution and exposure to chemicals can play a role, too.

For Hodgkin lymphoma, while it's not as common as some other cancers, its prevalence is still affected by these factors. It mainly affects young adults and older people.

Non-Hodgkin lymphoma, on the other hand, is more common and can affect people of all ages, including children. Both types of lymphoma are becoming more widespread globally.

For instance,

This increasing prevalence means a growing need for specialized services and treatments in Hematology-Oncology. More people seek help for symptoms, diagnosis, and treatment options related to lymphomas.

For instance,

This demand drives the development of better drugs, therapies, and diagnostic tools specifically customized for these conditions. It also means healthcare providers in hemato oncology are busier, as they work to meet the needs of more patients affected by lymphomas. So, as cancer rates rise, especially for lymphomas like Hodgkin and non-Hodgkin, the demand for hemato oncology services continues to grow.

Why Did the Polymerase Chain Reaction (PCR) Segment Dominate the Hemato Oncology Testing Market?

The polymerase chain reaction (PCR) segment accounted for the highest revenue share of the market in 2025. PCR is used in hemato oncology to help diagnose cancers and blood disorders early. It makes copies of a tiny bit of DNA from a patient's cells, which can help detect genetic abnormalities associated with these conditions.

Here's how it works: First, scientists take a small sample of the patient's blood or tissue. Then, they use special chemicals and a PCR machine to amplify or make many copies of specific DNA sequences found in the sample. If any cancer-related genetic changes are present, PCR can detect them even when there are just a few cancer cells in the sample.

PCR is crucial in diagnosing blood cancers by identifying specific bone marrow and blood cell biomarkers. These tests are susceptible, enabling the detection of cancer cells that might not be noticeable using other techniques like FISH. PCR's high efficiency ensures accurate identification of blood cancer cells, aiding in early diagnosis and treatment planning.

For instance,

This technique is susceptible and can identify genetic mutations associated with various cancers and blood disorders. By detecting these abnormalities early, doctors can start treatment sooner, which may lead to better patient outcomes. PCR is a valuable tool for early diagnosis and monitoring hemo-oncology conditions, helping patients receive timely and appropriate care.

Which End-User Segment Led the Hemato Oncology Testing Market?

The hospitals segment led the market in 2025, due to favorable infrastructure and increasing patient admissions. Hospitals invest heavily in adopting specialized tools and equipment for the diagnosis and treatment cancers. They have skilled professionals from different departments, providing multidisciplinary expertise to patients. Patients prefer visiting hospitals due to favorable reimbursement policies, enhancing their affordability.

The landscape for hemato-oncology in North America encompasses many factors, including the prevalence of hemato-oncology, leukemia, lymphoma, and myeloma, which are significant health concerns in North America. The region has a relatively high incidence rate compared to other parts of the world, with variations across different states and provinces.

Canada Market Trends

For instance,

Several organizations are undertaking efforts to improve care for blood cancer, which is anticipated to stimulate market expansion.

For instance,

The Asia-Pacific region is home to a significant portion of the world's population, including countries like China, India, Japan, South Korea, and Australia. With a large and aging population, the region faces increasing cancer incidence rates, including hematologic malignancies. The prevalence of hematologic cancers differs across countries within the Asia-Pacific region. For example, certain types of leukemia and lymphoma are more common in some Asian populations compared to Western populations. Environmental factors, genetic predispositions, and lifestyle differences contribute to these variations.

India Market Trends

For instance,

Europe is considered to be a significantly growing area, due to advancements in diagnostic technologies, growing awareness of early cancer diagnosis, and favorable government support. Government organizations provide funding to develop innovative hemato-oncology testing tools and kits. The increasing demand for point-of-care diagnostics and suitable regulatory landscapes contribute to market growth. The rising adoption of advanced technologies and growing R&D investments also foster the market.

UK Market Trends

Approximately 250,000 people are living with blood cancer in the UK. The UK has a suitable clinical trial infrastructure. As of 2025, 300 trials were reported on the clinicaltrials.gov website related to blood cancer diagnosis, accounting for 6.17% of the total trials. The UK government invested £11 million in six projects, aimed at increasing early cancer diagnosis.

The Middle East & Africa are expected to grow at a considerable CAGR in the upcoming period. The increasing prevalence of blood cancer and advances in diagnostic technologies boost the market. The growing demand for point-of-care diagnostics and the rising adoption of advanced technologies foster market growth. Countries like the UAE, Saudi Arabia, and South Africa conduct clinical trials related to hemato-oncology.

UAE Market Trends

The UAE government is at the forefront of promoting cancer prevention, diagnosis, and treatment. In 2025, it approved the first gene therapy, CASGEVY, for the treatment of blood disorders. As of December 2025, the UAE locally produces 3 oncology drugs, including Lenalidomide, Pomalidomide, and Sunitinib.

Latin America is expected to grow at a notable CAGR in the foreseeable future. Government bodies launch initiatives to raise awareness about the screening and early diagnosis of hematology cancer. Numerous institutions conduct seminars, workshops, and conferences to share the latest updates about the latest diagnostic techniques. The increasing healthcare expenditure and growing research and development activities also contribute to market growth.

Brazil Market Trends

Brazil ranks second in Latin America after Mexico in the biotechnology sector. AC Camargo and Oncoclinicas & Co. are clinics that provide hematology testing to Brazilians. Brazil recently opened the largest blood products factory in Latin America, with an investment of R$1.9 million, to produce high-cost medicines from human plasma.

By Offerings

By Cancer Type

By Technology

By End User

By Geography

January 2026

January 2026

January 2026

December 2025