February 2026

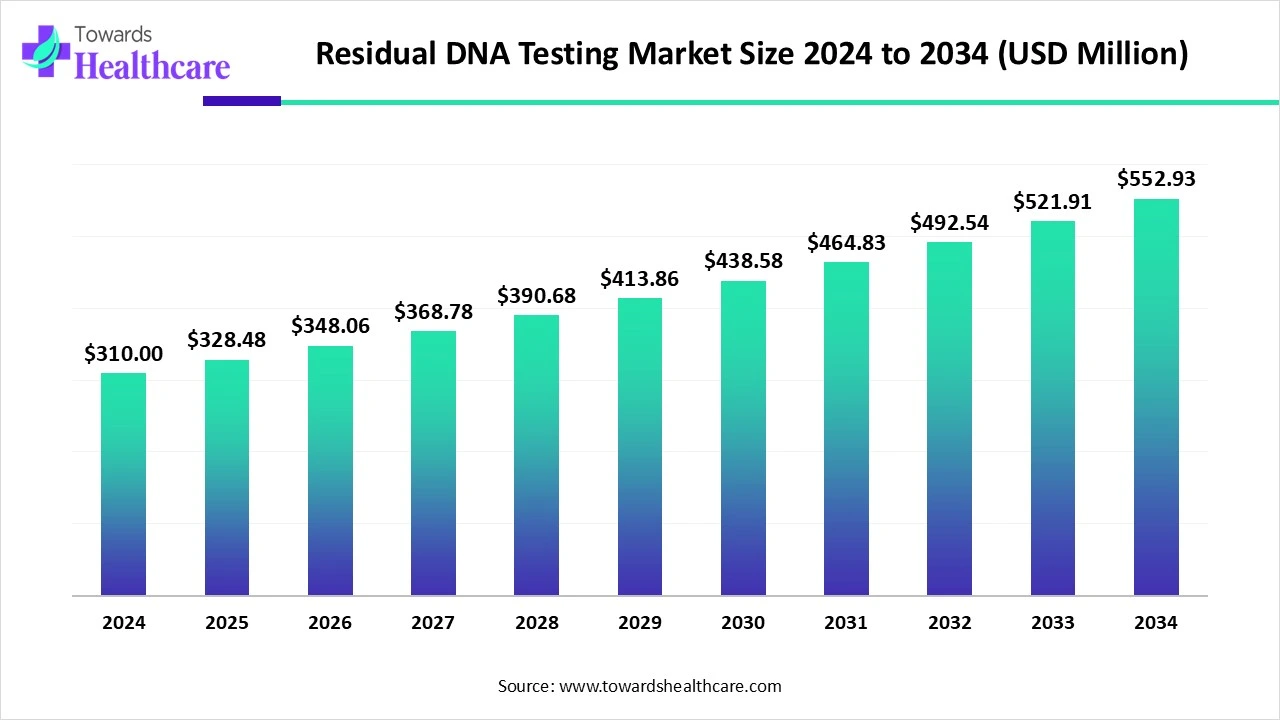

The global residual DNA testing market size stood at US$ 310 million in 2024, grew to US$ 328.48 million in 2025, and is forecast to reach US$ 552.93 million by 2034, expanding at a CAGR of 5.96% from 2025 to 2034.

Due to reasons including changing customer tastes, technical developments, and increased knowledge of the product's advantages, the market for residual DNA testing is expanding quickly. Market growth is further fueled by companies increasing their services, innovating to match customer wants, and capitalising on emerging trends as demand grows. The market for residual DNA testing is anticipated to grow as sequencing technology advances further. Examples of these advancements include next-generation sequencing (NGS).

| Table | Scope |

| Market Size in 2025 | USD 328.48 Million |

| Projected Market Size in 2034 | USD 552.93 Million |

| CAGR (2025 - 2034) | 5.96% |

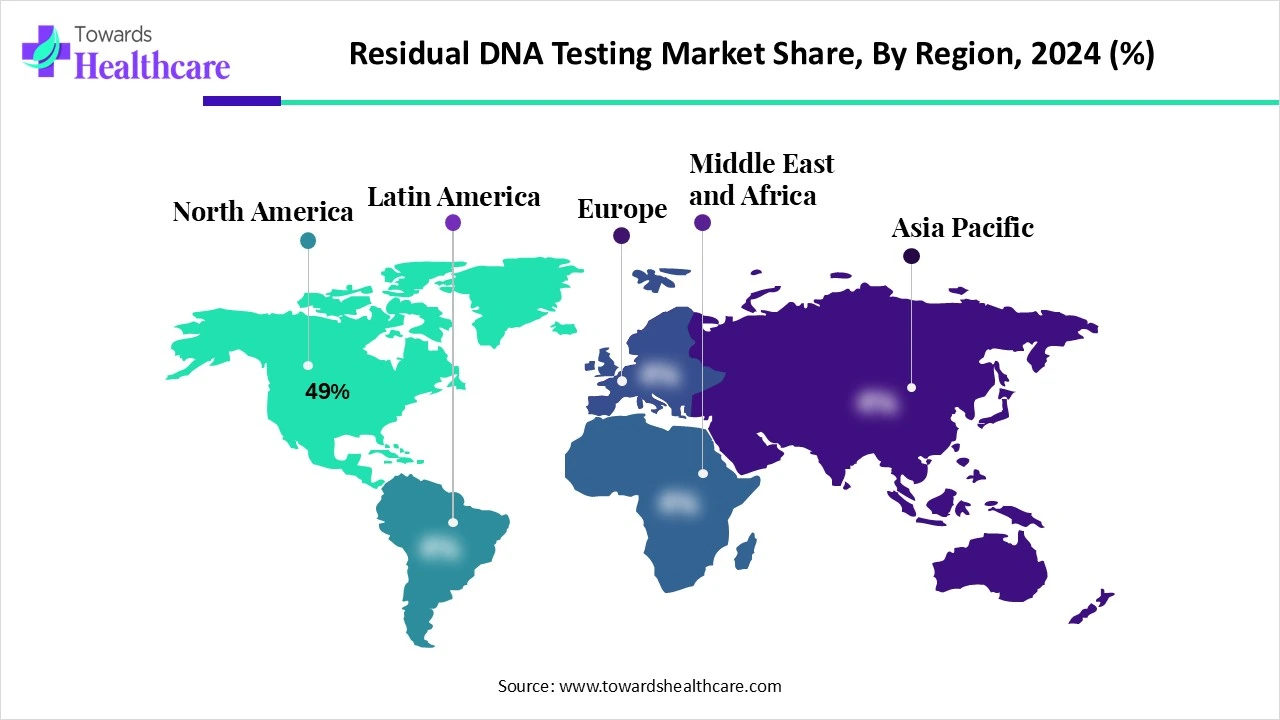

| Leading Region | North America Share 49% |

| Market Segmentation | By Technology, By Product & Service, By Application, By End User, By Sample Type, By Region |

| Top Key Players | Thermo Fisher Scientific, Merck KGaA (MilliporeSigma), QIAGEN N.V., Roche Diagnostics, Promega Corporation, Agilent Technologies, Bio-Rad Laboratories, Abcam plc, Takara Bio Inc., Lonza Group AG, SGS SA, Charles River Laboratories, Eurofins Scientific, WuXi Biologics, Catalent, Inc., bioMérieux SA, ZyGEM, Everest Biosciences, SCIEX (Danaher), GenScript Biotech |

The residual DNA testing market refers to the segment of the biopharmaceutical and life sciences industry focused on detecting and quantifying trace amounts of host cell DNA that may remain in biologic products (e.g., vaccines, monoclonal antibodies, cell and gene therapies, and recombinant proteins). Regulatory bodies such as the FDA, EMA, and ICH mandate stringent limits on residual DNA to ensure product safety, purity, and consistency. Testing typically targets DNA from host production cells such as CHO, E. coli, HEK293, or Vero. This market is driven by growth in biologics, regulatory compliance needs, and advancements in quantitative molecular technologies.

Growing Collaboration Among Top Companies: Residual DNA testing has become an essential part of the biotechnology and pharmaceutical industries, especially due to the growing demand for biologics and vaccines. This has increased the growing demand for DNA testing kits, due to which a lot of major companies are collaborating to provide high-quality products and services.

For instance,

AI may greatly improve residual DNA testing in a number of ways, such as enhancing purifying procedures, detecting possible disease-causing variations, and increasing data analysis speed and accuracy. In order to identify genetic illnesses more quickly and accurately, artificial intelligence (AI) systems can categorise variations, analyse enormous quantities of genomic data, and forecast how these variants will affect gene function. AI can also forecast purification success by correlating DNA clearance data with process characteristics. This helps to optimise procedures and avoid contamination problems.

Need for Safety & Quality in Biological Products

Even though it is frequently found in extremely small amounts, leftover DNA might cause safety issues and regulatory red flags if it is not adequately managed and measured. Forensic science, cell therapy, gene therapy, and biopharmaceuticals are all quickly developing fields where residual DNA testing is an essential safety and quality step.

The FDA Guidance for Industry, ICH Q6B, and EMA quality guidelines, among others, set strict limitations on residual DNA content to guarantee that biological products fulfil safety, effectiveness, and purity requirements. Manufacturers must take proactive measures to mitigate residual DNA hazards when new therapeutic modalities including CAR-T therapies, mRNA vaccines, and viral vector-based treatments become available in order to meet market demands and compliance regulations.

High Cost of Testing

Although there is a lot of potential in the residual DNA testing business, there are a number of obstacles that might slow its rate of expansion. In areas where cost is still a major deciding factor, price sensitivity is one of the most prevalent issues. Despite the increase in demand, customers still compare prices and seek good value.

What are the opportunities in the residual DNA Testing Market?

Additionally, the industry offers a wealth of chances for expansion and creativity. New detection techniques are being developed as a result of the growing cooperation between pharmaceutical corporations and academic organisations. Accurate detection techniques are required as a result of the growing need for customised biopharmaceutical solutions brought about by personalised medicine. Additionally, businesses that specialise in residual DNA detection technology have a great chance to grow into new countries where regulatory frameworks are changing. Businesses may efficiently serve these expanding markets by utilising their resources and skills.

By technology, the quantitative PCR (qPCR) segment held the largest share of the residual DNA testing market in 2024. The detection of residual host cell DNA (resDNA) in therapeutic protein preparations requires the use of real-time quantitative PCR (qPCR). Although each project has a different ideal solution, qPCR is regarded as the gold standard for quantifying leftover DNA. For identifying specific sequences of concern, its sequence-specific amplification is the most economical method available.

By technology, the next-generation sequencing (NGS) segment is estimated to grow at the highest rate during the forecast period. NGS is being used more and more in residual DNA testing because it provides a strong means of identifying and describing genetic material in samples, even at low quantities. NGS makes it possible to sequence millions of DNA fragments at high throughput, yielding comprehensive data on genetic mutations and variants. Finding certain DNA sequences or mutations that could be present in tiny levels is frequently the aim of residual DNA testing, where this skill is very helpful.

By product & service, the testing kits & reagents segment led the residual DNA testing market in 2024. The final therapeutic material must be examined when dealing with biopharmaceuticals to make sure it is devoid of contaminants, such as host cell DNA residue. The dual-labeled hydrolysis probes used in residual DNA detection kits enable the sensitive and quick real-time PCR measurement of remaining host cell genomic DNA.

By product & service, the assay development & custom services segment is anticipated to witness the fastest CAGR during the upcoming period. Services for developing custom assays are intended for specialised or unique host cells. For specialised assistance in furthering medication research and development, Tailored R&D Solutions provide direct access to knowledgeable experts and cutting-edge technology.

By application, the monoclonal antibodies & recombinant proteins segment held the major share of the residual DNA testing market in 2024. Remaining host cell DNA contamination must be kept to acceptable levels throughout the production of biopharmaceuticals, such as monoclonal antibodies, therapeutic and recombinant proteins, and vaccinations, in order to prevent possible safety hazards including immunogenicity and oncogenicity.

By application, the cell & gene therapies segment is estimated to be the fastest growing during the predicted period. Remaining quantities of host-cell DNA (hcDNA) may be present in cell and gene therapies produced using cell-substrate manufacturing techniques. This poses a safety concern to patients receiving treatment. As a result, pharmaceutical companies keep an eye on and regulate the amounts of residual hcDNA in purified goods.

By end-user, the pharmaceutical & biotechnology companies segment was dominant in the residual DNA testing market in 2024. In pharmaceutical and biotechnology industries, residual DNA testing is essential to guaranteeing the quality and safety of biopharmaceutical products. Trace levels of host cell DNA that could still be present in finished goods following manufacture and purification are found and measured. In order to maintain uniformity between batches, assure product safety, and satisfy regulatory standards, this testing is crucial.

By end-user, the contract research & testing organizations segment is anticipated to grow at the highest rate during 2025-2034. By offering pharmaceutical, biotechnology, and medical device businesses specialised research and testing services, contract research and testing organizations, often referred to as Contract Research Organisations (CROs), play a critical role in the healthcare industry. These groups support the management of clinical trials, expedite the drug development process, and guarantee regulatory compliance.

By sample type, the final drug substance/formulation segment led the residual DNA testing market in 2024. Cell line residual DNA may remain in the finished medication formulation or substance, which, if harmful genetic material is transmitted, may result in negative side effects for patients. Regulatory bodies have set limitations for this critical quality attribute (CQA) that vary based on the dosing schedule and parental cell line, ranging from 10 to 100 pg host cell DNA/dose.

By sample type, the fill-finish samples segment is expected to grow at the highest CAGR during the forecast period. Leaders in fill finish must set themselves apart in the production process by being efficient and safe. Because it necessitates meticulous planning, highly skilled workers, and specialised, sterile facilities and equipment, aseptic fill finish processing for extremely powerful and biologic goods is particularly difficult.

North America dominated the residual DNA testing market share by 49% in 2024. Increased investments in the life sciences sector have led to a rise in demand for residual DNA testing products and services, which may be attributed to the presence of industry leaders and the growth in biologics research and development. Its market dominance is reinforced by the region's concentration of multinational organisations, such as biotech and pharmaceutical companies, which also encourages biologics innovation.

The U.S. residual DNA testing market is set for strong growth from 2025 to 2034, with revenues expected to reach hundreds of millions, driven by changing consumer needs and advances in technology.

The FDA's CBER is responsible for regulating biological products for human use in accordance with relevant federal regulations, such as the Federal Food, Drug, and Cosmetic Act and the Public Health Service Act. CBER safeguards and promotes public health by guaranteeing that biological products are accessible to people in need and are safe and effective. To encourage the responsible and safe use of biological products, CBER also disseminates information to the general public.

Health Canada strives to optimise the safety and efficacy of radiopharmaceuticals, biologics (such as vaccines and biotechnology products), and biopharmaceuticals in the Canadian market and healthcare system. A biologic must be shown safe, effective, and of appropriate quality by a significant body of scientific data before it can be considered for approval.

Asia Pacific is estimated to host the fastest-growing residual DNA testing market during the forecast period. In countries like China, Japan, and India, the growing prevalence of cancer, the growing use of advanced molecular diagnostic technologies, and the development of healthcare infrastructure all contribute to this trend. Adoption is also being fueled by favourable reimbursement regimes, growing government backing, and the rise of international diagnostics firms in APAC nations.

China has prioritised advancing the research and development of biosimilars due to its high demand for biologic medicines. Since China's drug evaluation and approval system has undergone ongoing reform in recent years, the National Medical Products Administration (NMPA) has issued a number of guidelines for the development and evaluation of biosimilars in the country. These guidelines are based on the World Health Organization's (WHO) and other international guidelines for biosimilars, but they also take into account China's unique situation.

More foreign corporations are collaborating with Indian businesses as biosimilars take a larger portion of the global biologicals industry and because India offers a more affordable location for research and development.

Europe is expected to grow significantly in the residual DNA testing market during the forecast period. Germany, France, and the United Kingdom are in the vanguard of Europe, which comes in second. With strong legislative frameworks, these countries place a high priority on healthcare innovation. The need for residual DNA testing is fueled by the growing incidence of cancer and the emphasis on precision medicine.

Up from £1.80 billion last year, the UK's cutting-edge biotech and life sciences sector has already secured £1.98 billion in investment in Q1 and Q2 2024. By creating and implementing measures to establish the UK as the centre of medical innovation, fostering higher-risk science, and enhancing the country's top-notch clinical research environment, the government and business community want to use the UK's current competitive advantages.

In January 2024, according to Joydeep Goswami, chief strategy and business development officer and chief financial officer of Illumina, this partnership demonstrates the potential of the company's whole-genome approach in cancer as well as the worth of our exclusive MRD technology. In order to further clinical research in cancer, we are collaborating with pharmaceutical partners like as Janssen to develop a whole-genome sequencing MRD test that is sensitive, accurate, and widely accessible.

By Technology

By Product & Service

By Application

By End User

By Sample Type

By Region

February 2026

February 2026

January 2026

January 2026