February 2026

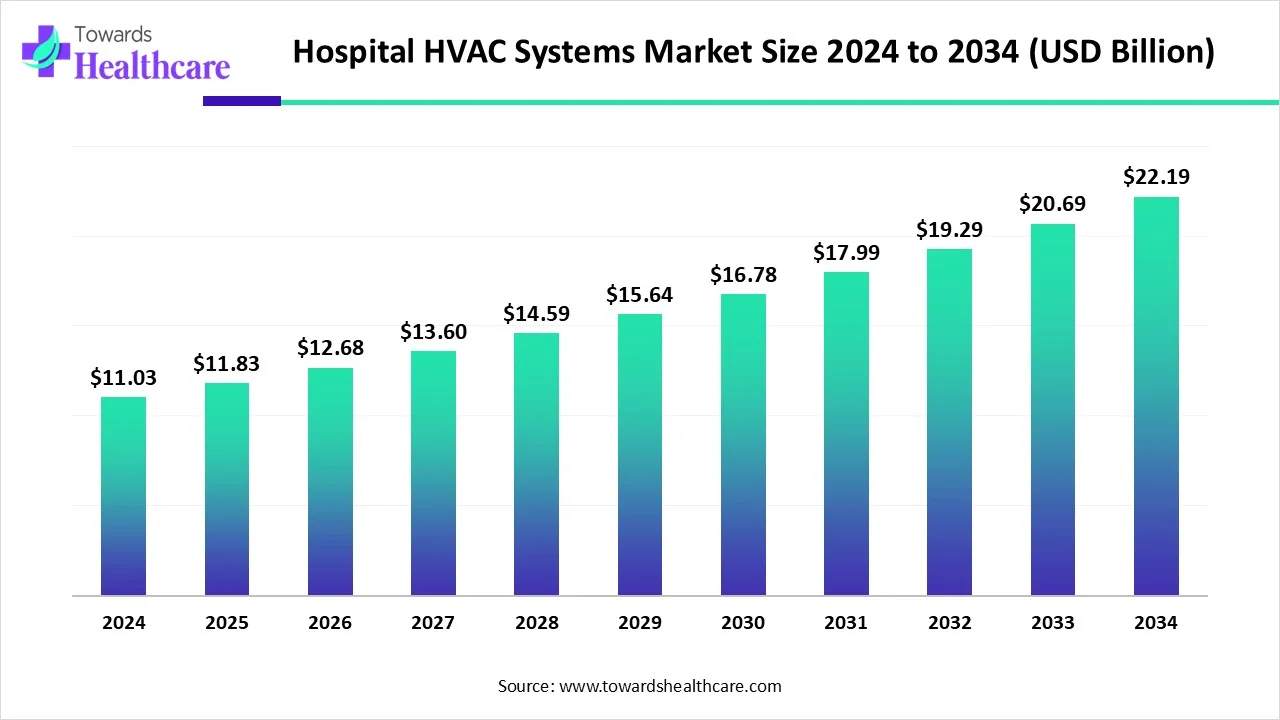

The global hospital HVAC systems market size is calculated at USD 11.03 billion in 2024, grows to USD 11.83 billion in 2025, and is projected to reach around USD 22.19 billion by 2034. The market is expanding at a CAGR of 7.24% between 2025 and 2034.

| Metric | Details |

| Market Size in 2024 | USD 11.03 Billion |

| Projected Market Size in 2034 | USD 22.19 Billion |

| CAGR (2025 - 2034) | 7.24% |

| Leading Region | Asia-Pacific |

| Market Segmentation | By Product, By End Use, By Region |

| Top Key Players | LG Electronics, Lennox International Inc., Carrier Corporation,Samsung Electronics Co., Ltd., Electrolux AB Corporation, United Technologies Corporation, Haier Inc., Havells India Ltd., Johnson Controls–Hitachi Air Conditioning, Emerson Electric Co., Rheem Manufacturing Company, Mitsubishi Electric Trane HVAC US LLC |

The hospital HVAC system is an integrated mechanical system specifically designed for healthcare facilities to regulate indoor environmental conditions such as temperature, humidity, air flow, and air purity to ensure patient safety, comfort, and infection control. It includes advanced components like HEPA filters, air pressure control, and zoning capabilities to meet the stringent health, safety, and regulatory standards required in areas like operating rooms, intensive care units, and isolation wards. The market is expanding due to rising healthcare infrastructure, growing awareness of infection control, and strict regulatory standards. An advanced HVAC system improves air quality, ensures patient safety, and supports energy efficiency. Technological innovation, like smart controls and IoT integration, further boosts demand. Additionally, aging hospital facilities are being upgraded, driving the need for modern systems.

Artificial Intelligence is transforming the market by enhancing energy efficiency, ensuring optimal air quality, and reducing operational costs. Through real-time data analysis, AI enables systems to adjust settings based on occupancy, temperature, and air quality, which is vital in healthcare environments. It also supports predictive maintenance, minimizing downtime and extending equipment lifespan. Additionally, AI allows for seamless integration with smart hospital systems, promoting overall operational efficiency. These advancements help maintain strict environmental standards while improving patient safety and reducing energy and maintenance expenses.

Hospital HVAC System Upgrade Demand 2025

The hospital required round-the-clock climate control, making energy efficiency essential for reducing operational costs. Additionally, stricter environmental regulations and sustainability goals are pushing healthcare facilities to upgrade to greener technologies. Modern HVAC systems also enhance indoor air quality, which is critical for infection control and patient health. Technological advancements, such as smart control and heart recovery systems, further boost the appeal of energy-efficient solutions in the healthcare environment.

High Maintenance and Installation Costs

The system requires complex designs tailored to strict healthcare standards. Installation involves specialized equipment and skilled labor, leading to higher upfront costs. Additionally, ongoing maintenance is essential to ensure consistent air quality and system efficiency, which adds to operational expenses. Smaller hospitals or those in developing regions may find these costs prohibitive, limiting widespread adoption. These financial barriers can delay upgrades or discourage investment in advanced HVAC technologies despite their long-term benefits. The installation of HVAC systems often requires a significant financial investment, typically ranging from USD 3,000 to more than USD 30,000, while a full system replacement can cost between USD 15,000 and USD 40,000, making the high upfront and maintenance expenses a major factor that may limit the expansion of the hospital HVAC systems market.

Integration of IoT with HVAC Systems

The integration of IoT with the HVAC system presents a major opportunity for the hospital HVAC systems market by enabling real-time monitoring, control, and optimization of the indoor environment. IoT sensors help maintain critical parameters such as temperature, humidity, and air quality, ensuring safer, cleaner conditions for patients and staff. This technology supports predictive maintenance, reducing downtime and repair costs. Additionally, IoT-enabled HVAC systems improve energy efficiency and help hospitals comply with strict health and safety regulations. Remote access and automation further enhance operational efficiency, making IoT integration a valuable investment for modern healthcare facilities.

IoT Analytics GmbH projects that IoT device connections will grow from 11.7 billion in 2020 to 30.9 billion by 2025, at a CAGR of 13%. This surge in connected devices is expected to boost the adoption of smart HVAC systems. In hospitals, integrating IoT with HVAC can improve efficiency, automation, and air quality control, creating new growth opportunities in the healthcare HVAC market.

By product, the cooling segment accounted largest share in the hospital HVAC systems market in 2024, due to the critical need for precise temperature and humidity control in a medical environment. Cooling systems help maintain sterile conditions, prevent the growth of harmful microorganisms, and ensure the optimal functioning of sensitive medical equipment. Additionally, they support patient comfort and safety, particularly in operating rooms and intensive care units. With rising energy efficiency demands and increasing heat loads from advanced medical devices, hospitals are investing more in advanced cooling solutions within their HVAC infrastructure.

By product, the heating segment is estimated to grow at a significant CAGR over the forecast period, due to the rising demand for reliable indoor heating in colder regions and during winter seasons. Hospitals require consistent heating in colder regions and during winter seasons. Hospitals require consistent heating to maintain patient comfort, ensure optimal recovery conditions, and support temperature-sensitive medical functions. Additionally, growing healthcare infrastructure, especially heating systems. Advancements in energy-efficient and environmentally friendly heating technologies further contribute to the hospital HVAC systems market expansion.

By end-user, the intensive care unit (ICU) held a significant share of the market in 2024, due to its critical need for precise environmental control. ICUs require HEPA filters to maintain sterile conditions, such as preventing the spread of airborne infection. Additionally, strict temperature and humidity control are required. These units also utilize specialized pressure-controlled rooms to minimize cross-contamination, which demands advanced HVAC technology. Given their 24/7 operation and high sensitivity to environmental changes, ICUs necessitate robust, reliable, and efficient HVAC systems, driving greater investment in the hospital HVAC systems market.

By end-user, the airborne infection isolation rooms segment is expected to grow at a lucrative rate in the coming years, due to increasing awareness of infection control and the rising incidence of airborne diseases such as tuberculosis and measles. Regulatory bodies are enforcing strict guidelines for air quality and isolation standards, encouraging hospitals to invest in advanced HVAC solutions. Additionally, ongoing improvements in healthcare infrastructure and the growing need to ensure patient and staff safety are further boosting demand for AIIR systems.

In 2024, the Asia-Pacific region dominated the hospital HVAC systems market due to a combination of rapid healthcare infrastructure development and rising demand for modern medical facilities. Countries such as China, India, and those in Southeast Asia have significantly increased investments in hospitals to meet growing healthcare needs. This, combined with rapid urbanization, economic growth, and stricter government regulations on air quality and infection control, drove demand for advanced HVAC systems. Additionally, the region’s booming medical tourism and affordable, localized HVAC solutions contributed to its market leadership and technological adoption.

China’s market is accelerating rapidly due to strong government investment in healthcare infrastructure, particularly in developing urban areas. The rising urban population and aging demographic are driving demand for modern hospitals with advanced HVAC systems to ensure patient safety and comfort. Stricter regulations on air quality and infection control are also pushing hospitals to adopt high-performance HVAC solutions. Additionally, local manufacturers are offering innovative, energy-efficient systems at competitive prices, further boosting market growth in both new constructions and upgrades.

India’s market is growing due to expanding healthcare infrastructure, especially in tier II and III cities. Government initiatives like 'Make in India' and the PLI scheme are boosting domestic HVAC manufacturing. Rising demand for energy-efficient and smart HVAC solutions, coupled with the country’s hot and humid climate, is increasing adoption in hospitals. Post-pandemic awareness of indoor air quality and infection control has further fueled investment in advanced HVAC systems to ensure safe, comfortable environments for patients and healthcare professionals.

For Instance,

North America is anticipated to grow at the fastest CAGR in the market during the forecast period, due to strict indoor air quality regulations and increasing investments in healthcare infrastructure. The demand for advanced, energy-efficient HVAC systems is rising as hospitals aim to improve patient comfort and operational efficiency. Additionally, the region benefits from strong technological advancements and the presence of leading HVAC manufacturers, contributing to the faster adoption of smart systems and sustainable climate control solutions in modern medical facilities.

The U.S. market is rising due to a combination of regulatory, technological, and infrastructure-driven factors. Stringent standards for air quality and thermal comfort in healthcare settings require hospitals to adopt high-performance HVAC systems. Growing investments in hospital construction and renovation projects further fuel demand for modern, energy-efficient climate control solutions. Additionally, advancements in smart HVAC technologies, such as automated monitoring and energy optimization, are gaining traction. The increasing focus on sustainability and operational cost reduction also drives hospitals to upgrade or replace outdated systems.

The Canadian market is increasing due to demand for specialized systems that support infection control, equipment cooling, and controlled environments for sensitive medical procedures. Aging hospital infrastructure is also prompting retrofitting with modern HVAC systems tailored to critical care areas. Additionally, provincial healthcare funding and public-private partnerships are accelerating HVAC upgrades in both urban and remote facilities. The push toward digital infrastructure in healthcare is further increasing the need for precision-controlled environments, boosting demand for advanced HVAC solutions.

Europe is expected to see significant growth in the hospital HVAC systems market during the forecast period, due to increasing demand for energy-efficient and sustainable solutions, driven by strict regulatory standards. The need to upgrade aging hospital infrastructure and improve indoor air quality has become more urgent, especially following heightened awareness after the pandemic. Technological advancements, such as smart HVAC systems, are also encouraging adoption. Additionally, government investments in healthcare infrastructure are supporting the modernization of hospitals, contributing to the expansion of the hospital systems' HVAC market across the region.

The UK market is expanding due to several key factors. Government initiatives, such as the Heat and Buildings Strategy, are accelerating the transition to low-carbon heating solutions, encouraging the use of renewable energy sources like heat pumps. The growing demand for smart buildings has led to increased integration of IoT-based HVAC systems, providing enhanced control, automation, and energy management. Additionally, the emphasis on improving indoor air quality has prompted upgrades to HVAC systems, incorporating advanced filtration technologies and air purifiers to create healthier environments. These developments, supported by government incentives and a focus on sustainability, are driving the growth of the market in the UK.

The market in France is expanding due to strict energy efficiency regulations and government incentives promoting sustainable infrastructure. Programs like MaPrimeRenov encourage hospitals to adopt advanced, energy-efficient systems, including heat pumps. The country’s emphasis on reducing carbon emissions and improving indoor air quality supports the upgrade of existing facilities. Additionally, the push for smart technologies and modernized healthcare infrastructure is driving demand for innovative HVAC solutions. These combined factors are contributing to the steady growth of the market in France.

In October 2024, Chris Hani Baragwanath Academic Hospital recently opened a specialised adult burns ICU, with a key focus on an advanced HVAC system to support patient recovery. The project, launched in late 2021 and funded by Wits University alumni, was designed to meet the unique needs of burn patients, who require strict temperature and humidity control due to their compromised skin. The unit maintains a temperature of 26°C to 28°C and humidity between 50% and 60%, following international standards. Lead engineer Kamva Ndlala from Maninga Engineering explained that hybrid air handling units with three-stage filtration, primary, secondary, and HEPA, were used to maintain clean air.

By Product

By End Use

By Regions

February 2026

January 2026

February 2026

November 2025