February 2026

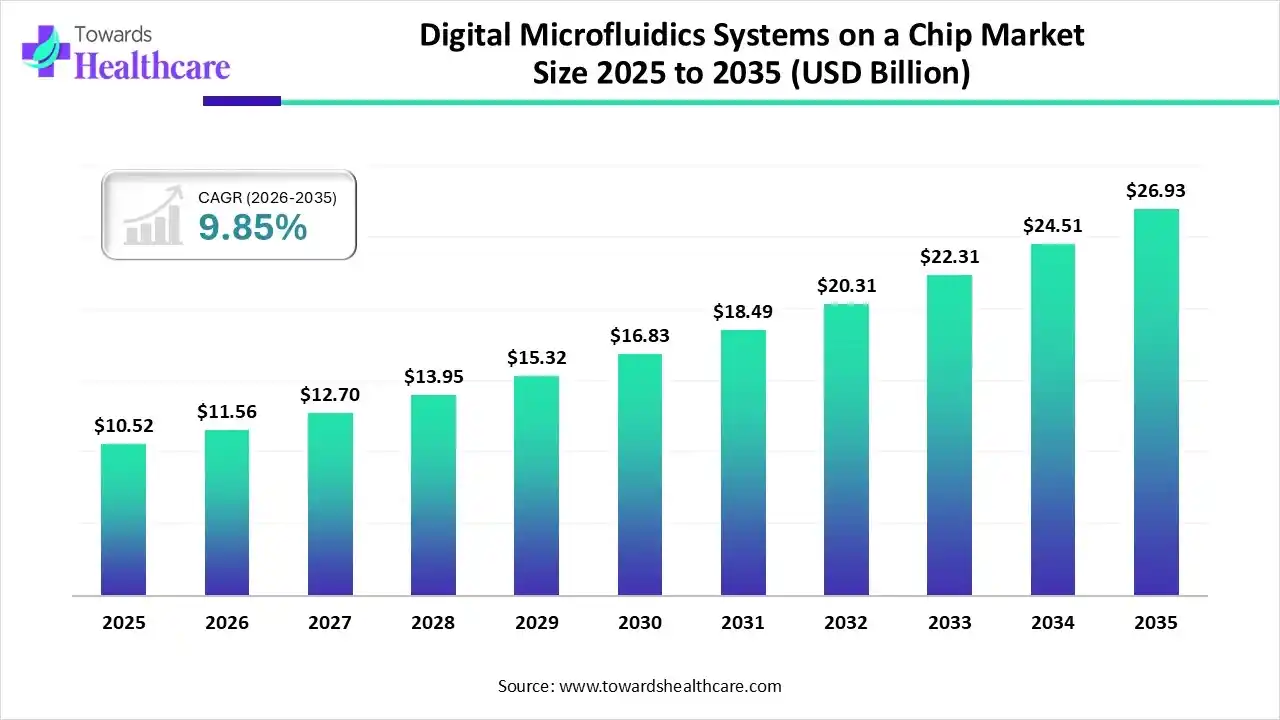

The digital microfluidics systems on a chip market size touched US$ 10.52 billion in 2025, with expectations of climbing to US$ 11.56 billion in 2026 and hitting US$ 26.93 billion by 2035, driven by a CAGR of 9.85% over the forecast period.

The growing incidence of various diseases is increasing the use of digital microfluidics systems on a chip for their early detection. It is also being used for the development and selection of drug candidates. This is leading to new developments and launches by the companies that are supported by various funding and investments. AI is also being integrated with it to enhance its automation and reduce errors. Thus, this is increasing its use in different regions, which is promoting the market growth.

| Key Elements | Scope |

| Market Size in 2026 | USD 11.56 Billion |

| Projected Market Size in 2035 | USD 26.93 Billion |

| CAGR (2026 - 2035) | 9.85% |

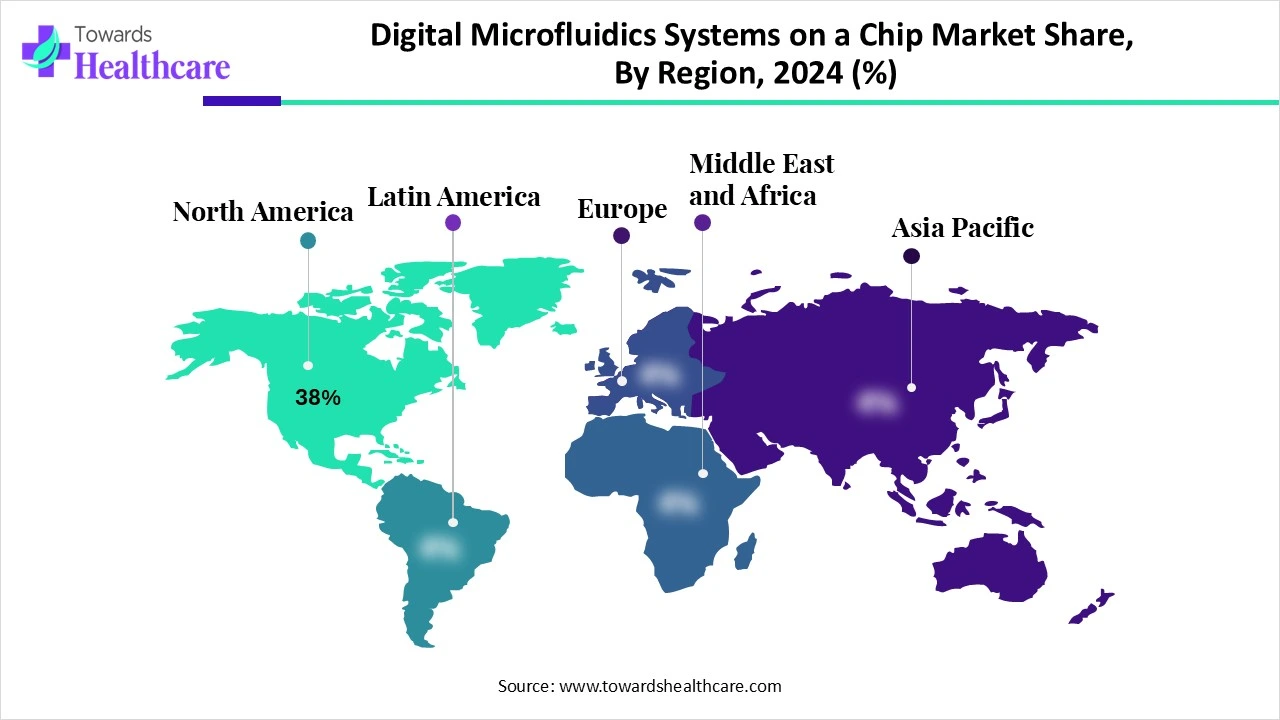

| Leading Region | North America by 38% |

| Market Segmentation | By Technology Type, By Application, By End-User, By Product Type, By Material Type, By Mode of Operation, By Region |

| Top Key Players | Advanced Liquid Logic (now part of Illumina), Illumina, Inc., Micronit Microtechnologies B.V., Microfluidic ChipShop GmbH, Bio-Rad Laboratories, Inc., Fluidigm Corporation, Danaher Corporation (Beckman Coulter), Tecan Group Ltd., Agilent Technologies, Inc., Merck KGaA (MilliporeSigma), PerkinElmer, Inc., Thermo Fisher Scientific Inc., Droplet Genomics, Emulate, Inc., Sphere Fluidics Ltd., Blacktrace Holdings Ltd. (Dropix), Fluigent, Caliper Life Sciences (now part of PerkinElmer), Fluigent, BioFluidica, Inc. |

The digital microfluidics systems on a chip market refers to miniaturized platforms that manipulate discrete droplets of liquids on an array of electrodes using electrical signals. Unlike continuous microfluidic flow systems, digital microfluidics control droplets individually by electrowetting, dielectrophoresis, or other electrical methods on a chip surface. These systems enable precise, programmable, and automated handling of tiny fluid volumes (picoliters to microliters) and are widely used in biomedical diagnostics, chemical synthesis, drug discovery, point-of-care testing, and environmental monitoring.

To enhance various parameters of the digital microfluidics system on a chip, the use of AI is increasing. With the use of AI, the droplet movements can be controlled and optimized. It helps in the development of reliable devices as it can detect errors and the chances of failures during operations. Moreover, it provides accurate diagnoses and interpretations. The microfluidic steps can also be automated with the use of AI. Thus, smart microfluidics devices are being developed, which can provide decision support utilizing AI.

Increasing Demand for Point-of-Care Diagnostics

Due to the growing diseases and awareness, the demand for point-of-care diagnostics is increasing. This is increasing the use of digital microfluidics systems on a chip for quick and accurate detection of diseases. As these devices involve simple procedures, minimize errors, and are portable, their use is increasing. Its use for the selection of appropriate medications is also increasing.

Complex Fabrication Process

The slight changes in the fabrication of digital microfluidics systems on a chip can lead to the failure of the device. The selection of materials for its development is difficult, as they must be biocompatible, non-absorptive, and non-reactive with the biological samples. They may also get contaminated or degraded due to improper storage or development conditions. Thus, this affects their fabrication process.

Growing Advancements

To improve the accuracy and sensitivity of digital microfluidics systems on a chip, various innovations are being conducted. Sensors are also being integrated into these devices to enhance the wireless automation and promote continuous health monitoring through smartphones. Development to enhance the testing of pathogens, biomarkers, contaminants, and pollutants is also being considered for designing multiplexed testing platforms. Moreover, different types of materials are also being used to provide eco-friendly solutions. Thus, this promotes the digital microfluidics systems on a chip market growth.

For instance,

Why Did the Electrowetting-on-Dielectric (EWOD) Segment Dominate in the Digital Microfluidics Systems on a Chip Market in 2024?

By technology type, the electrowetting-on-dielectric (EWOD) segment held the largest share of the market with approximately 45% in 2024. It provides accurate droplet control and does not require any external valves or pumps. Moreover, the reagents and sample volume required are low. This contributed to the market growth.

By technology type, the magnetic digital microfluidics segment is expected to show the fastest growth rate at a notable CAGR during the predicted time. It involves a simple mechanism and is affordable. Moreover, it is suitable for various biological samples, which promotes its use.

How Clinical Diagnostics Segment Dominated the Digital Microfluidics Systems on a Chip Market in 2024?

By application type, the clinical diagnostics segment led the market with approximately a 40% share in 2024. The microfluidic devices were used in clinical diagnostics for fast and accurate detection of disease. Moreover, as they are portable and require less sample, which resulted in their increased use.

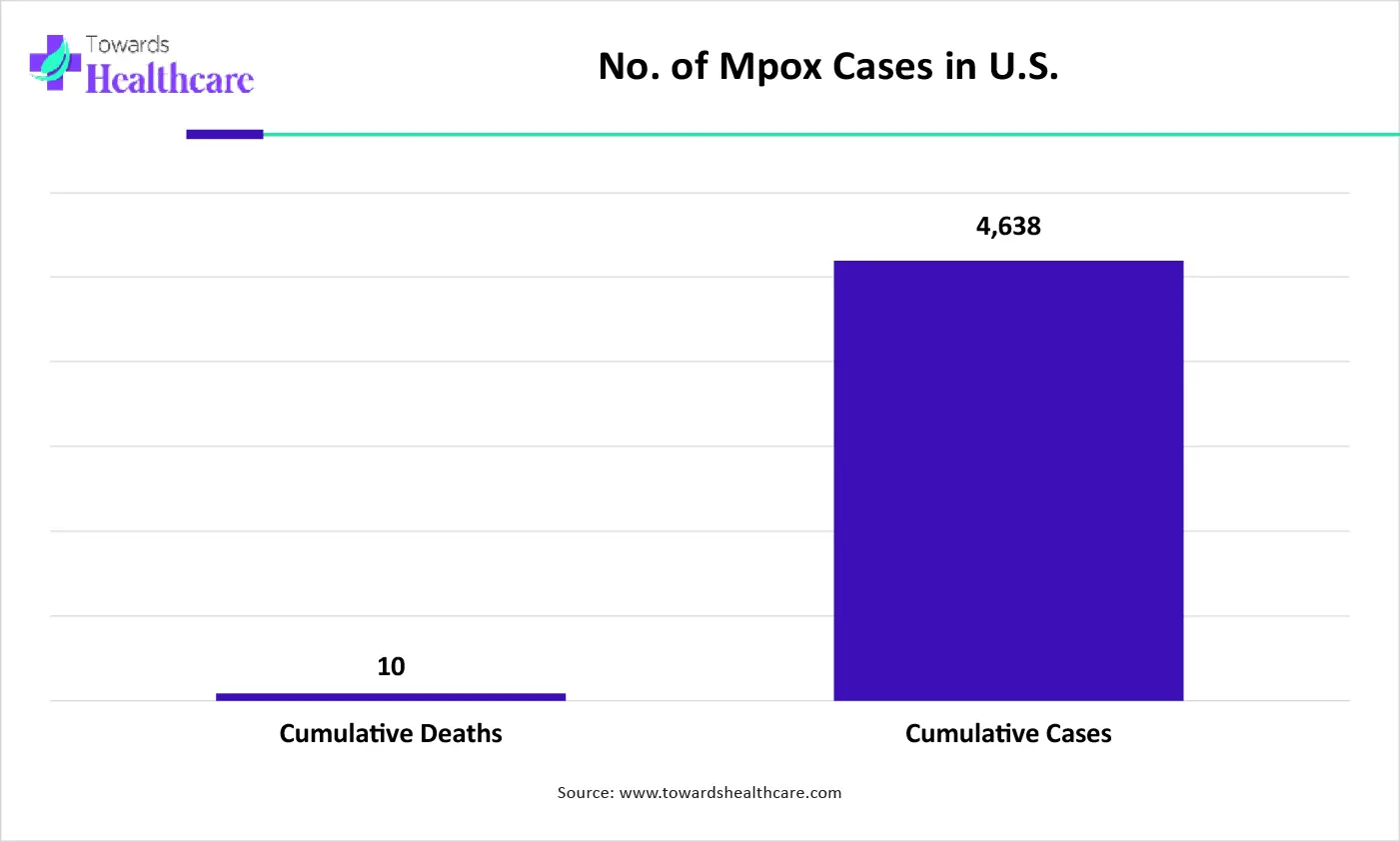

In the clinical diagnostics segment, the infectious disease testing sub-segment dominated the market. The rise in infectious diseases increased the reliance on digital microfluidic devices. It was used in mass screening as it provided fast and accurate testing.

The graph represents the total number of mpox cases observed in the U.S. from January 2023 to April 2025. It indicates that there will be a rise in cases of mpox. Hence, it increases the demand for digital microfluidics systems on a chip for their early diagnosis and effective management. Thus, this in turn will ultimately promote the market growth.

By application type, the drug discovery & development segment is expected to show the fastest growth rate during the upcoming years. The digital microfluidic devices help in the testing of a large volume of drug candidates. This, in turn, accelerates the selection and optimization of the drug candidates.

What Made Hospitals & Diagnostic Laboratories the Dominant Segment in the Digital Microfluidics Systems on a Chip Market in 2024?

By end user, the hospitals & diagnostic laboratories segment held the largest share of the global market with approximately 50% in 2024. The hospitals & diagnostic laboratories enhanced the use of digital microfluidics systems on a chip for the diagnosis of numerous patients. It was used in the detection of different types of disease, enhancing the market growth.

By end user, the contract research organizations (CROs) segment is expected to show the fastest growth rate during the predicted time. The growing research and development of CROs is increasing the use of digital microfluidic devices. They are enhancing the scalability and speed of these studies.

How Digital Microfluidics Chip (Consumables) Segment Dominated the Digital Microfluidics Systems on a Chip Market in 2024?

By product type, the digital microfluidics chip segment led the market with approximately 55% share in 2024. Most of the microfluidic devices were single-use, which increased the use of digital microfluidics chips (consumables). They were widely used for drug discovery and genomics.

By product type, the software & services segment is expected to show the highest growth during the upcoming years. They are important for controlling various process parameters of the device. Furthermore, the growing advancements are increasing their use.

Which Material Type Segment Held the Dominating Share of the Digital Microfluidics Systems on a Chip Market in 2024?

By material type, the polymer-based segment held the dominating share of the market with approximately 50% in 2024. These were mostly used for the development of disposable microfluidic devices. Their affordability and biocompatibility with biological samples increased their use. This promoted the market growth.

By material type, the paper-based microfluidics segment is expected to show the highest growth during the predicted time. Due to their simple development technique and affordability, their use is increasing. Moreover, they provide rapid results, which is increasing their use for home testing.

Why the Closed Digital Microfluidics Segment Dominated the Digital Microfluidics Systems on a Chip Market?

By mode of operation type, the closed digital microfluidics segment led the market with approximately 60% share in 2024. Rather than detection, it also helped in incubation, mixing, and splitting of the samples. It also minimized the risk of sample contamination.

By mode of operation type, the open digital microfluidics segment is expected to show the highest growth during the upcoming years. It offers direct sampling and reagent addition. Thus, they are used for various research purposes.

North America dominated the digital microfluidics systems on a chip market share by 38% in 2024. North America consisted of an advanced R&D sector, along with the presence of advanced technologies. This promoted the research and development of digital microfluidics systems on a chip. This contributed to the market growth.

The U.S. Digital Microfluidics Systems on a Chip Market Trends

The industries and the institutes of the U.S. are well-established, which in turn enhances the development of digital microfluidics systems on a chip. This, in turn, is supported by the NIH investments. Moreover, new collaborations among the industries are also being formed to enhance their application and production.

The Canada Digital Microfluidics Systems on a Chip Market Trends

The use of digital microfluidics systems on a chip is increasing in Canada to enhance the testing of various diseases. At the same time, the growing research and development is also contributing to the same. These are further supported by the funding provided by the government and regulatory bodies.

Asia Pacific is expected to host the fastest-growing digital microfluidics systems on a chip market during the forecast period. The growing diseases in the Asia Pacific are increasing the demand for the use of digital microfluidics systems on a chip for their effective and early detection. This is driving their development and investments, enhancing the market growth.

The China Digital Microfluidics Systems on a Chip Market Trends

The industries in China are focusing on the development of clinical testing solutions and drug discoveries. This is increasing the utilization and development of microfluidic devices. At the same time, their research and development are encouraged by the government initiatives.

The India Digital Microfluidics Systems on a Chip Market Trends

Various affordable digital microfluidics systems on a chip are being developed by the Indian industry. These devices are being used in the diagnosis of various diseases as well as environmental testing. Thus, these innovations are supported by the government investments.

Europe is expected to grow significantly in the digital microfluidics systems on a chip market during the forecast period. The growing research and development in European industries and institutes is enhancing the development of digital microfluidics systems on a chip. This amplifies their use. Thus, this promotes the market growth.

The Germany Digital Microfluidics Systems on a Chip Market Trends

The increasing startups and collaboration among industries in Germany are promoting the development of microfluidic devices. They are utilizing eco-friendly materials to improve their biodegradable properties. Furthermore, their use for cancer diagnosis is also increasing.

The UK Digital Microfluidics Systems on a Chip Market Trends

The use of microfluidic devices in the UK is increasing for the development of precision medications and for disease management. At the same time, the industries are adopting and utilizing advanced technologies to enhance the performance and application of these devices. The funding provided by the government sector is accelerating their development.

South America is expected to grow significantly in the digital microfluidics systems on a chip market during the forecast period, due to growing healthcare investments. The increasing demand for advanced diagnostic solutions are also increasing their use, where the growing incidence of infectious disease, are also promoting the market growth.

Brazil Market Trends

With the growing demand for rapid, accurate diagnostics and point-of-care diagnostic solutions, the use of digital microfluidics systems on a chip in Brazil is increasing. The expanding healthcare, growing R&D activities, and increasing government screening programs are also increasing their adoption rates.

MEA is expected to grow significantly in the digital microfluidics systems on a chip market during the forecast period, due to expanding healthcare, which is increasing the adoption of various advanced technologies. The growing government initiatives and increasing disease burden are also increasing the demand for advanced diagnostics solutions, leading to their innovations and promoting market growth.

Saudi Arabia Market Trends

The growing government health initiatives in Saudi Arabia are increasing the adoption and advancements of the digital microfluidics systems on a chip. The growing demand for point-of-care diagnostic solutions and their growing application in the drug discovery and development of personalized medicine is also increasing their adoption rates.

R&D

Clinical Trials and Regulatory Approvals

Packaging and Serialization

Distribution to Hospitals, Pharmacies

Patient Support and Services

By Technology Type

By Application

By End-User

By Product Type

By Material Type

By Mode of Operation

By Region

February 2026

February 2026

January 2026

January 2026