February 2026

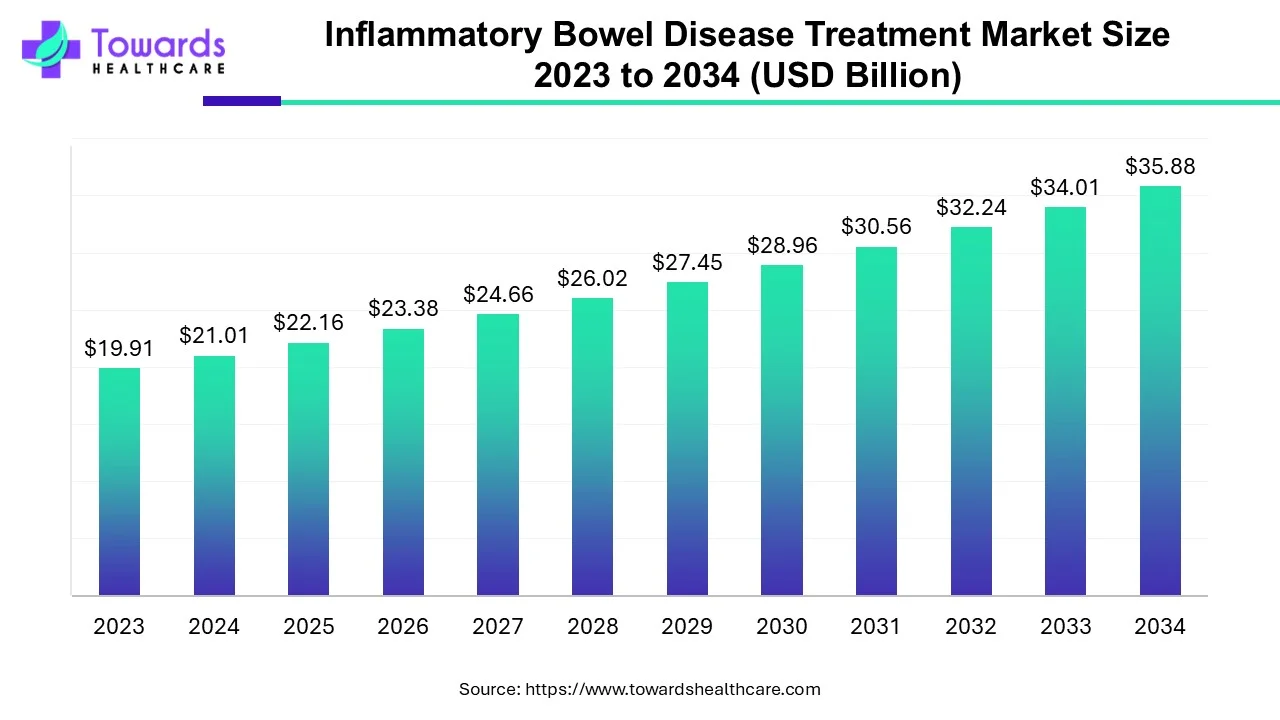

The inflammatory bowel disease treatment market size is projected to reach USD 35.88 billion by 2034, growing from USD 22.16 billion in 2025, at a CAGR of 5.5% during the forecast period from 2025 to 2034.

Every hour, a person in Canada is diagnosed with Crohn's disease or ulcerative colitis. Canada has one of the highest rates of Crohn's and colitis in the world.

Inflammatory bowel disease (IBD) is associated with chronic infections in the digestive tract. It includes two conditions such as Crohn’s disease and ulcerative colitis. Ulcerative colitis is characterized by inflammation and ulcers on the lining of the large intestine (colon) and rectum. Crohn’s disease is defined by inflammation of the digestive tract’s lining, which can sometimes involve the deeper layers. Crohn’s disease primarily affects the small intestine. However, it can affect the large intestine and, in rare cases, the upper gastrointestinal tract. Ulcerative colitis affects just the mucosa of the large intestine (colon) and rectum. Crohn's disease can affect any part of the gastrointestinal tract, including the mouth and anus.

The global prevalence of IBD, which includes both Crohn's disease and ulcerative colitis, is rising. This development has major consequences for the healthcare industry and the lives of millions of people. The Western diet, which is frequently heavy in processed foods, refined carbohydrates, and harmful fats, may contribute to IBD development. This could be attributed to the effect on gut microbiota (gut bacteria) and alteration of the immune system's response to gut bacteria. For instance, more than 0.7% of Americans with around 721 cases per 100,000 population are affected with IBD. According to studies the prevalence of IBD is projected to significantly increase over the years. In addition, cigarette smoking has long been linked to Crohn's disease. The nicotine in cigarettes may affect the immune system's response in the stomach.

Furthermore, sedentary lifestyles are increasingly connected to chronic diseases such as IBD. Regular physical activity may assist in controlling the immune system, thus lowering the risk of IBD. According to studies, urban regions have a higher frequency of IBD than rural areas. This could be attributed to environmental causes or lifestyle variations caused by urbanization.

Crohn's disease and ulcerative colitis, the two primary types of inflammatory bowel disease (IBD), have a similar increase trend in prevalence over time. In 2023, the anticipated total prevalence of IBD in Canada is 825 per 100,000 individuals.

This translates into:

Looking ahead, the prevalence is anticipated to rise even more by 2035, reaching 1.08% of the population. This represents a potential increase of 470,000 Canadians living with IBD by that year. Furthermore, the findings show a considerable increase in IBD prevalence across all age ranges.

Moreover, the prevalence of IBD is fostered by the rise in the number of children with IBD. For instance, data from the National Institute of Health 2023 estimates, show a concerning increase in pediatric-onset inflammatory bowel disease (IBD). In 2014, the incidence was recorded as 13.9 per 100,000 children. Forecasts foresee a continuous annual increase of 1.23%, potentially reaching 18.0 per 100,000 by 2035.

In contrast, the incidence of IBD diagnoses in adults and seniors (aged 64 and up) has been steady and is predicted to continue throughout the next decade. This shows that the underlying variables that contribute to the development of IBD may differ between these age groups.

In June 2024, the CDC funded a cooperative agreement, Improving Health Outcomes for Patients with Inflammatory Bowel Disease (IBD). Two recipients were awarded funding, which is scheduled to continue until the fall of 2028. Advancement of digital health interventions to improve IBD management and patient engagement.

Crohn’s and Colitis Canada is a Canadian national charity based volunteered funders to discover treatments for ulcerative colitis and Crohn’s disease to enhance the patients’ lives. They are one of the globe's largest health charity funders of Crohn's and colitis research, having invested more than $145 million in research since 1974, resulting in significant advances in genetics, gut microbes, inflammation, and cell repair, while also providing the groundwork for new and improved therapies. They provide patient programs, services, research, advocacy, and create awareness. According to the National Institute of Health, the GEM project sheds light on the factors that determine IBD. In 2023, The Genetic, Environmental, and Microbial (GEM) project research team discovered that those who get Crohn's disease have a different gut bacteria composition than those who remain well for years before developing Crohn's. Following are some of their recently funded research programs related to Crohn’s disease and ulcerative colitis:

| Program | Study Title | Researcher | Institution | Funding Start Year | Amount Funded in 2022 |

| INN | Understanding how proteins protect the gut from harmful bacteria | Jennifer Jones | Dalhousie University | 2022 | $44,239 |

| INN | Investigating immune mechanisms underlying ulcerative colitis in the elderly | Farhad Peerani | University of Alberta | 2022 | $49,828 |

| INN | Unravelling the link between Crohn’s disease and Type-2 diabetes | Dana Philpott | University of Toronto | 2022 | $50,000 |

| GIA | Understanding the causes of ulcerative colitis using a new lab model | David Lohnes | University of Ottawa | 2022 | $62,500 |

As inflammatory bowel diseases are untreatable at the moment there is no currently available cure for the disease. With current treatment approaches the symptoms of IDB can only be managed and not treated. Hence there is a huge growth opportunity in this field. Government organizations and several non-profit firms are investing in conducting research to find innovative treatment options for Crohn’s disease and ulcerative colitis.

For instance,

In March 2024, a team of Northwestern University researchers invented the first wireless, implantable temperature sensor, marking a significant development in Crohn's disease management. This new technology has the potential to provide continuous, real-time monitoring of inflammation in patients. This earlier diagnosis of flare-ups could be a game changer, allowing clinicians to intervene more quickly and potentially avoid or reduce the long-term damage caused by these inflammatory episodes.

In addition, in April 2023’s approval of Rinvoq (upadacitinib) by the European Commission (EC) marked a key milestone in the treatment of Crohn's disease for AbbVie. Rinvoq is the first oral Janus Kinase (JAK) inhibitor medication approved in Europe for adult patients with moderately to highly active Crohn's disease.

The approval is intended for patients who have not reacted well to conventional therapy or biologic medicines, or who have developed intolerance to these treatments. Rinvoq is available in two dosage options: a 45 mg induction dose followed by either a 15 mg or 30 mg maintenance dose. This personalized strategy provides new hope for those who are struggling to control their Crohn's disease.

Furthermore, a promising collaborative effort has evolved in the fight against Crohn's disease. In May 2023, Amgen and TScan Therapeutics, Inc. collaborated to use TScan's TargetScan, a unique target-finding technology. This platform is used to determine the exact antigens recognized by T cells in Crohn's disease patients. This collaboration has enormous potential for the development of novel therapeutic strategies.

The agreement proposes a multi-year relationship, with TScan getting a substantial upfront payment of $30 million. They are also entitled for additional hefty awards totaling more than $500 million. These potential future payments are conditional on meeting critical milestones throughout the development process, including preclinical, clinical, regulatory, and commercial phases. Furthermore, TScan is supposed to profit from tiered, single-digit royalty payments dependent on the commercial success of any resulting medicines. This framework encourages both organizations to move forward with this possibly significant research.

In April 2022, the FDA released draft guidance to assist sponsors in the clinical development of therapies for treating individuals with Crohn's disease and ulcerative colitis. This draft guidance outlines the FDA's recommendations for clinical trials for drugs developed under section 505 of the Federal Food, Drug, and Cosmetic Act (21 U.S.C. 355), section 351 of the Public Health Service Act (42 U.S.C. 262), and 21 CFR parts 312, 314, and 601 to treat CD. In this draft, development program recommendations include trial population, trial design, efficacy considerations, and safety considerations.

The TNF inhibitors have changed patient management in Crohn’s disease patients by providing a safer and more effective treatment regimen than existing treatment options. Remicade (infliximab), Humira (adalimumab), and Enbrel (etanercept) are popular TNF inhibitor medications that are effective in the treatment of moderate to severe IBD. The rising use of such prescription drugs has contributed to the growth of TNF inhibitors. In addition, these medications successfully lower inflammation, which improves symptom control, disease activity, and quality of life for IBD patients. This in turn has improved patient outcomes and contributed to the inflammatory bowel disease treatment market growth. While TNF inhibitors may cause some adverse effects, they are generally well tolerated in comparison to other IBD treatments.

Furthermore, the patent expiration of various TNF inhibitor medications is paving the way for biosimilar equivalents that provide comparable efficacy at a reduced cost. This could make the market more accessible to patients. While TNF inhibitors remain prominent, other therapy classes such as JAK inhibitors are emerging. TNF inhibitors, on the other hand, are likely to remain popular due to their proven efficacy.

The future of the IBD treatment market may involve personalizing medicine to each patient's needs and reactions. This could include using biomarkers to select patients who will benefit the most from TNF inhibitors.

Thus, the TNF inhibitor segment of the IBD therapeutic market is well-established and rising. Its high efficacy, safety profile, and long-standing use will very certainly keep it in the lead for the foreseeable future. However, the introduction of biosimilars and the ongoing research of novel medicines will have an impact on the market landscape.

North America dominated the inflammatory bowel disease treatment market as the burden of Crohn’s disease and ulcerative colitis are more in North America followed by Europe, where Asia and Africa regions experience less prevalent cases as compared to North America and Europe. In addition, healthcare costs including diagnosis and treatment costs associated with inflammatory bowel disease are higher in countries such as the U.S., Canada, Germany, U.K., France, and several other European countries than the Asian countries. Studies have also reported a dynamic increase in the prevalence of IBD in adults and especially in children in the last decade which is one of the major reasons for North America’s dominance in the inflammatory bowel disease treatment market.

Over the course of the forecast period, Asia Pacific is anticipated to exhibit the fastest growth in the market for treatments for inflammatory bowel disease. An older population, a higher risk of inflammatory diseases, a rise in the prevalence of inflammatory bowel disorders, and better healthcare regulations in the area are some of the reasons that will propel market growth in the next years. India was the market with the quickest rate of growth in the treatment of inflammatory bowel disease, while China accounted for the biggest proportion of the market.

Europe is estimated to grow at a significant rate during the forecast period. Another important market for IBD therapy is the treatment of inflammatory bowel disease (IBD), to which nations like Germany, France, and the United Kingdom contribute significantly. Europe has seen a steady rise in the number of persons with inflammatory bowel disease (IBD), which has raised the need for novel and efficient treatment approaches. distinct countries have distinct approval procedures for new treatments, which contributes to the diverse regulatory environment that defines the European market. One of the features that sets the market apart is the variety of the regulatory environment. The reason behind this is that different countries have different approaches to their healthcare systems.

(**We also provide cross-sectional analysis in market segments)

By Type

By Drug Class

By Route of Administration

By Distribution Channel

By Geography

February 2026

February 2026

January 2026

January 2026