February 2026

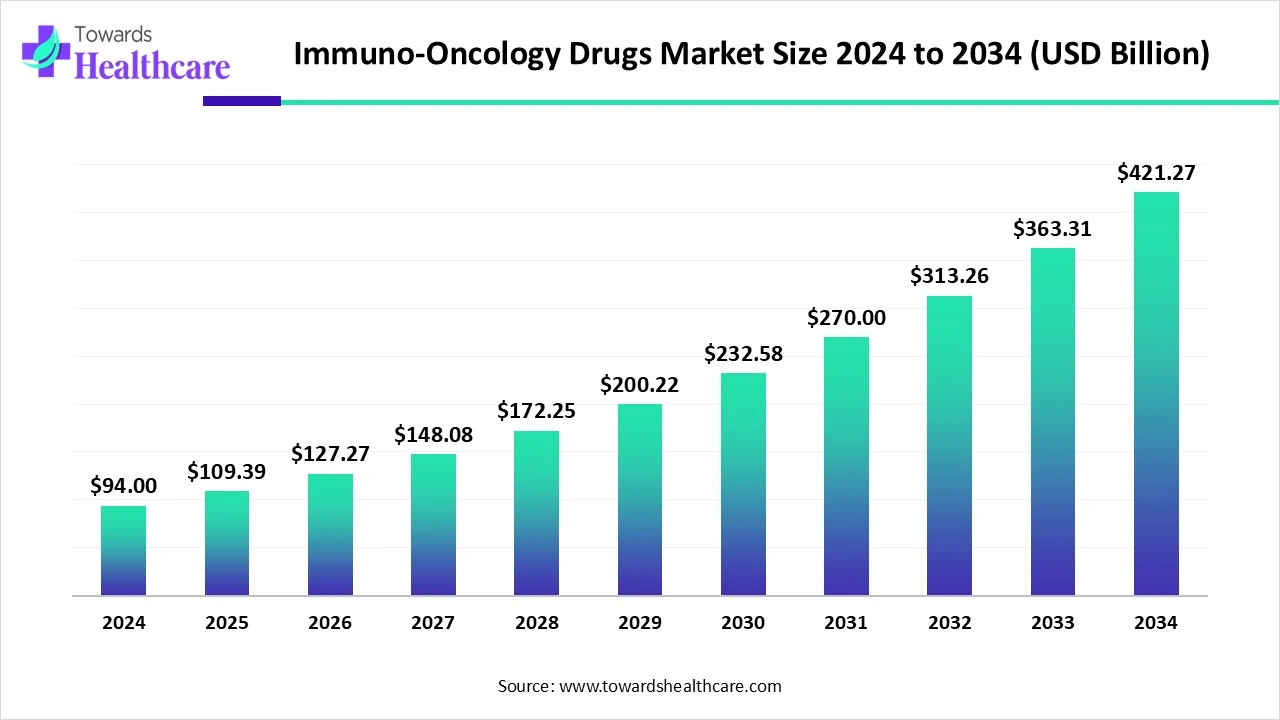

The global immuno-oncology drugs market size is calculated at US$ 94 billion in 2024, grew to US$ 109.39 billion in 2025, and is projected to reach around US$ 421.27 billion by 2034. The market is expanding at a CAGR of 16.34% between 2025 and 2034.

The use of cancer immunotherapy, a cutting-edge tactic that harnesses the body's immune system to prevent, treat, and eradicate cancer, is driving the rapid growth of the immuno-oncology industry. The advancement of immuno-oncology depends heavily on strategic innovation, particularly when it comes to exploring novel combinations that might broaden its benefits to a wider patient population and alter treatment outcomes. Continuous research into new routes, immuno-oncology agents, and potential therapies. Cancer vaccines which boost the immune system to combat cancer cells, provide a promising development route in the immuno-oncology drugs market.

Immuno-oncology drugs are a class of drugs used in the treatment of the immune system to combat cancer. Generally, they work by enhancing the potential of the immune system to recognize and attack cancer cells or by promptly targeting particular molecules that assist cancer cells in evading immune attack. Primarily, the immuno-oncology drugs market is driven by several factors, including growing instances of cancer, robust economic expansion, and increasing healthcare spending. Furthermore, raised investment in immune-oncology R&D, with novel product development, is fueling the demand for the growth of the market.

Majorly, AI in the respective market plays a vital role in the escalation of drug discovery and development by analysing biological information to detect novel targets for immunotherapeutic agents, which efficiently results in the development of new drugs. Also, AI algorithms enable estimation of various drug interactions, supporting researchers to find out synergistic combinations that enhance efficacy and reduce side effects. AI can identify the right patient in a clinical trial and trial design optimization, which minimizes the expenses and time associated with drug development.

For instance,

Growing Cancer Cases and the Acquisition of Combination Therapies

Globally, there is a rising number of cancer cases that is significantly boosting the market growth, fueled by accelerated geriatric populations, lifestyle choices (Smoking and diet), and environmental factors. Moreover, these cases demand widely effective and targeted cancer treatments, like immunotherapy. Along with this, numerous oncologists are adopting combination therapies to enhance treatment efficacy and ultimate survival. These therapies include combining immunotherapy with chemotherapy, targeted drugs, or else treatments.

Limitations in Access and Expenses

The immuno-oncology drugs market, growing challenges are including the expensive drugs, particularly personalized therapies, than conventional cancer treatments are significantly contributing because of increased expenditure on R&D, specialized equipment, and personalized treatment approaches. This may create limited access to the IO drug for various patients, specifically in developing countries and for patients possessing limited healthcare resources.

Progressing Funding and New Therapy Development

Different opportunities are developing as major funding in the R&D department in the IO sector, boosting the development of novel therapies and biomarkers, which support personalized treatment plans related to the individual patient profile. As well as escalating the target on personalized and precision medicine, employing genetic, immune, metabolic, and proteomic profiling, is propelling the development of customized treatments for each patient. Additionally, a combination of IO drugs with else therapies, like small-molecule targeted therapies or vaccines, is providing different cancers highly efficient treatment than single-agent treatments.

By treatment type, the immune checkpoint inhibitors segment dominated the immuno-oncology drugs market by holding the major revenue share in 2024. Around the world, the increasing incidences of cancer, such as lung, breast, and melanoma, are a widely impacting expansion of this segment in the market, including advances in different cancers, which are fueling the demand for the broad adoption of efficient immune checkpoint inhibitors. Also, boosting FDA approval for this segment, allied with clinical trials, is enhancing the market growth and prospects in the R&D department.

By treatment type, the cell therapy segment is expected to be the fastest-growing segment in the upcoming years, as these cell therapies are mostly used in the replacement of damaged or diseased cells to achieve targeted therapies. This activity is rising due to widespread progress in biotechnology, particularly in cell engineering and gene editing, which has shown dominance in the development of greater efficient and targeted cell therapies. Coupled factors, such as encouraging regulatory authorities and expedited approval processes for these market drugs, are providing the faster commencement of novel therapies in the immuno-oncology drugs market.

By disease type, the lung cancer segment led the market in 2024, due to the contributing factors like the raised prevalence of lung cancer, which is leading to cancer-related deaths over the world. Furthermore, non-small cell lung cancer (NSCLC) and small cell lung cancer (SCLC), these kinds of conditions demand potential treatments such as immunotherapies. Also, the accelerating awareness about the advantages of immunotherapy in lung cancer treatment, particularly immune checkpoint inhibitors, is impelling their adoption.

By disease type, the prostate cancer segment is expected to grow at the fastest CAGR in the immuno-oncology drugs market during the projected period. Being combined factors like demographic changes, enhanced detection rates, and urbanization are majorly impacting on growing prevalence of prostate cancer, which highly demands effective IO treatments. Accelerated adoption of immunotherapy, including the use of vaccines like sipuleucel-T (Provenge), which supports boosting the immune system to act against prostate cancer cells.

By distribution channel, the hospital pharmacies segment held the major revenue share of the market, resulting in its dominance in the market. Usually, the hospitals possess vast diagnostic capabilities and detect and treat a greater number of cancer cases, which generates a robust demand for IO drugs. Attributing share in hospital pharmacies is fueled by widely adopted IO therapies, which are highly effective in cancer patients who are treated in hospital settings. Also, specialized personnel and resources are required to operate the difficult administration and monitoring of IO treatments, which are achieved in hospital pharmacies are driving the growth of the immuno-oncology drugs market.

By distribution channel, the online pharmacies segment is expected to grow fastest in the upcoming years, due to expanded trends towards digital healthcare, in which patients and healthcare providers are widely operating online platforms for different services, including medication access. This segment generates a convenient way for patients to achieve medication access at home by skipping in-person visits to conventional pharmacies. Also, the E-commerce leaders are highly investing in this segment to serve the rising demand for online medication access, which is driving the growth of the immuno-oncology drugs market.

North America held the largest revenue share of the market in 2024, due to accelerated cancer instances, especially in the US, which is driving the demand for potential treatments, including IO therapies. As well as this region also possesses a hub for pharmaceutical R&D, resulting in the generation of novel and innovative IO drugs. Additionally, supportive government policies and accelerated approval processes for IO drugs are encouraging expansion of the market.

The U.S. is a major driver for the expansion of the market because of a growing number of cancer cases, which greatly demands immunotherapy drugs. Moreover, novel developments in antibody engineering, comprising targeted therapies, and patient shifts towards personalized medicine with targeted treatments are impacting the growth of the market.

For instance,

The market is experiencing significant growth driven by raised shift towards personalized medicine, where treatments are customized to each patient’s needs and cancer properties. The most effective approach is IO therapies with targeted cancer cells, which aligns with the trend. Also, the boosting collaborations with investments between pharmaceutical industries and research organizations are escalating the transfer of scientific discoveries into clinically feasible IO treatments.

For instance,

Asia Pacific is expected to be the fastest-growing region during the forecast period in the market. The immuno-oncology drugs market is primarily driven by the increased number of cancer cases, which need boosted spending on healthcare infrastructure, especially in countries like China and India. Also, the population in Asia Pacific has raised disposable income, which contributes to a greater capacity to approach advanced therapies. As well as technological advancements in antibody engineering and immunotherapy research, this results in the development of novel and optimized drugs.

For instance,

In China, there is a growing population with increasing age-related cancers, which is moreover propelling demand for oncology treatments. Also, the Chinese government is strongly promoting the development of novel drugs and assisting R&D, which is a contributing factor in the expansion of the market. Heavy investments are catering to the Chinese oncology market by both domestic and foreign companies, leading to a rise in drug development and accessibility.

India's growth in the market is impacted by accelerating cancer cases, the emergence of new IO therapies with fewer side effects, and rising government supportive actions to enhance cancer diagnosis. Along with these factors, breakthroughs in biotechnology and immunotherapy research, partnerships between pharmaceutical industries and research organizations, and encouraging regulatory considerations are propelling market growth. The wide utilization of immunotherapy by rising cancer hospitals and healthcare centers across India.

For instance,

The immuno-oncology drugs market is experiencing significant growth in Europe, which is influenced by the growing prevalence of cancer, breakthroughs in IO therapies, and regulatory approvals. Major contributing factors, like new drug approvals by the EMA and FDA, support investment in IO research and development, resulting in accelerated acquisition by healthcare providers and optimized patient outcomes. Also, the broad emphasis on personalized medicine and combination treatments in oncology is boosting the market growth.

For instance,

In Germany, the market is experiencing lucrative growth due to technological advancements in antibody engineering, especially in targeted therapies are significantly contributing factors. Agencies, including EMA and FDA, provide approval for novel IO drugs, which gives assurance to investors and drives innovation. A strong healthcare system in Germany gives complete coverage for cancer treatments, which increases demand for oncology drugs.

Numerous factors are driving the growth of the market are increase of immunotherapy as a cancer treatment, the development of novel and efficient drugs, and the UK’s robust pharmaceutical companies. Moreover, the accelerating number of cancer cases due to the geriatric population, government funding in cancer research, and the establishment of clinical trials are also contributing to the expansion of the market.

For instance,

By Treatment Type

By Disease Type

By Distribution Channel

By Region

February 2026

February 2026

January 2026

January 2026