February 2026

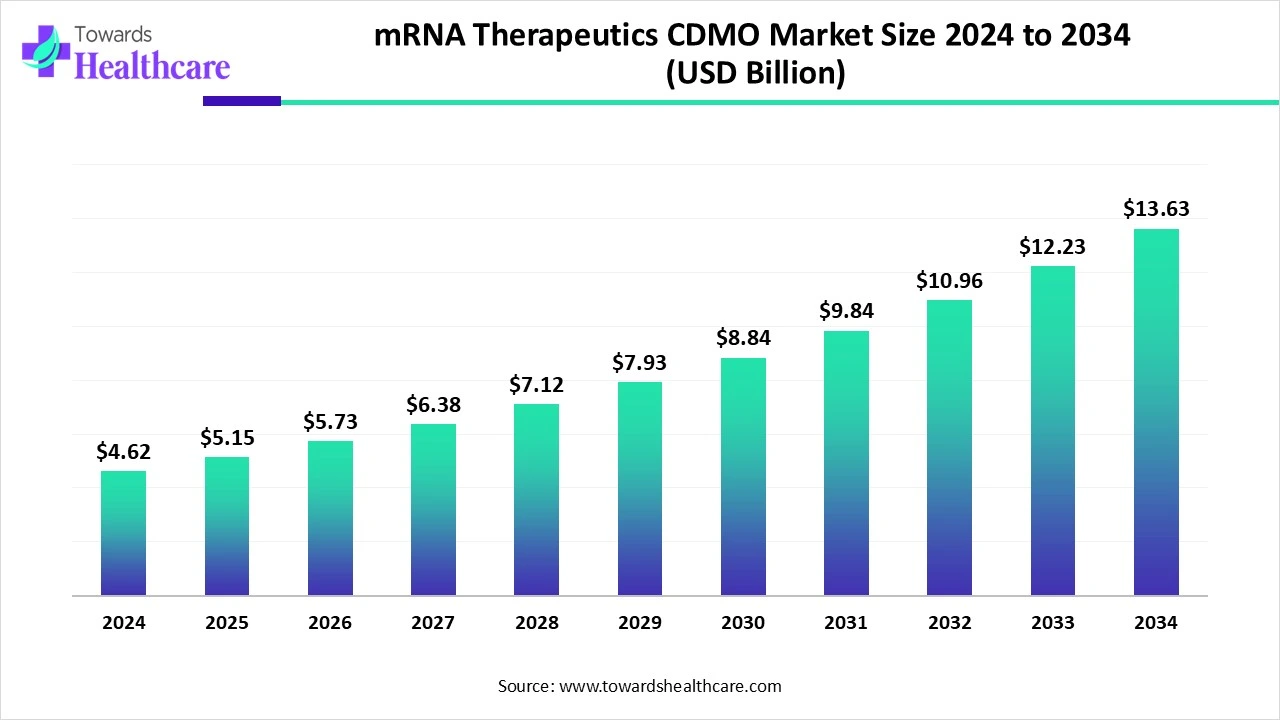

The global mRNA therapeutics CDMO market size is calculated at USD 4.62 billion in 2024, grew to USD 5.15 billion in 2025, and is projected to reach around USD 13.63 billion by 2034. The market is expanding at a CAGR of 11.37% between 2025 and 2034.

The mRNA therapeutics CDMO market is primarily driven by the rising prevalence of chronic disorders and growing research and development activities. The increasing need for vaccination potentiates the demand for mRNA therapeutics. Numerous government organizations support the development of mRNA therapeutics through funding. The future looks promising, with technological advancements and the integration of AI/ML into biologics manufacturing.

| Metric | Details |

| Market Size in 2025 | USD 5.15 Billion |

| Projected Market Size in 2034 | USD 13.63 Billion |

| CAGR (2025 - 2034) | 11.37% |

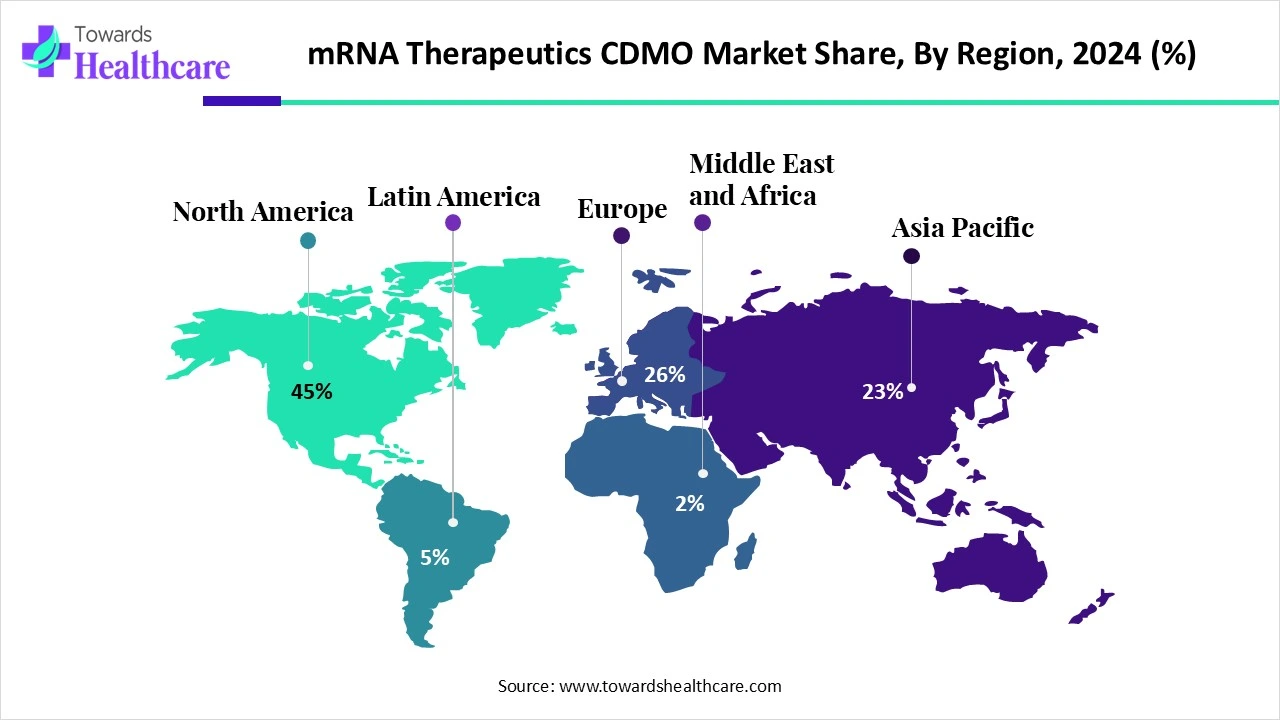

| Leading Region | North America share by 44% |

| Market Segmentation | By Service Type, By Application, By Scale of Operation, By End-User, By Region |

| Top Key Players | CordenPharma, Lonza Group AG, Samsung Biologics, Catalent Inc., Wacker Biotech GmbH, Aldevron (a Danaher company), Thermo Fisher Scientific (Patheon), BioNTech Manufacturing Services, Moderna Manufacturing Partnerships, Emergent BioSolutions, Evonik Industries AG, Rentschler Biopharma, Recipharm AB, TriLink BioTechnologies (Maravai LifeSciences), Acuitas Therapeutics (LNP tech provider), eTheRNA Manufacturing, IDT (Integrated DNA Technologies, part of Danaher), WuXi Biologics / WuXi STA, AGC Biologics, MilliporeSigma |

The mRNA therapeutics CDMO market refers to third-party organizations that offer contract-based development and manufacturing services for messenger RNA (mRNA)-based therapeutics and vaccines. CDMOs in this space support biopharmaceutical companies by providing end-to-end or modular services such as plasmid DNA production, in vitro transcription (IVT), lipid nanoparticle (LNP) formulation, fill-finish, analytical testing, and regulatory support. The market has surged due to the success of COVID-19 mRNA vaccines and is expanding rapidly across oncology, infectious diseases, rare genetic disorders, and personalized medicine.

The various factors influencing market growth include the increasing prevalence of genetic and infectious diseases, as well as the growing development of novel mRNA therapeutics. The COVID-19 pandemic has potentiated the need for mRNA therapeutics. The growing demand for personalized medicines also promotes market growth. The increasing investments by governments and private organizations, as well as the rising collaborations among key players, contribute to market growth.

Artificial intelligence (AI) can revolutionize the design and development of mRNA therapeutics, improving efficiency and accuracy. AI enables researchers to develop structurally stable mRNA products, enhancing protein expression. AI and machine learning (ML) algorithms can analyze vast amounts of data and predict properties of mRNA therapeutics. They enable researchers to design and develop novel lipid nanoparticle formulations to deliver mRNA. AI and ML can also streamline the manufacturing process of mRNA therapeutics and overcome several challenges faced by conventional methods.

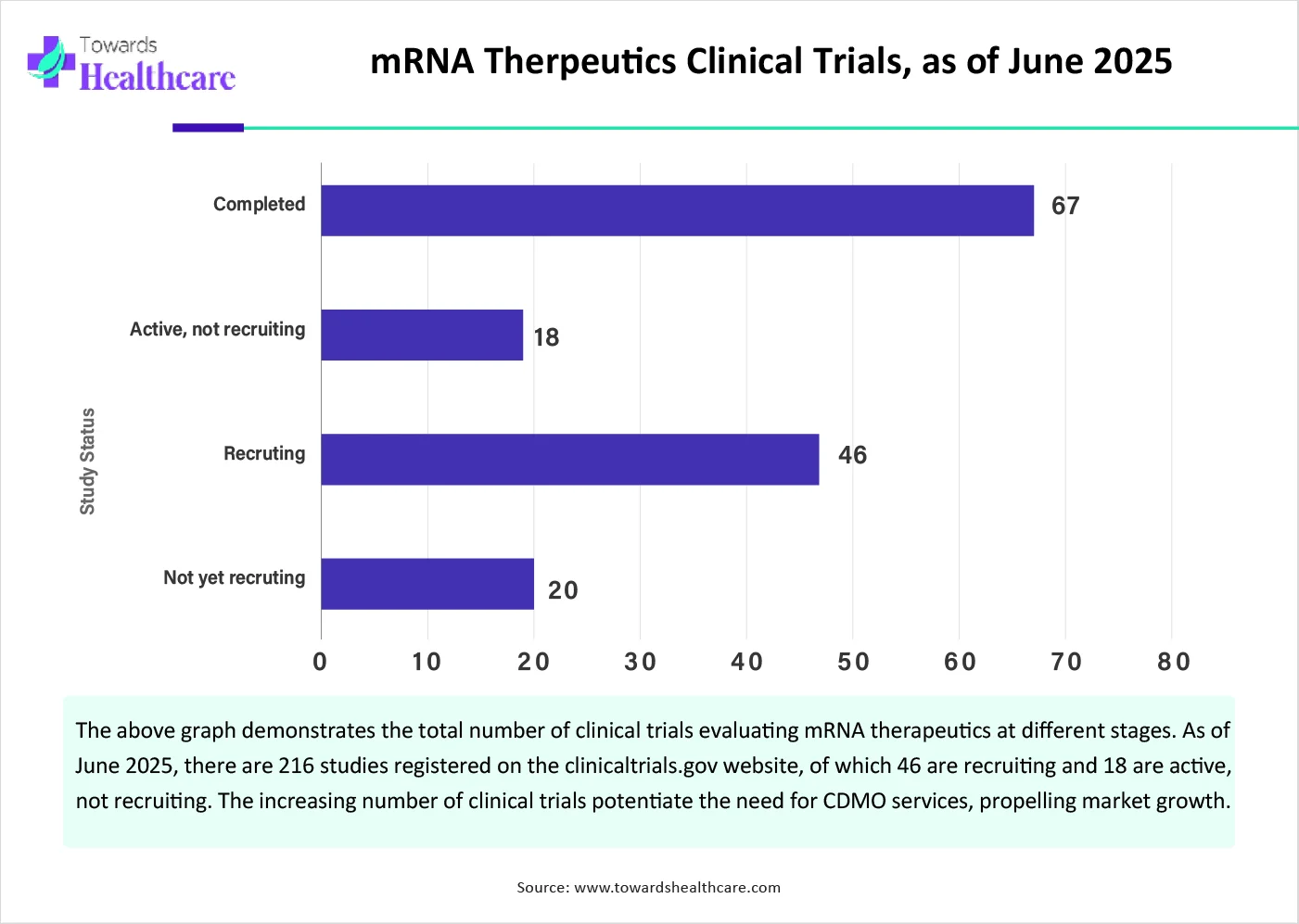

Increasing Number of Clinical Trials

The major growth factor of the mRNA therapeutics CDMO market is the increasing number of clinical trials. The growing research activities have led to the development of novel mRNA therapeutics. Some existing and approved mRNA therapeutics are evaluated for their efficacy in different disorders. The U.S. Food and Drug Administration (FDA) approved two mRNA therapeutics as of March 2025. The FDA approval of both mRNA-based vaccines, Comirnaty and Spikevax, for SARS-CoV-2 highlighted the significance of mRNA therapeutics. This potentiated the demand for more novel and innovative mRNA-based vaccines.

Regulatory Challenges

There is a lack of a universally established and stable regulatory approval process for mRNA therapeutics with diverse applications. This slows down the commercialization of mRNA therapeutics. CDMOs need to keep up with the evolving regulatory landscape for mRNA-based products, restricting market growth.

What is the Future of the mRNA Therapeutics CDMO Market?

The future of the market is promising, driven by increasing collaborations between pharmaceutical companies and CDMOs. Pharma & biotech companies collaborate with CDMOs to expand their services and conduct multiple projects simultaneously. CDMOs offer assistance in every stage of mRNA therapeutics development, including research, manufacturing, distribution, and regulatory approval. This helps companies to focus on product sales and marketing. CDMOs provide access to their state-of-the-art manufacturing infrastructure to develop innovative therapeutics. Thus, CDMOs enable companies to bring new treatments to patients more efficiently, ultimately improving health outcomes and ushering in a new era of medicine.

By service type, the mRNA drug substance manufacturing segment held a dominant share of the market in 2024. This segment dominated due to advances in manufacturing technology of mRNA and the growing demand for mRNA. Synthetic mRNA is made by introducing laboratory-made nucleic acids into the body, allowing cells to combat infections or diseases. The rapid development and successful implementation of mRNA vaccines during the COVID-19 pandemic have highlighted the significance of mRNA manufacturing. They were also found to maintain robust mRNA production capabilities to respond swiftly to such outbreaks.

By service type, the end-to-end CDMO services segment is expected to grow at the fastest CAGR in the market during the forecast period. End-to-end CDMO services provide companies with advanced services, encompassing research, development, manufacturing, clinical trial logistics, supply chain management, and commercial packaging. They offer an all-in-one alternative solution to challenges faced during the cell manufacturing process. This enables companies to rely on only one partner for all services.

By application, the infectious diseases segment contributed the biggest revenue share in 2024. The segmental growth is attributed to the rising prevalence of infectious diseases and the availability of FDA-approved mRNA-based vaccines for infectious diseases. Approximately 346,000 COVID cases are reported by the World Health Organization (WHO) from May 15 to June 15, 2025. The highest number of cases was reported in Thailand. (Source - WHO) Scientists are evaluating the role of mRNA therapeutics in infectious diseases other than SARS-CoV-2.

The table below shows the 2 FDA-approved mRNA therapeutics-based vaccines. The availability of FDA-approved vaccines facilitates the segment’s growth.

| Product | Company | Purpose | Approved Year |

| Comirnaty | Pfizer-BioNTech | SARS-CoV-2 | 2020 |

| Spikevax | Moderna, Inc | SARS-CoV-2 | 2022 |

By application, the oncology segment is expected to grow with the highest CAGR in the market during the studied years. The rising prevalence of cancer necessitates researchers to develop mRNA therapeutics-based products and vaccines for the treatment of cancer. The latest advances in mRNA stability, delivery systems, and immunogenicity have significantly enhanced the feasibility of mRNA-based cancer therapies. About 135 clinical trials are registered on the clinicaltrials.gov website as of June 2025. (Source - Clinical trials)

By scale of operation, the commercial manufacturing segment held the largest revenue share of the market in 2024. This segment dominated due to the ability of CDMOs for large-scale manufacturing of mRNA-based therapeutics for commercial purposes. CDMOs possess suitable manufacturing infrastructure and relevant expertise, thereby producing high-quality mRNA molecules. The success of mRNA vaccines during COVID-19 demonstrated the need to scale up their production rapidly and deliver to a large population globally.

By scale of operation, the clinical manufacturing segment is expected to expand rapidly in the market in the coming years. The increasing number of clinical trials potentiates the need for manufacturing mRNA therapeutics for clinical purposes. Currently, 216 clinical trials are registered on the clinicaltrials.gov website. Major companies collaborate with CDMOs to conduct clinical trials on a large scale across different geographical locations. CDMOs assist companies in the distribution of mRNA therapeutics, complying with stringent regulations.

By end-user, the biopharmaceutical & biotechnology companies segment led the global market in 2024. This is due to the increasing competition among biotech companies and the rising number of startups. This facilitates companies to collaborate with CDMOs as they provide advanced services. CDMOs reduce the time-to-market approval of novel products and help companies expand their product pipeline. By collaborating with CDMOs, small-scale and large-scale companies can strengthen their market position.

By end-user, the personalized medicine companies segment is expected to witness the fastest growth in the market over the forecast period. The growing demand for personalized medicines enables companies to develop personalized medicines for various disorders. Recent advances in genomics and proteomics, as well as rapidly changing demographics, favor the development of personalized medicines. These companies focus on developing innovative therapeutics for individualized patients.

North America dominated the global market share by 45% in 2024. The availability of state-of-the-art research and development facilities, the presence of key players, and increasing government funding are the major growth factors of the market in North America. Government organizations launch initiatives to promote early diagnosis and treatment of chronic disorders, facilitating the production of novel mRNA therapeutics. Favorable regulatory policies also contribute to market growth.

Key players, such as Catalent, Inc., Aldevron, and Thermo Fisher Scientific, are the major contributors to the market in the U.S. According to a recent study, the U.S. government invested approximately $31.9 billion in public funds directly into the development, manufacturing, and purchasing of mRNA COVID-19 vaccines from 1985 to 2022.

The Government of Canada provides $11 million in funding for 2 research projects for advancements in mRNA vaccine technology and to boost the impact of the University of British Columbia's biotechnology on the global stage. Providence Therapeutics, Moderna, and ME Therapeutics, Inc. are the major companies in Canada providing mRNA vaccines.

Europe is expected to grow at the fastest CAGR in the mRNA therapeutics CDMO market during the forecast period. The rising adoption of advanced technologies and growing research and development activities bolster market growth. The growing demand for personalized medicines enables researchers to develop mRNA-based therapeutics. The presence of a robust healthcare infrastructure and increasing investments favor market growth. European companies make constant efforts to expand their oncology pipeline and strengthen their market position as global leaders.

German pharmaceutical company BioNTech planned an mRNA cancer treatment trial in Britain. The company aims to provide immunotherapy to up to 10,000 people with individualized tumors by the end of 2030, either in trials or as an approved treatment. (Source - France24) In June 2025, BioNTech acquired CureVac to strengthen the research, development, manufacturing, and commercialization of mRNA-based cancer immunotherapy candidates. (Source - Biontech)

The burgeoning biotech sector enables numerous companies to invest in Belgium and set up their mRNA therapeutics manufacturing facility. In 2023, Quantoom Biosciences and Kaneka Eurogentec invested $13.9 million and $15 million, respectively, to expand their mRNA production capabilities in Belgium and support the development of mRNA vaccines and therapeutics.

Asia-Pacific is expected to grow at a notable CAGR in the mRNA therapeutics CDMO market in the foreseeable future. The burgeoning pharmaceutical and biotechnology sector and favorable government support drive the market. Countries like China, India, and Japan have suitable manufacturing infrastructure, encouraging foreign investors to set up their manufacturing facilities in these countries. Government and private organizations conduct seminars, conferences, and workshops to train individuals about the novel mRNA technology and share recent updates in the field.

China approved CSPC Pharmaceutical Group’s cancer cell therapy based on the synthetic mRNA technology for human clinical trials. The cell therapy, SYS6020, is also studied for the treatment of autoimmune diseases, such as systemic lupus erythematosus and myasthenia gravis. Currently, 35 clinical trials are being conducted in China related to mRNA therapeutics.

In May 2025, the Department of Biotechnology (DBT), Government of India, along with BIRAC, conducted the 14th webinar on “Biomanufacturing for mRNA Therapeutics” as part of the BioE3 policy. The webinar was conducted to promote sustainable biomanufacturing, support economic growth, and provide access to affordable healthcare. Companies like PopVax and the Tata Institute for Genetics and Society focus on developing mRNA-based therapies.

Latin America is considered to be a significantly growing area in the mRNA therapeutics CDMO market, due to the increasing awareness of advanced therapeutics and favorable government support. People from Latin America are becoming aware of screening, early diagnosis, prevention, and treatment of complex disorders, facilitating the development of mRNA therapeutics. Regulatory agencies are developing uniform regulations across Latin America and strengthening the region’s manufacturing ecosystem.

Pantheon Pharma Services and Samsung Biologics are global companies that have their manufacturing facility in Mexico due to the high potential of mRNA therapeutics. Brazil and Mexico signed a Memorandum of Understanding (MoU) to foster innovation and scientific and technological cooperation in products based on the mRNA platform.

TriLink Biotechnologies, Etherna Manufacturing, and SGS Brazil are some mRNA therapeutics CDMOs in Brazil. Brazil is also developing its clinical trial infrastructure to deliver indigenously produced mRNA therapeutics to Mexicans. As of September 2025, 3 trials have been registered on the clinicaltrials.gov website related to mRNA therapeutics.

BIOVECTRA, a part of Agilent Technologies, received the 2025 Outsourced Pharma “CDMO Leadership Award” in the category of biologics. Brain Carothers, Vice President and General Manager, Advanced Manufacturing Partnerships Division, Agilent Technologies, commented that the award is a testament to the company’s deep commitment to a client-first approach rooted in scientific excellence and manufacturing solutions. (Source - News)

By Service Type

By Application

By Scale of Operation

By End-User

By Region

February 2026

February 2026

February 2026

February 2026