February 2026

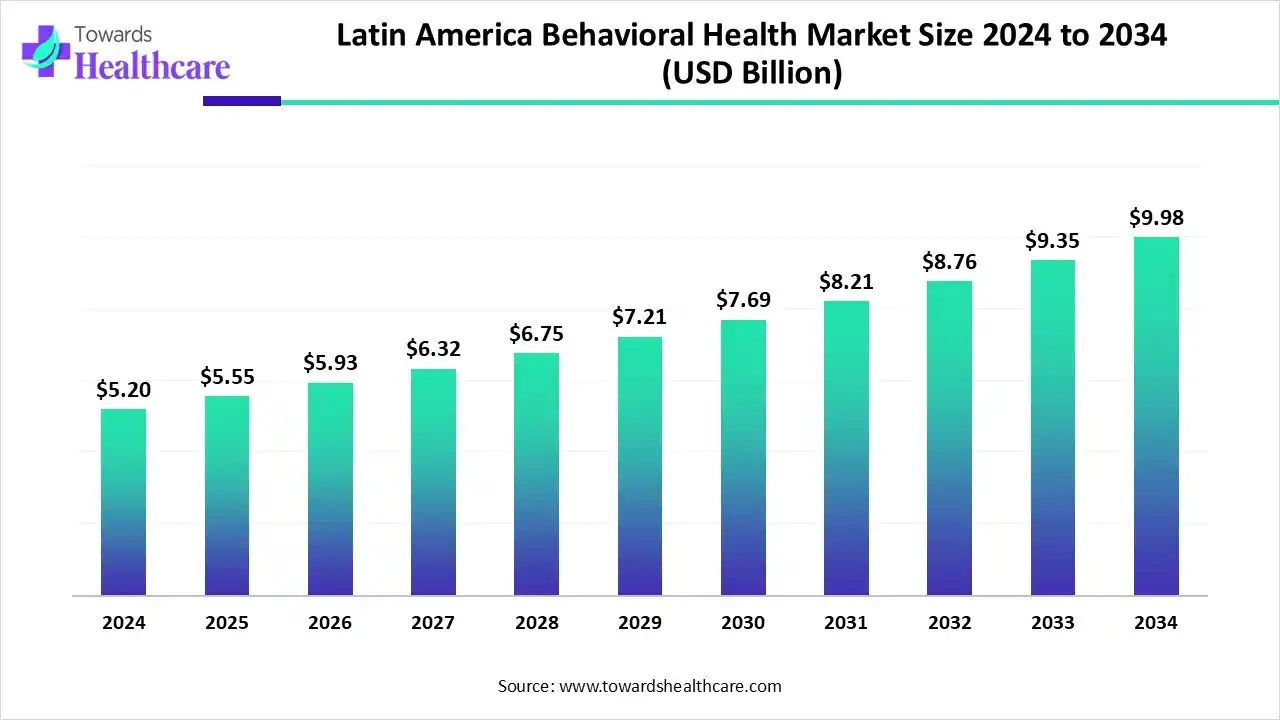

The Latin America behavioral health market size reached US$ 5.2 billion in 2024 and is anticipate to increase to US$ 5.55 billion in 2025. By 2034, the market is forecasted to achieve a value of around US$ 9.98 billion, growing at a CAGR of 6.74%.

The Latin America behavioral health market is expanding as more private and public healthcare providers invest in specialized mental health services. Rising urbanization, workplace stress, and lifestyle-related mental health issues are increasing the demand for counseling, therapy, and psychiatric care. Technological advancements such as mobile health apps and telepsychiatry, are improving patient reach, while regional collaborations and training programs are strengthening professional capacity, positioning Latin America for sustained market growth over the coming years.

The market is growing due to rising mental health awareness, increasing prevalence of psychiatric disorders, and greater adoption of digital therapy solutions. Behavioral health refers to the connection between a person’s behaviors, mental well-being, and overall physical health, including the prevention and treatment of mental illness, substance use, and emotional disorders. Innovation is reshaping the Latin America behavioral health market by streamlining service delivery and improving patient engagement.

New platforms for data-driven mental health assessments, digital counseling tools, and interactive therapy programs are enhancing diagnosis and treatment efficiency. Additionally, integration of cloud-based records and AI-supported care coordination helps clinicians personalize interventions and track progress more effectively. These technological and procedural advancements are expanding the reach of behavioral health services and supporting faster market growth across the region.

AI is transforming the Latin America behavioral health market by supporting population-level mental health monitoring and trend analysis, helping policymakers allocate resources effectively. It also aids in automating administrative tasks, reducing clinician workload, and enabling scalable digital therapy platforms. AI-driven insights can identify high-risk patients and suggest proactive interventions, improving overall care outcomes. Furthermore, the technology fosters integration of behavioral health services into primary care, expanding reach and efficiency, which accelerates market growth across the region.

| Latin America | Total Population | Latin America/Total Population Ratio |

| 13.2 | 13.9 | 0.95 |

The outpatient counseling/clinics segment led the market in 2025 as it catered to a wide range of mental health needs under one roof, from therapy to medication management. Their multidisciplinary approach, involving psychologists, psychiatrists, and social workers, improves treatment outcomes and patients' trust. Growing urbanization and increasing stress-related disorders further boosted demand for these services.

The telebehavioral/virtual/telehealth services segment is projected to grow fastest in the Latin America behavioral health market as it enables real-time monitoring, follow-up sessions, and group therapies without physical visits. Its scalability helps providers reach larger populations efficiently in underserved regions. Continuous advancements like secure cloud platforms, multilingual therapy apps, and wearable-linked mental health tracking are expanding adoption.

The mood & anxiety disorders segment held the largest revenue shares in 2024 as these conditions often require long-term, recurring treatment, generating consistent demand for services. Their high comorbidity with other health issues, such as cardiovascular disease or substance abuse, further increases the need for continuous management. Moreover, the strong focus of pharmaceutical companies on developing antidepressants and anxiolytics, combined with expanding access to counseling and psychotherapy, reinforced this segment's dominance in the behavioral health market.

The neurodevelopmental/behavioral disorders segment is expected to grow at the fastest CAGR in the Latin America behavioral health market, as rising diagnoses of conditions like autism spectrum disorder (ASD) and ADHD are driving demand for early intervention and specialized therapies. Growing awareness among parents, coupled with improved school-based screening programs, is supporting timely treatment. Advancements in digital learning tools, behavioral therapies, and personalized care plans are further expanding access.

The software/digital platforms/apps segment dominated the market in 2024 as they became central to connecting patients with providers through centralized portals, appointment scheduling, and electronic health record (EHR) integration. Their role in streamlining workflows for clinicians, improving patient engagement through reminders and progress tracking, and offering multilingual and culturally adapted solutions expanded their reach.

The AI/chatbots/virtual assistants segment is expected to grow at the fastest CAGR in the Latin America behavioral health market in 2024 because it enables proactive patient engagement, automates routine assessments, and provides consistent follow-up without requiring in-person visits. These solutions support early detection of mental health issues and deliver personalized interventions, improving treatment adherence. Their ability to analyze large datasets for behavioral trends and integrate with existing healthcare systems enhances clinical decision-making. Growing acceptance by both providers and patients for AI-driven support contributed to the segment’s dominant market position.

Latin America dominated the behavioral health market owing to the rising prevalence of psychiatric disorders, increased private-sector investments in mental health facilities, and growing availability of specialized clinics and telehealth services catering to urban and semi-urban populations.

The behavioral health market in Brazil is growing due to increased investment in mental health facilities, rising demand for specialized therapies, and wider adoption of digital and telehealth solutions. Enhanced government support, awareness campaigns, and expanding access to psychiatric and counseling services are further driving market expansion across the country.

The behavioral health market in Mexico is expanding as private healthcare providers invest in specialized mental health clinics, telehealth services gain traction, and rising urbanization and workplace stress drive demand for accessible psychiatric and behavioral care solutions.

The Argentina behavioral health market is expanding as more private and public institutions invest in mental health infrastructure. The growing prevalence of stress-related and behavioral disorders, combined with the rising adoption of digital therapy platforms and community-based programs, is driving increased access and service utilization across the country.

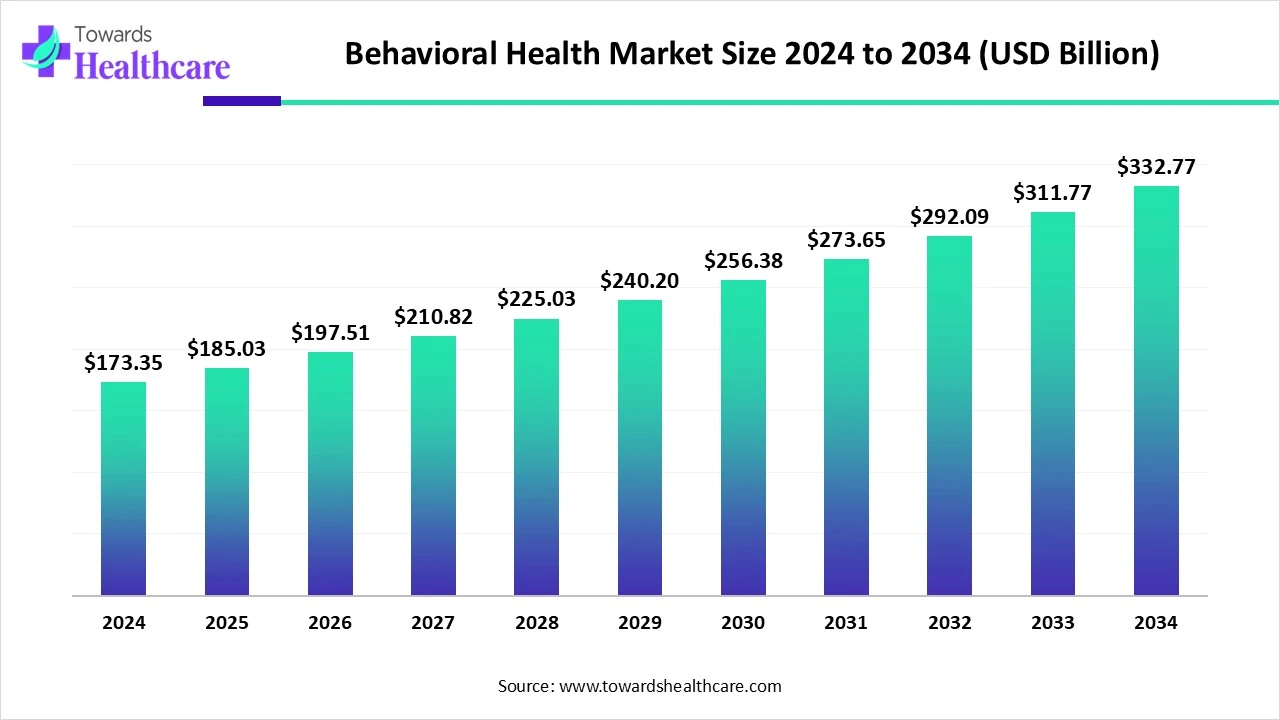

The global behavioral health market is valued at US$ 173.35 billion in 2024, increasing to US$ 185.03 billion in 2025, and is projected to reach approximately US$ 332.77 billion by 2034. This growth reflects a CAGR of 6.74% from 2025 to 2034.

Clinical trials for behavioral health are growing in Latin America, with programs like LATIN-MH and the Portal of Clinical Trials of the Americas enhancing research capacity and bridging the mental health treatment gap.

These studies use mobile technology and target conditions such as depression and substance abuse, promoting culturally appropriate, accessible care in community and primary care settings.

Regulatory approvals for behavioral health in Latin America require authorization from national health agencies, such as Brazil’s ANVISA and Mexico’s COFEPRIS. Efforts to streamline processes through digital systems and greater transparency are ongoing.

Regional differences in regulations can cause delays, and while some countries consider approvals from trusted authorities like the FDA or EMA, adapting treatments to local contexts remains essential to ensure safe and effective market access.

In Latin America, patient support for behavioral health includes programs providing emotional support, follow-ups, and care coordination to enhance treatment adherence.

Initiatives also focus on psychiatric rehabilitation, incorporating peer support, family education, and assisted living to address the needs of individuals with severe mental illnesses.

By Service Modality / Delivery Mode

By Disorder / Condition Type

By Technology / Tools / Solution Type

By Region

February 2026

February 2026

January 2026

January 2026