January 2026

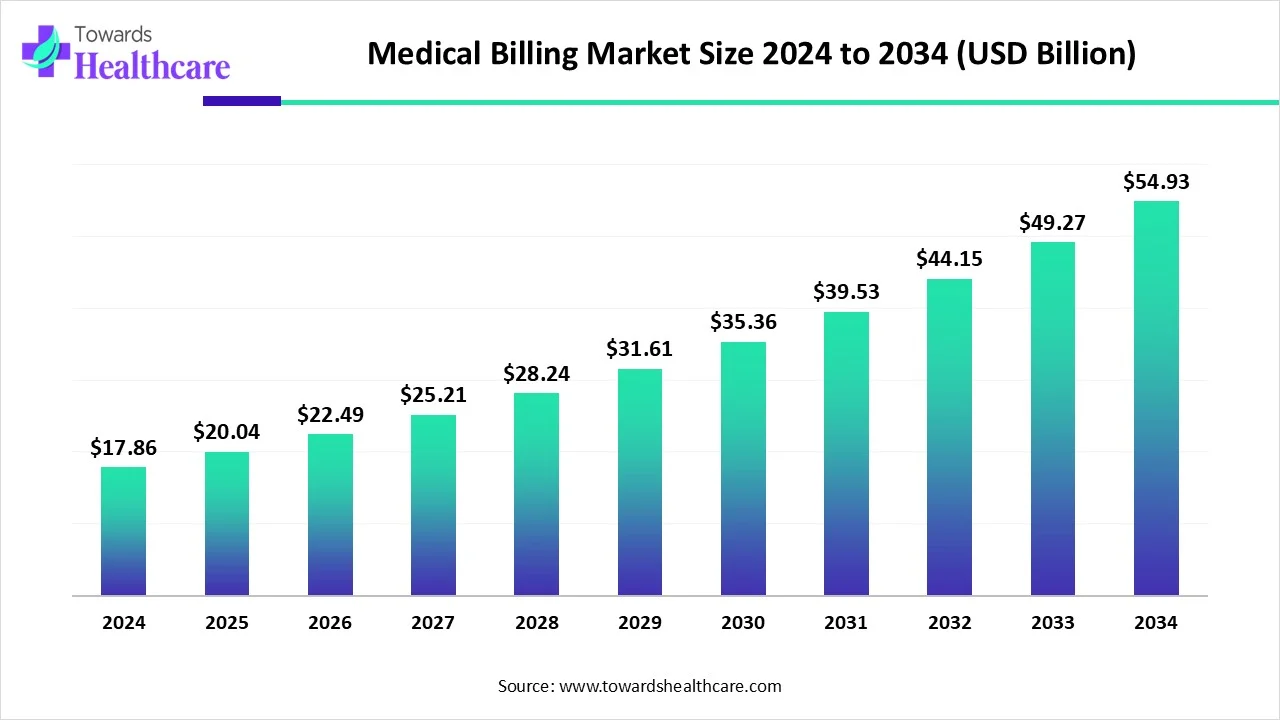

The global medical billing market size is calculated at USD 20.04 billion in 2025, grows to USD 22.48 billion in 2026, and is projected to reach around USD 63.19 billion by 2035. The market is expanding at a CAGR of 12.17% between 2026 and 2035.

| Metric | Details |

| Market Size in 2025 | USD 20.04 Billion |

| Projected Market Size in 2034 | USD 63.19 Billion |

| CAGR (2025 - 2034) | 12.17% |

| Leading Region | North America |

| Market Segmentation | By Type, By Application, By Process, By Region |

| Top Key Players | Accenture, TCS, AGS Health, Cognizant Technology Solutions , GeBBS Healthcare, Genpact, HCL Technologies, INFINIT Healthcare, Medusind |

Medical billing is the process of translating healthcare services into billing claims, submitting them to insurance companies, and ensuring providers are reimbursed for their services. It involves patient information, treatment details coding, and follow-up on claim status. Technological advancements are significantly shaping the medical billing market by streamlining processes, reducing errors, and improving efficiency. Automation tools, AI-driven coding, and cloud-based billing systems have simplified claim submission and tracking. These innovations help healthcare providers manage large volumes of data, ensure accurate billing, and reduce claim denials. Additionally, real-time analytics and integrated EHR systems enhance revenue cycle management, leading to faster reimbursements and improved financial performance across healthcare facilities.

For Instance,

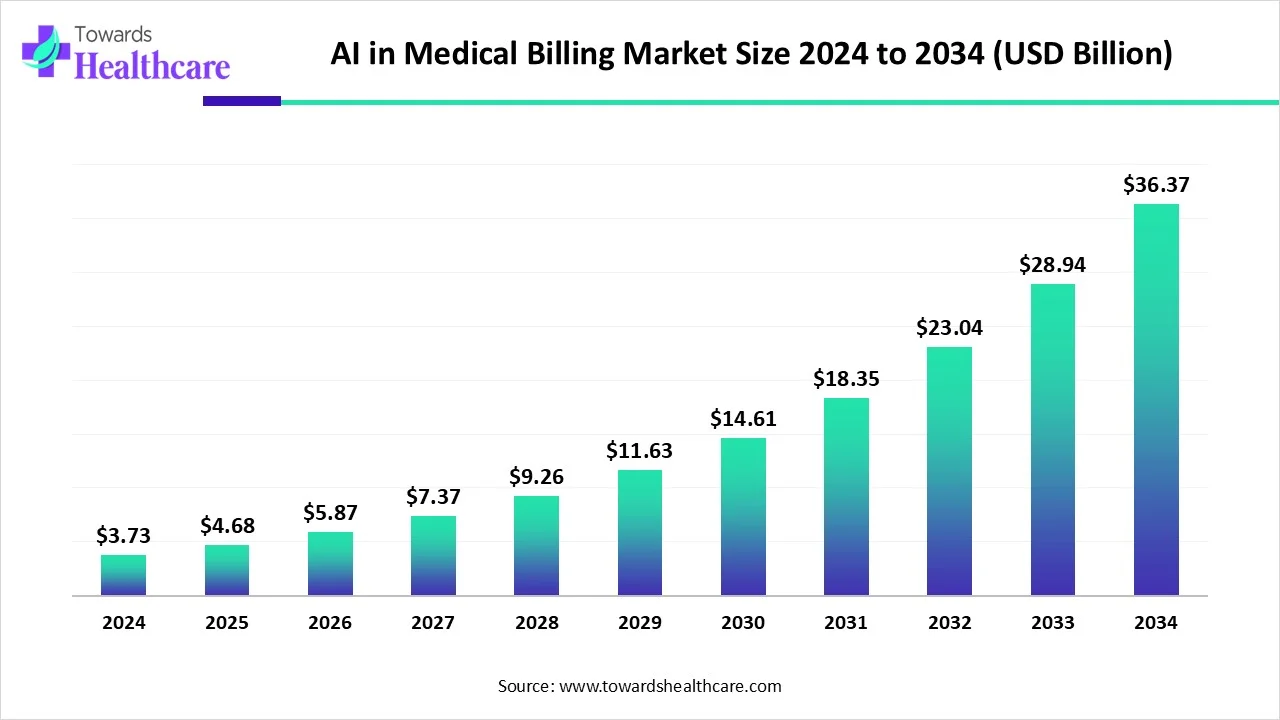

AI is enhancing advancements in the market by automating time-consuming tasks like coding, claim submission, and payment processing. It reduces human error, speeds up workflows, and improves claim accuracy, resulting in fewer denials and faster reimbursements. AI also enables predictive analytics for better revenue forecasting and real-time fraud detection. These innovations streamline the entire billing cycle, helping healthcare providers improve efficiency, reduce costs, and ensure more consistent cash flow.

The global AI in medical billing market size is valued at USD 3.73 billion in 2024, expected to rise to USD 4.68 billion in 2025, and is projected to reach approximately USD 36.37 billion by 2034, advancing at a CAGR of 25.4% from 2025 to 2034.

For Instance,

Growing Patient Number and Ensuring Expansion of Health Insurance

As more individuals access healthcare services due to population growth, aging demographics, and chronic illness, the volume of medical claims rises. Simultaneously, broader insurance coverage increases the number of insured patients, leading to a surge in insurance claims and reimbursement processes. This creates a need for accurate billing, coding, and regulatory compliance. Healthcare providers rely on efficient medical billing systems to handle complex claims, reduce errors, and ensure timely payments, making medical billing a critical component of modern healthcare operations.

For Instance,

Regulatory and Compliance Complexity

Regulatory and compliance complexity is a major restraint for the medical billing market because frequent changes in healthcare laws, coding standards, and insurance policies require constant updates and staff training. Failure to comply can lead to claim denials, financial penalties, or legal issues. This increases administrative burden and costs, especially for smaller providers, making it difficult to maintain accurate, timely, and efficient billing processes.

Increasing Demand for AI and Cloud-Based Deployment

AI technology automates time-consuming tasks such as coding, claim processing, and error detection, which reduces human error and accelerates reimbursement cycles. Cloud-based systems provide healthcare providers with real-time access to billing data, improve data security, and reduce the need for expensive IT infrastructure. These technologies also enable easier updates to comply with changing regulations and facilities' scalability for growing patient volumes. Overall, the integration of AI and cloud solutions helps streamline billing operations, improve accuracy, and enhance financial performance in the healthcare industry.

For Instance,

By type, the institutional billing segment was dominant in the market in 2024 due to the high volume and complexity of claims processed by large healthcare facilities such as hospitals and nursing homes. These institutions handle a wide range of services, including inpatient and outpatient services, diagnostics, and surgeries, requiring detailed and accurate billing. Institutional billing systems are designed to manage this complexity efficiently, making them essential for large-scale operations, and the need for streamlined revenue cycle management further contributed to the medical billing market dominance.

By type, the professional billing segment is expected to grow at the fastest rate in the market during the forecast period, due to rising demand for outpatient services and specialized care providers by individual practitioners and clinics. These settings require efficient billing systems to handle high patient volumes and frequent transactions. Additionally, the adoption of value-based care models and advancements in digital billing technologies, such as AI and cloud-based solutions, further support faster and more accurate claim processing, making professional billing increasingly attractive for healthcare providers.

By application, the financial segment held the major market share in 2024 and is expected to grow at the fastest rate during the forecast period because of the growing need for efficient revenue cycle management in healthcare. Hospitals and clinics face increasing pressure to manage billing, coding, and reimbursement accurately to maintain cash flow and reduce financial losses. The financial segment includes services like claim processing, payment collection, and financial analytics, which help providers optimize operations. As healthcare costs rise and billing complexity increases, demand for robust financial solutions in medical billing continues to grow in the medical billing market.

By application, the database management segment is estimated to grow at a significant rate in the market during the studied years, due to the increasing need for secure, accurate, and organized handling of large volumes of patient and billing data. As healthcare providers generate vast amounts of information daily, an efficient database vast essential for storing, retrieving, and managing medical and financial records. The rise in electronic health records, regulatory requirements, and data-driven decision-making further boosts the demand for advanced database management solutions and drives market growth.

By process, the medical billing segment contributed the biggest market share in 2024. The dominance is primarily due to the increasing complexity of healthcare billing processes, which has led many providers to. Outsourcing offers several advantages, including cost savings, reduced administrative burdens, and improved accuracy in claims proceedings. Additionally, the need for compliance with evolving healthcare regulations has made professional billing services more attractive to healthcare institutions. These factors collectively have propelled the growth and dominance of the medical billing market.

By process, the electronic billing segment is projected to grow at the fastest rate between 2025 and 2034, due to its ability reimbursement speed. The integration of cloud-based systems and electronic health records(EHRs) enhances efficiency and data accuracy. Additionally, electronic billing supports regulatory compliance and offers cost-effective, scalable solutions. These advantages make it increasingly preferred by healthcare providers seeking to optimize revenue cycle management.

North America dominated the market in 2024, due to its advanced healthcare infrastructure, widespread adoption of electronic health records (EHRs), and strong regulatory support for healthcare digitization. High healthcare spending and increasing insurance coverage also boost demand for efficient billing solutions. Additionally, the region’s focus on technological innovations like AI and cloud-based systems accelerates the growth and modernization of medical billing services.

The U.S. market is growing due to rising healthcare expenditures and increasing patient volumes, which create greater demand for efficient billing services. Complexity in insurance claims, regulatory compliance requirements, and the need to reduce billing errors drive healthcare providers to adopt advanced medical billing solutions. Additionally, technological advancements such as automation and AI improve accuracy and speed, making outsourcing medical billing more attractive. This helps providers optimize revenue cycle management and enhance cash flow, fueling market growth.

The Canadian market is expanding due to increasing healthcare demand from an aging population and more complex medical services. Advances in technology, such as automation and cloud-based billing systems, improve efficiency and accuracy. Strict regulatory requirements also push providers to adopt better billing practices to ensure compliance. Additionally, more healthcare providers are outsourcing billing functions to reduce administrative workload, allowing them to focus on patient care, which further drives market growth.

For Instance,

Asia-Pacific is anticipated to grow at the fastest rate in the market during the forecast period, due to growing healthcare infrastructure, rising patient awareness, and increasing adoption of digital health technologies. Rapid urbanization and government initiatives to improve healthcare access boost demand for efficient billing solutions. Additionally, cost-effective outsourcing and the presence of skilled medical billing professionals attract global providers, fueling market growth in the region.

China’s market is growing due to increased healthcare digitization, driven by nationwide reforms and investments in smart hospital systems. The adoption of electronic health records (EHRs), AI-powered billing tools, and cloud-based platforms is streamlining administrative processes and improving accuracy. Rising healthcare demand from urbanization and lifestyle changes also contributes to the need for more efficient billing systems. Additionally, the push for transparency and standardized billing practices supports continued market expansion.

The country's growing healthcare infrastructure and rising health insurance penetration have increased the demand for efficient billing services. Additionally, India's strong position in the outsourcing industry, with its cost-effective and high-quality services, attracts global healthcare providers. Technological advancements, including the adoption of AI and cloud-based solutions, further enhance billing accuracy and efficiency, contributing to the market's growth.

Europe is accelerating the market through the increased adoption of digital health technologies, including AI-driven billing systems, to enhance efficiency and accuracy. The complexity of healthcare reimbursement models and stringent regulatory requirements, such as GDPR, are prompting healthcare providers to outsource billing services to specialized firms. Additionally, the shift towards value-based care models and the need for cost-effective administrative solutions are driving the demand for advanced medical billing services across the region.

The UK's market is expanding due to increasing demand for private healthcare, driven by long NHS waiting lists and staffing shortages. This shift has led to a surge in self-pay patients and private insurance usage, prompting providers to adopt advanced billing systems. Technological advancements, such as AI-driven automation and cloud-based platforms, enhance billing accuracy and efficiency. Additionally, the complexity of reimbursement procedures and regulatory compliance requirements is encouraging healthcare providers to outsource billing services, further fueling market growth.

Germany's market is expanding due to increased healthcare digitization, driven by reforms and investments in smart hospital systems. The adoption of electronic health records (EHRs), AI-powered billing tools, and cloud-based platforms is streamlining administrative processes and improving accuracy. Rising healthcare demand from urbanization and lifestyle changes also contributes to the need for more efficient billing systems. Additionally, the push for transparency and standardized billing practices supports continued market growth.

Latin America is considered to be a significantly growing area, due to the rising prevalence of chronic disorders, the increasing number of hospitalizations, and favorable government support. Government and private insurers provide reimbursement for various acute and chronic diseases. The burgeoning healthcare sector and increasing healthcare spending also contribute to market growth. The rising adoption of advanced technologies facilitates the development of AI-based medical billing platforms.

It is estimated that approximately 45% of Brazilians aged 18 years and above suffer from chronic diseases, such as hypertension, diabetes, arthritis, and depression. Brazil is the largest healthcare market in Latin America, spending 9.7% of its GDP on healthcare. In 2023, about 26% of Brazilians were covered by voluntary medical insurance, and an additional 16% had voluntary coverage for dental care exclusively.

In September 2024, August Health launched its new Billing & Payments solution to help senior living providers streamline billing processes and improve revenue accuracy. Integrated with August Health’s EHR and Move-Ins systems, it uses real-time data to automate billing updates and reduce manual errors. The platform also enhances the payment experience for families by offering flexible options like autopay, multi-payer support, scheduling, and various payment methods, including ACH, credit, and debit. (Source - businesswire)

By Type

By Application

By Process

By Region

January 2026

January 2026

January 2026

December 2025