January 2026

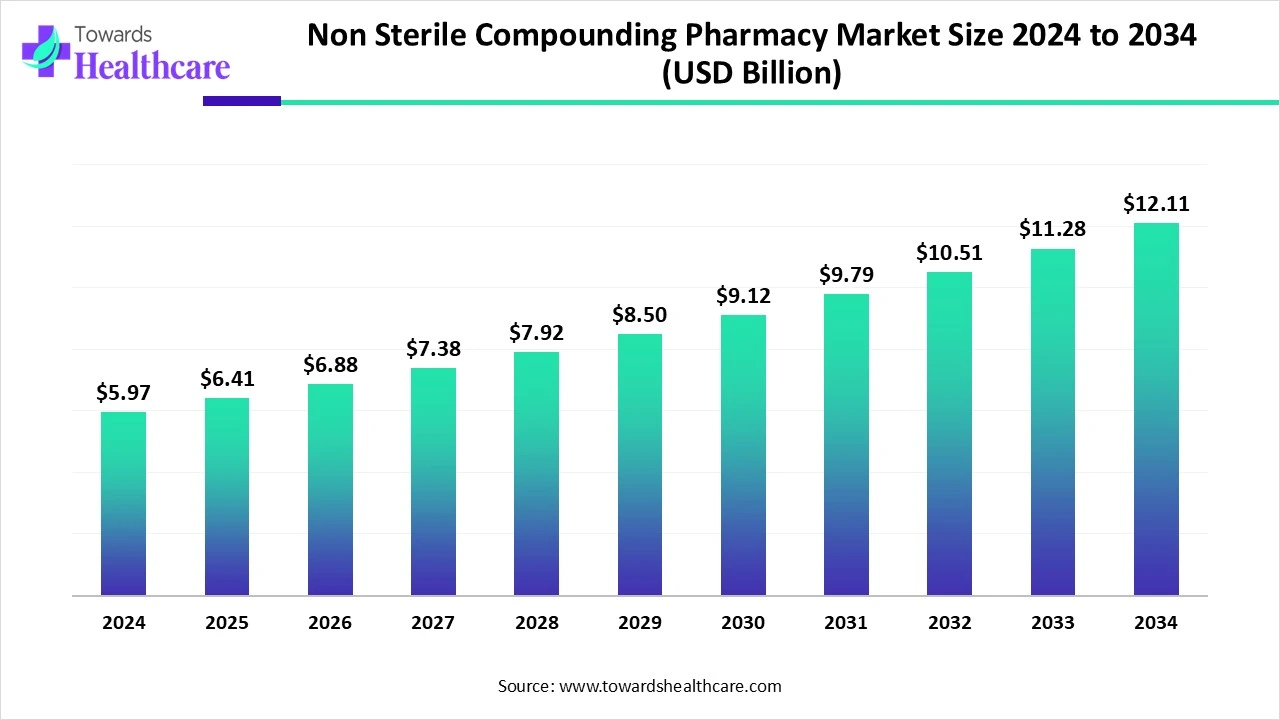

The global non-sterile compounding pharmacy market size is calculated at US$ 5.97 billion in 2024, grew to US$ 6.41 billion in 2025, and is projected to reach around US$ 12.11 billion by 2034. The market is expanding at a CAGR of 7.34% between 2025 and 2034.

Advances in pharmaceutical compounding processes and the growing demand for customized treatments have propelled the non-sterile compounding pharmacy market's recent notable expansion. The field of dermatology is one that is expanding significantly, as compounded drugs are designed to treat certain skin disorders like psoriasis and eczema. New developments in formulation and delivery techniques help this industry by improving patient compliance and treatment effectiveness. The wide range of uses for compounded pharmaceuticals outside of conventional healthcare settings is demonstrated by their applicability across industries.

| Metric | Details |

| Market Size in 2025 | USD 6.41 Billion |

| Projected Market Size in 2034 | USD 12.11 Billion |

| CAGR (2025 - 2034) | 7.34% |

| Leading Region | North America |

| Market Segmentation | By Dosage Form, By Therapeutic Area, By Type of Compounding, By Sales Channel, By Regulatory Classification, By Region |

| Top Key Players | Advanced Pharmacy, Avella Specialty Pharmacy, BCP (Belmar Pharma Solutions), CareFirst Specialty Pharmacy, Central Compounding Center, Cipla Medpro (Compounding Division), Clinigen Group, Columbia Veterinary Pharmacy, Fagron, Innovation Compounding, ITC Compounding Pharmacy, Letco Medical, Medisca, National Custom Compounding, Pencol Compounding Pharmacy, PCCA (Professional Compounding Centers of America), PharmScript, Rx3 Compounding Pharmacy, Triangle Compounding Pharmacy, Wedgewood Pharmacy |

The non-sterile compounding pharmacy market refers to the segment of pharmaceutical services focused on the custom preparation of medications that are not required to be sterile, such as oral solids and liquids, topical formulations, and suppositories. Compounding pharmacies create personalized medications tailored to the needs of individual patients such as modified doses, allergen-free formulations, or combinations of active ingredients often when commercially available drugs are unsuitable or unavailable. Unlike sterile compounding (which includes injectables and ophthalmic solutions), non-sterile compounding is subject to USP <795> regulations in the U.S. and equivalent international compounding standards. This market is driven by increasing demand for hormone therapy, veterinary medications, pediatric formulations, and dermatological treatments.

In personalized medicine, compounding is essential because it allows pharmacists to design unique therapies based on the needs of individual patients. By guaranteeing prompt access to non-sterile compounding services, AI-powered solutions improve the efficiency of this procedure. Pharmacy efficiency may be greatly increased by introducing AI help. To guarantee that pharmacists receive accurate and consistent information, AI solutions also lower the possibility of misunderstandings. Future developments might strengthen AI's usefulness in pharmaceutical care by introducing predictive analytics, improved data integration, and automated workflow support.

Rising Demand for Personalized Medicine

In the rapidly evolving healthcare sector, non-sterile compounding has emerged as a vital component of personalized medicine, providing tailored pharmacological therapies when traditional medications may not be sufficient. To meet the needs of particular patients, licensed pharmacists mix, alter, or combine ingredients in non-sterile compounding. This method addresses specific medical needs that are not met by medications, while also enhancing patient compliance and treatment efficacy.

Lack of Awareness

The expansion of the industry may be hampered by healthcare practitioners' ignorance about the advantages of compounded pharmaceuticals. The compounding procedure may be unknown to many doctors, which might result in the underuse of these crucial services.

What are the Opportunities in the Non-Sterile Compound Pharmacy Market?

Emerging markets have untapped potential due to rising levels of urbanization, industrialization, and disposable income. Through strategic partnerships, mergers, and cooperative ventures, businesses may expand their customer bases, diversify their holdings, and gain access to new technology. Growing concern about sustainability is opening up lucrative opportunities for eco-friendly and energy-efficient product lines. Businesses that invest in circular economy ideas, green manufacturing practices, and reduced carbon footprints are anticipated to achieve long-term market value.

By dosage form, the oral solids segment led the non-sterile compounding pharmacy market in 2024. Oral solid dosage forms, like tablets and capsules, are the preferred option for drug formulation because of their widespread acceptance, ease of use, precise dosing, stability, and manufacturing efficiency. These factors make them perfect for delivering medications when they are important.

By dosage form, the topicals segment is estimated to grow at the highest CAGR during the upcoming period. These dosage forms are extensively utilized in many different applications, especially in the administration of drugs topically and transdermally. Topical formulations intended for skin application include semi-solid dose forms such as gels, creams, lotions, and ointments. Numerous dermatological and cosmetic applications make extensive use of these topical preparations.

By therapeutic area, the hormonal replacement therapy (HRT) segment held the largest share of the non-sterile compounding pharmacy market in 2024. Non-sterile compounding pharmacies are experts in making drugs that are specifically suited to each patient's needs. In the case of HRT, this may be particularly advantageous. HRT can be produced by compounding pharmacies as creams, gels, pills, or injections, based on what the patient finds most practical and efficient.

By therapeutic area, the dermatology segment is expected to grow at the fastest CAGR during the forecast period. Despite the large number of medicines produced by the pharmaceutical industry, compounding is a crucial part of the treatment of skin problems. Compounding has been a valuable tool in the treatment of disorders for which there are no particular medications since the early days of dermatology.

By type of compounding, the traditional compounding segment dominated the non-sterile compounding pharmacy market in 2024. The most prevalent type of medicine compounding is non-sterile compounding, which is the conventional method of creating precise dosages of medications for patients in different routes of administration. Benefits include modifying dose amounts, developing more easily administered formulations (such as liquids for people who have trouble swallowing tablets), and eliminating components that trigger sensitivities or allergic responses.

By type of compounding, the veterinary compounding segment is estimated to be the fastest-growing during the forecast period. There is a wide range of treatment demands in veterinary medicine, and there aren't many authorized pharmaceutical medications available for all animal species and indications. Because of this, veterinary medical remedies sometimes include the impromptu creation, or compounding, of medications. To reduce human exposure to medication residues, veterinary compounding has a wide range of applications, with a major focus on meeting the medicinal needs of companion animals rather than those of animals raised for food.

By sales channel, the direct/walk-in pharmacy segment captured the major share of the non-sterile compounding pharmacy market in 2024. In many countries, a large portion of medical supplies and related services are distributed via retail pharmacies, which are essential to health systems. In high-income countries, retail pharmacies often enter into agreements with public or private insurance to supply pharmaceuticals to both public and private outpatients.

By sales channel, the online/mail order services segment is anticipated to grow at the highest rate during 2025-2034. Online pharmacies that specialize in compounding have a number of benefits. Patients who live in rural places or have mobility challenges may particularly benefit from online compounding pharmacies, which provide a simple option for patients to obtain drugs from the comfort of their homes. Patients can save time and effort by purchasing and receiving their medications online more quickly than they would in a typical pharmacy.

By regulatory classification, the 503A pharmacies segment held the major share of the non-sterile compounding pharmacy market in 2024. Typically run by the state, 503A pharmacies are conventional compounding pharmacies that make drugs according to patient-specific prescriptions. More closely connected to what may be referred to as typical compounding pharmacies are 503A pharmacies. 503A pharmacists' dedication to quality and safety highlights their significance as patient advocates and their pivotal position as mediators in the healthcare system.

By regulatory classification, the 503B outsourcing facilities segment is expected to grow at the fastest CAGR during the forecast period. Pharmaceutical companies entered the medication compounding business with the goal of meeting the needs of individual patients; they mostly provided outsourcing services to hospital pharmacies. The FDA encourages 503Bs to register as outsourcing facilities. Traditional compounding pharmacies and major pharmaceutical manufacturers are balanced in a significant way by 03B outsourcing facilities.

North America dominated the non-sterile compounding pharmacy market in 2024. In North America, non-sterile compounding pharmacies must adhere to stringent laws and quality requirements to guarantee patient safety and the effectiveness of their prepared drugs. Regulatory agencies that oversee and give guidance for adherence to acceptable non-sterile compounding methods include Health Canada in Canada and the Food and Drug Administration (FDA) in the U.S.

In January 2025, the FDA released guidelines for 503A pharmacies and 503B outsourcing facilities on the use of bulk drug substances in compounding. These regulations provide security and support to pharmacies and outsourcing facilities that utilize particular kinds of bulk drug ingredients, and the FDA is still reviewing products for inclusion on lists of items that can be used in medication compounding.

As a fundamental component of their work, pharmacists in Canada typically combine medications, a practice that is governed by the relevant regulatory bodies in each province or territory. To guarantee that medication production and compounding are both governed by the proper authorities, a uniform strategy across Canada must be developed.

Asia Pacific is estimated to host the fastest-growing non-sterile compounding pharmacy market during the forecast period. Significant demand is being created by the fast industrialization, population expansion, and growing urban centers in nations like China, India, and Southeast Asia. This area is a hub for new market entry and expansion plans due to lower production costs and increased infrastructural expenditures.

China has addressed healthcare issues in recent years with a range of legislative initiatives, emphasizing individualized care for an aging populace. Regional inequities and growing out-of-pocket expenses are among the issues that still exist despite greater government funding. Using vast health information and diagnostic tools, China is making significant investments in PM.

Given its ethnic variety, 1.3 billion people, and high illness burden, India presents a special potential for the use of precision medicine in public health. The initiative will provide a comprehensive database of genetic diversity for Indian people by whole-genome sequencing, which would also create new avenues for the advancement of next-generation personalized medicine, or PM.

Europe is expected to grow significantly in the non-sterile compounding pharmacy market during the forecast period. The United Kingdom, France, Germany, and other nations are driving the expansion. The market in this area is driven by rising healthcare costs, the incidence of chronic illnesses, and growing knowledge of the advantages of compounded drugs. The existence of professional associations and encouraging government regulations that encourage high standards of practice in compounding pharmacies also help to fuel industry expansion.

Germany is the fourth-biggest pharmaceutical market globally, behind the US, China, and Japan, and the largest in Europe. Due to factors including changing demographics, an increase in chronic illnesses, and a greater focus on self-medication and prevention, Europe's largest pharmaceutical market is expanding more quickly than the German economy. Germany is becoming a major provider of innovative biopharmaceuticals as well.

13 million HRT items were prescribed in England in 2023–2024. Compared to 2022–2023, this represented a 22% rise. Between 2022–2023 and 2023–2024, the expected number of recognized patients grew by 12%, from 2.3 million to 2.6 million. April 2023 saw the introduction of the HRT PPC. In 2023–2024, an HRT PPC was utilized for 14.5% of HRT products. In June 2024, this percentage rose to 21%.

In January 2025, Donald Prentiss, founder and CEO of Qualthera, discusses the importance of compounding pharmacies in meeting specific and unmet prescription requirements that are not satisfied by commercially accessible medications in a video interview with Pharma Commerce. Depending on whether they are 503A or 503B compounding facilities, their function in the pharmaceutical supply chain differs. (Source - Pharmaceutical Commerce)

By Dosage Form

By Therapeutic Area

By Type of Compounding

By Sales Channel

By Regulatory Classification

By Region

January 2026

December 2025

January 2026

December 2025