February 2026

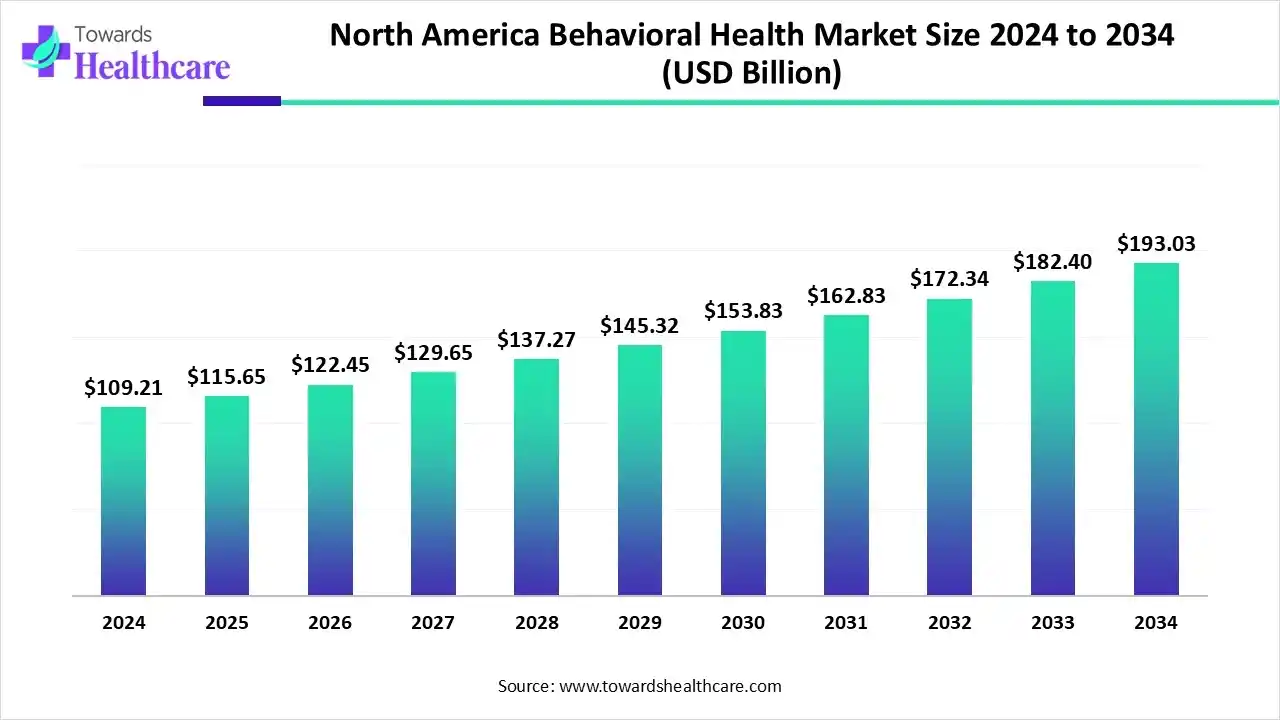

The North America behavioral health market size is calculated at US$ 109.21 billion in 2024, grew to US$ 115.65 billion in 2025, and is projected to reach around US$ 193.03 billion by 2034. The market is expanding at a CAGR of 5.86% between 2025 and 2034.

The National Institute of Mental Health, under the National Institutes of Health (NIH), transformed the North America behavioral health market through the understanding and treatment of mental illnesses. It has reported the data of the diagnostic assessment from the National Survey on Drug Use and Health (NSDUH) and the National Comorbidity Survey Adolescent Supplement (NCS-A). Mental Health America (MHA) is the leading national non-profit organization dedicated to promoting mental health, well-being, and illness prevention.

| Table | Scope |

| Market Size in 2025 | USD 115.65 Billion |

| Projected Market Size in 2034 | USD 193.03 Billion |

| CAGR (2025 - 2034) | 5.86% |

| Market Segmentation | By Condition Category, By Service Modality, By Patient Age Group, By Payer/Funding, By Region |

| Top Key Players | Acadia Healthcare Co, Universal Health Services (UHS), LifeStance Health, Lyra Health, Talkspace, Spring Health, Headspace Health, BetterHelp, Oracle Corporation, Epic Systems |

The North American population, including the U.S., is experiencing a mental health crisis, which covers mental disorders related to social, behavioral, and psychological illnesses. The North America behavioral health market is mainly expanding through evolving strategies to improve behavioral healthcare access. These include expanding primary care and behavioral health integrated care, leveraging health support workers, and using telebehavioral health. Behavioral health needs are growing for children, older adults, and rural and underserved areas. The significant investments in the behavioral health workforce and adequate workforce planning will be important to address the healthcare needs. The Medicaid programs, telehealth services, audio-only services, and telebehavioral health services are allowed for people in many states, which enhance access to care from home.

Artificial intelligence plays a crucial role in the North America behavioral health market. It is useful in diagnosis, clinical care, disease surveillance, outbreak response, drug development, and health systems management. AI helps to meet sustainable development goals while ensuring safety and equity. AI ensures trust and ethical practices in healthcare. The emerging uses of AI in health revolve around electronic health records, personalized healthcare plans, health monitoring, wearables, virtual health, AI-robot-assisted surgery, and mental health. AI is a powerful source for innovation, ethical integrity, and equity in healthcare.

| State Rankings | Prevalence of Mental Illness | Adult Prevalence of Mental Illness |

| 1 | Connecticut | New Jersey |

| 2 | New Jersey | Florida |

| 3 | Georgia | Delaware |

| 4 | South Carolina | Connecticut |

| 5 | Texas | New York |

| 6 | Mississippi | Hawaii |

| 7 | Hawaii | Texas |

| 8 | New York | Illinois |

| 9 | Massachusetts | Mississippi |

| 10 | North Carolina | California |

The mood & anxiety disorders segment dominated the North America behavioral health market in 2024, owing to the key roles of behavioral health in assessment, diagnosis, psychotherapy, and preventative care. The integrated care models potentially deliver better outcomes, allow early identification, and enable increased access and reduced stigma. The mental health campaigns, policies, and professional medical organizations are raising awareness and improving access to behavioral health services.

The substance use disorders segment is expected to grow at the fastest CAGR in the market during the forecast period due to the importance of behavioral interventions in addressing social, psychological, and emotional factors of individuals that lead to addiction. The North America behavioral health market is expanding due to the novel behavioral therapies used in North America, such as cognitive behavioral therapy, family and couples therapy, 12-Step Facilitation Therapy, etc., which contribute to expanding access to mental health care. Moreover, motivational interviewing, motivational enhancement therapy, and dialectical behavior therapy (DBT) also help individuals to get rid of mental illnesses.

The outpatient counselling & psychiatry segment dominated the market in 2024, owing to its critical role in assessment, diagnosis, talk, behavioral therapy, and life management. It helps to grow the North America behavioral health market with medication management, higher-level care, collaboration, and detailed evaluations. This approach covers integrated expertise, detailed treatment plans, and improved patient experience.

The tele-behavioral/virtual care segment is estimated to grow at the fastest rate in the market during the predicted timeframe due to its convenience, flexibility, and reaching up to underserved populations during a crisis. It promotes early interventions and enhances patient comfort. It is effective than in-person care due to the integration of digital tools for improved care.

The adults segment dominated the North America behavioral health market in 2024, owing to the rising cases of poor physical health and its behavioral consequences. The unhealthy habits, poor behavioral health, and their impact on physical health also drive the need for behavioral therapies. The behavioral interventions bring holistic wellness, reduced healthcare costs, and enhanced productivity.

The children & adolescents segment is anticipated to grow at a notable rate in the market during the upcoming period due to the primary role of behavioral health in the diagnosis of anxiety, depression, and behavioral disorders. The rising trends of telehealth and public-private partnerships are effective in the North America behavioral health market for medication management and providing remote psychotherapy. The established health infrastructure and accessible resources for mental health crises save millions of lives, including children and adolescents.

The public & social insurance segment dominated the market in 2024, owing to the reduced cost barriers, integrated care, and innovations. Public insurance programs provide wide access to mental health and substance abuse treatment for people with disabilities and low-income adults. The expanded coverage, systemic reforms, and increased access to care through public and social insurance help to address behavioral health issues in the North America behavioral health market.

The commercial/employer-sponsored segment is predicted to grow at a rapid rate in the market during the studied period due to various benefits such as psychiatric medication, counselling, therapy, inpatient hospitalization, and substance use treatment. Digital mental health platforms and flexible work arrangements drive innovations in behavioral and mental health services. The investments in employee assistance programs and the creation of a supportive environment are influenced by workplace culture.

North America dominated the market in 2024, owing to supportive government policies and technological innovations in treatment and delivery. The North America behavioral health market is driven by the Substance Abuse and Mental Health Services Administration (SAMHSA), the agency located in Maryland and across the U.S., which has taken certain initiatives in 2025, like the ongoing State Opioid Response (SOR) grants, the Substance Abuse Prevention and Treatment Block Grant, and the Community Mental Health Services Block Grant. The government-led behavioral health programs launched in North America include the Innovation in Behavioral Health (IBH) Model of the U.S. federal government and new funding activities for youth mental health in Canada.

In August 2025, the Centers for Disease Control and Prevention (CDC) launched a new campaign to address mental health issues and substance use disorders in youth.

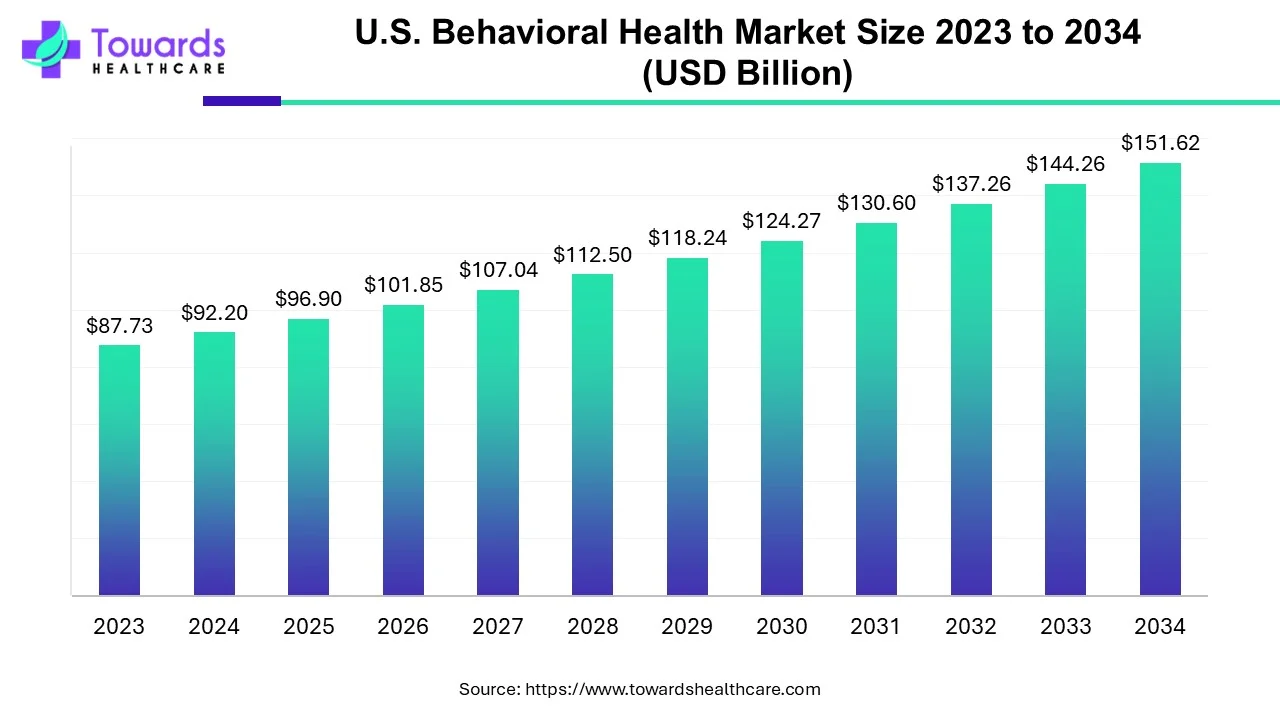

The U.S. behavioral health market size was calculated at USD 92.2 billion in 2024, to reach USD 96.9 billion in 2025 is expected to be worth USD 151.62 billion by 2034, expanding at a CAGR of 5.1% from 2024 to 2034.

In February 2025, Teva Pharmaceuticals and the National Association of Free and Charitable Clinics (NAFC) announced the funding of $75,000 to each of 11 charitable and free clinics across Texas, Alabama, and Mississippi under the Access to Mental Health Care grants initiative, which will continue its efforts to address the growing need for expanded mental health services in medically underserved communities.

In February 2025, Frontera, located across the U.S., launched $32 million in seed funding to enhance its AI-powered platform to help clinicians diagnose and treat children struggling with autism and related disorders.

In November 2024, the Government of Canada launched a youth mental health fund to support better mental health services for youth and community organizations across Canada.

In September 2025, the Government of Canada invested in research to inform youth about better mental health and wellness services across Canada.

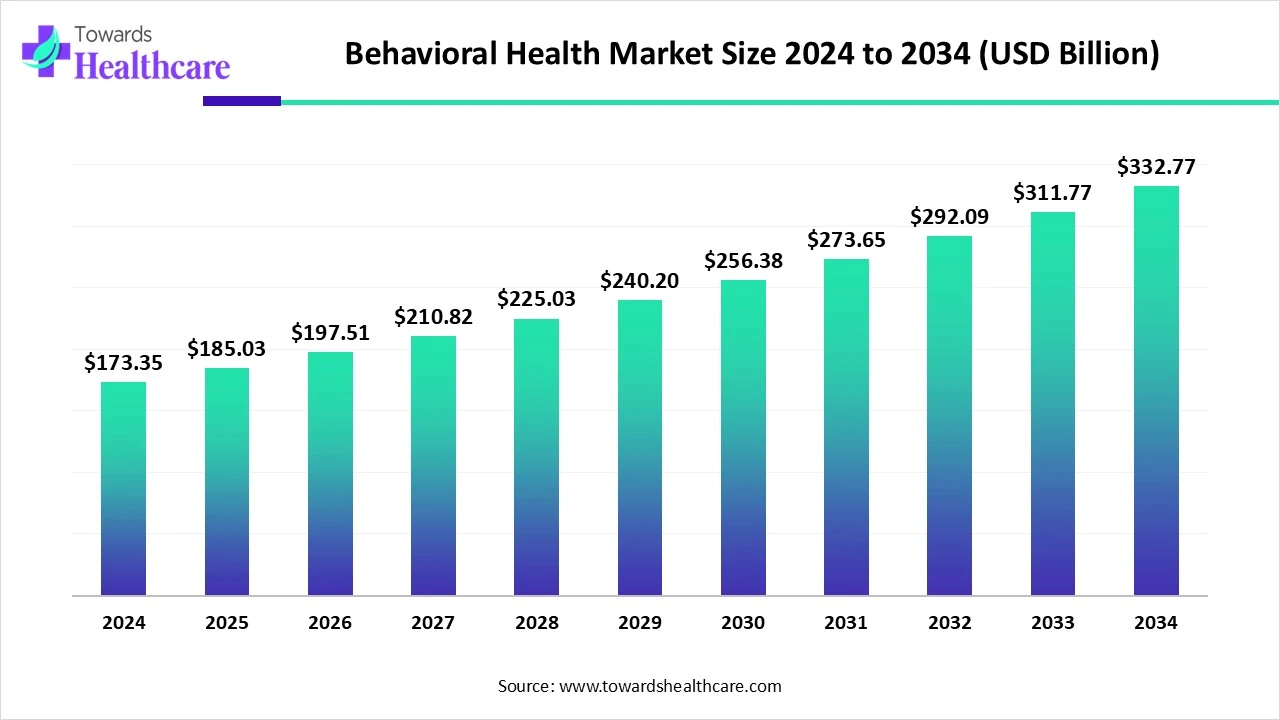

The global behavioral health market was valued at US$ 173.35 billion in 2024 and grew to US$ 185.03 billion in 2025. It is expected to reach approximately US$ 332.77 billion by 2034, expanding at a CAGR of 6.74% from 2025 to 2034.

The R&D process for behavioral therapy in North America involves five stages of R&D, such as discovery and development, preclinical research, clinical research, regulatory review, and post-market safety monitoring.

Key Players: Akili Interactive, Big Health, Click Therapeutics, Headspace Health, Lyra Health, Spring Health, Talkspace.

The services include emergency care, outpatient counselling, medication distribution, telepharmacy, digital health, online pharmacies, etc.

Key Players: AmerisourceBergen, Cardinal Health, McKesson Corporation, Magellan Health, Evernorth.

The key trends include expansion of telehealth and digital tools, focus on integrated behavioral health, growth in targeted and specialized services, public and employer-sponsored programs, and regulatory and billing updates.

Key Players: Talkspace, BetterHelp, Headspace Health, Teladoc Health, Amwell, Lyra Health, Spring Health.

By Condition Category

By Service Modality

By Patient Age Group

By Payer/Funding

By Region

February 2026

February 2026

January 2026

January 2026