December 2025

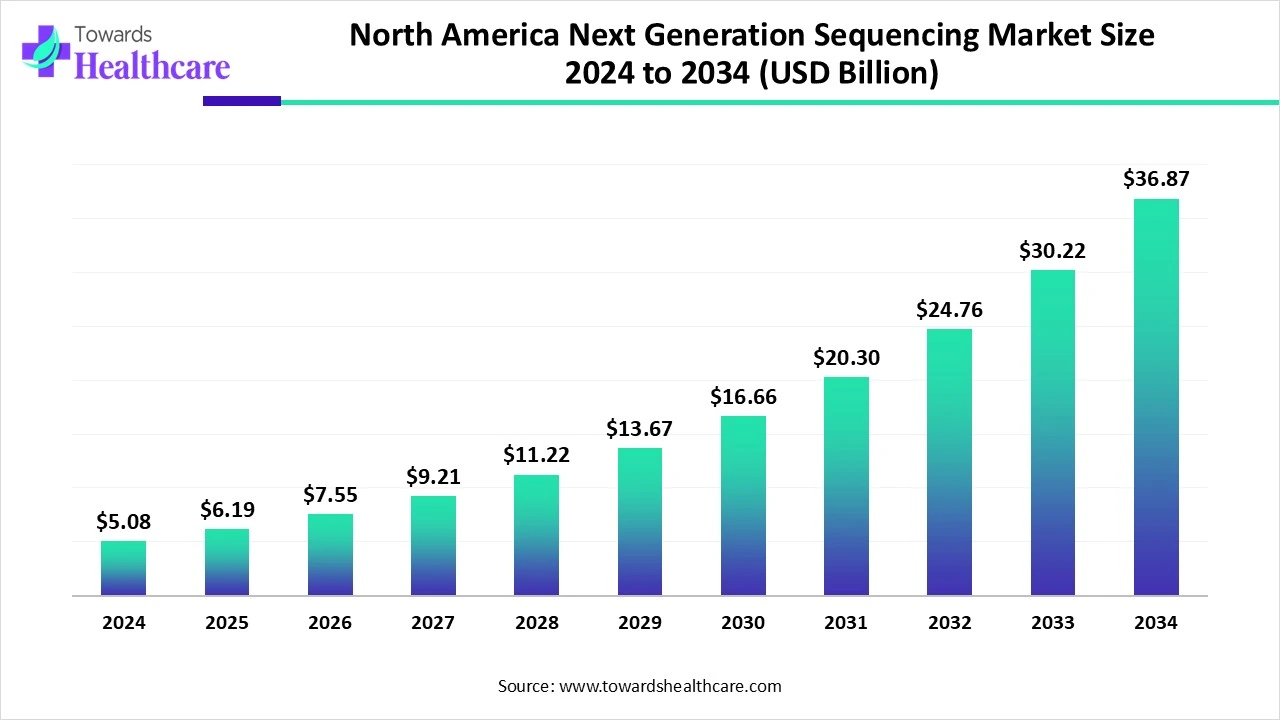

The North America next generation sequencing market size is calculated at USD 5.08 in 2024, grew to USD 6.19 billion in 2025, and is projected to reach around USD 36.87 billion by 2034. The market is expanding at a CAGR of 21.93% between 2025 and 2034.

| Metric | Details |

| Market Size in 2025 | USD 6.19 Billion |

| Projected Market Size in 2034 | USD 36.87 Billion |

| CAGR (2025 - 2034) | 21.93% |

| Market Segmentation | By Technology, By Product, By Application, By Workflow, By End-use, By Region |

| Top Key Players | Agilent Technologies, Inc., ThermoFisher Scientific, Inc., QIAGEN, Illumina, Inc., Bio-Rad Laboratories, Inc., Illumina, Inc., Pacific Biosciences of California, Inc., 10x Genomics, Inc., PerkinElmer, Inc., Genewiz, Partek Incorporated, Becton, Dickinson and Company (BD), Genomic Health, Inc., Guardant Health, Inc., Personalis, Inc. |

A novel technique for DNA and RNA sequencing, as well as variant/mutation identification, is called next-generation sequencing (NGS). NGS can quickly sequence an entire genome or hundreds of thousands of genes. Deciphering intricate genomic landscapes, locating functional components in genomes, and comprehending the genetic foundation of characteristics and illnesses have all benefited greatly from it. In medicine, NGS has significantly advanced individualized therapy and illness diagnostics. It makes it possible to quickly and thoroughly profile a person's genetic composition.

Two revolutionary innovations that have made great strides in recent decades are artificial intelligence (AI) algorithms and sequencing technology. As more data is handled by the biomedical sector and AI systems are able to better handle biological complexity, the connection between these two fields of study will only grow. In many different situations, ML and DL approaches have been used to sequence data. Significant advances in data processing and interpretation by AI algorithms have benefited the discipline as a whole in a number of areas, such as monitoring minimum residual illness, classifying disease subtypes, predicting treatment response, and risk assessment and early diagnosis.

Heavy Usage in Diagnostics

The market's growth has been largely attributed to the growing and diverse applications of next-generation sequencing in diagnostics. As a result of its declining costs, sequencing is now being used more often to diagnose various diseases. A range of test kits and testing services is being introduced by the running firms for a number of applications, such as genetic testing, cancer screening, non-invasive prenatal testing, and more.

High Expense of NGS

For both patients and healthcare providers, the cost of NGS procedures, which include sequencing, data processing, and interpretation, is a significant barrier to accessibility. NGS equipment's use in clinical settings is limited by the expense of purchasing and maintaining it, especially in institutions with limited resources.

Are Portable Sequencing Devices the Next Step in Next Generation Sequencing?

The ability to sequence the DNA of any organism and make scientific and therapeutic inferences has proven transformative for public health. Because portable handheld sequencing technologies reduce costs, simplify, and speed up sequencing without requiring big clinical laboratories, they are opening the door for the market's future growth. Thanks to real-time sequencing, scientists and medical professionals may now react to sequencing data instantly. For less than $1,000, portable nanopore-based sequencers can sequence the whole genome.

By technology, the target sequencing & resequencing segment held the major share of the North America next generation sequencing market in 2024. Targeted sequencing offers a rapid and cost-effective way to identify known and undiscovered changes in certain gene sets or genomic regions. Highly concentrated single-gene sequencing is accurate, fast, and affordable with Sanger sequencing. Resequencing is the most effective and crucial method for identifying sequence changes in clinical diagnosis. It provides researchers with precise and understandable details about the variations they have discovered.

By technology, the WGS segment is expected to grow at a significant rate in the North America next generation sequencing market during 2025-2034. Whole genome sequencing (WGS) is the preferred method for both the identification of actionable cancer drivers and the molecular genetic diagnosis of rare and unknown diseases. Compared to traditional molecular genetic methods, WGS captures most of the genomic variety and eliminates the need for sequential genetic testing. WGS data may also be reexamined and reinterpreted several times throughout the course of the patient's journey, possibly making them a lifelong companion.

By product, the consumables segment dominated the North America next generation sequencing market in 2024 and is expected to be the fastest-growing during the forecast period. NGS has become a useful technique for gaining a more thorough and precise look into the molecular foundations of certain cancers as genomics-focused pharmacology starts to play a bigger role in cancer treatment. NGS-driven companion diagnostics are often seen as directing therapy selection to maximize patient outcomes in the future, since targeted drugs are quickly emerging as the new gold standard of care for cancer. The field of cancer may be greatly impacted by the speed, sensitivity, and accuracy benefits that NGS offers over conventional techniques.

By application, the oncology segment captured the dominant share of the North America next generation sequencing market in 2024. NGS has become a useful technique for gaining a more thorough and precise look into the molecular foundations of certain cancers as genomics-focused pharmacology starts to play a bigger role in cancer treatment. NGS-driven companion diagnostics are often seen as directing therapy selection to maximize patient outcomes in the future, since targeted drugs are quickly emerging as the new gold standard of care for cancer. The field of cancer may be greatly impacted by the speed, sensitivity, and accuracy benefits that NGS offers over conventional techniques.

By application, the consumer genomics segment is anticipated to witness the fastest growth rate in the North America next generation sequencing market during the predicted timeframe. As more individuals buy direct-to-consumer (DTC) genomic tests, the number of people receiving genetic testing outside of the traditional medical paradigm may surpass that of those receiving it. This suggests that doctors and health institutions need to be ready to assist people in understanding the results of genetic testing that is done directly to consumers. Every consumer has a different experience with DTC genetic testing. Thus, a more customized method of providing findings could be required.

By workflow, the sequencing segment held the largest share of the North America next generation sequencing market in 2024. The science of genomics has undergone a revolution thanks to the fast development of next-generation sequencing (NGS) technologies over the past 20 years, which have also made sequencing available for several clinical and scientific applications. Although the present NGS industry is dominated by typical short-read sequencing technologies, single-cell, long-read, and direct-read sequencing have been made possible by more recent third-generation devices.

By workflow, the NGS data analysis segment is expected to be the fastest-growing in the North America next generation sequencing market during 2024-2034. Understanding the various NGS data file types in-depth is necessary for effective NGS data analysis. There are many different ways to analyze NGS data. These include using cloud-based one-click analysis systems like BaseSpace or using command-line tools like BWA, STAR, Bowtie, or samtools directly on your local computers. Many NGS data analysis tools come with comprehensive guides, documentation, and best practices guidelines.

By end-use, the academic research segment dominated the North America next generation sequencing market in 2024. With recent technological breakthroughs (NGS), the cost per genome has significantly dropped, making genomic data more accessible to independent researchers. Because genomic analysis is getting cheaper, it is becoming a more desirable and necessary part of every successful bioscience research endeavor. In addition to working on local and international genome projects, the Next Generation Genomics Facility (NGGF) provides genomics services to scientists and teaches researchers.

By end-use, the clinical research segment is anticipated to grow at the fastest CAGR in the North America next generation sequencing market during the forecast period. NGS is one of the key technologies that has transformed the molecular and diagnostic domains of pharmacogenomics. Researchers may provide thorough descriptions of genomic landscapes and fill up the gaps in missing data with NGS technology, which helps clinical trials collect as much information as possible regarding the medication.

North America dominated the North America next generation sequencing market in 2024. because of its advanced healthcare system, significant government funding, and extensive research and development. This domination encourages innovation and early adoption, which drives market growth and attracts important players and investments. Prominent genomics companies and research facilities drive market expansion and shape trends that impact global market dynamics.

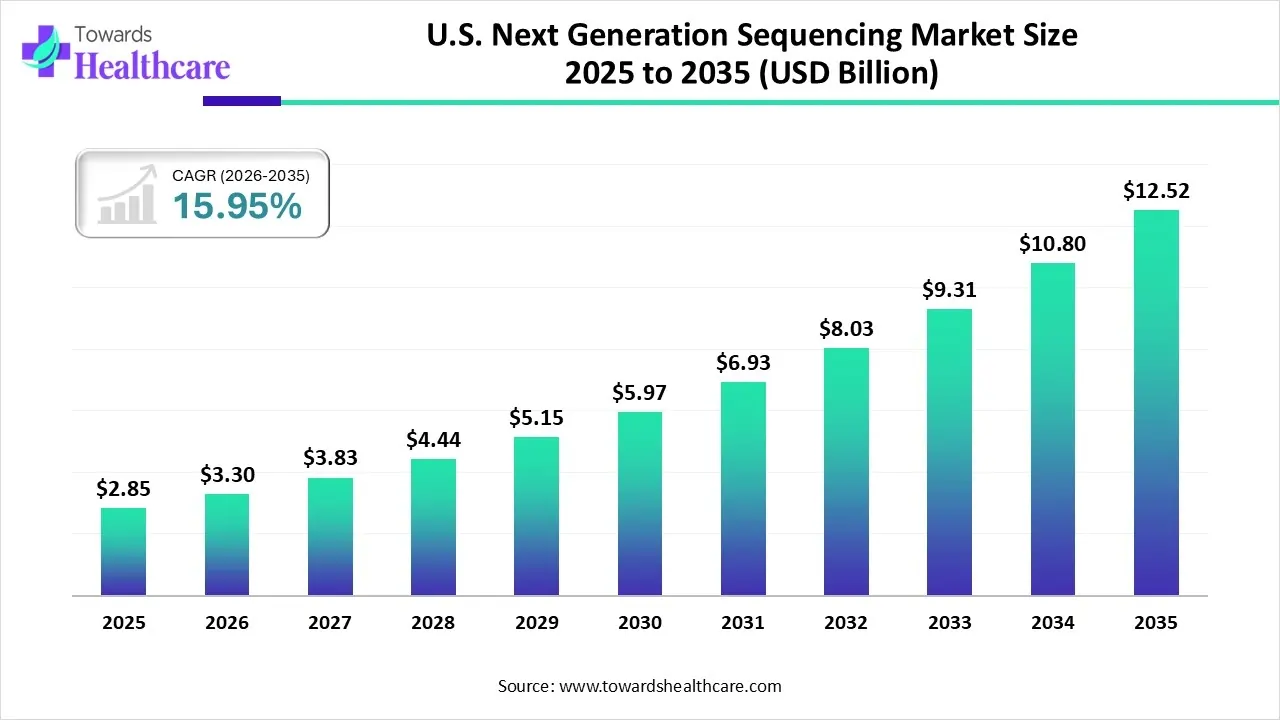

The U.S. next generation sequencing market size is calculated at USD 2.85 billion in 2025, grew to USD 3.3 billion in 2026, and is projected to reach around USD 12.52 billion by 2035. The market is expanding at a CAGR of 15.95% between 2026 and 2035.

One of the biggest and most diverse countries in the world, the U.S. is home to a wide range of people from many cultures and languages. The healthcare and genomics landscape in the United States is as diverse and expansive as the country itself. Numerous internationally renowned research facilities, notable genomics initiatives, and influential individuals call the U.S. home. As the country's population continues to rise, the already massive U.S. healthcare industry continues to expand. The Centers for Medicare and Medicaid Services estimate that by 2028, the U.S. will spend an incredible $6.2 trillion on healthcare.

Leading the genomics revolution are Canadian researchers, companies, and organizations, who are releasing the science's potential to advance industrial innovation, solve global issues, and enhance people's quality of life. The genomics revolution, for example, is being led by Canadian scientists, companies, and organizations, who are releasing the science's potential to enhance commercial innovation, solve global issues, and enhance people's quality of life. In order to treat cancer, chronic illnesses, and uncommon diseases, it will encourage the development of customized medicine, cutting-edge diagnostics, and innovative treatments, such as next-generation vaccinations.

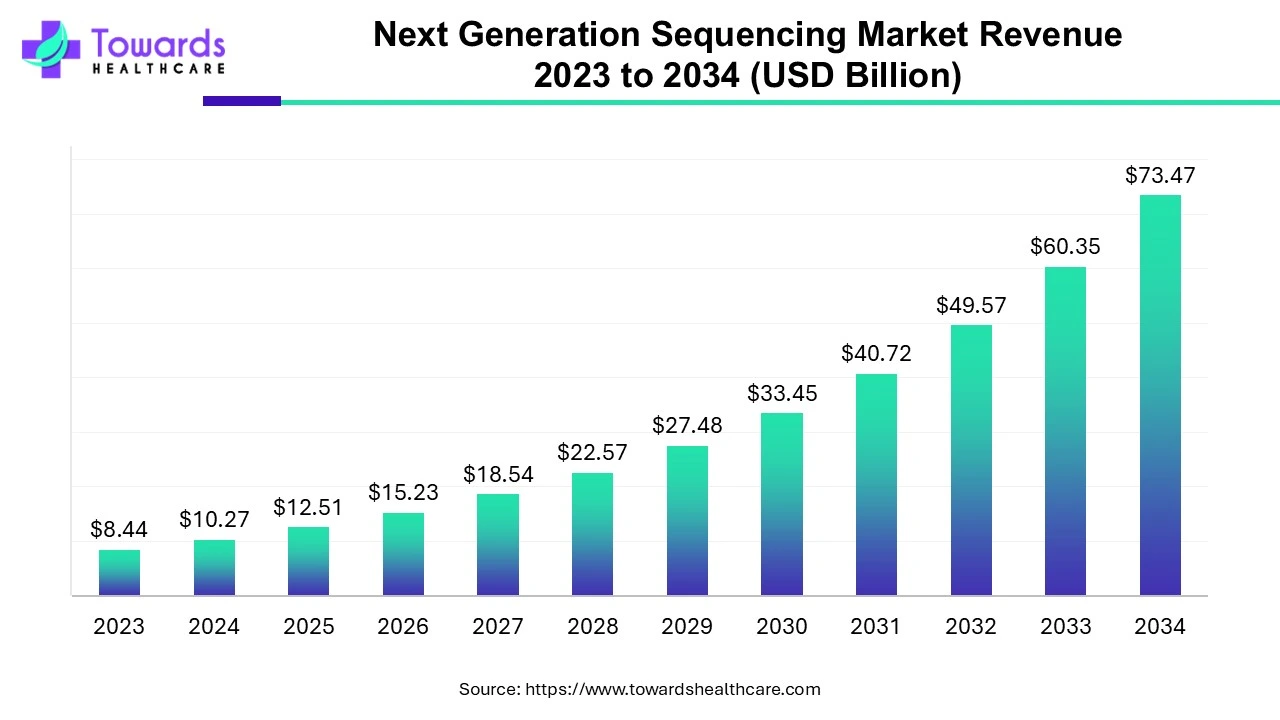

The global next-generation sequencing market is valued at $10.27 billion in 2024, expected to rise to $12.51 billion in 2025, and projected to reach about $73.47 billion by 2034, growing at an impressive annual rate of 21.74% over the decade.

In March 2024, according to Madhuri Hegde, PhD, FACMG, SVP and chief scientific officer at Revvity, the company's new process aims to improve the customer experience by utilizing a comprehensive variant library for newborn sequencing research and offering essential components required to go from sample to result. By tackling the common issues that labs encounter, we are expediting the democratization of genomic sequencing. (Source - revvity)

By Technology

By Product

By Application

By Workflow

By End-use

By Region

December 2025

December 2025

January 2026

October 2025