January 2026

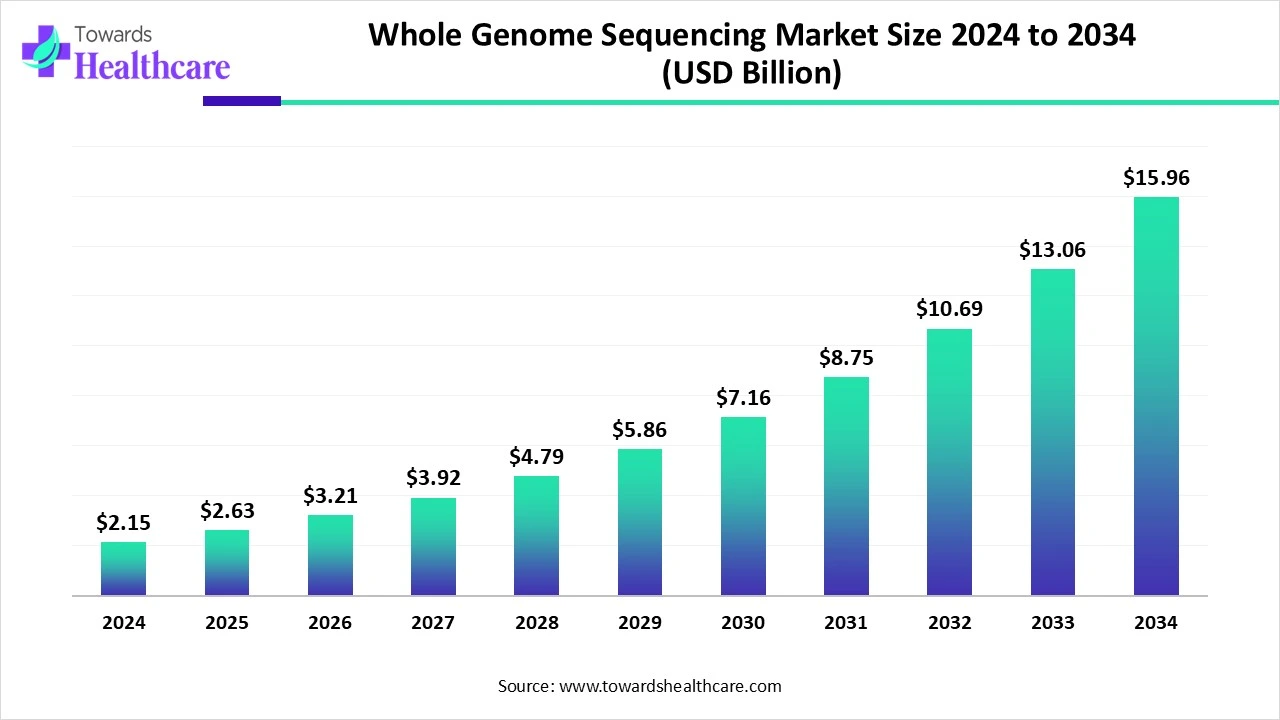

The global whole genome sequencing market size is calculated at USD 2.15 billion in 2024, grows to USD 2.63 billion in 2025, and is projected to reach around USD 15.96 billion by 2034. The market is expanding at a CAGR of 22.2% between 2025 and 2034.

| Metric | Details |

| Market Size in 2025 | USD 2.63 Billion |

| Projected Market Size in 2034 | USD 15.96 Billion |

| CAGR (2025 - 2034) | 22.2% |

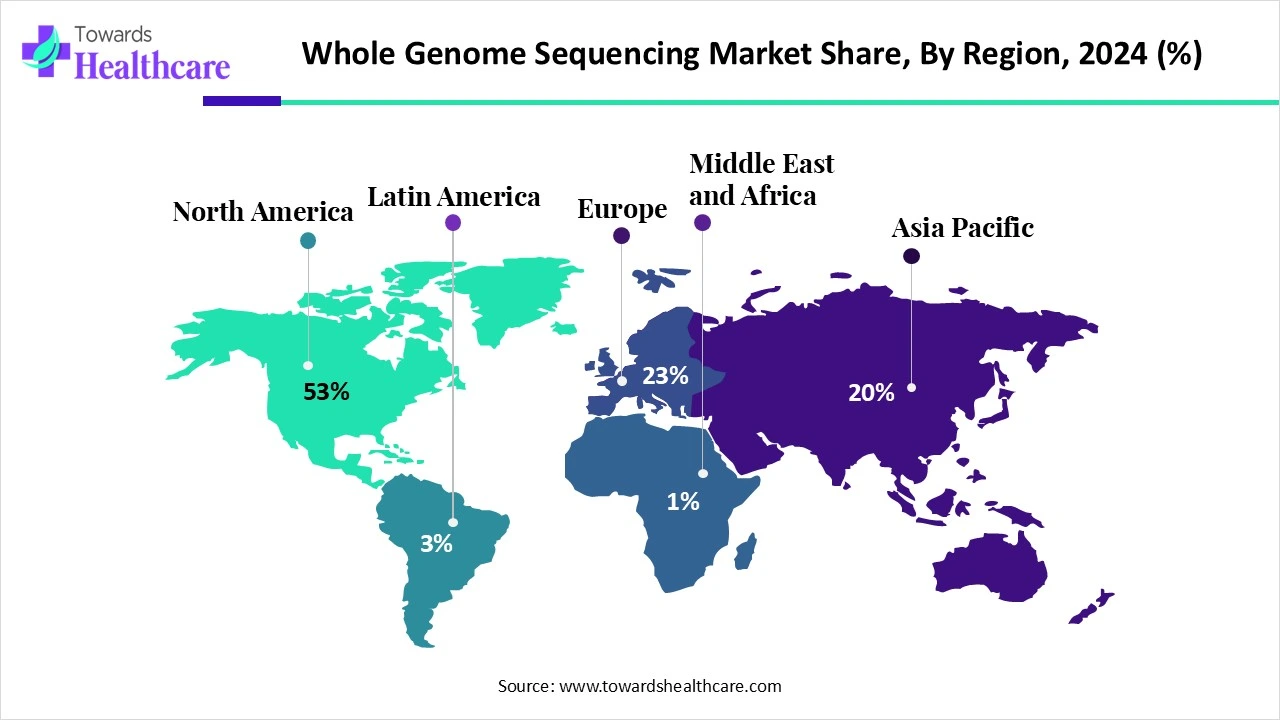

| Leading Region | North America |

| Market Segmentation | By Product & Service, By Type, By Workflow, By Application, By End Use, By Regions |

| Top Key Players | Illumina, Inc., Thermo Fisher Scientific, Inc., Oxford Nanopore Technologies, Pacific Biosciences of California, Inc., BGI, QIAGEN, Agilent Technologies, ProPhase Labs, Inc. (Nebula Genomics), Psomagen, Azenta US, Inc. (GENEWIZ) |

The whole genome sequencing market encompasses the products and services involved in decoding an organism's entire DNA sequence, primarily for use in medical research, diagnostics, and personalized healthcare. The market is growing rapidly due to rising demand for personalized medicine, early disease diagnosis, and genetic disorder management. Advancements in sequencing technology have significantly reduced costs and turnaround times, making it more accessible. Additionally, genomics increased government funding, research initiatives, and growing awareness of the genomics role in healthcare are driving market expansion across clinical, research, and pharmaceutical sectors.

For Instance,

AI can revolutionize the market by accelerating data analysis, improving accuracy in identifying genetic variants, and enabling faster disease diagnosis. It can handle vast genomic datasets efficiently, uncovering complex patterns and insights that traditional methods may miss. AI-driven tools also support personalized medicine by predicting disease risks and treatment responses. Additionally, automation through AI reduces costs and turnaround times, making genome sequencing more accessible and practical for clinical and research applications.

Increasing Prevalence of Cancer

The rising prevalence of cancer is a key driver for the whole genome sequencing market, as it enables detailed analysis of cancer-related genetic mutations. WGS helps in early detection, precise diagnosis, and the development of targeted therapies tailored to an individual's genetic profile. This personalized approach improves treatment outcomes and is increasingly adopted in oncology boosting demand for advanced sequencing technologies.

For Instance,

High Cost of Infrastructure and Data Management

Despite advancements in technology, the high cost of setting up and maintaining sequencing infrastructure remains a major barrier to the widespread adoption of whole genome sequencing. Expenses related to advanced equipment, data storage, computational resources, and skilled personnel can be prohibitive, especially for smaller healthcare facilities and research institutions. Additionally, managing and interpreting the vast amount of genomic data requires sophisticated software and expertise, further increasing operational costs.

How will technology be used as a future Opportunity in the Whole Genome Sequencing Market?

Technological advancements in therapies, especially in precision and gene-based treatment, present a significant opportunity for the whole genome sequencing market. As new treatments rely heavily on understanding an individual's genetic makeup, WGS becomes essential for identifying mutations and tailoring therapies accordingly. This personalized approach enhanced treatment effectiveness and minimized side effects. As therapeutic innovation grows, the demand for comprehensive genomic insights will rise, driving greater adoption of whole genome sequencing in clinical settings.

For Instance,

By product & Service, the consumables segment held a dominant presence in the market in 2024, due to the recurring need for reagents, kits, and other supplies required for each sequencing run. Unlike instruments, consumables are used continuously in high volumes across various applications, driving consistent demand. Additionally, the growing number of sequencing tests and research activities further boosted the consumption of these essential products, contributing to the market expansion.

By product & Service, the services segment is anticipated to grow at the fastest CAGR in the market during the studied years due to increasing demand for outsourced sequencing and data analysis solutions. Many healthcare and research institutions prefer a services-based model to avoid high infrastructure costs and to access advanced expertise and technologies. Additionally, the rising adoption of personalized medicines and large-scale genomic projects is fueling the need for reliable, scalable sequencing services, which ultimately boosts the whole genome sequencing market growth.

By type, the large whole genome sequencing segment accounted largest share in the market in 2024. Because of its comprehensive coverage of the entire genome, it is ideal for in-depth genetic analysis. It is widely used in research, clinical diagnostics, and personalized medicine, providing valuable insights into complex diseases and genetic disorders. The growing demand for high-resolution data and the expanding use of genomics in healthcare and research contributed to the dominance in the market.

By type, the small whole genome sequencing segment is expected to grow at the fastest rate in the market during the forecast period due to its critical role in analyzing smaller genomes, such as those of bacteria and viruses. This capability is essential for advancing research in infectious diseases, antibiotic resistance, and microbiome studies. As the demand for precise and efficient genomic analysis in these areas increases, small WGS offers a cost-effective and high-throughput solution, driving its rapid adoption across clinical, agricultural, and environmental applications.

By workflow, the sequencing segment was dominant in the market in 2024. The dominance is attributed to the central role of sequencing in the WGS workflow, encompassing sample preparation, library construction, and the actual sequencing process. Advancements in sequencing technologies, such as the introduction of high-throughput platforms and automation, have enhanced efficiency and accuracy, making sequencing more accessible for both research and clinical applications. Additionally, the launch of innovative products by major companies has further propelled the adoption of sequencing processes, solidifying its leading position in the whole genome sequencing market.

By workflow, the data analysis segment is predicted to grow at the fastest CAGR in the market due to the exponential increase in genomic data generated by advanced sequencing technologies. As WGS becomes more prevalent, the need for sophisticated data analysis tools to interpret complex genomic information becomes critical. The integration of artificial intelligence and machine learning speeds up interpretation, further driving demand.

By application, the human whole genome sequencing segment held the highest share of the market in 2024. This dominance is attributed to the increasing prevalence of genetic disorders and the growing emphasis on personalized medicine, which relies heavily on comprehensive genomic insights. Advancements in sequencing technologies have reduced costs, making human WGS more accessible for clinical and research initiatives, and biobanks have expanded the availability of human genomic data, further driving the whole genome sequencing market acceleration.

By application, the microbial whole genome sequencing segment is estimated to grow at the highest CAGR in the whole genome sequencing market during the studied years due to its vital role in studying infectious diseases, antibiotic resistance, and microbiome research. It enables detailed analysis of microbial genomes, supporting better diagnostic and treatment strategies. Advancements in Sequencing technologies have made microbial WGS faster and more affordable, increasing its adoption. Additionally, its expanding use in agriculture, environmental monitoring, and public health further drives the growth of the market.

By end use, the academic & research institutes segment led the market, due to its extensive involvement in genomics research, disease studies, and large-scale sequencing projects. These institutions often receive significant government and private funding, enabling them to adopt advanced sequencing technologies. Their focus on innovation, genetic discovery, and data generation for public databases further drives high utilization of whole genome sequencing, making them a dominant contributor to market demand.

By end use, the hospitals& clinics segment is expected to grow at the fastest CAGR in the market during the studied years, due to the rising adoption of WGS for personalized medicine, cancer diagnostics, and genetic disorder detection. Advancements in sequencing technology have made it more affordable and clinically viable, enabling integration into routine healthcare. Additionally, supportive regulations and improved reimbursement policies are encouraging hospitals and clinics to implement WGS for more accurate diagnoses and effective patient care.

North America dominated the whole genome sequencing market in 2024, due to its strong research infrastructure, significant investments in genomics, and rapid technological advancements. The region benefits from widespread adoption of next-generation sequencing and a high prevalence of genetic disorders and cancers, which drive demand for precise diagnostics and personalized medicine. Additionally, supportive government initiatives and a favorable regulatory environment have further accelerated the integration of WGS technologies across clinical and research applications.

The U.S. market is growing due to rapid advancements in sequencing technologies that have made genome sequencing faster and more affordable. Increasing applications in personalized medicine, cancer research, and genetic disorder diagnosis are driving demand. Strong government support, extensive research activities, and the presence of major biotech companies further contribute to the market’s expansion, enabling wider adoption of whole genome sequencing in clinical and research settings.

Canada's market is expanding due to substantial government investments and large-scale research initiatives. The Canadian Precision Health Initiative, a $200 million project led by Genome Canada, aims to sequence over 100,000 genomes, enhancing personalized healthcare and fostering economic growth. Additionally, the establishment of the Genome Library, supported by a $15 million investment, ensures diverse and equitable genomic data access for researchers. These efforts, combined with advancements in sequencing technologies, are propelling the growth of WGS applications in clinical diagnostics and research across the country.

The Asia-Pacific whole genome sequencing market is expected to grow rapidly due to increasing investments in genomics research and expanding healthcare infrastructure. Rising awareness of personalized medicine, coupled with growing incidences of genetic disorders and chronic diseases, is driving demand. Additionally, government initiatives and collaborations between academic institutions and biotech companies are boosting adoption. Advances in sequencing technology and cost reductions are also making whole-genome sequencing more accessible in this region.

China's market is accelerating due to substantial government investments and strategic initiatives. The "Healthy China 2030" plan emphasizes genomic research for disease prevention and treatment, fostering growth in the sector. Additionally, the "Genome China" project aims to sequence over 1 million genomes, enhancing personalized medicine and public health strategies. These efforts, combined with advancements in sequencing technologies and increasing healthcare expenditure, are propelling China's WGS market forward.

India's market is expanding due to several key factors. The Genome India Project, which has sequenced over 10,000 genomes, provides a valuable reference for genetic research and personalized medicine initiatives. Government support, increased investment in genomics infrastructure, and a growing focus on precision healthcare are driving demand. Additionally, advancements in sequencing technologies and decreasing costs are making WGS more accessible for clinical and research applications across the country.

Europe is experiencing notable growth in the whole genome sequencing (WGS) market due to significant government initiatives, such as the UK's 100,000 Genomes Project and France's Genomic Medicine 2025 plan, which are enhancing access to genomic technologies. The European Union's '1+ Million Genomes' initiative aims to provide safe access to genomic data across Europe, facilitating research and personalized medicine. Additionally, declining sequencing costs and advancements in next-generation sequencing technologies are making WGS more accessible, further propelling market expansion in the region.

The UK's market is growing rapidly, driven by robust government initiatives and integration into healthcare. Programs like the 100,000 Genomes Project and the NHS's plan to sequence 500,000 genomes by 2024 have positioned the UK as a leader in genomics. Additionally, the NHS's Genomic Medicine Service offers WGS for patients with rare diseases and cancer, enhancing early diagnosis and personalized treatment. Collaborations between the NHS, academia, and biotech firms further bolster the UK's genomics landscape.

Germany's market is expanding due to its strong bioinformatics capabilities, robust healthcare infrastructure, and a significant focus on precision medicine. The country leads Europe in genomic research, driven by the increasing prevalence of genetic disorders and cancer, prompting demand for advanced diagnostics. Collaborations between academic institutions and biotech firms, along with government initiatives like the German Human Genome Project, are fostering innovation. Furthermore, advancements in sequencing technologies and decreasing costs are making WGS more accessible for clinical and research applications.

The Middle East & Africa are expected to grow at a considerable CAGR in the upcoming period. The increasing prevalence of genetic disorders and the rising adoption of advanced genomic technologies boost the market. Government and private organizations support advanced research activities through funding and initiatives. People are becoming aware of screening and early diagnosis of genetic disorders, enabling healthcare professionals to provide personalized treatment.

The UAE government launched the “Emirati Genome Programme” to explore the genetic makeup of Emiratis, using cutting-edge DNA sequencing and AI technologies. The need for premarital genetic screening is increasing in the UAE, with around 2,428 couples already performing it. Of these, 92% were found to be compatible. Based on these results, some couples were provided personalized genetic counselling to assess and diagnose risk factors.

The Saudi Genome Program by the Saudi Arabian government aims to construct a pioneering database that will capture the genetic blueprint of Saudi society and revolutionize healthcare by enabling personalized medicine. The National Biotechnology Strategy was recently launched to transform the Kingdom into a global biotech hub by 2040.

In January 2025, India compiled a year-long database of 10,000 human genomes covering 83 population groups, about 2% of the country’s total. Known as the ‘Genome India’ project, this collection is stored at the Indian Biological Data Centre in Faridabad and is now open for global research. Initial analysis revealed 27 million rare genetic variants, including 7 million previously unrecorded. The database aims to support studies on disease, drug response, and genetic diversity. (Source - Azadi ka Amrit Mahostsav)

January 2026

November 2025

November 2025

November 2025