January 2026

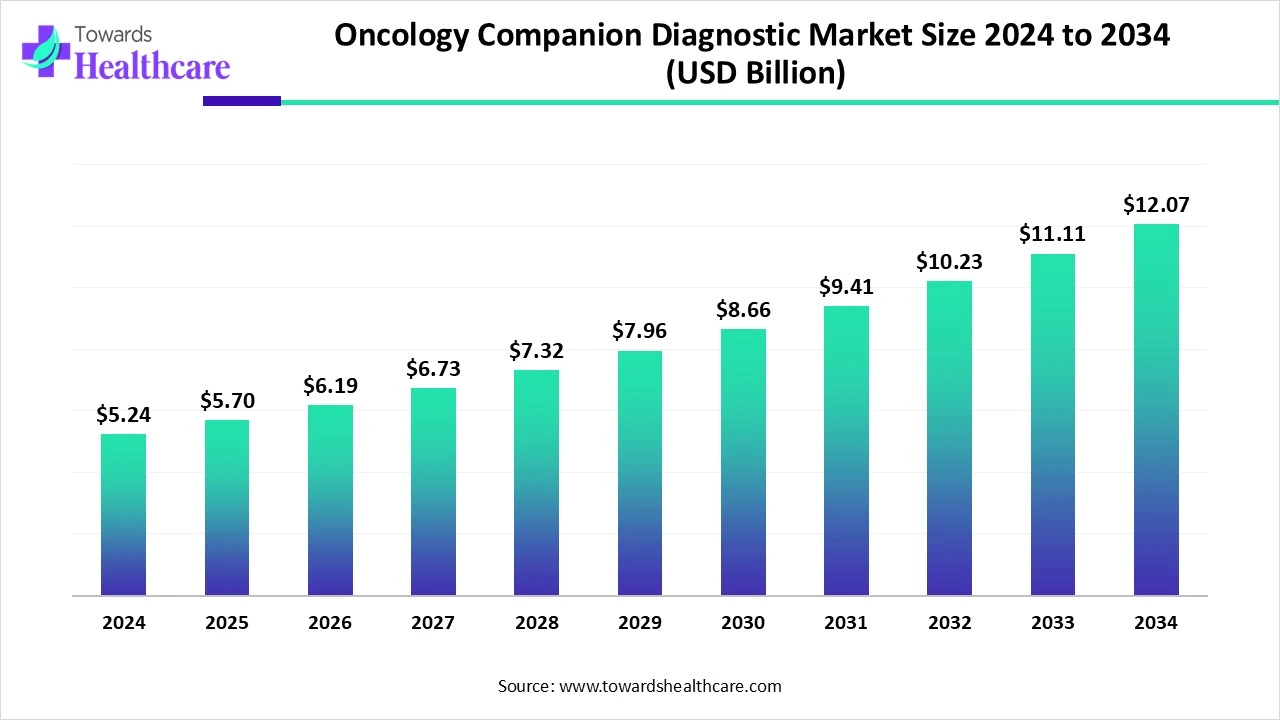

The global oncology companion diagnostic market size is calculated at USD 5.24 in 2024, grew to USD 5.7 billion in 2025, and is projected to reach around USD 12.07 billion by 2034. The market is expanding at a CAGR of 8.73% between 2025 and 2034.

| Metric | Details |

| Market Size in 2025 | USD 5.7 Billion |

| Projected Market Size in 2034 | USD 12.07 Billion |

| CAGR (2025 - 2034) | 8.73% |

| Leading Region | North America Share by 41% |

| Market Segmentation | By Product & Services, By Technology, By Disease Type, By End-use, By Region |

| Top Key Players | Agilent Technologies, Inc., Illumina, Inc., QIAGEN, Thermo Fisher Scientific Inc., Foundation Medicine, Inc., Myriad Genetics, Inc., F. Hoffmann-La Roche Ltd., BioMérieux, Abbott, Leica Biosystems, Guardant Health, Inc., EntroGen, Inc. |

Oncology companion diagnostic is an in vitro diagnostic test (IVD), which delivers the necessary information for cautious and productive use of a comparable therapeutic product, often about a targeted cancer drug. The oncology companion diagnostic market is impacted by factors such as rising occurrences of cancer instances, one of the major drivers for growth, and development and approval of novel targeted chemotherapies, specifically for such instances necessitating companion diagnostics for medication commencement, influencing the demand for diagnostic tools.

AI has a major role in the market, as it assists in rising precision medicine, smoothing diagnostics, and enhancing treatment results. AI algorithms examine medical images like CT scans, MRIs to identify fine abnormalities, detect tumors with higher accuracy, and classify them based on features, supporting the early detection and diagnosis. Also, AI-powered tools can recognize genomic data, proteomics, and other biological data to find biomarkers that estimate responses to treatment, track disease progression, and personalize treatment decisions.

The Rising Cancer Prevalence and Personalized Medicine

Globally, the rising instances of several cancers are generating demand for advanced diagnostic tools that can precisely determine the patients who will benefit from targeted therapies. Moreover, the accelerating factor for the growth of the oncology companion diagnostic market is increased adoption of personalized medicine, in which patients with individual profiles are considered for specific treatments, and also in which diagnostic tools help to generate the particular molecular pathways changed in tumors.

Limitations for Investments in Development

For companion diagnostics development and validation demand significant investments in research, clinical trials, and regulatory approaches are required, which leads to the creation of barriers for small-scale companies and labs. However, one more factor challenging the market growth is the generation of boundaries for technological advancements like NGS, due to lagging in coverage of the insurance, resulting in discouragement for suppliers from embracing these tests.

Expansion in Research and Development with AI Algorithms

The oncology companion diagnostic market is experiencing growth with rising opportunities in research and development, including novel biomarkers for highly precise and accurate diagnostic tools, multi-gene panels permit investigation of a patient’s cancer profile, which supports in wide range of options for targeted treatment. Although AI and ML algorithms can increase data analysis, lead to rapid and more efficient outcomes.

By product & services, the products segment dominated the market in 2024. The extensive products, mainly instruments and consumables, are included in the oncology companion diagnostic market, for accurate analysis of patient samples to inform treatment decisions. These products are widely employed by oncologists in personalized treatment depends on the individual patient profile. Instruments such as automated stainers, PCR machines, NGS platforms, FISH instruments, mass spectrometers, microscopes, flow cytometers, and fluorescence readers have broader applications. The consumables, in conjunction with instruments, antibodies, PCR reagents, sequencing kits, FISH probes, and various assay plates and quality control samples, are used in diagnosis processes.

By product & services, the services segment is estimated to grow at the fastest CAGR in the upcoming years. Services comprise research and development, testing, regulatory considerations, and a market plan of action. In R&D, biomarker discovery, assay development, and validation are highly used to get more efficient, accurate and reliable, and reproducible diagnostic tests. In clinical trials services assist in determining the particular therapy responds to the patient, which makes clinical trials feasible and boosts drug development.

By technology, the polymerase chain reaction (PCR) segment led the market in 2024. One of the popular technologies used is PCR in the oncology companion diagnostics market, which has major selectivity and sensitivity, making it a chosen method employed in the detection of cancer biomarkers and genetic mutations, impacting the oncology companion diagnostic market growth. In a patient’s tumor, for determination of tumor-specific changes or variations supports suitable treatments.

By technology, the next-generation sequencing (NGS) segment is predicted to grow at the fastest rate during the predicted timeframe. Next-generation sequencing (NGS) is a significant, adaptable technology having several applications, primarily in areas of genomics, diagnostics, and personalized medicine. It has faster and high-throughput sequencing of DNA and RNA, able to detect genetic changes, mutations, and expression patterns.

By disease type, the non-small cell lung cancer segment dominated the oncology companion diagnostic market in 2024.In the oncology companion diagnostics market, due to the rising occurrence and various targeted therapies, needed companion testing for treatment induction. It is widely impelled by different targeted therapies like EGFR inhibitors, ALK inhibitors, and PD-L1-based immunotherapies, which demand companion diagnostics to achieve the selection of proper treatment.

By disease type, the breast cancer segment is anticipated to grow at the fastest CAGR during the projected period. It is propelled by factors such as the increasing prevalence of breast cancer and advancements in diagnostic techniques. The companion diagnostics have a crucial role in the identification of the most responsive therapies, enhancing treatment results, and decreasing adverse effects. Highly used diagnostic tests are HercepTest, Syantra, capivasertib, and fulvestrant.

By end-use, the hospitals segment led the oncology companion diagnostic market in 2024 as it has a major share due to the systematic laboratory setups, polymathic cancer care teams, and expert molecular diagnostic labs, which enable integrated tests into treatment approaches.

By end-use, the pathology/diagnostic laboratory segment is expected to grow at the fastest rate over the forecast period. These laboratories are liable for the development and execution of those test that assists in the detection of biomarkers in oncological patients, also providing personalized treatment decisions. They have a vital role in getting precise test results and efficient treatment results, alliances with pharmaceutical industries, healthcare professionals, and patients.

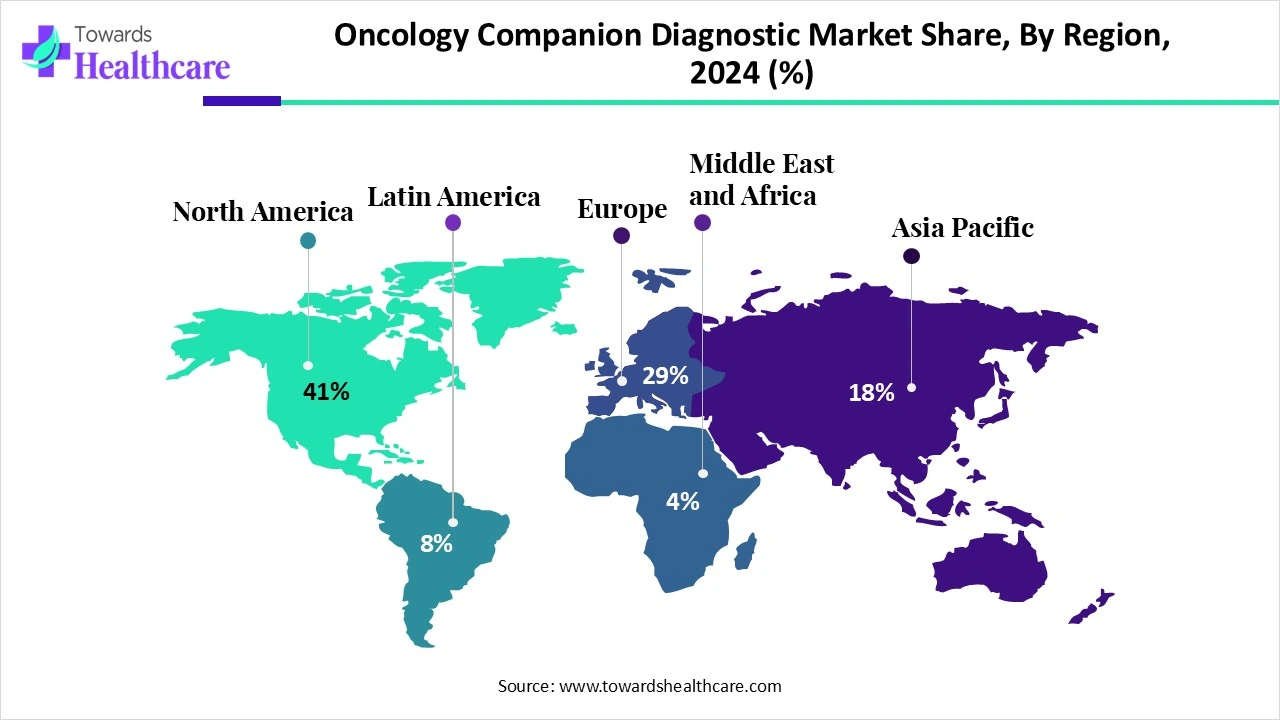

North America led the market share by 41% in 2024. The market growth is driven by the advanced, well-developed healthcare infrastructure, which is boosting the acquisition of advanced diagnostic technologies. Moreover, major investments in healthcare enable the wide range of applications of diagnostic tools, inclusive of companion diagnostics, that are necessary for personalized cancer treatment.

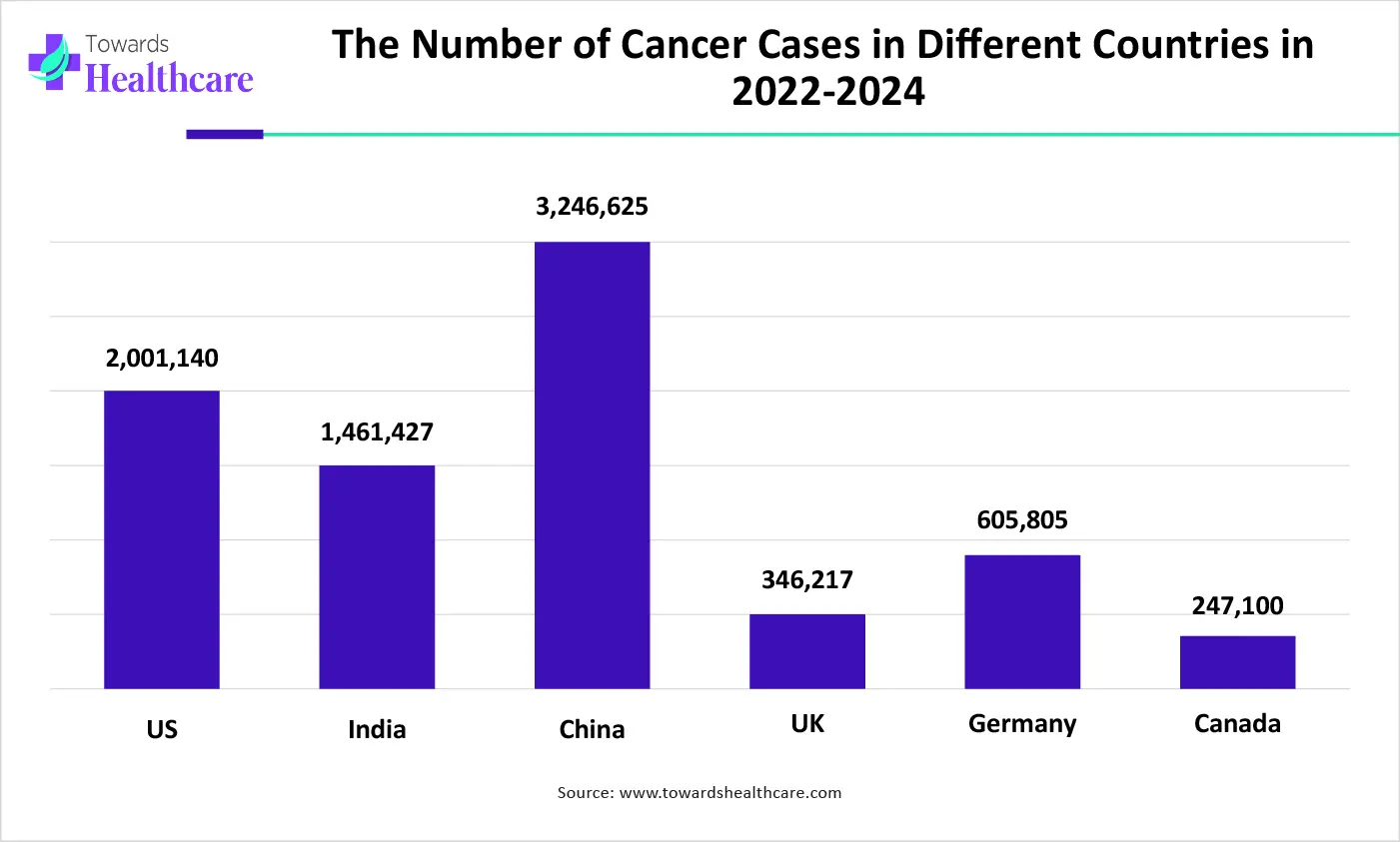

In the U.S, the market is fueled by growing cancer cases, the rising acquisition of personalized medicine, and development in genomic technologies. Also, the government is encouraging the promotion of precision medicine and regulatory sanctions for innovative diagnostic tests. Furthermore, increasing alliances with pharmaceutical industries are accelerating the co-development of companion diagnostic tests, which supports in growth of the market.

The Canada market is widely influenced by factors like the increasing instances of cancer, especially non-small cell lung cancer (NSCLC), which demands more efficient diagnostic tools such as companion diagnostics to inform treatment decisions. Along with this, the adoption of advances in genomic technologies, including next-generation sequencing (NGS), is contributing to the growth of the market.

Asia Pacific is anticipated to be the fastest-growing region during the forecast period. The oncology companion diagnostics market in Asia Pacific is primarily driven by rising cancer instances, healthcare expenditure, and the increasing significance of personalized medicine. As well as the government steps towards the upgradation of precision medicine, advances in healthcare infrastructure, and the growing acquisition of diagnostic technologies.

The Chinese government has been encouraging advances in precision medicine and prior identification of cancer via initiatives like the "Healthy China 2030" plan. Moreover, Chinese companies are adopting R&D investments, targeting NGS and AI-aided diagnostics to evolve novel companion diagnostic products.

The growing various kinds of cancer cases, targeted, more precise, and accurate cancer treatments are impacting the growth of the market. However, the regulatory framework has rising adoption of companion diagnostics, prioritizing patient safety, clinical effectiveness, and the incorporation of advanced diagnostic tools.

Europe is expected to be a significantly growing area. In Europe, with rising cancer cases and therapies, growing collaborations with pharmaceutical companies are also propelling the growth of the market. The pharmaceutical companies are involved in R&D, which assists in the co-development of companion diagnostics, innovation in targeted chemotherapies by using AI and ML tools, as well.

The UK has shown significant growth in the market, which is influenced by the advanced healthcare infrastructure, strategic alliances, and the emerging novel products. Whereas, increasing incidents of non-small cell lung cancer (NSCLC) followed by breast cancer are a significant growing segment in the UK.

The Germany market is driven by the development of sophisticated molecular diagnostic techniques that can perform accurate analysis of patients' samples, promoting the detection of related biomarkers. Besides this, advanced healthcare infrastructures, government regulatory considerations are also contributing factors in the market growth.

By Product & Services

By Technology

By Disease Type

By End-use

By Region

January 2026

December 2025

November 2025

October 2025