January 2026

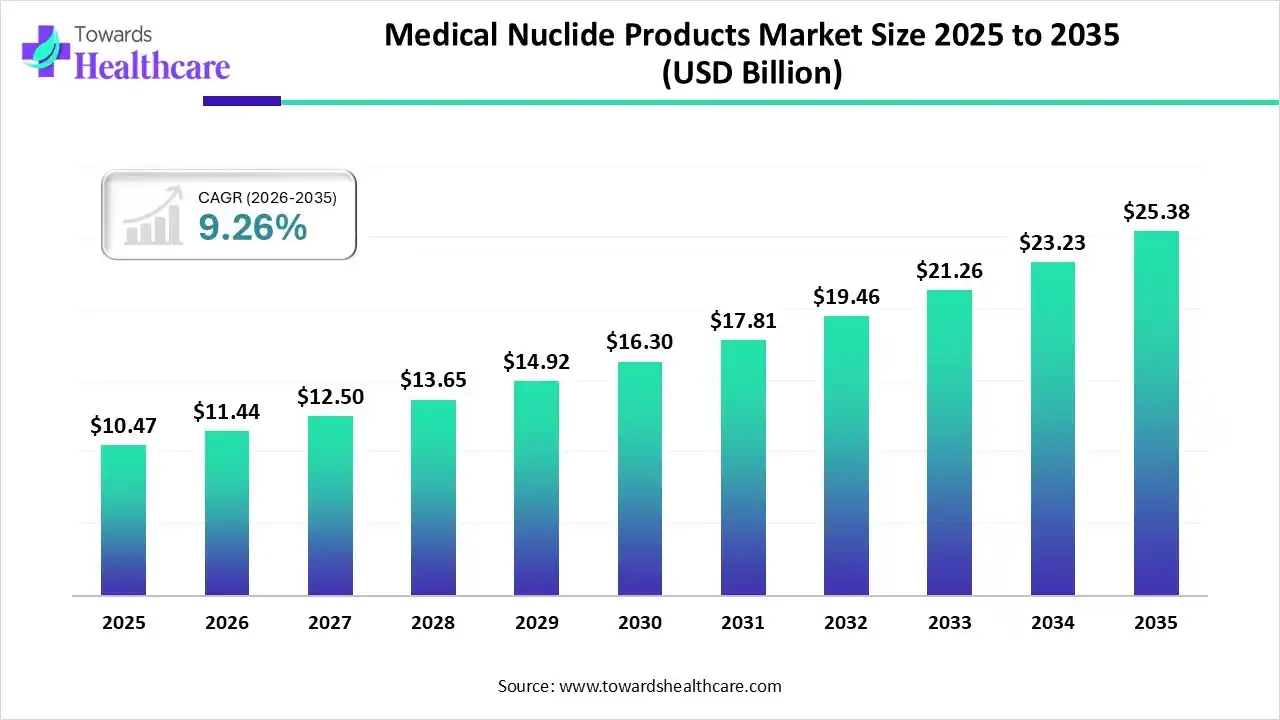

The medical nuclide products market size stood at US$ 10.47 billion in 2025, grew to US$ 11.44 billion in 2026, and is forecast to reach US$ 25.38 billion by 2035, expanding at a CAGR of 9.26% from 2026 to 2035.

The medical nuclide products market is expanding due to the growing demand for nuclear medicine in targeted and diagnostic therapies, particularly in cardiology and oncology. Significant product includes fluorine-18, technetium-99m, and iodine-131 widely applied in SPECT and PET imaging. North America is dominated in the market by the increasing prevalence of chronic diseases and recent development in radiopharmaceuticals, while Asia Pacific is the fastest growing with increasing healthcare investment and enhanced access to nuclear medicine.

| Key Elements | Scope |

| Market Size in 2026 | USD 11.44 Billion |

| Projected Market Size in 2035 | USD 25.38 Billion |

| CAGR (2026 - 2035) | 9.26% |

| Leading Region | North America |

| Market Segmentation | By Product Type, By Application, By End User, By Region |

| Top Key Players | Nordion Inc., ITM Isotopen Technologien München AG, Lantheus Medical Imaging, Inc., Advanced Accelerator Applications (AAA) / Novartis, Cardinal Health, GE Healthcare, Siemens Healthineers, Curium Pharma, Alliance Medical, Medi-Radiopharma, ABX Advanced Biomedical Compounds GmbH, Isotope Technologies Dresden (ITD), NTP Radioisotopes SOC Ltd., Nordion (a BWXT Company), Synatom (Engie Group), Biodex Medical Systems, Jubilant Radiopharma, Sumitomo Heavy Industries, Curium Pharma, Isologic Innovative Radiopharmaceuticals Inc. |

The medical nuclide products market refers to the global market for radioactive isotopes (also called radionuclides or radioisotopes) used primarily in medical applications. These applications include diagnosis, therapy, and research in nuclear medicine, such as imaging techniques (PET, SPECT), radiotherapy for cancer treatment, and radiopharmaceutical development. Medical nuclides can be naturally sourced or artificially produced and are used to target specific organs or diseases, enabling precise diagnosis and treatment.

Integration of AI in the medical nuclide products drives the growth of the market as AI-driven technology contributes to combating diseases. It supports the diagnosis and treatment of cancer by enhanced image interpretation and accurate cancer contouring, allowing more precise treatment management and adaptive radiotherapy. AI in radiation oncology is dichotomized into the two main goals. The first is to improve effectiveness, mostly through automation, while the second is to offer analytical devices for an improved personalization of radiation oncology. It improves the accuracy and effectiveness of some domains in the sector of radiology, with workflow optimization, image analysis, personalized medicine, and research.

Increasing Applications of Radiopharmaceutical

Ongoing progress in radiopharmaceutical research is driving the creation of new radionuclides, enhanced molecular targeting techniques, and innovative drug delivery methods. These developments are boosting the safety, specificity, and therapeutic efficiency of radiopharmaceuticals, strengthening their role in precision medicine. As the field advances, radiopharmaceuticals are likely to open fresh opportunities in personalized treatment, potentially leading to better patient outcomes and setting new benchmarks for disease detection and therapy. This, in turn, propels the medical nuclide products market.

Increasing Cost of Radiopharmaceuticals

The cost of radiopharmaceutical materials is significantly higher compared to other resources used in the nuclear medicine department. Inefficient use of these expensive materials results in waste and increases financial pressure on the healthcare system. This can lead to longer patient wait times for essential diagnostic procedures, particularly for urgent cases, thereby constraining the medical nuclide products market.

Increasing Advancement in Ground-Breaking Tools

The increased clinical use of radiopharmaceuticals for diagnosis and therapy, along with more regulatory approvals and burgeoning preclinical research, has positioned targeted radiopharmaceuticals at the forefront of oncology. These radiopharmaceuticals serve as groundbreaking tools in modern medicine, transforming diagnostic imaging and targeted treatments through remarkable technological progress. As the need for precision medicine grows, especially in oncology, neurology, and cardiology, global research and development efforts in radiopharmaceuticals are expanding significantly. This growth presents opportunities for the expansion of the medical nuclide products market.

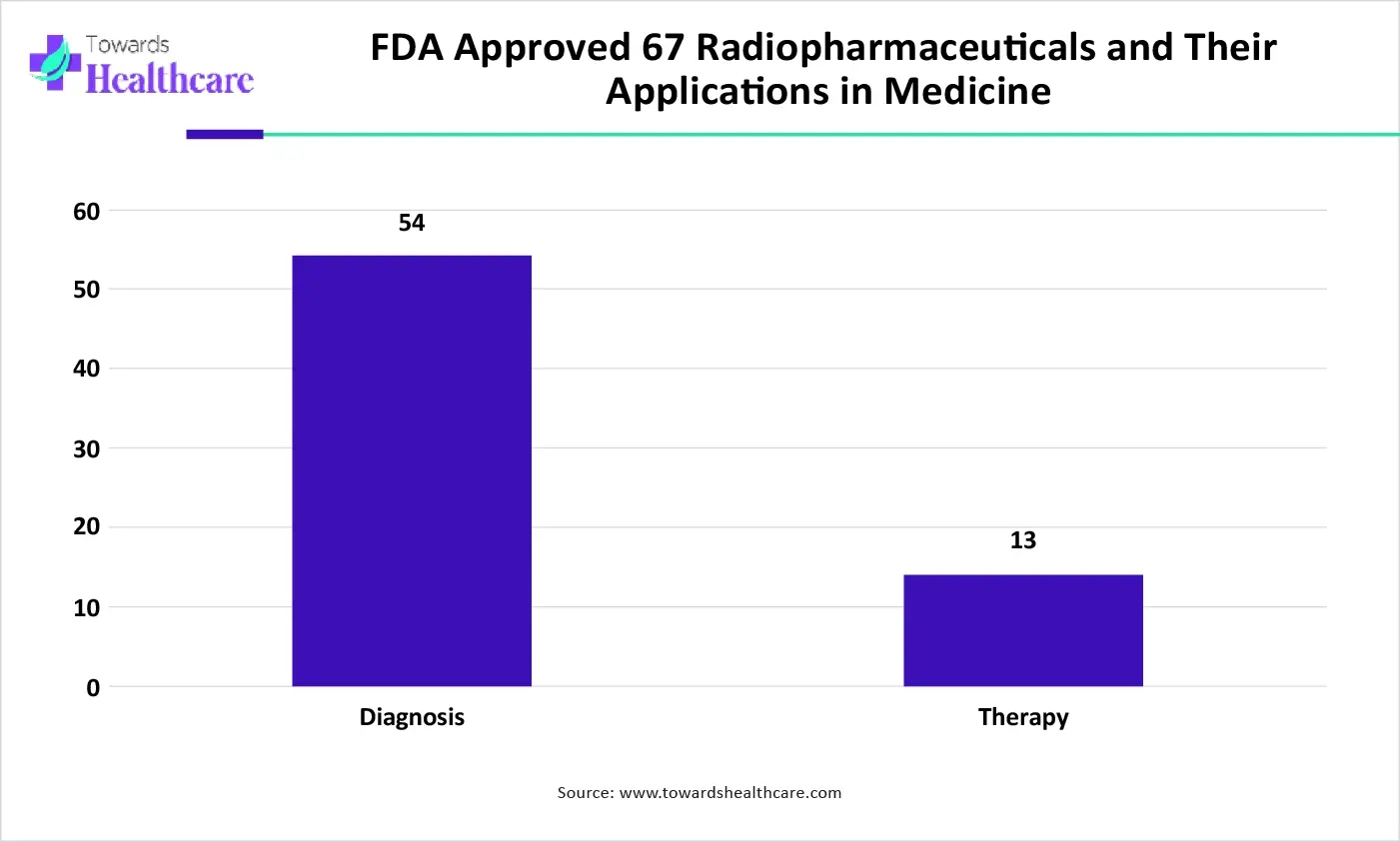

By product type, the diagnostic nuclides segment led the medical nuclide products market, due to radionuclide therapy progressively becoming more effective in managing persistent disease and doing so with lower toxic side-effects. With the therapeutic procedure, the goal is to confine the radiation to well-defined target volumes of the patient. Diagnostic radiopharmaceuticals play a significant role in patient stratification and treatment planning, leading to enhanced therapeutic results in targeted radionuclide therapy.

On the other hand, the therapeutic nuclides segment is projected to experience the fastest CAGR from 2025 to 2034, as radionuclide therapy has many advantages of delivering an extremely concentrated absorbed dose to the targeted tumour while sparing the surrounding normal tissues. Radiopharmaceutical therapy (RPT) contributes to the targeted delivery of radiation to cancer cells or to the tumor microenvironment. This approach is similar to external beam radiotherapy and brachytherapy in that the radiation is delivered by unencapsulated radionuclides.

By applications, the diagnostic applications segment dominated the medical nuclide products market in 2024, as nuclear medicine is a specialized area of radiology. It uses small amounts of a radioactive substance for health research, diagnosis, and management of different conditions, including cancer. Nuclear medicine imaging is a combination of various disciplines, which include chemistry, physics, mathematics, computer technology, and medicine. Nuclear medicine methods are significant for the expansion of novel medicines and to accelerate research into future treatments and management of disorders.

The therapeutic applications segment is projected to grow at the fastest CAGR from 2025 to 2034, as diagnostic radiopharmaceuticals play a significant role in patient stratification and handling planning, leading to better therapeutic results in targeted radionuclide therapy. Nuclear medicine for treatment includes radioactive iodine therapy and brachytherapy. Brachytherapy is a treatment where a sealed radiation source is located inside or next to the area needing treatment.

By end user, the hospitals and clinics segment led the medical nuclide products market in 2024 due as nuclear medicine is crucial for the early detection of diseases like cancer, cardiac conditions, and neurological disorders, detecting abnormalities before symptoms become challenging. Nuclear medicine is used to determine cancer staging and monitor its spread. The advanced models developed by SPECT scanning detect and measure tumour size and growth, while PET assesses how much certain organs are working under additional strain.

The diagnostic centers segment is projected to experience the fastest CAGR from 2025 to 2034, as nuclear medicine measures apply radioactive material in the body to see how organs or tissue are functioning. Nuclear medicine is used to target and destroy damaged or diseased organs or tissue. Radiotherapy aims to deliver as much dose to the tumour whilst sparing normal tissue. Technological advances integrating novel imaging modalities, more influential computers and software, and novel delivery systems like advanced linear accelerators have the support to achieve this.

North America dominated the market in 2024 as the increasing use of positron emission tomography (PET) and targeted radionuclide therapy has shaped the requirement for steady supplies of a diversity of other radionuclides, and the demand is expected to drive this region. Nuclear medicine in North America has grown due to advances in technology, with hybrid imaging, the introduction of advanced radiopharmaceuticals for diagnosis and treatment, which contributes to the growth of the market.

For Instance,

In the United States, the growth of nuclear medicine events is because to nuclear cardiology. The volume of PET events in the United States is around 1.5 million per year. Oncology accounts for more than 90% of the PET and PET/CT procedures performed, while neurology and cardiology account for about 4% each. According to the National Oncology PET Registry, roughly 84% of the slightly more than 1,600 PET facilities in the United States have PET/CT systems, which drives the growth of the market.

In Canada, the development of molecular imaging with novel radiopharmaceuticals and technologies is likely to result in sustained growth in the coming decades. The government is spending in the healthcare isotopes sector to ensure that Canada remains an international leader in medical treatments and that Canadians have access to the standard health care possible. Canada has played a key leadership role in the development and use of medical isotopes for over 70 years, positioning the country as a worldwide leader in the production and supply of medical isotopes, which drives the market growth.

Asia Pacific is estimated to be the fastest-growing medical nuclide products market during the forecast period, as the Government of Asia Pacific is responsible for delivering on its promise to rebuild and strengthen the biomanufacturing and life sciences field in this region. The IAEA presently hosts its first workshop to support countries in the Asia-Pacific region in developing strategic funding documents to increase access to nuclear medicine and radiotherapy, essential services to address the increasing burden of cancer. With novel cancer cases expected to rise to 32.6 million by 2035, many countries are looking to boost advanced nuclear medicine services to help early detection, like Positron Emission Tomography (PET)

For Instance,

China has made important progress in radiopharmaceutical Research and Development, powerfully supported by noteworthy government investment, augmented funding, and a strategic focus on development innovation. China is the third country in the global to master the production technology of industrial cobalt-60 radiation sources, which supports the growth of the market.

Nuclear technology is broadly recognized as a high-tech manufacturing in contemporary society, characterized by high technology, efficiency, and quality. With the growing cancer load in India, demand for ToF PET/CT has risen in remote cities in India, enhancing the management of cancer. Increasing research and development, such as Bhabha Atomic Research Centre (BARC), a unit of DAE, Government of India, producing numerous medically important radioisotopes like 99Mo, 131I, 125I, 153Sm, 32P, 177Lu, using its research reactor for their supply to the nuclear medicine centers in India. DAE further improved its radioisotope production capability by hiring APSARAU, which contributes to the growth of the market.

Europe is notably growing in the market, as transport of radioisotopes in the entire EU is significant for ensuring access for patients, considering that some of them must be applied within a few hours or days after being produced, also the fact that production is mainly concentrated in only a few member states. Paediatric nuclear medicine is the subspecialty in nuclear medicine where isotopes are applied in the treatment and diagnosis of diseases of children in Europe, which is increasing the demand for medical nuclide products.

In Germany, more than 50 million nuclear medicine events are performed annually, and demand for radioisotopes is growing. This region is emerging as a hub of radiopharmaceutical innovation and research. Germany, a leading role in this healthcare revolution is ITM Isotope Technologies Munich SE, a radiopharmaceutical biotech company focusing on the development of targeted therapies and diagnostics for challenging-to-treat cancers. In 2024, ITM announced an equity investment of EUR 188 million, led by Temasek with participation from funds managed by BlackRock, Qatar Investment Authority (QIA), ATHOS, and Carbyne, which drive the growth of the market.

In the UK, approximately 700,000 nuclear medicine procedures supplied radioisotopes are carried out every year, like diagnosing coronary disease, identifying the spread of cancer to bones, and managing thyroid cancer. Radioisotopes are also a significant tool for progressive biomedical research. There is a tradition in the application of radionuclides in the UK for the study of human physiological functioning and, presently, for imaging human pathology, which contributes to the growth of the market.

In January 2025, Nusano CEO Chris Lowe stated, “The Nusano platform of technologies will stabilize radioisotope supply chains and allow innovation by making radioisotopes available in the volumes and varieties needed for all industries. We will quickly scale to serve our broad customer base.” (Source - Nusano)

By Product Type

By Application

By End User

By Region

January 2026

January 2026

January 2026

January 2026