February 2026

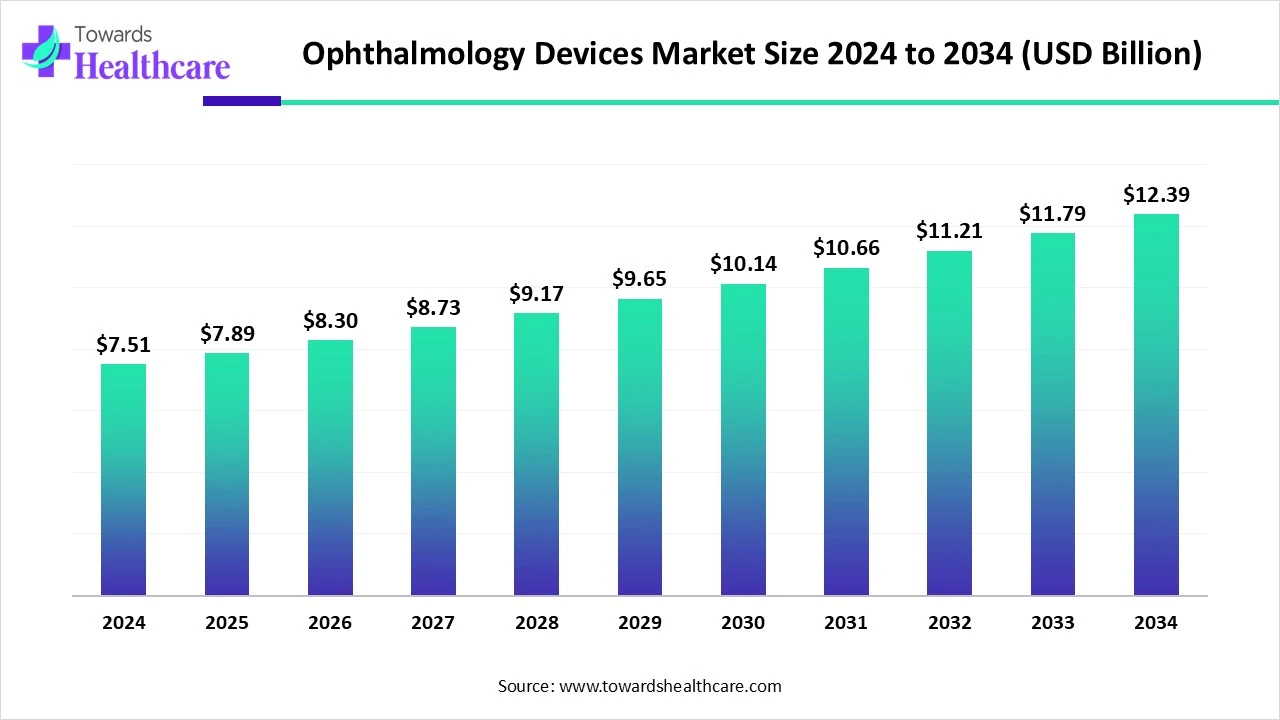

The global ophthalmology devices market size is calculated at US$ 7.51 billion in 2024, grew to US$ 7.89 billion in 2025, and is projected to reach around US$ 12.39 billion by 2034. The market is expanding at a CAGR of 5.14% between 2025 and 2034.

The ophthalmology devices market's expansion may be ascribed to the increasing incidence of visual conditions such as diabetic retinopathy, cataracts, glaucoma, and vitreoretinal diseases. The market base for development is anticipated to be further expanded by improved government measures to raise awareness of visual impairment. To help nations reach the global eye care target of a 40% increase in availability of suitable glasses for individuals, the WHO launched the SPECS 2030 programme in May 2024. The need for ophthalmic equipment is rising as the senior population grows, since they are increasingly vulnerable to age-related eye conditions. The National Institute of Aging (NIA) estimates that by 2030, there will be about 72 million people in the elderly population.

| Metric | Details |

| Market Size in 2025 | USD 7.89 Billion |

| Projected Market Size in 2034 | USD 12.39 Billion |

| CAGR (2025 - 2034) | 5.14% |

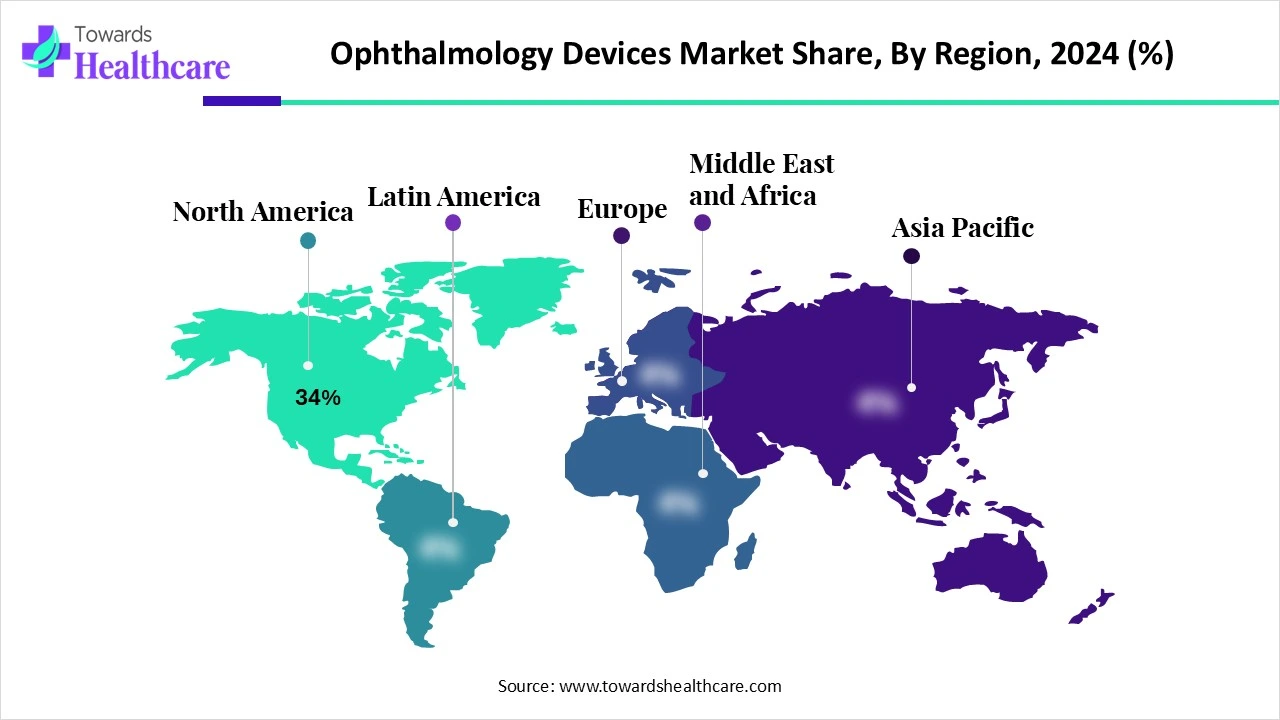

| Leading Region | North America Share by 34% |

| Market Segmentation | By Product Type, By Application, By End Use, By Region |

| Top Key Players | Alcon Inc., Johnson & Johnson Vision, Bausch + Lomb, Carl Zeiss Meditec AG, Hoya Corporation, EssilorLuxottica, CooperVision, Inc., Topcon Corporation, NIDEK Co., Ltd., Canon Medical Systems, Ziemer Ophthalmic Systems, Lumenis, Haag-Streit Group, Glaukos Corporation, Ellex Medical Lasers Ltd., IRIDEX Corporation, SCHWIND eye-tech-solutions, STAAR Surgical, OCULUS Optikgeräte GmbH, Quantel Medical (Lumibird Group) |

The ophthalmology devices market encompasses a broad range of medical devices used in the diagnosis, monitoring, and treatment of eye disorders such as cataracts, glaucoma, refractive errors, age-related macular degeneration (AMD), and diabetic retinopathy. These devices include surgical equipment, diagnostic instruments, vision care products, and laser-based systems. The market serves ophthalmologists, optometrists, and surgical centers. It is closely linked to aging populations, rising incidences of diabetes and eye disorders, and technological advancements such as AI diagnostics and minimally invasive surgery.

Artificial intelligence (AI) is revolutionising ophthalmology by providing new chances to improve service delivery, customise treatment regimens, and increase diagnostic accuracy. AI-powered instruments are improving the accuracy of medical operations such as cataract surgery, which leads to shorter recovery periods and fewer problems. Global inequities in healthcare availability are also being addressed by AI-powered teleophthalmology services, which are increasing access to eye care in rural and disadvantaged locations.

For instance,

How do Rising Cases of Eye Disorders Promote the Market’s Expansion?

The expansion of the ophthalmology devices market is associated with eye disorders, as increased cases lead more people to opt for ophthalmology devices or surgeries that utilize these devices. 1.1 billion individuals worldwide suffer from visual loss, and 90% of cases are preventable. It will reach 1.8 billion by 2050 if eye health care is not funded. More than 3.4 million hospital outpatient visits and 8.9 million vision outpatient appointments were made in 2023, indicating that eye problems remain a common concern in both primary and secondary care settings. According to a 2024 survey, 31% of people with eye disorders would seek other healthcare facilities, such as pharmacies, 37% would speak with their high street optician, and 32% would initially contact their general practitioner.

High Cost of Equipment and Surgeries

The high expense and risk of eye procedures severely hamper ophthalmic treatment development and accessibility. Retinal, refractive, and advanced cataract operations are among the most costly procedures because they need specialised tools, highly qualified surgical teams, and post-operative care. Because high-end intraocular lenses and advanced technology are more expensive, people from poorer socioeconomic backgrounds find them more difficult to afford and less accessible.

How will Telehealth Improve the Ophthalmology Devices Market?

Since digitally transmissible pictures and videos may be used for diagnosis and illness management, ophthalmology continues to be a prime specialty for telehealth integration. Over the past century, teleophthalmology has advanced quickly, and with the help of new technologies like artificial intelligence and 5G and 6G internet, it will only become better. In addition to improving time and convenience for patients and doctors, teleophthalmology has made it easier for doctors to collaborate, allowing general eye care professionals to consult with distant experts on other continents. Telehealth in ophthalmology offers a great potential to provide access to eye exams and treatments and broaden the geographic reach of eye care worldwide due to its proven clinical effectiveness, patient satisfaction, and continuous improvements.

By product type, the vision care products segment dominated the ophthalmology devices market in 2024. In the fast-paced world of today, eye care is more important than ever. There is a growing need for high-quality eye care solutions as eyesight needs rise. Enterprises such as Johnson & Johnson Vision, Hanuchem Laboratories, and Alcon Inc. are essential to the pursuit of improved eye care. Their commitment to sustainability, innovation, and quality puts them at the forefront of influencing how eye care will develop in the future. Third-party manufacturing's expansion is a viable way for companies to effectively introduce premium eye care goods to the market. The outlook for eye care appears more promising than ever as consumer needs and technological advancements continue to grow.

Among the vision care products segment, the contact lenses sub-segment dominated the ophthalmology devices market in 2024. The optical sector has undergone a transformation thanks to contact lenses. Nowadays, a lot of patients choose contact lenses over glasses for aesthetic and cosmetic reasons. Due to freedom from glasses, cosmesis, and occupational demands, young patients choose contact lenses.

By product type, the diagnostics and monitoring devices segment is estimated to witness the fastest growth in the ophthalmology devices market during the forecast period. Diagnostic services include glaucoma screening and monitoring, as well as assistance with corneal, retinal, and cataract disorders. To identify conditions like macular degeneration, glaucoma, or retinal tears, top clinics frequently employ cutting-edge technology like Fundus Fluorescein Angiography (FFA), Optical Coherence Tomography (OCT), and Visual Field Tests. The eye expert can see the inside anatomy of the eye more clearly because of the high-definition images and mapping provided by this equipment.

By application, the cataract surgery segment held the largest share of the ophthalmology devices market in 2024. The global frequency of cataract is expanding as life expectancy continues to climb, particularly in wealthy nations. Cataract is the most common cause of distant vision impairment or blindness, impacting 94 million people out of the 1 billion who have visual impairment that might have been avoided or has not yet been treated. Microincision phacoemulsification is now the recommended technique for cataract surgery, one of the most common operations performed globally, because of its high success rates, shortened recovery periods, and lower complication rates.

By application, the refractive error correction segment is anticipated to be the fastest-growing in the ophthalmology devices market during the upcoming period. Uncorrected refractive error (URE) is responsible for moderate to severe visual problems in around 116 million cases. The projected cost of URE to the world economy is $269 billion. It is concerning to note that myopia is expected to affect almost half of the world's population, with prevalence rates in Asian nations ranging from 84% to 97%.

By end-user, the hospitals segment dominated the ophthalmology devices market in 2024. People with vision issues, eyesight issues, or any other eye-related condition should seek out hospitals with the top ophthalmology departments. The hospital's ophthalmology department is primarily focused on giving patients with eye health issues, including visual issues and procedures, the finest medical care possible. Ophthalmologists use cutting-edge diagnostic tools in hospitals to provide thorough evaluations of eye health.

By end-user, the ambulatory surgical centers (ASCs) segment is estimated to grow at the highest CAGR in the ophthalmology devices market during 2025-2034. Increased surgeon productivity, better patient and surgeon convenience, lower out-of-pocket patient expenditures, and lower insurer per-case costs are some of the factors contributing to ASCs' growing popularity. To reduce escalating surgical care costs, several insurers have suggested rewarding patients to have surgery at ASCs rather than HOPDs.

North America dominated the ophthalmology devices market share by 34% in 2024, due to increased product approvals, the use of new technology, and rising healthcare costs associated with eye illnesses. The U.S. and Canada contribute significantly to the region's market revenue. Main growth drivers include an ageing population, the large amount of ophthalmology procedures performed, and the incidence of eye problems such as cataracts, glaucoma, diabetic retinopathy, AMD, and refractive illnesses.

In the U.S., the most common eye condition is refractive error. The primary cause of blindness among working-age adults in the U.S. is diabetic retinopathy. Approximately 1.8 million Americans over 40 suffer from AMD. Another 7.3 million people who have big drusen are at a high risk of AMD. For those 65 and older, AMD is the primary cause of long-term impairment in reading and fine or close-up vision. 6.1 million (5.1%) Americans aged 40 and over have undergone surgery to remove their lens, while an estimated 20.5 million (17.2%) have cataracts in one or both eyes. 150 million Americans might see better with adequate refractive correction, according to the National Eye Institute.

The main issues facing Canadians include excessive screen usage, excessive exposure to UV and solar radiation, and environmental variables, including pollution and smoke from wildfires. Within the last two years, 71% of Canadians have had at least one eye or vision-related ailment. Dr. Phil Hooper, president of the Canadian Ophthalmological Society, says that as more Canadians learn about the four main eye conditions, more education is required to promote preventative care.

Asia Pacific is estimated to host the fastest-growing ophthalmology devices market during the forecast period. Because over 400 million people suffer from preventable visual impairment, and because government-led programmes are aimed at reducing the backlog of cataract surgeries. With 7 million cataract procedures performed yearly by India's National Programme for Control of Blindness, which depends on affordable phacoemulsification equipment and intraocular lenses, the two countries account for the majority of demand. 60% of screenings in rural regions take place in community health camps, although portable diagnostic tools like handheld OCT machines are becoming more popular there. While paediatric myopia epidemics in East Asia increase demand for orthokeratology lenses, the region's diabetes population, which exceeds 220 million, drives the use of non-mydriatic retinal cameras for retinopathy monitoring.

A projected research on the burden of vision estimates that by 2030, there would be 180 million visually impaired children and adolescents in China alone, up from the current 6.4 million. Myopia is most common in China, where an estimated 300 million individuals suffer from the condition, the majority of whom are youngsters.

One of the biggest public health issues in India is blindness and visual impairment. In India, there are an estimated 0.24 million blind children, 35 million visually impaired persons (2.55%), and 4.95 million blind adults (0.36% of the total population). In India, cataracts and refractive errors continue to be the leading causes of blindness and visual impairment, respectively.

Europe is expected to grow significantly in the ophthalmology devices market during the forecast period, because of an established healthcare system, an ageing population, and an increasing need for cutting-edge eye care products. Strong research and development (R&D) efforts and advantageous reimbursement regulations are two ways that nations like Germany, the UK, and France greatly contribute to market expansion. Additionally, the region's top producers of ophthalmic devices encourage innovation and market growth.

In Germany, an estimated 15–20 million individuals suffer from eye conditions. Refractive error is the most prevalent condition among Germans. An incorrect refraction of light in the eye through the cornea or lens is the source of this problem. In Germany, 63.5% of people 16 years of age and older use glasses.

Over 2 million individuals in the UK are blind or visually impaired. Approximately 340,000 of them are listed as blind or partially sighted. The leading charity in the UK helping those who have lost their vision is the RNIB. The RNIB website provides helpful information, including how to accept vision loss.

In June 2025, TECNIS Odyssey IOL is the fastest-growing PC-IOL in the U.S., and we are thrilled to be making it available to more patients worldwide, said Peter Menziuso, corporate group chairman of Vision at Johnson & Johnson, in a company press release. It fills a big gap in the market for cataract sufferers who want more freedom with their eyewear. Now, in conjunction with TECNIS PureSee, TECNIS Odyssey IOL strengthens and expands our worldwide IOL range to better serve the various demands of the ageing population of today. (Source - Ophthalmology Times)

By Product Type

By Application

By End Use

By Region

February 2026

February 2026

February 2026

February 2026