February 2026

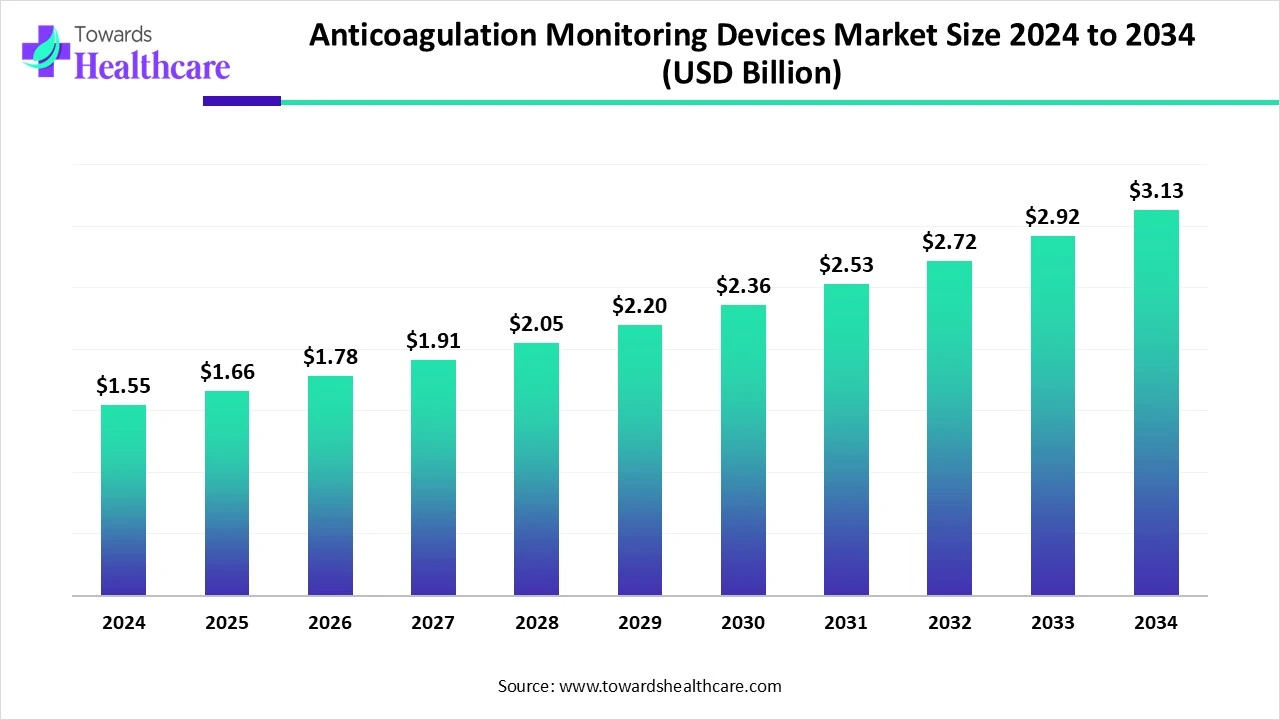

The anticoagulation monitoring devices market was valued at USD 1.55 billion in 2024 and is projected to reach USD 3.13 billion by 2034, registering a CAGR of 7.24% from 2025 to 2034.

| Metric | Details |

| Market Size in 2025 | USD 1.66 Billion |

| Projected Market Size in 2034 | USD 3.13 Billion |

| CAGR (2025 - 2034) | 7.24% |

| Market Segmentation | By Device Type, By End-user, By Region |

| Top Key Players | Sysmex, HORIBA, Ltd., Koninklijke Philips N.V. |

The anticoagulation monitoring devices market refers to the production, distribution, and use of anticoagulation monitoring devices. We see patients who need regular monitoring of their anti-clotting or blood-thinning medication. Medication helps to treat and prevent blood clots and reduce our chances of developing serious conditions like heart attacks and strokes. The potential benefits of an anticoagulation monitoring device are to assist the body in properly balancing clotting and anticoagulant factors. This is why monitoring the therapy is critical to success. Supporting the clotting process requires that dosages remain within certain effective ranges.

The proliferation of healthcare infrastructure, increased patient preferences for advanced devices in minimally invasive procedures, increasing consumer awareness about anticoagulation management, and rising healthcare expenditure contribute to the growth of the anticoagulation monitoring devices market.

According to a report, regarding anticoagulant usage in the population, data from the medicare dataset (2015-2021) show that Apixaban was most commonly used (58.3%), followed by Revaxaban (34.5%), with less frequent use of Dabigatran (7.05%) and Edoxaban (0.2%).

According to a report published in July 2023 in adherence to oral anticoagulation measured by electronic monitoring in a Belgian atrial fibrillation population, a total of 768 patients were evaluated (11.8% SC vs 86.8% any education group, mean age: 70.1±7.9 years). Patients were taking non-vitamin K OAC (once daily, 53.8%; twice daily, 35.9%) or vitamin K antagonists (9.4%), equally distributed over the different study arms.

Artificial intelligence (AI) assists in personalized anticoagulation decisions, catheter ablation planning, and optimizing antiarrhythmic drug selection. Studies show that anticoagulation medication guidance based on an AI recurrent neural network can enhance the accuracy of anticoagulation prediction, thereby reducing the dosing error to achieve the target INR value. Safe and effective INR control is an important determinant of anticoagulation complications. AI monitors adherence via EHRs, wearables, and patient inputs, using NLP-driven chatbots and virtual assistance to deliver tailored reminders and education. Predictive models identify potential non-adherence risks, allowing proactive interventions.

AI improves diagnostic accuracy in interpreting many cardiac images, like echocardiograms, CT scans, and MRIs. AI and language models streamline medical record documentation, improve operational efficiency, and automate administrative costs, allowing healthcare professionals to focus more on direct patient care.

What are the Anticoagulation Monitoring Devices Market Drivers?

Anticoagulation monitoring devices market drivers are anticoagulants, especially new oral variants like DTIs and factor Xa inhibitors, which are widely prescribed to elderly patients with atrial fibrillation to prevent blood clots and reduce the risk of strokes and heart attacks.

Anticoagulants are one of the most frequently prescribed medications in elderly patients. Current use of oral anticoagulation therapy in elderly patients with atrial fibrillation results from an Italian multicenter perspective study. The goal of anticoagulant therapy is to assist the body in properly balancing clotting and anticoagulant factors. Anticoagulants are medicines that help prevent blood clots. They are given to the senior population who have a high risk of getting clots, to reduce their chances of developing serious conditions like heart attacks and strokes. A blood clot is a seal created by the blood to stop bleeding from wounds.

The new oral anticoagulants (NOACs) offer significant benefit as compared to previously available agents, but their introduction will also be accompanied by a new set of problems and limitations. The two classes of NOACs are currently available: the oral direct thrombin inhibitors (DTIs; e.g., dabigatran) and oral direct factor Xa inhibitors (e.g., rivaroxaban, apixaban, and edoxaban).

What are the Anticoagulation Monitoring Devices Market Restraints?

Anticoagulation monitoring devices market expansion is hindered by a number of factors. While regulatory frameworks promote fairness and growth, they can hinder competitiveness and burden small businesses, just as anticoagulant therapies, though essential, carry bleeding risks that require careful monitoring and professional oversight.

Disadvantages of regulatory frameworks include slowed competitiveness, negative effect on small businesses, regulating activities within an economy or a region can be costly due to the processes involved, and imposing regulatory controls and checks can be time-consuming since plenty of controls may be needed. It ensures that businesses operate within the law, serve the interests of people fairly, and drive economic growth.

Risk of side effects from anticoagulants may occur due to concurrent use of antiplatelet medications, dosing errors, or inadequate monitoring, underscoring the importance of healthcare professionals’ knowledge about potential complications such as hematoma formation, intracranial & gastrointestinal bleeding, and available reversal agents. A possible side effect of anticoagulants is excessive bleeding (hemorrhage), due to these medicines increase the time it takes for blood clots to form. Patients on anticoagulants can experience intraarticular, gastrointestinal, intracranial, retroperitoneal, intramuscular, and subcutaneous bleeding.

What are the Anticoagulation Monitoring Devices Market Opportunities?

Anticoagulation monitoring devices market opportunities include digital transformation, which allows businesses to increase profitability, strengthen security, accelerate efficient workflows, and modernize legacy processes. eHealth tools promise for clinical applications in anticoagulation management after CVR, with the potential to improve postoperative rehabilitation. High-quality research is required to explore the economic advantages of eHealth tools in long-term anticoagulant therapy and the potential to reduce the occurrence of adverse events.

Sandra Lesenfants, senior vice president of Abbott’s Structural Heart Disease, said, “Tendyne is a much-needed addition to our comprehensive U.S. structural heart portfolio that offers less invasive treatment options for a range of heart diseases.” “This approval builds on our more than two decades of mitral valve leadership that includes developing first-of-their-kind devices that truly change and save people’s lives."

Why Did PT-INR Devices Lead in 2024, and What’s Driving ACT Segment Growth?

The PT-INR testing devices segment held a dominant presence in the anticoagulation monitoring devices market in 2024. PT-INR testing devices a portable, battery-operated meters used to monitor patient response to warfarin. This meter has a screen that displays results and an opening for meter-specific test strips. INR is a standardized measure of PT, ensuring consistency in results across different laboratories. At-home INR testing allows patients to monitor their INR levels more frequently without frequent lab visits. Key benefits of INR testing include potentially lower clotting risk, improved INR management, easier testing process, and more convenience.

The activated clotting time (ACT) segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. The activated clotting time (ACT) is commonly used when very high doses of heparin are needed, like percutaneous angioplasty and cardiopulmonary bypass. Activated clotting time (ACT) is generally used to monitor anticoagulation during cardiac surgeries. Final ACT values may be essential to predict postoperative bleeding and transfusions, although ideal values remain unknown. Clotting time testing is necessary if you are experiencing issues with blood clot formation or are prone to easy bruising and bleeding. Clotting disorders may lead to prolonged bleeding, causing a significant loss of blood and further complications.

How Are Shifts in Patient Monitoring Needs Reshaping the Role of Hospitals and Fueling Homecare Growth?

The hospitals & clinics segment accounted for a considerable share of the anticoagulation monitoring devices market in 2024. The role of anticoagulant hospitals & clinics is to provide specialized services in patients’ management on anticoagulant treatment. Anticoagulants are medicines that help prevent blood clots. The goal of anticoagulant therapy is to assist the body in properly balancing clotting and anti-clotting. Anticoagulant clinic prevents and treats patients who are at risk of stroke due to such conditions as atrial fibrillation, placement of mechanical heart valves, pulmonary embolism, and deep vein thrombosis.

The homecare segment is projected to experience the highest growth rate in the market between 2025 and 2034. The potential benefits of home care or self-monitoring and self-management include improved convenience for patients, better treatment adherence, more frequent monitoring, and fewer thromboembolic and hemorrhagic complications. At home INR testing allows patients to monitor their INR levels more frequently without frequent lab visits. Additionally, home INR monitoring allows for more frequent monitoring and has been shown to reduce adverse events (AEs) like bleeding and clotting.

North America dominated the global anticoagulation monitoring devices market. Regulatory support, sustainability trends, shift towards emerging markets, expanding applications, technological advantages, increasing consumer demand, rising disposable incomes, and urbanization contribute to the growth of the market in North America.

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period. Increasing senior population, rising adoption of new oral anticoagulants (NAOCs), and rising prevalence of chronic disease are contributing to the growth of the anticoagulation monitoring devices market in the Asia Pacific region.

Year of Incorporation: 1968

Headquarters: Kobe, Hyogo, Japan. Over 190 countries where it operates. It operates in the healthcare organizations, clinical laboratories, provision of instruments & reagents, and in vitro diagnostics (IVD) sectors around the world.

Year of Incorporation: 1953

Headquarters: Kyoto, Kyoto, Japan. About 29 countries where it operates. It operates in the automotive, environmental, medical, and semiconductor sectors around the world.

Year of Incorporation: 1891

Headquarters: Amsterdam, Netherlands. Over 100 countries where it operates. It operates in the healthcare sector, including personal health, connected care, and diagnosis & treatment sectors around the world.

By Device Type

By End-user

By Region

February 2026

January 2026

January 2026

December 2025