January 2026

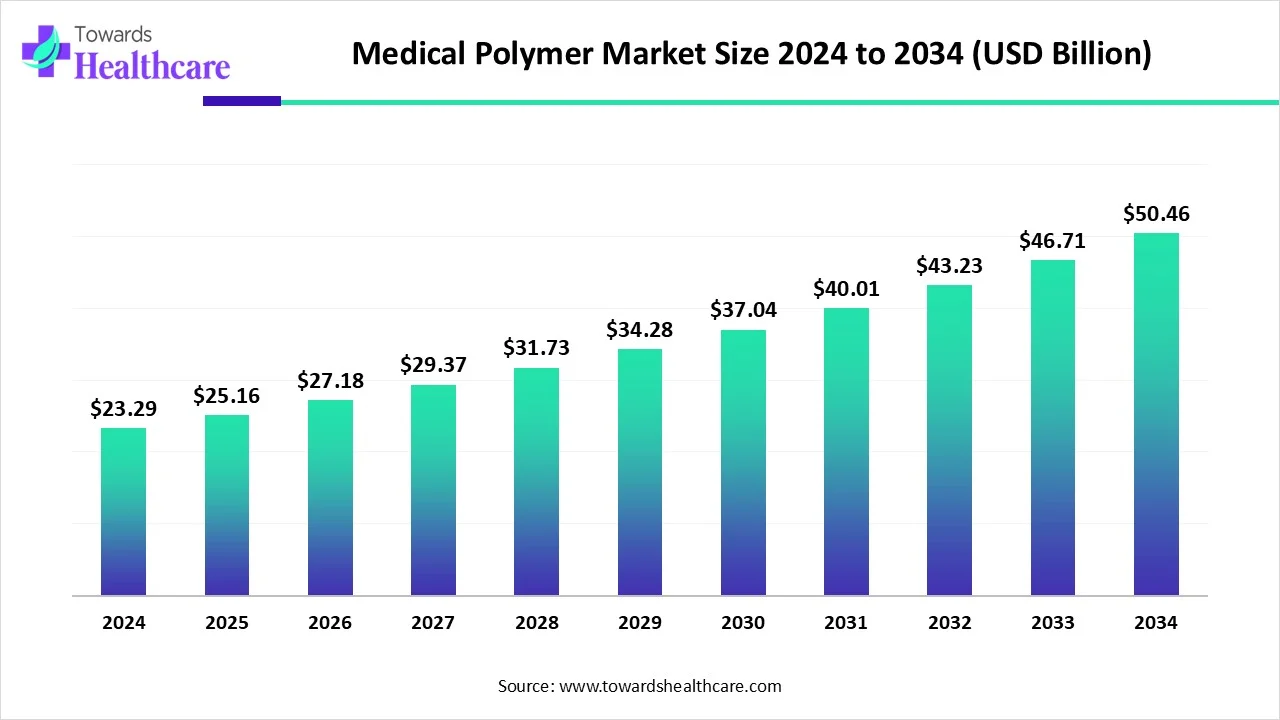

The global medical polymers market size is calculated at USD 23.29 billion in 2024, grew to USD 25.16 billion in 2025, and is projected to reach around USD 50.46 billion by 2034. The market is expanding at a CAGR of 8.04% between 2025 and 2034.

| Metric | Details |

| Market Size in 2025 | USD 25.16 Billion |

| Projected Market Size in 2034 | USD 50.46 Billion |

| CAGR (2025 - 2034) | 8.04% |

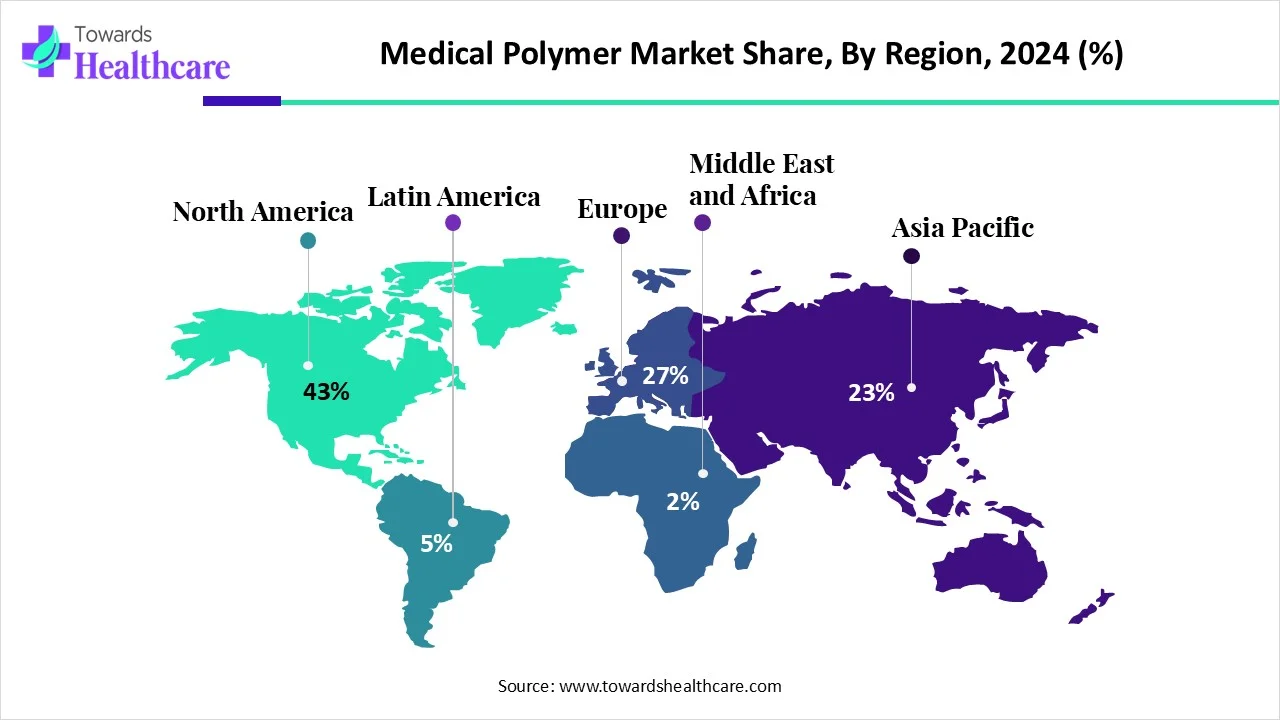

| Leading Region | North America share by 43% |

| Market Segmentation | By Product, By Application, By Region |

| Top Key Players | ALBIS, Arkema Global, Celanese Corporation, Eastman, ELIX Polymers, Evonik, Foster Corporation, Genesis Medical Plastics, HMC Polymers, Lubrizol Corporation, Polymer Medical, SIBUR, Wacker Chemie AG |

Medical polymers are medical-grade plastics that are used in various medical devices and drug delivery systems. These polymers deliver suitable resistance to impact, wear, temperature, and corrosion. Some common examples of medical polymers include polycarbonate, polypropylene, polyethylene, polyvinyl chloride, and polymethyl acrylate. The selection of medical polymers is based on their biocompatibility, sterilizability, and chemical & thermal stability properties. They must be durable and possess good optical properties or clarity.

The growing need for innovative drug delivery systems and medical devices boosts the market. The availability of generic drug alternatives and favorable regulatory frameworks increases the demand for medical polymers. Technological advancements lead to the development of novel methods for manufacturing medical polymers. Stringent regulations on pharmaceutical packaging encourage companies to use high-quality and compliant polymers. The rising demand for home healthcare contributes to the worldwide demand for medical disposables.

Artificial intelligence (AI) and machine learning (ML) algorithms can play a vital role in developing medical polymers. They can analyze vast amounts of data and suggest different types of polymer compositions with appropriate amounts. This enables researchers to produce novel synthetic polymers with desired properties. AI and ML can also determine the properties of existing and novel polymers. Large datasets and computational power enable researchers to achieve exceptional accuracy in forecasting polymer behaviors. Deep learning algorithms and generative models reveal the complex, non-linear relationships between a polymer’s molecular structure and its macroscopic properties.

New Drug Delivery Systems

The rising prevalence of chronic disorders and the growing demand for targeted therapies facilitate the development of novel drug delivery systems (DDS). DDS are required to transport drugs to the desired body part and to control their release based on patients’ needs. They offer numerous benefits, such as enhanced drug stability and minimized degradation, optimized drug distribution, and precise drug localization. Polymers are an integral part of DDS. Polymers play an indispensable role in DDS by providing controlled release of therapeutic agents in a constant dose. Natural polymers such as arginine, chitosan, and dextrin, as well as synthetic polymers such as polymethyl acrylate, polyethinime, and dendritic polymers are used for developing DDS.

Waste Generation

The major challenge of the medical polymers market is the waste generation of medical polymers. Medical waste, including contaminated plastics, can pose significant environmental and health risks. Most of the plastic wastes are sterilization wraps, polypropylene face masks, and packaging materials. In the U.S., 14,000 tons of waste are generated daily by hospitals, out of which 20-25% is plastic. (Source - HPRC)

What is the Future of the Medical Polymers Market?

The future of the market is promising, driven by the increasing use of 3D printing technologies for the manufacturing of biomedicine, implants, drug delivery systems, and tissue engineering products. 3D printing is an emerging technique due to its ability for rapid prototyping and customized production. The technique is also used to produce soft robotics, fabricated with flexible polymers like thermoplastic polyurethane, that can be integrated into wearable devices to monitor physiological activities. Medical polymers are widely used for manufacturing products using 3D printing technology. Advancements in polymer chemistry and biomedical engineering present future opportunities for market players. The growing demand for personalized medicines also leads to the use of 3D printing technology.

By product, the fibers & resins segment held a dominant presence in the market in 2024. Fibers and resins are widely used in the healthcare sector due to their versatility. They are used in medical devices, equipment, and packaging. The different types of polymer resins are nylon 6, PBT, polycarbonates, polyesters, and PVC. Polymer resins and fibers are light and adaptable, making them easier to transport. Additionally, they are biocompatible and durable, resisting corrosion. Their cost-effectiveness and the ability to customize make them a suitable choice for researchers and manufacturers.

By product, the medical elastomers segment is expected to witness significant growth in the market over the forecast period. Medical elastomers are predominantly used in fluid pathways, blood pressure tubing, wound drainage, and DDS. They offer excellent sterilization properties and other essential physical and performance characteristics for the medical sector. Some common examples of medical elastomers are ethylene propylene diene monomer, isolast, and fluoroelastomer. Thermoplastic elastomers are used in prosthetic liners and orthopedic bandages.

By application, the medical components segment led the global market in 2024. Medical components are the parts that are used to produce medical devices, instruments, and equipment. Polymers used for medical equipment housings are polycarbonate, acrylonitrile butadiene styrene, and polybutylene terephthalate. The rising prevalence of chronic disorders and the burgeoning medical device sector augment the segment’s growth. Medical devices are used to diagnose, prevent, and treat diseases, improving the quality of life of individuals. Medical components enhance the accuracy, reliability, and safety of medical procedures.

By application, the medical device packaging segment is expected to grow with the highest CAGR in the market during the studied years. The increasing launch of new medical devices and the growing demand for innovative medical products contribute to the segment’s growth. Medical device packaging ensures the integrity, safety, and sterility of medical devices. The packaging materials must be compliant with suitable regulatory standards. Hence, high-quality medical polymers are preferred for preparing packaging, such as pouches, bags, blister packs, and thermoformed trays.

North America led the global market share by 43% in 2024, owing to the rapidly expanding pharmaceutical and healthcare sectors and new product launches. The presence of state-of-the-art research and development facilities favors the development of novel drug delivery systems for targeted therapy. Numerous companies adopt advanced technologies for manufacturing medical polymers to strengthen their market position. Other factors that govern the market growth are increasing healthcare expenditure and the rising prevalence of chronic disorders.

Lubrizol Corporation, Eastman, and Celanese Corporation are the major players that contribute to the development of medical polymers in the U.S. The Centers for Medicare & Medicaid Services reported that the U.S. healthcare spending grew 7.5% in 2023, reaching $4.9 trillion or $14,570 per person.

Health Canada reviews the safety, effectiveness, and quality to approve medical devices for Canadians. The Canadian government increased its 2023 budget by $46.2 billion to provinces and territories. Approximately 30% to 40% of the provincial and territorial budgets are consumed by the healthcare sector, and the costs are expected to increase at an annual rate of 5.2% over the next decade.

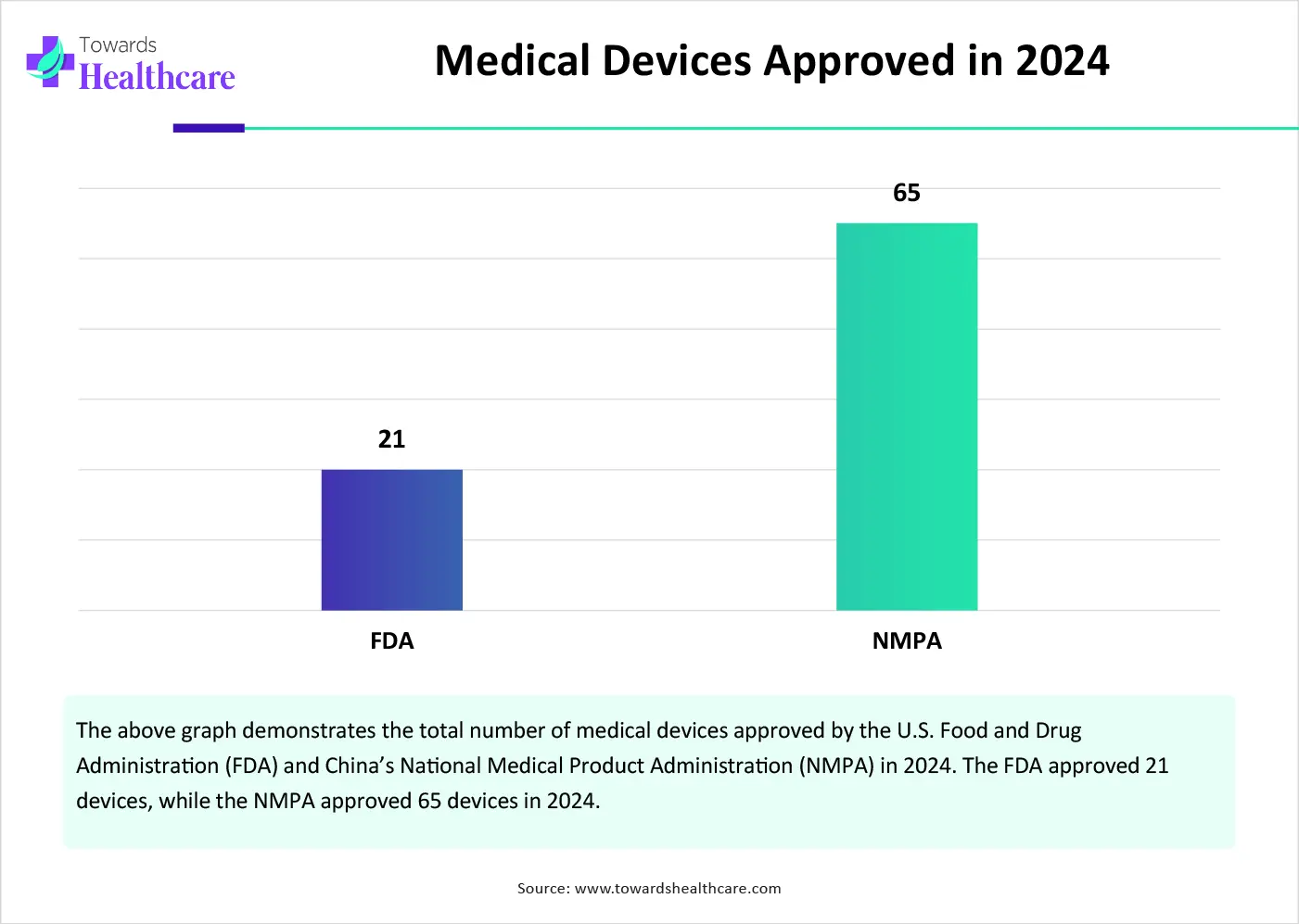

Asia-Pacific is expected to grow at the fastest CAGR in the medical polymers market during the forecast period. The increasing geriatric population and the rising disposable incomes drive the market. Countries have suitable manufacturing infrastructure for the production of medical polymers. Favorable trade policies contribute to market growth. Vietnam and China are the major exporters of medical polymers to the world. The growing research and development activities for producing novel drug delivery systems foster market growth.

China exported around 55,088 shipments of medical plastics from November 2023 to October 2024. China recently issued a guideline to deepen the reform of regulating drugs and medical devices to promote the high-quality development of the pharmaceutical industry. The government anticipates enhancing the legal and regulatory frameworks for drug and medical device supervision.

Vietnam was the leading exporter of medical plastics from November 2023 to October 2024, accounting for 58,093 shipments. The Vietnamese government aims to draft a “Law on Medical Devices” for developing the manufacturing industry, clinical trials, and the management and use of medical devices in medical facilities and the community.

Europe is expected to grow at a notable CAGR in the medical polymers market in the foreseeable future. Favorable government initiatives encourage the use of medical devices and other healthcare products for diagnosing and treating chronic disorders. The European Medicines Agency (EMA) regulates the approval of medical products in Europe. The burgeoning healthcare sector and the increasing demand for injectables promote the use of medical polymers. Moreover, the presence of key players and the growing demand for biocompatible materials propel the market.

The medical technology sector is booming in Germany, with increased expenditure in R&D. The German medtech industry spent approximately EUR 10 billion on R&D in 2023. Germany accounts for 27% of the market share in Europe, with a total sales of EUR 43 billion in 2023. The Germany Trade & Invest also reported approximately EUR 38.6 billion of turnover in the medical device segment and EUR 4.3 billion in the IVD segment.

The French government provides funding to hospitals and clinics to adopt cutting-edge technologies and equipment for advanced care. The National Health Insurance Expenditure Targets (ONDAM) for hospitals allocated a budget of €109.6 billion. The funding allocated to hospitals and clinics represents a 3.8% increase, equivalent to an additional €3.9 billion.

Latin America is expected to grow at a notable CAGR in the medical polymers market in the foreseeable future. The rising prevalence of chronic disorders, growing research and development activities, and advancements in medical technologies drive the market. The increasing R&D investments and the presence of key players contribute to market growth. Favorable regulatory policies lead to the development of novel medical devices and innovative drug delivery systems.

Foscote, Brazilian Plastics, and Gerresheimer are major manufacturers and suppliers of medical polymers in Brazil. Brazil ranks second in Latin America for U.S. medical devices. Its research and clinical trial infrastructure is expanding at a rapid rate. Public funding for biomedical research in the country accounts for approximately 1.3% of the GDP.

The latest research on medical polymers refers to the development of smart and responsive polymers for targeted drug delivery and biodegradable materials.

Key Players: Evonik Industries AG, DSM, and BASF SE.

Medical polymers and innovative products derived from polymers are assessed through clinical trials and are subsequently approved by the regulatory agencies of respective countries.

Key Players: Prevent-Plus LLC, Aeris Therapeutics, and Suzhou Hearthill Medical Technology Co., Ltd.

Medical devices and other products derived from medical polymers are distributed to hospitals and retail pharmacies through wholesalers.

Lary Acquarulo, CEO of Foster, commented that bioresorbable compounds are the fastest-growing area. The company blends specialty additives into bioresorbables to give them unique properties. He also said that another area of growth is the use of nano-reinforcements to enhance the physical properties of plastics at the molecular level. Companies should focus on understanding customer applications and tailoring properties to meet the precise requirements.

By Product

By Application

By Region

January 2026

January 2026

December 2025

December 2025