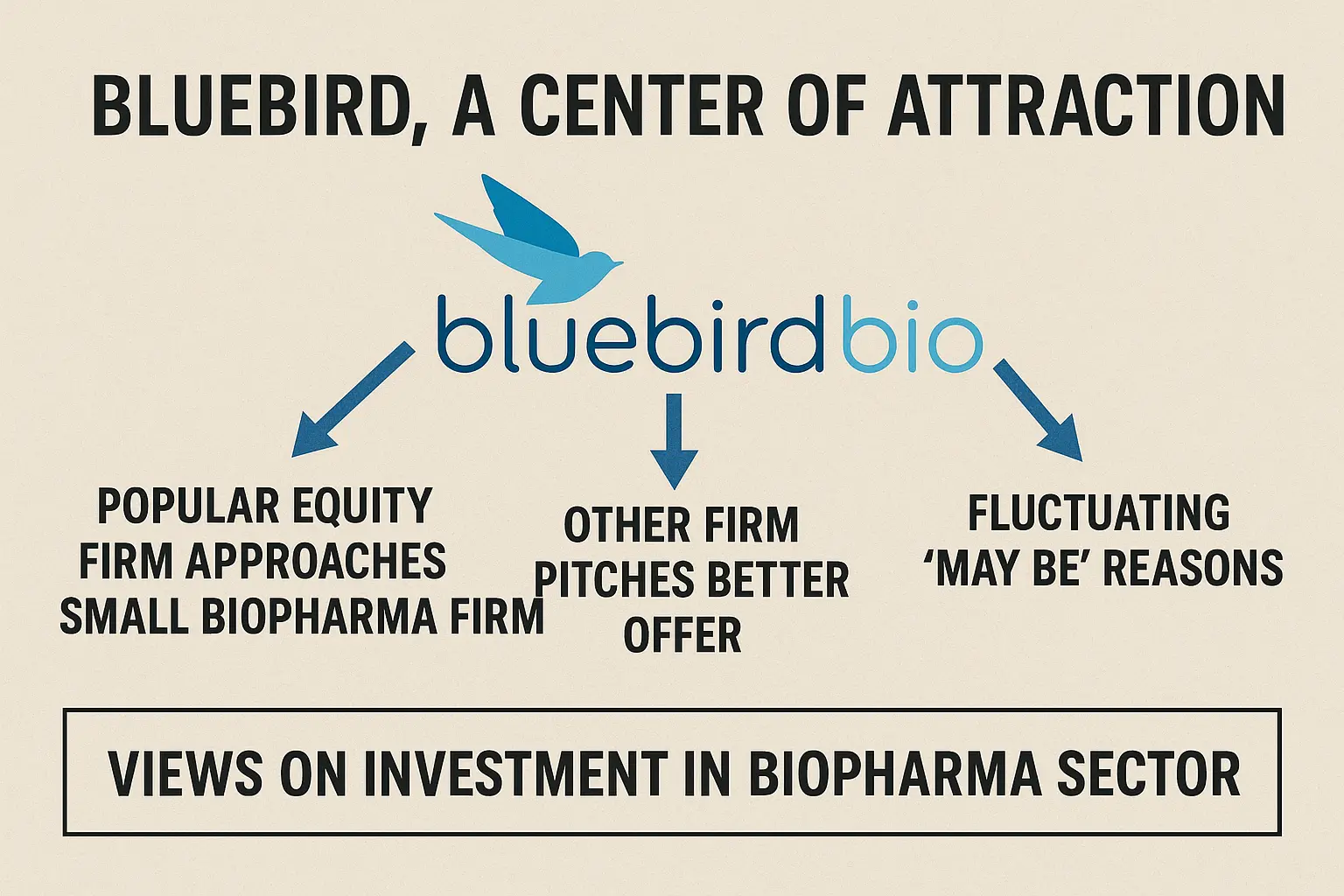

The Carlyle Group, along with SK Capital partner, intends to buy bluebird Bio for under $50 million. The Carlyle Group, with its $453 billion in assets under management, and SK Capital partner of $10 billion, are now behind securing investments for bluebird. This deal raised many questions in investors' minds. The reason was smart enough that the month-long investment in Bluebird’s cell therapy biotech can earn the firm a quite satisfying return on a minimal amount of work.

Ayrmid, a second buyer, pitched a better offer. It is the parent company of a cell therapy biotech, Gamida Cell. This deal will turn out to be a suitable match for Bluebird’s assets. Though the financing emergency, Bluebird distant the offer. This raised another question and left the market and investors curious.

The bluebird deal has been a difficult deal to crack in the industry for a few years. The private equity playbook highlights that most of the deals are signed with the intention to buy a company and make changes to generate highest of the highest profit, also merging it with others and suddenly flipping on the same changes within no time. Bluebird’s hesitance doesn’t clear the reason for its challenge, hindering its competitiveness so far.

The current market state is aggressive and mainly affects biopharma that bolsters science, yet lacks recognition in the market. Biotech should be provided with financing assistance, and PE-type deals should be approached to balance the condition.

A pitchbook senior biotech analyst, Kazi Helal, said, “A lot of firms have been seeking an opportunity in distressed and biotech assets, and it’s difficult to palm off. The PE firms in a shorter timeframe switched and joined in fundraising like a venture capital firm. Though during COVID was apt for VC than PE.” Further, he observed tInvestment in adopting innovative treatment.