January 2026

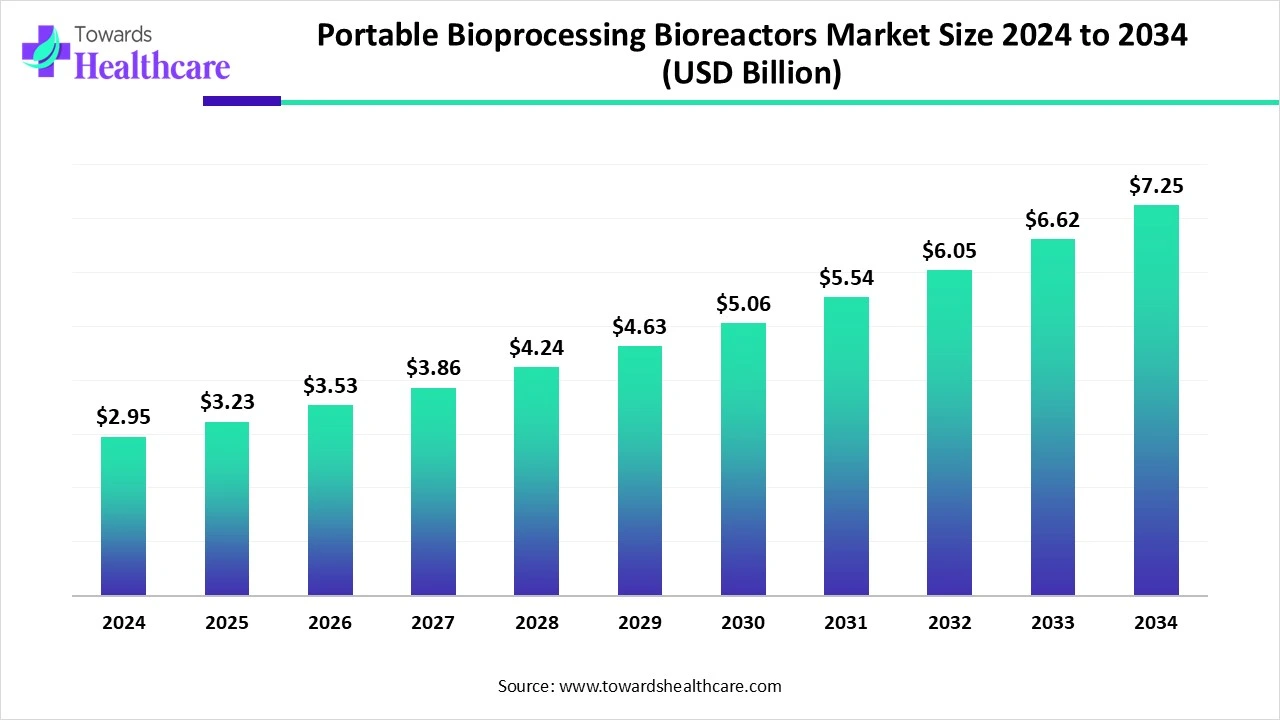

The global portable bioprocessing bioreactors market size is calculated at USD 2.95 billion in 2024, grow to USD 3.23 billion in 2025, and is projected to reach around USD 7.25 billion by 2034.

The portable bioprocessing bioreactors market is experiencing significant growth, driven by the increasing demand for flexible and scalable biomanufacturing solutions. These compact systems are ideal for producing biologics, cell and gene therapies, and personalized medicines, offering advantages like reduced contamination risk and lower operational costs. Technological advancements, including automation and integration of single-use technologies, enhance efficiency and adaptability. Additionally, the expansion of biomanufacturing in emerging markets and the pharmaceutical rise of contract development and manufacturing organizations (CDMOs) are further propelling the market growth.

| Metric | Details |

| Market Size in 2025 | USD 3.23 Billion |

| Projected Market Size in 2034 | USD 7.25 Billion |

| CAGR (2025 - 2034) | 9.37% |

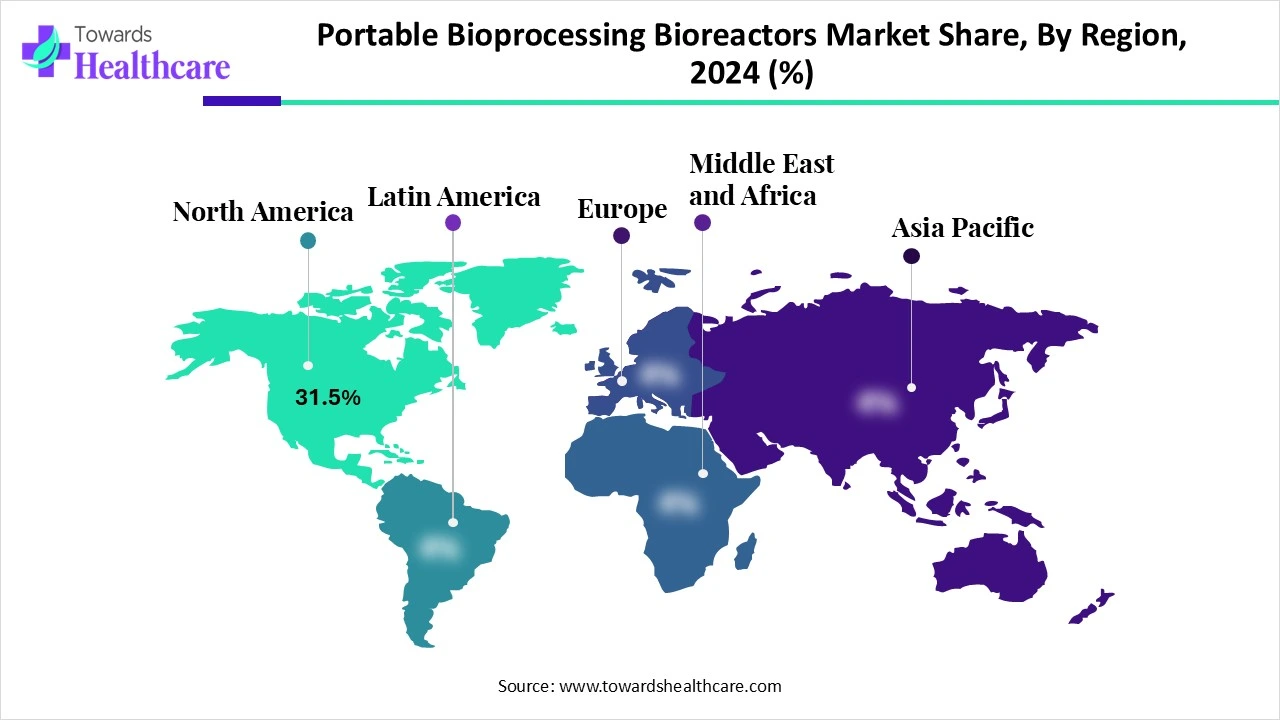

| Leading Region | North America share by 31.5% |

| Market Segmentation | By System Type, By Capacity, By Mode of Operation, By Material/Construction, By Control Type, By End Use, By Regions |

| Top Key Players | Thermo Fisher Scientific, Sartorius AG, Merck KGaA, Eppendorf AG, Danaher Corporation, GE Healthcare, IKA Labortechnik, Biosan, PBS Biotech, Pall Corporation, Solaris Biotech, Applikon Biotechnology, Distek Inc., Parker Hannifin Corporation, Avantor Fluid Handling LLC, BioProcessors Corporation, Uma Pharmatech Machinery, Merck & Co., Inc., Applikon, General Electric |

The portable bioprocessing bioreactors market focuses on compact and mobile bioreactor systems used for small-batch, decentralized production in biopharmaceuticals, cell & gene therapies, vaccine development, diagnostics, and research applications. These systems allow flexible, GMP-compliant biomanufacturing with streamlined control, scalability, and cost-effectiveness. Innovation is reshaping the portable bioprocessing bioreactors market by introducing smarter, more compact systems that cater to evolving biomanufacturing needs. The new design focuses on ease of use, faster setup, and improved mobility, making them ideal for small-batch production and research settings. Integration of digital tools like IoT and AI enhances process control and data tracking. These advancements support greater efficiency, lower production costs, and rapid scalability, fueling the adoption of portable systems across diverse biotech applications.

Portable bioreactors increasingly use disposable components, reducing the need for cleaning and sterilization. This lowers the risk of cross-contamination and shortens turnaround time between production cycles.

The surge in demand for therapeutic proteins, monoclonal antibodies, and biosimilars is increasing the need for flexible and efficient bioproduction tools like portable bioreactors.

Contract Development and Manufacturing Organizations are adopting portable bioreactors for their versatility and scalability, allowing them to serve a wider range of clients and projects.

Modern portable bioreactors come equipped with automated controls for temperature, pH, oxygen levels, and nutrient feeds, ensuring consistent and high-quality production with minimal manual intervention.

AI is significantly enhancing the market by enabling real-time monitoring, automation, and predictive analytics. It allows for precise control of key bioprocessing parameters, improving efficiency and product quality. AI-driven systems can forecast equipment issues, reduce downtime, and optimize production workflows. Additionally, AI supports remote operations and rapid decision-making, which is crucial for decentralized and small-scale biomanufacturing. These advancements are making portable bioreactors more intelligent, efficient, and adaptable to evolving industry needs.

Growing Demand for Flexible and Scalable Biomanufacturing Solutions

The growing emphasis on adaptable and space-efficient manufacturing is fueling demand for portable bioprocessing bioreactors. These systems allow quick changes in production scale and location, making them ideal for research pilot studies or small-batch therapies. Their modular nature and simplified operation help biopharma companies respond swiftly to evolving therapeutic needs without heavy infrastructure investment. His flexibility is particularly valuable in personalized medicine and emerging markets, where rapid deployment and cost-effective solutions are crucial for competitive biomanufacturing.

High Initial Investment and Limited Scalability for Large-Scale Production

The high upfront cost and restricted production capacity of portable bioprocessing bioreactors limit their appeal for large-scale operations. These systems are often optimized for flexible and small-batch processing, making them less suitable for mass manufacturing needs. For companies aiming for industrial-level output, investing in larger, fixed advanced technologies embedded in portable models-such as automation and smart sensors, can drive up initial expenses, posing financial challenges for startups and budget-constrained facilities.

Growing Demand for Personalized and Precision Medicine

The shift towards personalized and precision medicine presents a strong opportunity for the portable bioprocessing bioreactors market, as it demands agile, small-scale production systems that can accommodate individualized treatment needs. Unlike a conventional setup, portable bioreactors enable quick turnaround and easy configuration for unique formulations. Their adaptability supports frequent changes in production requirements, making them ideal for niche therapies and targeted biologics, where flexibility, speed, and precision are critical for successful outcomes.

The dominance of the single-use portable bioreactors segment in the market is driven by their ease of use, minimal setup requirements, and ability to support rapid process development. These bioreactors offer enhanced operational agility, reduce the need for complex infrastructure, and are ideal for producing small-volume, high-value biologics. Their disposable nature also reduces labor and validation efforts, making them highly suitable for emerging biotech firms and contract manufacturing organizations seeking flexible and efficient solutions.

The 1-10L capacity segment leads the portable bioprocessing bioreactor market due to its strong adoption in precision medicine and personalized therapy development. Its compact size supports rapid experimentation, faster turnaround, and efficient use of costly reagents or cell lines. This capacity range is particularly favored in clinical trial manufacturing and preclinical research, where flexibility, ease of transport, and lower operational costs are essential, making it highly practical for decentralized and small-batch bioproduction settings.

The fed-batch segment led the market as it offers a balanced approach between batch and continuous processing. It enables controlled nutrient addition, which supports consistent cell growth and higher product concentration without requiring complex equipment. This method is especially suited for portable systems where space, resources, and volume are limited. Its flexibility, cost-effectiveness, and compatibility with various biologics make it ideal for mobile labs, clinical trials, and personalized medicine production.

The single-use segment held the largest share in the portable bioprocessing bioreactor market by material and construction due to its convenience, reduced infrastructure needs, and compatibility with modern biomanufacturing practices. These systems are pre-sterilized, easy to transport, and support quick changeovers between batches. Their growing use in modular and decentralized production facilities, especially for short-run or personalized therapies, has increased their adoption. This makes them ideal for flexible, small-scale, and contamination-sensitive bioprocessing environments.

The automated segment led the portable bioprocessing bioreactor market as it enables real-time adjustments, minimizes manual intervention, and supports seamless process integration. These systems offer advanced control features that help optimize productivity and maintain uniformity across batches, even in compact setups. Their ability to simplify complex bioprocesses and enhance overall workflow makes them ideal for research labs and small-scale manufacturers aiming for faster turnaround, greater accuracy, and improved operational efficiency in portable bioproduction environments.

The cell & gene therapy segment dominated the portable bioprocessing bioreactor market because these therapies require highly controlled, small-volume, and adaptable production environments. Portable bioreactors align with these needs by offering mobility, ease of handling, and suitability for closed-system operations. As these advanced therapies often involve individualized treatment and short production timelines, the use of compact, flexible bioreactors has increased, making them ideal for research institutions, clinical settings, and decentralized manufacturing facilities involved in regenerative medicines.

In 2024, the biopharmaceutical & biotechnology companies segment captured the largest share of the market as they increasingly focused on rapid innovation, decentralized manufacturing, and agile production models. These companies often manage complex pipelines involving biologics and advanced therapies that demand adaptable, space-saving technologies. Portable bioreactors align with their need for speed, precision, and lower infrastructure dependency, enabling efficient early-stage research, pilot-scale production, and quicker transition from development to clinical or commercial manufacturing.

North America led the portable bioprocessing bioreactors market share by 31.5% in 2024 due to its early adoption of innovative manufacturing platforms and the growing presence of mobile and modular bioproduction units. The region benefits from strong collaborations between industry and academia, as well as an increasing focus on localized and small-batch biological production. Additionally, the demand for precision medicine and advancements in digital bioprocess control systems have supported the widespread integration of portable bioreactors across various biomanufacturing facilities.

The U.S. market is growing steadily due to the expanding pipeline of small-scale biologics and the need for rapid, decentralized manufacturing. The country’s focus on accelerating clinical development timelines and reducing facility footprints has encouraged the adoption of compact, mobile bioreactor systems. Additionally, the rise of emerging biotech startups and contract development firms has fueled demand for versatile bioprocessing tools that support innovation and flexible production in a regulated environment.

Canada’s market is expanding due to substantial government investments in biomanufacturing infrastructure and research. Initiatives like the Strategic Innovation Fund have supported projects such as STEMCELL Technologies' GMP facility and OniaBio’s expansion, enhancing domestic capabilities in cell and gene therapy production. The growing demand for personalized medicine and biologics, coupled with the adoption of single-use technologies, further drives the need for flexible, scalable bioprocessing solutions, positioning Canada as a major player in the global biomanufacturing landscape.

Asia-Pacific is anticipated to witness the fastest CAGR in the market owing to the rising presence of domestic biotech firms, increased outsourcing of biomanufacturing, and growing focus on regional self-reliance in healthcare production. Expanding clinical research activities, lower production costs, and growing collaboration between global pharmaceutical companies and Asian manufacturers are also accelerating demand. These factors, combined with improved regulatory frameworks, make the region highly attractive for portable and scalable bioprocessing solutions.

The Chinese market is growing due to the rising number of clinical trials, expanding biologics manufacturing facilities, and shift towards localized, flexible production models. The increasing partnership between global pharma companies and Chinese biotech firms has also fueled technology transfer and the adoption of advanced portable systems. Moreover, the need for compact, mobile solutions in the urban and regional healthcare centers supports wider integration across the country’s biomanufacturing landscape.

India’s portable market is expanding due to the rise in start-up biotech firms, increasing demand for decentralized manufacturing, and greater emphasis on rapid vaccines and biologics development. The push for indigenous production capabilities and the growing trend of localized clinical research have fueled the need for compact and modular bioreactor systems. Additionally, India’s growing role in contract biomanufacturing has further boosted the adoption of portable and flexible processing technologies.

In 2024, Europe is approaching the portable bioprocessing bioreactor market with a strong focus on decentralized production, supporting the growth of smaller, agile biotech firms and research institutions. There’s rising interest in modular transportable systems that allow flexibility in early-stage drug development and clinical manufacturing. Additionally, the region is prioritizing innovation in the bioreactor design to support cell therapy, biosimilar production, and reduce dependency on large-scale centralized facilities, promising a faster response to emerging health needs.

The UK market is growing due to increasing focus on localized biomanufacturing and the demand for rapid, small-scale production systems. The rise of precision medicine and advanced therapy development has led to a greater need for flexible, mobile solutions. Additionally, the presence of emerging biotech firms and clinical-stage research centers across the UK is driving the adoption of compact bioreactor technologies tailored to fast-paced and decentralized production environments.

Germany’s market is increasing due to the growing need for compact and decentralized production solutions, especially for early-stage biologics and vaccine development. The rise in biotech startups and regional research hubs has boosted demand for flexible, small-footprint bioreactors. Additionally, Germany’s strong focus on clinical trial manufacturing and expansion of cell and gene therapy capabilities supports the integration of portable systems into its evolving biomanufacturing landscape.

In July 2024, NICE approved relugolix (Orgovyx) as the first oral hormone therapy for advanced hormone-sensitive prostate cancer in the UK. This tablet, taken before or with radiotherapy, offers a more convenient alternative to injections. Dr. Lyndsy Ambler from Cancer Research UK noted that with around 55,000 prostate cancer cases diagnosed annually, this at-home treatment can improve patient quality of life by reducing the need for frequent clinic visits. (Source - Cancer Research)

By System Type

By Capacity

By Mode of Operation

By Material/Construction

By Control Type

By Application

By End Use

By Region

January 2026

November 2025

November 2025

January 2026